Modern Economy

Vol. 3 No. 8 (2012) , Article ID: 26141 , 5 pages DOI:10.4236/me.2012.38114

The Effect of R&D Investment on Firms’ Financial Performance: Evidence from the Chinese Listed IT Firms

School of Accounting, Zhejiang Gongshang University, Hangzhou, China

Email: zhuzhh@126.com

Received September 15, 2012; revised October 20, 2012; accepted October 29, 2012

Keywords: R&D; ROE; IT firms

ABSTRACT

Technological innovation by R&D is at the core of business strategy for firms to compete in the competitive market. This paper tests the correlation between firms R&D investment intensity and the one-year lagged performance of Chinese Listed IT firms, and suggests that firms with an intensive investment strategy in R&D will have significantly larger financial performances in the following year.

1. Introduction

The growth of technological firms is based on the exploitation of innovative products and services thus forcing them to strongly invest in research and development (R&D) [1]. It is important for firm’s managers to understand the relationship between R&D investment and firm’s performance and value [2].

Many researchers have been interested in the relationship between R&D investment and the firm’s market value, and have shown their positive and significant correlation. For example, Connolly and Hirschey’s (1984) study, which concentrated on 390 firms of the classification Fortune 500, showed the existence of a positive correlation between the R&D expenditures and the firm’s value [3]. Bae and Kim found that R&D investment consistently has a significant positive effect on the market value of firms in all three of the most advanced economies—the US, Germany, and Japan [4]. Hall, Thoma, and Torrisi found that Tobin’s q is positively and significantly associated with R&D and patent stocks [5].

Beyond their impact on the firm’s market value, R&D may have an influence on the firm’s financial performance [1], which is appreciated in terms of income, sale growth, and so on. Some researchers have attested the relation between R&D and firm’s financial performance, and have found firms with an intensive investment strategy in R&D have significantly larger financial performances. Brenner and Rushton noticed that the firms which have higher R&D expenditures on average obtain a sales growth rate higher than the market average rate, and vise versa [6]. Sougiannis found there’s positive correlation between the annual R&D expenditures and the net income announced by the firms in their annual report [7].

However, Lantza and Sahutb reached the opposite conclusion. They observed that the beta is nearly two times higher, and the return nearly two times lower for companies with intensive investments in R&D, compared to low R&D investing companies. Indeed, firms with an intensive investment strategy in R&D have significantly lower financial performances [1].

The review of the literature insists on contradictory results about the incidence of the R&D expenditures on the firm’s financial performance. And on the other hand, Chinese firms may have different characteristics in their R&D activities, so it is of significant importance for us to test the relation between R&D investment and firm’s financial performance in Chinese firms.

This paper is organized as follow. In Section II, we located our research in R&D in Chinese firms and related literature in order to define our framework and formulate assumptions to study the impacts of R&D investment on firm’s return on assets (ROA). In Section III, after a descriptive analysis of our sample, we test our assumptions using multiple regressions. Lastly, a brief conclusion is put forward.

2. Research Background and Development of Hypotheses

2.1. Research Background and Related Studies in China

R&D has also been known as one key strategic factor to continually improve the product and services in today’s business world based on new technology innovation [8]. Facing increasing competition and globalization, Chinese firms have been expanding their R&D and innovation since middle 1990s in order to reconstruct their technology capability and knowledge structure [9].

Meanwhile, the relation between R&D and firms performance is attracting some Chinese researchers’ attention recently. Liang and Yan, with pooled 2001-2003 data for about 240 Chinese firms traded publicly in Shenzhen Stock Exchange, found that there were positive correlation between firms R&D and current, one-year lagged and two-year lagged main business service profit margin with a descending regression coefficient [10]. Xu and Tang tested the relation between R&D and gross profit ratio with the sample of Chinese listed firms from 2002-2006, and also found that R&D investment can promote firm’s performance [11]. But Li, Huang and Wang suggested there was not a regression relationship between enterprise R&D expend and profit ability [12].

