Open Journal of Accounting

Vol.06 No.02(2017), Article ID:75726,10 pages

10.4236/ojacct.2017.62003

Does Benefit Relationship Affect Analysts’ Earnings Forecast?―Evidence from Chinese Stock Market

Yinlin Ou

Department of Accounting, School of Management, Jinan University, Guangzhou, China

Copyright © 2017 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY 4.0).

http://creativecommons.org/licenses/by/4.0/

Received: March 13, 2017; Accepted: April 25, 2017; Published: April 28, 2017

ABSTRACT

Under the information asymmetrical theory, the Chinese securities analysts are affected by many benefit factors, so the purpose of the study is trying to figure out what benefit elements and how to affect analysts’ earnings forecasts. Using data from 2012 to 2015, the author creatively quantifies interest factors, and does the empirical analysis. Regression results indicate that the closer relationship between securities analysts and the listed companies management or institutional investors, the greater accuracy of their earnings forecasts. Besides, analysts’ reputation exists a negative correlation between earnings forecasts accuracy. Furthermore, securities’ underwriting relationships have no significant influence on the accuracy of analysts’ earnings forecasts, but the underwriting analysts are more likely to overestimate earnings per share of the target companies.

Keywords:

Securities Analysts, Benefit Relationship, Earnings Forecasts

1. Introduction

Since China’s security market established in 1984, demands for information have changed from focusing historical information to future information with gradual development of the domestic capital market. Nowadays, there are two main sources of predictive information in China: one is forecast released by management; the other is issued by securities analysts. Considering the cost of information disclosure, the management of listed companies is usually unwilling to voluntary disclosure predictive information, so forecast information issued by securities analysts plays a more important role in the security market.

Securities analysts, originating from the United States early 20th century, are responsible for collecting and analyzing listed companies’ information including operational and financial data, and then make earnings forecasts and investment proposals as investors’ decision-making basis. Strictly speaking, there are two types of securities analysts, one from buy side who serves information receivers such as fund companies and insurance companies, while the other from the sell side serving brokerages and other information providers. Relative to developed countries, the industry of securities analyst in China started late, but as an information transmission bridge between companies and investors, it grew rapidly and the number of domestic registered sell-side analysts reached 2866 according to the Securities Association of China 2015’s report.

In recent years, some violating analysts’ independence events drew public attention. For example, Zhigang Ye, the chief analyst of machinery industry in Haitong securities, was punished by China Securities Regulatory Commission in 2012 because of manipulating stock prices. Such events which damaged the interests of investors, made us doubt about the qualities of analysts’ forecasts and proposals. No one will deny that analysts are affected by factors of behavioral finance giving rise to various deviations of judgments and decisions. As members of securities companies, analysts’ reputation and rewards are not only affected by their companies’ brokerages, but also strongly influenced by the relationship with the listed companies management or institutional investors. All of above mentioned may reduce analysts’ earnings forecasts accuracy, so this paper attempts to seek answer to how benefit elements affect analysts.

This paper is organized as follows: part 2 is mainly about the literature review of securities analysts’ earnings forecasts based on other scholars and combining with the theoretical model proposes four hypotheses; part 3 explains the empirical model and the sources of data; the fourth part shows the results of equation regression; the last part makes a conclusion of this paper and puts forward some related policy proposals.

