Paper Menu >>

Journal Menu >>

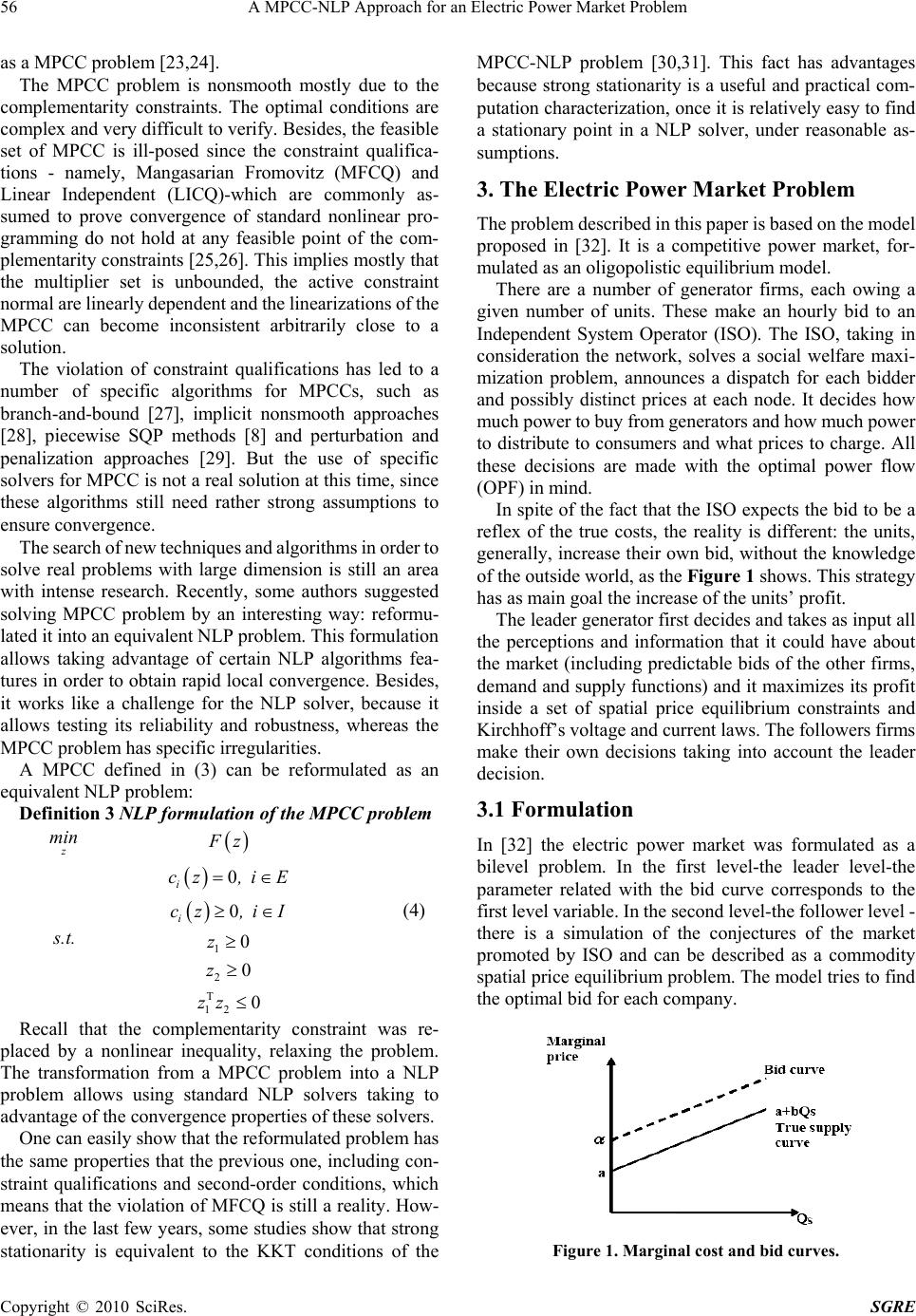

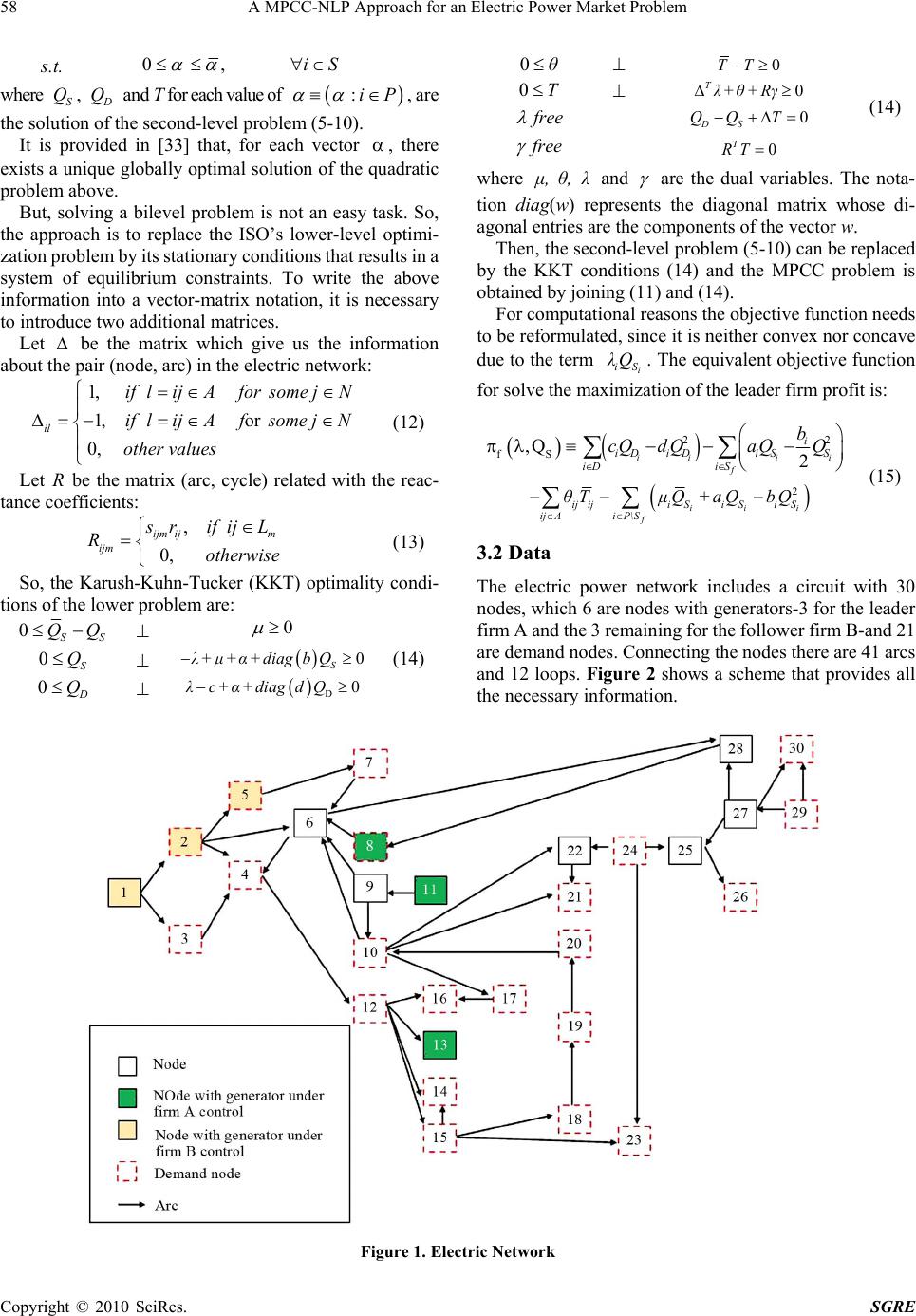

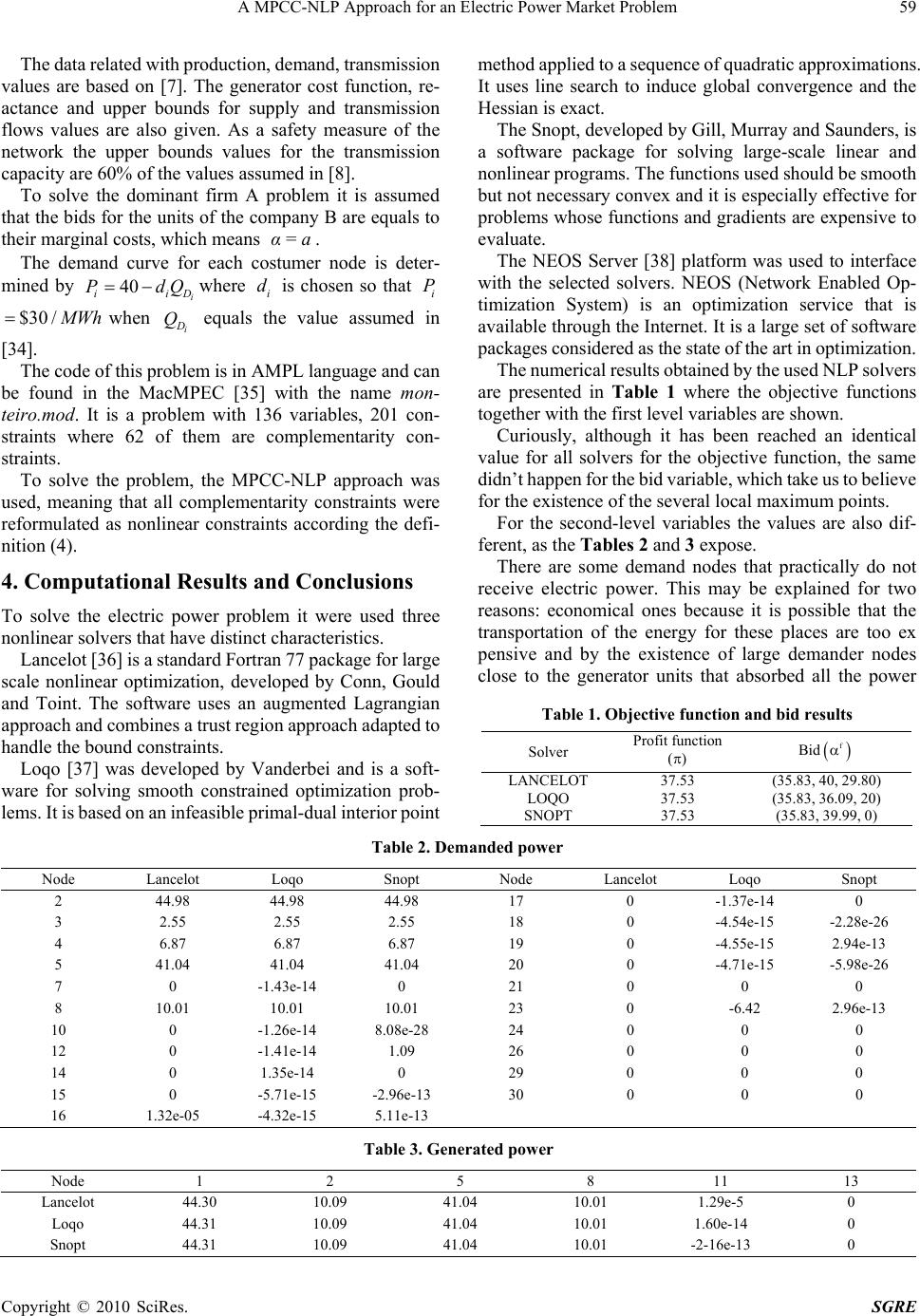

Smart Grid and Renewable Energy, 2010, 1, 54-61 doi:10.4236/sgre.2010.11009 Published Online May 2010 (http://www.SciRP.org/journal/sgre) Copyright © 2010 SciRes. SGRE A MPCC-NLP Approach for an Electric Power Market Problem Helena Sofia Rodrigues1, Maria Teresa Torres Monteiro2, António Ismael Freitas Vaz2 1School of Business Studies, Viana do Castelo Polytechnic Institute, Valença, Portugal; 2Department of Production and Systems, University of Minho, Braga, Portugal Email: sofiarodrigues@esce.ipvc.pt, {tm, aivaz}@dps.uminho.pt Received November 21st, 2009; revised May 14th, 2010; accepted May 14th, 2010. ABSTRACT The electric power market is changing-it has passed from a regulated market, where the government of each country had the control of prices, to a deregulated market economy. Each company competes in order to get more cli.e.nts and maximize its profits. This market is represented by a Stackelberg game with two firms, leader and follower, and the leader anticipates the reaction of the follower. The problem is formulated as a Mathematical Program with Complementarity Constraints (MPCC). It is shown that the constraint qualifications usually assumed to prove convergence of standard algorithms fail to hold for MPCC. To circumvent this, a reformulation for a nonlinear problem (NLP) is proposed. Numerical tests using the NEOS server platform are presented. Keywords: Electric Power, Stackelberg Game, Nonlinear Programming, Complementarity Constrained Optimization 1. Introduction The electric power market is in transition. Until recently, the market was regulated by the government of each country, and companies could on ly sell to a restrict set of consumers. With the deregularization, electricity industry becomes a liberalized activity where planning and operation sch- eduling are independent activities which are not constra- ined by centralized procedures. On the other side, the generator fi rms take m ore risk as they becom e responsible for their decisions. While in a regulated market the industry goal was to minimize the costs - once the price was fixed-now, it is also to maximize profit. A competition environment is created in order to benefit the consumers through price reduction, but ill effects can occur if the level of concen - tration in the market grows. In order to