These studies did not lead to a consensus about the R&D impacts on financial performance [13]. There may be three reasons for these inconsistent results. First, some researches focus on test the relation between firms R&D and their performance of the same year, while R&D activities are future-aimed actives, and their impacts may be some years lagged, so, such model may undervalue the contribution of R&D. Second, most of the researches are focus on manufacture firms, which include food, textile, wood and furniture, petroleum, electronics, medicine and biological products, information technology industry and so on. R&D activity may have a different impact on the firm performance across different type of industry [8], and the existing researches pay little attention on this difference. The last, and the most important one is, R&D investment is not mandatory information in PRC Accounting Standard for Business Enterprises (CAS), and a firm may disclose R&D information voluntarily if its managers suggest this information may have a material effect on the decisions of shareholders and stakeholders. It is in the new CAS 6-intangible assets, which Ministry of Finance People’s Republic of China issue in 2006 and carry into execution in 2007, prescribe the disclosing of list firms’ R&D first time. So most of the existing researches are based on the data before 2007 which only a small quantity of firms disclose their R&D activities accurately and fully. The only one relevant research used a sample of 2007-2008 Chinese listed firms [14] fell into an error which took the firms whose “development expenditure” was bigger than “0” as the R&D intensive firms. In CAS 6, it is asked that a firm’s expenditures for its internal research and development projects should be classified into research expenditures and development expenditures, while the research expenditures and parts of development expenditure should be recorded into the profit or loss for the current period; and only when they satisfy some conditions simultaneously, the development expenditures may be confirmed as intangible assets. So, the closing balance of “development expenditure” only represents the expenditures which a firm tries to confirm as intangible assets after they meet the conditions for confirmation, doesn’t represent the total R&D amount in current year. Researcher needs to peruse the annual financial report and confirm the accurate R&D investment with professional knowledge and judgment.

So, this paper tries to explore the relationship between firms R&D and their financial performance in Chinese Information Technology industry from 2007-2009.

2.2. R&D and Firm’s Performance: Negative or Postive?

2.2.1. R&D: Uncertainty and Long-Term Oriented

Though it is general recognized that new products and services are of great importance in competitive success, it is alleged that managers are risk averse and favor shortterm earnings, and they maybe avoid R&D for the following reasons.

First, intangible investments have a greater probability of failure than tangible investments. R&D, a long-term growth investment, may involve a technological and competitive risk—a technological rupture brutally makes obsolete the discovery, and its discovery may be not become a market standard [1]. On the other hand, compared to returns from tangible investments, those of R&D and innovation investments are more remote in time. What is good in the long run is not always good in the short.

Another characteristic R&D expenditure is irreversibility, that is, if a firm stops a R&D project, it cannot recover all the money invested, because generally these investments are partly specific to the firm and cannot be sold at their acquisition cost.

Third, the spillovers relating to processes of specific R&D make it possible for competitors to gain competitiveness at a lower cost, the imitation of the processes. It is found that the output of R&D activity has public good characteristics; its results cannot be fully appropriated by the inventor.

2.2.2. R&D: New Products, Knowledge and Absorptive Capability

Firm’s competitiveness is a function of the firm’s tangible and intangible stocks. Nowadays, business environments are coming into an environment which D’Aveni named “hyper-competition”, firms must continuously develop themselves in new directions which are based on rapid technology and knowledge creation, acquirement, diffusion and use to keep a sustainable competitive advantage; intangible capital stocks are superseding tangible capital stocks to be at the core of business strategy for firms, which are dependent on firm’s R&D investment. The key competitive success factor is the ability to constantly develop new products, processes or services providing the customer with increased functionality and performance [15,16].

A firm’s R&D investment plays a pivotal role in the firm’s innovation activities. Innovative activity is risky, but its successful outcome confers monopoly power on the innovator Successful R&D can create new products and services, improve the quality of the products and/or services, which may work as barriers to entry, intangible capital stocks, or market demand factors that bring positive values to a firm’s performance and future growth opportunities.

Another output of R&D activities is new knowledge and information. In the emerging learning economy, which is not only connected to the flow of objects from the “stock of knowledge”, but also the generation of new knowledge, particularly through R&D & innovation [17], the ability to generate, learn and share ideas and knowledge has been considered, from a strategic perspective, as a critical source of competitive advantage [18].