2. Literature Review and Hypotheses Development

2.1. Literature Review

As is known, sell-side analysts have a great influence on stock market prices and investors’ decisions [1] [2] [3] [4] [5] , so many scholars have conducted wide- spread research on the influencing factors of sell-side analysts’ earnings forecasts. Unanimously, the scholars found that earnings forecasts and recommendations made by analysts exist optimistic bias [2] - [7] , and then a lot of literature explored what factors led analysts to forecasting too optimistically. The factors include information quality [2] [8] , earnings predictability, earnings volatility [6] [9] , firm size [1] , firm growth, and ownership [5] [9] . Shi, Su, and Qi [9] using the sample of listed companies in SHSE from 2004 to 2005 studied the determinants of the precision of analysts’ earnings forecast, and found that precision of analysts’ earnings forecast is enhanced by increasing in the numbers of analysts and by improving on earning s predictability and information disclosure. Firth, Lin, and Liu [1] examined how the firm size and other factors affect the accuracy of earnings forecasts, and drawn a conclusion that the accuracy is reduced by more drastic variance of earnings and larger size of firm. Xiao, Zheng, and Li’ s article showed earnings predictability , earning management, variance of earnings and rapid development of firm have significant influence on pessimistic earnings forecast [6] . Furthermore, taking the non-financial listed companies in China from 2012 to 2014 as the research sample, Wang and Li [10] found that analysts are keen on earnings forecasts for companies with stable earnings,low forecast difficulty better operating prospects.

Furthermore, with the development of behavioral finance, other scholars study analysts’ earnings forecasts and recommendations considering their behavioral motives [11] , emotions and personal characteristics [12] . Wu, Zheng and Yang [11] examined whether the conflicts of interest affect analysts’ recommendations and found that the incentive of cultivating the relationship with institutional investors and investment banking department encourages analysts to report optimistically biased recommendation. Besides, Fang and Yasuda’s study showed the analysts with higher reputation are not inclined to report credibly, their recommendation even more positively biased although they report relatively conservative earning forecasts [13] . They believe that the experience of analysts, the securities they belong, the numbers of the companies or industries they follow and other characteristics have influences on the accuracy of the earnings forecasts. Some scholars combine this topic with sheep-flock effect [14] . Recently, some scholars pay attention to the relationship between analysts’ forecast and management of the listed companies, including industry competition and strategic choice [15] . Groysberg et al. [15] believed that heuristic bias and interest relation are usually independent of each other in leading analysts to make optimistic earnings forecasts,but they may complement each other and mutually affect analysts’ forecasts when listed companies with great financing have significant economic relationship with security companies,which would arrange non-star analysts to follow such listed companies.

2.2. Theoretical Analysis and Hypothesis

It is generally believed that the main sources of securities analysts’ interest conflicts contain the securities companies the analysts belong to, the management from the listed companies, institutional investors and analysts themselves (Guan, 2012) [16] , but the reputation mechanism take effect when conflicts happen. When overly optimistic or inappropriate forecasts are published concerning about above interest conflicts, it will undermine the analysts’ reputation, so that they have to balance relations with securities, institutional investors and companies’ management to maximize their value.

In order to ensure the information channels to the listed companies’ management, securities analysts must maintain good relationship and cooperate with them. As is known to us, it’s hard to quantify relationship between securities analysts and the listed companies’ management, but we try to use the analyst recommendation to the same company in the same time to quantify this relationship following (Wu, 2013) [11] , the higher rating in the analyst recommendation, the closer relationship between securities analysts and the listed companies’ management. Closer relationship makes analysts are easier to get useful information. As such, we argue that relationship between securities analysts and the listed companies’ management can enhance their earnings forecasts accuracy.

Hypothesis 1: The closer relationship between analysts and the listed companies’ management, the higher analysts’ earnings forecasts accuracy.

The influence machine between analysts’ reputation and earnings forecasts accuracy may be uncertain. Obviously, the accuracy of earnings forecast affects the analyst future reputation. In the same time, analyst reputation will react up on earnings forecasts accuracy in following two ways. On one hand, the higher reputation of the analyst, the greater influence of their report, hence, the listed companies’ management want to develop stronger relationship with the analysts who enjoy high reputation, so that these analysts are more likely to issue over optimism earnings forecasts (Jackson, 2005) [17] . On the other hand, analysts enjoy higher reputation will get higher treatment. These two functions of reputation on analysts’ earnings forecasts are adverse, but in consideration of the game “bargaining power” and the durability of the decisional influence, the former function play a dominant role (Fang, 2005) [13] .