study the interaction of all market partici- pants and to have a better knowledge of the market con- ditions, firms and governments need suitable decision- support models. The deregularization process is under way in many countries. In 1998, the USA has begun their transition: California, Massachusetts and Rhode Island were the first states, but others will follow them over the next years. Nowadays, America’s electric power industry is highly fragmented [1]. In Europe, t he pr ocess has sta rted in the decade of 80 in England and Wales. In the last years, the market has been faced with fusions and merges between companies. The directives of European Union for an electric power liber- ality led up to increasing institutional and physical con- nections between markets from different countries. Some papers about studies in course, related with German, French and The Netherlands power markets-see [2-6] for more details-have emerged. According to [7], there are reasons to consider electric power as a special commodity: All power travels over the same set of power lines, in- dependently of the firm that generated it; this difference is particularl y marked when the networ ks contains lo ops and there are transmission cap acity limits; also electricity has unique physical properties, namely Kirchhoff voltage and current laws. As the electricity is difficult to store, and the quantity of power must be instantly adjusted to the demand, the companies that lead the market could easily manipulate the price, changing it to higher valu es, especially in peak consumption periods. The scientific community try to find models to predict how the prices will react to this new market structure. The organization of this paper is as follows: Section 2 introduces the Stackelberg game and the related concepts and definitions of optimization. In Section 3, it is present the formulation of the electric power problem as well as its transformation from MPCC into a MPCC-NLP prob-  A MPCC-NLP Approach for an Electric Power Market Problem 55 Copyright © 2010 SciRes. SGRE lem and also the data specifying the network for the computational experiments. Finally, the numerical results obtained by a set of solvers are shown and the main con- clusions are discussed in the last section. 2. Stackelberg Game and Optimization To simulate the decision making process for defining offered prices in a deregulated environment, it was used the game theory, in particular the Stackelberg game. A parallelism between this economic theory and optimiza- tion is also addressed. 