The last one, which is also of great importance is, R&D can the firm’s ability to recognize, assimilate the value of new, external information, and apply it to commercial ends, which Cohen label this capability a firm’s absorptive capabilities, is critical to firm’s innovation capabilities [19,20]. The ability to exploit external knowledge is a critical component of innovation capabilities, which is largely a function of the level of prior related knowledge. This prior knowledge includes basic skills or even a shared language, but also includes knowledge of the most recent scientific or technological developments in a given field, and it is firm’s R&D activities that construct most of thus related knowledge.

The review of the literature insists on contradictory results about the incidence of the R&D investments on the firm’s financial performance. Our synthesis and observation led us to suppose that the R&D activities should indicate the capacity of a firm to maintain its competitive advantages, especially in technological firms.

In order to test our assumption, we chose to focus our study on IT firms because their activities are based on the economic exploitation of their R&D results. Though Mank and Nystrom have found that the computer industry in America is undergoing a reduction in their R&D intensity, and there were consistently negative correlation between firm’s R&D intensity and its shareholders’ return [21]. This isn’t the true to the Chinese IT firms, and makes the following hypothesis:

Hypothesis: the firm’s following financial performance is increasing with the intensity of the expense in R&D.

3. Variable and Sample

3.1. Variable

Independent variable, R&D intensity, is calculated as firm’s R&D expenditures to its same year’s revenue which we labeled RDR. While the ratio of R&D expenditures to assets (RDA) as another independent variable when we conduct robustness test.

One-year lagged1 ROA is used as dependent variable in our model, while one-year lagged ROE does as another dependent variable for robustness test.

Firm’s size (LNA) and asset-liability ratio (ALR) are conducted as control variables.

3.2. Data Sources and Sample

For the purpose of our analysis, we use data from the 2007-2009 annual report of the Chinese listed IT firms that disclose their R&D expenditures. We eliminate the special treatment (ST) firms, because such firms maybe have strong motivation to manage their earning through multi-means including change R&D investment and R&D expenditures treatment. Therefore, our sample is composed of 106 firm-years in IT sector. And when we analyze the relation between R&D investment and oneyear lagged performance, there are 73 firm-years.

4. Empirical Results

4.1. Descriptive Analysis of the Sample

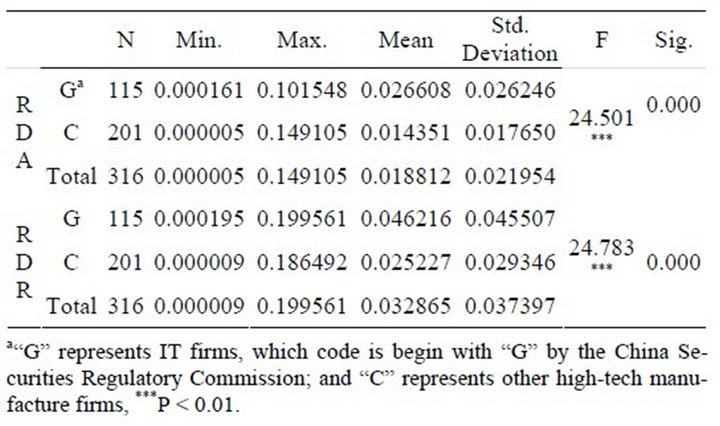

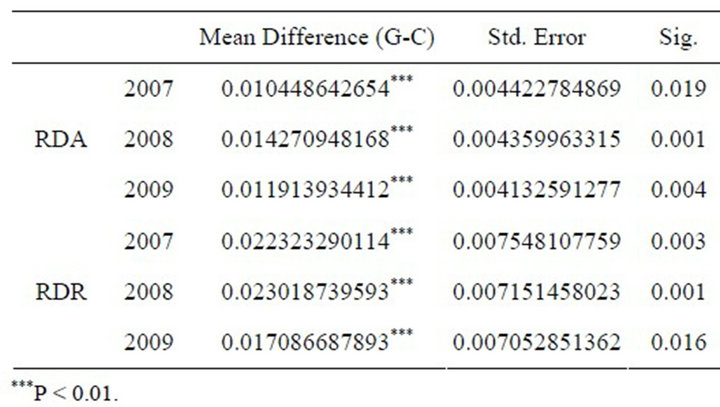

Descriptive analysis of sample firms RDR and RDA are shown in Table 1. In order to understand the intensity of R&D in IT industry, Table 1 also shows the R&D intensity of other high-tech manufacture firms, and the difference before these two kinds of industry. Table 2 describes the difference of every year.