Hypothesis 2: The higher reputation of the analysts, the lower analysts’ earnings forecasts accuracy.

If the securities company the analyst belongs to is the listed company’s underwriter, including lead and co-underwriters and distributors of its initial public offering, issuing share or rights issue, the analyst tends to add positive deviation to his earnings forecasts for preserving the benefits of the underwriting relationships(Mikhail, 2003) [18] . However, non-underwriters analysts can forecast without concerning over underwriting relationships.

Hypothesis 3: Compared to non-underwriters’ analysts, underwriters’ analysts have lower earnings forecasts accuracy.

It is well known institutional investors are the main buyers of securities, bringing commission which is the main income of securities companies in nowadays. If the higher of institutional investors holding, the closer relationship with institutional investors, analysts are more likely to track closely the listed companies’ information and to improve their information transparency and accuracy (Agrawal, 2008) [19] , to ensure that institutional investors gain more accurate information (Gu, 2013) [3] .

Hypothesis 4: The closer relationship between analysts and institutional investors, the higher analysts’ earnings forecasts accuracy.

Based on the literature review and the theoretical analysis, the following parts of this paper will introduce variable including recommendation rating, analyst ranking, underwriting condition and the ratio of share held by investment portfolio to quantify the benefit relationship mention above, and then use the regression model to test how those interests affect the accuracy of analysts’ earnings forecasts.

3. Data and Methodology

3.1. Data Source

This paper uses Chinese listed companies during 2012 and 2015 as analysis sample. Sample firms are listed on the boards of the Shenzhen and Shanghai stock exchanges. We exclude financial firms because their liabilities are not strictly comparable to those in other industries. The financial and accounting information data are extracted from the China Stock Market and Accounting Research (CSMAR) database commercially available from Shenzhen GTA Information Co. Ltd. Furthermore, we collect earnings forecasts and recommendations data from Securities analysts predict database in CSMAR, and we choose the latest annual earnings per share forecast as the research object if the same analyst predict a company more than twice a year. To mitigate the influence of outliers, we winsorize each continuous variable at the first and 99th percentiles. After eliminating missing data, in total there are 11,570 observations, involving 1601 companies, 102 securities and 2279 analysts. In this article, we use Excel and Stata14 to process data and to do the empirical analysis.

3.2. Variable Definition

Bias is the deviation degree of analysts’ earnings forecasts. In order to measure the accuracy of earnings forecasts, we use the deviation degree of analysts’ earnings forecasts, which is calculated as the following Equation (1),

(1)

(1)

where  is the actual value of the earnings per share;

is the actual value of the earnings per share;  is the predicted value of the earnings per share in analysts’ earnings forecasts. Lower value in Bias shows the lower level of errors in analysts’ earnings forecasts, which means the higher analysts’ earnings forecasts accuracy.

is the predicted value of the earnings per share in analysts’ earnings forecasts. Lower value in Bias shows the lower level of errors in analysts’ earnings forecasts, which means the higher analysts’ earnings forecasts accuracy.

Rank is a dummy. As is known, the higher rating in the analyst recommendation, the closer relationship between securities analysts and the listed companies’ management. If the analyst recommend buying the shares, its value is 1; when the recommendation is “outperform”, “neutral”, “underperform”, “selling”, its value is 2 to 5.

Rep is a dummy. If the analyst was the top three analysts ranked by New Fortune from 2012 to 2015, then Rep means 1, otherwise it is 0.

UW is a dummy. If the securities company the analyst belongs to is the listed company’s underwriter, including lead and co-underwriters and distributors of its initial public offering, issuing share or rights issue, then it means 1, otherwise it is 0.

Fund is a variable to measure the relationship with institutional investors. This article uses the ratio of share held by investment portfolio management to entire equity.