2.1 Stackelberg Game In Stackelberg game there are two kinds of players: the leader and the followers. The leader firm has the power to manipulate the prices, production and expansion ca- pacity in order to maximize its own profit and anticipates the reaction of the rest of the player firms. The leader uses the knowledge of the reactions in order to choose its own optimal strategy. The follower decisions are depen- dent on the leader strategy. The follower does not have the perception how its decisions influence the leader resolution. Between followers their behaviour act like a noncoop- erative Nash game, where all players have the same in- formation and no one can increase their own profit through unilateral d ecisions [8]. A Stackelberg game can be formulated as a bilevel programming problem and therefore we introduce the reader to it in the next subsection. 2.2 Bilevel Optimization Definition 1 Bilevel Optimization Problem A bilevel optimization problem is composed by a first-level problem: x ,y min 1() F x, y s.t. ()0gx,y (1) Where y, for each value of x, is the solution of the sec- ond-level problem : y min 2() F x, y s.t. ()0hx,y (2) with nx x IR, ny y IR, 12 ,: nx+ny F FIR IR, : g nx+ny nu I RIR, :nx+ny nl hIR IR. The variables x[y] are called as first [second] level variable, g(x,y) [h(x,y)] are the first [second] level con- straints and F1(x,y) [F2(x,y)] are the first [second] level objective function. A typical bilevel problem is an optimization model whose constraints require that certain of its variables (x) solve an optimization subproblem that dependents para- metrically on the remaining variables (y). Regarding with careful attention the structure of the bilevel problem, it is possible to observe that the first/second level of the bilevel problem corresponds to the leader/followers players on the Stackelberg game. A bilevel problem is convex if F2 and h are convex functions in y for all values of x that is to say if the second level problem is convex [9]. The problem studied in this paper is a c onvex bile vel pr ob lem . The grea t adva ntage of this property in bilevel optimization is th at, under certain conditions, the second level problem can be replaced by their own Karush-Kuhn-Tucker (KKT) conditions, and the resulting problem is one level optimization problem with complementarity constraints. 