Table 1. Descriptive analysis.

Table 2. Multiple comparisons of R&D of every year.

As Tables 1 and 2 show, the total and every year R&D intensity of IT firms are large than other high-tech manufacture firms significantly.

4.2. Multiple Regression Analysis

According to the hypothesis the variables we suggest above, a series of multiple regression analysis are conducted.

First, we test the IT firms R&D intensity and the current year’s financial performance, and it is suggested that there’s no significant correlation between same year’s R&D intensity and financial performance.

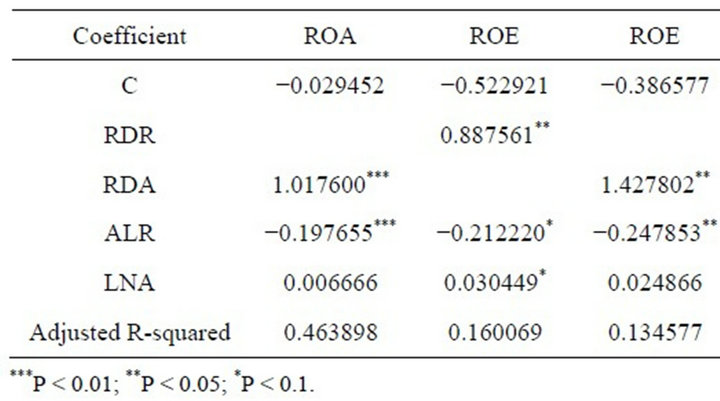

Then, we test their R&D intensity and one-year lagged performance. The results are shown in Table 3, In order to test the robustness of the model, we take RDA and ROE as independent variable and dependent variable respectively, and the main results are shown in Table 4.

It is noticed that the IT firm’s R&D investment intensity measured by the ratio R&D expenditures/revenue maintains a strong positive correlation (0.622285***) with the variable “one-year lagged Return to Assets (ROA)”. In other words, when the firm records significant expenditure of R&D, it will have large financial performance. Robustness test also suggest the same results.

5. Conclusions

A firm has to offer and/or the processes used to deliver the products and services and also to strengthen the competitive power in today’s business world based on new technology innovation [8]. So, R&D has also been known as one key strategic factor to firm’s sustainable competitive capability. But its greater probability of failure, its expenditure’s irreversibility and its returns’ more remote in time may result in managers’ R&D avoidance. So, an understanding of the relationship between R&D investment and firm’s performance is important both because of its relevance to setting R&D budgets and because it can inform some of the strategic choices made by the firm’s top management [2].

Table 3. Regression result.

Table 4. Regression result (robustness test).

This paper describes the R&D investment in Chinese listed IT firms, and tests the correlation between firms R&D intensity and the one-year lagged financial performance. The empirical results suggest that R&D intensity of IT firms are large than other high-tech manufacture firms significantly, and there’s significant correlation between R&D intensity and the following financial performance. That is, the firms which undertake intense R&D expenditures reinforce their performance.

6. Acknowledgements

Zhejiang Federation of Humanities and Social Sciences Circles support this research. The project Number is 2010Z05.

REFERENCES

- J. Lantza and J. Sahutb, “R&D Investment and the Financial Performance of Technological Firms,” International Journal of Business, Vol. 10, No. 3, 2005, pp. 251-269.

- M. Tubbs, “The Relationship between R&D and Company Performance,” Research-Technology Management, Vol. 50, No. 6, 2007, pp. 23-30.

- R. A. Connollly and M. Hirschey, “R&D, Market Structure and Profits: A Value-Based Approach,” Review of Economics and Statistics, Vol. 66, No. 4, 1984, pp. 682- 686. doi:10.2307/1935995

- S. C. Bae and D. Kim, “The Effect of R&D Investment on Market Value of Firms: Evidence from the US, Germany and Japan,” Multinational Business Review, Vol. 11, No. 3, 2003, pp. 51-75. doi:10.1108/1525383X200300016

- B. H. Hall, G. Thoma and S. Torrisi, “The Market Value of Patents and R&D: Evidence from European Firms,” NBER Working Paper, Cambridge, 2007.