Control variables: Because the closer between the day the analysts release their reports and the day they predict, the higher earnings forecasts accuracy (Das, 1998) [20] , we use the number of days between above two days as Span. In other words, the analysts predict the longer financial situation, the bias of their forecasts is bigger. PC means predictability for the company, which is confirmed as an important factor of earnings forecasts accuracy (Das, 1998) [20] . It is calculated as the ratio of non-operating profit to total profit. EV is a control variable, reflecting earning volatility of the listed company, which is measured as the standard deviations of the previous returns to each share (Shi, 2007) [9] . The larger EV means the more uncertainty of earnings, and it may bring more difficulties to analysts. Size is calculated by the natural log of total assets. Growth is measured by the increase rate of total assets.

3.3. Empirical Model

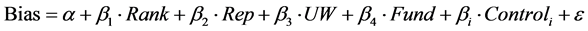

We use the following regression model to test the Hhypothesis 1 to Hhypothesis 4. We estimate the Equation (2) using ordinary lest squares (OLS).

(2)

(2)

refers to control variables, including Span, PC, EV, Size and Growth.

refers to control variables, including Span, PC, EV, Size and Growth.

4. Empirical Results

4.1. Descriptive Statistics

Table 1 presents summary statistics for some variables. The mean and the median of Feps are higher than those of Meps, suggesting that analysts forecast too optimistically. In the same time, the maximum of Bias is 6.4, while the minimum is 0, which illustrates the ability of analysts’ earnings forecasts is uneven in our country. Besides, the mean and the median of Rank is much lower than 3, which represents “neutral”, reflecting that analysts’ investment recommendations exist optimistic bias, which is comparable to most of the previous studies.

Table 2 presents the distribution of underwriter analysts and the top three

Table 1. Descriptive statistics of Bias, Rank, Fund and control variables.

Table 2. Descriptive statistics of UW and Rep.

Table 3. Empirical results of regression model.

analysts ranked by New Fortune from 2012 to 2015 in the sample. In general, only 4.2% of all analysts’ securities’ belongs to is the listed company’s underwriter, including lead and co-underwriters and distributors of its initial public offering, issuing share or rights issue, while 95.80% of the sample analysts don’t have underwriting relationships with their analysis objects. Besides, the proportion of the top three analysts is about 13%.

4.2. Empirical Results

In general, only when VIF is greater than 10, multiple regression equation of the variable exists serious multicollinearity problem, and in this case, VIF is 2.0291, rejecting the multicollinearity hypothesis. Besides, the F-Statistic of the model is 68.6063, illustrating that the model is a good fit (Table 3).

Consistent with Hypothesis 1, Rank is positively associated with Bias (p < 0.01). This indicates that the higher rating in the analyst recommendation, the closer relationship between securities analysts and the listed companies’ management, which will enhance forecast accuracy of analysts.

Secondly, it is clear that the positive correlation between Repand Biasis significant (p < 0.05), which is a strong evidence for Hypothesis 2. In the same time, we notice that the coefficient is small for the reason given in part 2. Although analysts want to increase their reputation for themselves, they have to issue overoptimistic forecasts to please the institutional investors, who vote for the top analysts, and this put analysts in a dilemma. The significant result shows that nowadays analysts in China pay attention to long-term reputation instead of short-term interest.

Thirdly, the value of p is larger than 0.1 in the third line, suggesting Hypothesis 3 is invalid. In other word, there are no significant differences between the forecast accuracy of underwriter analysts and non-underwriters analysts. We think it’s because of the imperfect information disclosure system in China capital markets, it’s hard for investors to collect related information in public, while with the underwriting business, the underwriters’ analysts enjoy an information advantage so that to some degree they can forecast more accurately.

Lastly, Fund is negatively associated with Bias (p < 0.01) in line 4, which supports Hypothesis 4. It suggests the closer relationship the securities analysts have with institutional investors, the small deviation between the actual and the forecast earning, meaning the higher accuracy of analysts’ earnings forecasts. We believe that the companies, which have high ratio of share held by investment portfolio management to entire equity, will receive more attention from the public, and that will increase accuracy of the companies’ related information. Meanwhile, analysts are more likely to track closely this type of companies’ information to maintain the relationship with institutional investors. Therefore, in general, analysts will forecast this type of companies more accurately.