2.3 Mathematical Program with Complementarity Constraints Definition 2 MPCC Problem Mathematical Program with Complementarity Con- straint (MPCC) is defined as: z min F z .. s t i cz=0,i E i cz0,i I 12 0zz 0 (3) where 012 ,,zzzz, with the control variable 0 z n I R and the state 12 ,p zz IR; F is the objective func- tion, i c,i EI are the set of equality and inequality constraints, respectively. The sets E and I are the finite sets of indices. The objective function F and the con- straints i c,i EI are assumed twice continuously differentiable. The constraints related to complementarity are defined with the operator and demand that the product of the two nonnegative quantities m ust be zero, i.e. 12ii zz 0 , i1,..., p. The concept of complementarity distinguishes an MP- CC from a standar d nonlinear optim ization problem and is a synonymous of equilibrium, reason why this type of problem is so popular in optimization (see [8,10,11] for some applications in the last years). In engineering, the MPCC problems are being used for contact and structural mechanic problems, namely in robotic [3,12,13], obstacle problems [14], elastohydrodi- namic lubrification [15,16], process engineering models [17] and traffic network equilibrium [18,19]. Applications in economics include the general equilib- rium and game theory from which Nash and Stackelberg game are instances [20-22]. A new field of applications is in ecological problems: the questions related with reduction of greenhouse gas emission rights, coalition formation and international trade in order to negotiate the emission rights between develop and developing countries can be also formulated  56 A MPCC-NLP Approach for an Electric Power Market Problem Copyright © 2010 SciRes. SGRE as a MPCC problem [23,24]. The MPCC problem is nonsmooth mostly due to the complementarity constraints. The optimal conditions are complex and very difficult to verify. Besides, the feasible set of MPCC is ill-posed since the constraint qualifica- tions - namely, Mangasarian Fromovitz (MFCQ) and Linear Independent (LICQ)-which are commonly as- sumed to prove convergence of standard nonlinear pro- gramming do not hold at any feasible point of the com- plementarity constraints [25,26]. This implies mostly that the multiplier set is unbounded, the active constraint normal are linearly dependent and the linearizations of the MPCC can become inconsistent arbitrarily close to a solution. The violation of constraint qualifications has led to a number of specific