- M. S. Brenner and B.M. Rushton, “Sales Growth and R&D in the Chemical Industry,” Research-Technology Management, Vol. 32, No. 2, 1989, pp. 8-15.

- T. Sougiannis, “The Accounting Based Valuation of Corporate R&D,” Accounting Review, Vol. 69, No. 1, 1994, pp. 44-68.

- J. Lee, K. Whang and E. H. Hall Jr., “A Comparative Approach to the Strategic Impact of R&D and Export Activity on Firm Economic Performance in Small Business Firms: US, Japan and Korea,” ICSB World Conference Proceedings, Washington DC, 21-24 June 2009, pp. 1-16.

- Z. Zhu and J. Chen, “Synergizing Innovation Assets within an Organization under Open Environment,” 2005 International Engineering Management Conference Proceedings, St. John’s, 11-13 September 2005, pp. 372-375. doi:10.1109/IEMC.2005.1559155

- L. Liang and S. Yan, “Empirical Research on R&D Expenditure and Its Economic Effect of Listed Companies,” Science of Science and Management of S&T, No. 7, 2006, pp. 34-38. (In Chinese)

- X. Xu and Q. Tang, “The impact of R&D Activities and Innovation Patents on Firm Value—A Study on Chinese Listed Companies,” R&D Management, Vol. 22, No. 4, 2010, pp. 20-29. (In Chinese)

- T. Li, X. Huang and C. Wang, “An Empirical Research on Enterprise R&D Expend and Operating Performance—An Comparison between Information and Manufactur E Industry Listed Companies,” Science of Science and Management of S&T, No. 7, 2008, pp. 170-174. (In Chinese)

- H. Ren and P. Shi, “Literature Review on the Relationship between R&D Investment and Firm Performance— From Direct Effects to Moderating Effects,” Science of Science and Management of S&T, No. 2, 2010, pp. 143- 151. (In Chinese)

- X. Cheng, J. Sun and L. Yao, “The Value Relevance of Capitalized R&D Expenditures: Empirical Evidences from China’s Listed Companies,” China Soft Science Magzine, No. 6, 2010, pp. 141-150. (In Chinese)

- R. D. Aveni, “Hypercompetition: Managing the Dynamics of Strategic Maneuvering,” The Free Press, New York, 1994.

- A. Drejer and J. O. Riis, “Competence Development and Technology, How Learning and Technology Can Be Meaningfully Integrated,” Technovation, Vol. 19, No. 10, 1999, pp. 631-644. doi:10.1016/S0166-4972(99)00064-4

- B. A. Lundvall, “The Learning Economy: Challenges to Economicy Theory and Policy,” In: K. Nielsen and B. Johnson, Eds., Institutions and Economic Change: New Perspectives on Marks, Firms and Technology, Edward Elgar, Cheltenham, 1998.

- R. M. Grant, “Prospering in Dynamically-Competitive Environments: Organizational Capability as Knowledge Integration,” Organization Science, Vol. 7, No. 4, 1996, pp. 375-387. doi:10.1287/orsc.7.4.375

- W. M. Cohen and D. A. Levinthal, “Innovation and Learning: The Two Faces of R&D,” The Economic Journal, Vol. 99, No. 397, 1989, pp. 569-596. doi:10.2307/2233763

- W. M. Cohen and D. A. Levinthal, “Absorptive Capacity: A New Perspective on Learning and Innovation,” Administrative Science Quarterly, No. 35, No. 1, 1990, pp. 128- 152. doi:10.2307/2393553

- D. A. Mank and H. E Nystrom, “Decreasing Returns to Shareholders from R&D Spending in the Computer Industry,” Engineering Management Journal, Vol. 13, No. 3, 2001, pp. 3-8.

NOTES

1The Chinese listed firms have adopted new CAS for only four years, while the most of annual financial report of the listed firms will be issued this month, so there are only three years data can we used for our test. On the other hand, there only about 80 listed IT firms and the fewer have disclosed their R&D expenditures fully, so we have no more sample for longer-term effect analysis.