5. Conclusions and Proposals

Given that Chinese security analysts are facing interest conflicts between generating accurate company reports and maintain good relationship with other parties, this paper proposes four theoretical hypothesizes that influence the accuracy of security analysts’ earnings forecasts, and verifies these hypothesizes by running a multiple regression model. The main findings are as follows:

・ In order to maintain the interest relationship with the management of the listed company, institutional investors and securities’ investment banking department, security analysts generate earnings forecasts and stock ranking with an optimistic bias.

・ If analysts rank highly of a stock, and have a closer relationship with the management of the listed company, they are more likely to have less bias forecasts for the company earnings. In other words, they have a higher chance to get accurate forecasts results. Therefore, security analysts’ relationship with the management of the listed companies is positively correlated to the accuracy of the earnings forecasts.

・ Although the analyst’s reputation is less connected to the earnings forecasts accuracy, those analysts with higher reputation tend to publish earnings forecasts with more positive views. This kind of overestimating forecast would decrease the accuracy of their earnings forecasts.

・ Based on the regression results, there are no significant differences between the forecast accuracy of underwriter analysts and non-underwriters analysts. However, underwriter analysts are more likely to overestimate the EPS and therefore lead to less accurate forecasting results.

・ The closer relationship the securities analysts have with institutional investors, the higher accuracy the earnings forecasting reports will be. Since institutional investors will help to increase information transparency of the listed companies, securities analysts are able to produce more accurate forecasts for listed companies with higher institutional investor’s shareholding ratio.

In conclusion, low accuracy of Chinese analysts’ earnings forecast reports is mainly due to the complicated interest conflicts that analysts are facing. In order to improve this situation, more regulations such as disclosure of listed company information as well as disclosure of security analysts’ interest conflicts are required in the security industry. In the same time, Securities Analysts Association of China and other organizations should strengthen the industry self-discipline to advance the development of the stock market.

Besides, security companies should also pay more attention on their own management to enhance the analysts’ forecasts quality. On one hand, banning the connection between the salaries of the analysts and the performance of investment banking as well as securities proprietary departments will enable the analysts to be more independent to generate forecasts. On the other hand, increasing the recruitment requirements will enhance analysts’ overall performance and contribute to better forecasting results.

Last but not the least, a matured security analyst reputation system will encourage analysts to focus more on the independence and accuracy of their reports. This is because analyst would rather to maintain good industrial reputation and build up promising career paths than to generate inaccurate report under the interest conflict pressure.

The limitation of this paper is that using the top three analysts ranked by New Fortune to measure analysts’ reputation may not a perfect and overall way to investigate their reputation, and the further study can look for a more appropriate variable to quantify it.

Cite this paper

Ou, Y.L. (2017) Does Benefit Relationship Affect Analysts’ Earnings Forecast?―Evidence from Chinese Stock Market. Open Journal of Accounting, 6, 33-42. https://doi.org/10.4236/ojacct.2017.62003

References

- 1. Firth, M., Lin, C. and Liu, P. (2013) The Client Is King: Do Mutual Fund Relationships Bias Analyst Recommendations. Journal of Accounting Research, 51, 165-200.

https://doi.org/10.1111/j.1475-679X.2012.00469.x - 2. Lin and Mc Nichols (1998) Underwriting Relationships, Analysts’ Earnings Forecasts and Investment Recommendation. Journal of Accounting and Economics, 25, 101-128.

- 3. Gu, Z.Y., Li, Z.Q. and Yang, Y.G. (2013) Monitors or Predators: The Influence of Institutional Investors on Sell-Side Analysts. The Accounting Review, 88, 137-169.

https://doi.org/10.2308/accr-50263 - 4. Hui, K.W., Wei, J. and You, W.F. (2013) Analyst Incentives, Forecast Biases, and Stock Returns. Working Paper, Hong Kong University of Science and Technology, Hong Kong.

- 5. Feng, X.N. (2012) Does Underwriting Relationship Affect the Security Analysts’ Behaviors: Evidences from Analysts’ Recommendations and Earnings Forecasts in China. China Accounting Review, 10, 395-410.

- 6. Xiao, B.Q., Zheng, L.L. and Li, X.D. (2012) Does Accounting Conservatism Affect Analysts’ Earnings Forecast?—Evidence from Chinese Stock Market. Management Review, 24, 36-44.

- 7. Lim, T. (2001) Rationality and Analysts’ Forecast Bias. Journal of Finance, 56, 369-385.

http://www.jstor.org/stable/222473

https://doi.org/10.1111/0022-1082.00329 - 8. Brown, Hagerman, Griffin and Zmijewski (1987) Security Analyst Superiority Relative to Univariate Time-Series Models in Forecasting Quarterly Earnings. Journal of Accounting & Economics, 9, 61-87.

- 9. Shi, G.F., Su, S.Y. and Qi, W.S. (2007) An Empirical Study about the Determinants of the Precision of Analysts’ Earnings Forecast. Journal of Finance and Economic, 33, 62-71.

- 10. Wang, H.F. and Li, C.C. (2016) An Empirical Study on the Accuracy of Securities Analysts’ Earnings Forecast in China. Journal of Nanjing Audit University, 6, 51-59.

- 11. Wu, C.P., Zheng, F.B. and Yang, S.J. (2013) Are Analysts’ Earnings Forecasts and Investment Recommendations Objective. China Economic Quarterly, 12, 935-958.

- 12. Clement, M.B. (1997) Analyst Forecast Accuracy: Do Ability, Resources, and Portfolio Complexity Matter. Journal of Accounting & Economics, 27, 285-303.

- 13. Fang, L. and Yasuda, A. (2005). The Effectiveness of Reputation as a Disciplinary Mechanism in Sell-Side Research. Social Science Electronic Publishing, 22, 3735-3777.

http://www.jstor.org/stable/40247675 - 14. Eames, M.J. and Glover, S.M. (2003) Earnings Predictability and the Direction of Analysts’ Earnings Forecast Errors. Accounting Review, 78, 707-724.

http://www.jstor.org/stable/3203222

https://doi.org/10.2308/accr.2003.78.3.707 - 15. Groysberg, B., Healy, P., Nohria, N. and Serafeim, G. (2011) What Factors Drive Analyst Forecasts? Financial Analysts Journal, 67, 18-29.

http://www.jstor.org/stable/20869898

https://doi.org/10.2469/faj.v67.n4.4 - 16. Guan, Z.P. and Huang, W.F. (2012) Securities Analyst’ Characteristic, Conflict of Interest and Accuracy of Earning Forecast. China Accounting Review, 4, 371-394.

- 17. Jackson, A.R. (2005) Trade Generation, Reputation, and Sell-Side Analysts. The Journal of Finance, 60, 673-717.

http://www.jstor.org/stable/3694764

https://doi.org/10.1111/j.1540-6261.2005.00743.x - 18. Mikhail, M.B., Walther, B.R. and Willis, R.H. (2003) The Effect of Experience on Security Analyst Under reaction. Journal of Accounting & Economics, 35, 101-116.

- 19. Agrawal, A. and Chen, M.A. (2008) Do Analyst Conflicts Matter? Evidence from Stock Recommendations. Journal of Law & Economics, 51, 503-537.

http://www.jstor.org/stable/10.1086/589672

https://doi.org/10.1086/589672 - 20. Das, S., Levine, C.B. and Sivaramakrishnan, K. (1998) Earnings Predictability and Bias in Analysts’ Earnings Forecasts. Accounting Review, 73, 277-294.

http://www.jstor.org/stable/248469