algorithms for MPCCs, such as branch-and-bound [27], implicit nonsmooth approaches [28], piecewise SQP methods [8] and perturbation and penalization approaches [29]. But the use of specific solvers for MPCC is not a real solution at this time, since these algorithms still need rather strong assumptions to ensure convergence. The search of new techniques and algorithms in order to solve real problems with large dimension is still an area with intense research. Recently, some authors suggested solving MPCC problem by an interesting way: reformu- lated it into an equivalent NLP problem. This formulation allows taking advantage of certain NLP algorithms fea- tures in order to obtain rapid local convergence. Besides, it works like a challenge for the NLP solver, because it allows testing its reliability and robustness, whereas the MPCC problem has specific irregularities. A MPCC defined in (3) can be reformulated as an equivalent NLP problem : Definition 3 NLP formulation of the MPCC problem z min F z s .t. 0 i cz,i E 0 i cz,i I 10z 20z T 12 0zz (4) Recall that the complementarity constraint was re- placed by a nonlinear inequality, relaxing the problem. The transformation from a MPCC problem into a NLP problem allows using standard NLP solvers taking to advantage of the convergence properties of these solvers. One can easily show that the reformulated problem has the same properties that the previous one, including con- straint qualifications and second-order conditions, which means that the violation of MFCQ is still a reality. How- ever, in the last few years, some studies show that strong stationarity is equivalent to the KKT conditions of the MPCC-NLP problem [30,31]. This fact has advantages because strong stationarity is a useful and practical com- putation characterization, once it is relatively easy to find a stationary point in a NLP solver, under reasonable as- sumptions. 3. The Electric Power Market Problem The problem describe d in this pa per is based on the model proposed in [32]. It is a competitive power market, for- mulated as an oligopolistic equilibrium model. There are a number of generator firms, each owing a given number of units. These make an hourly bid to an Independent System Operator (ISO). The ISO, taking in consideration the network, solves a social welfare maxi- mization problem, announces a dispatch for each bidder and possibly distinct prices at each node. It decides how much power to buy fr om gener ators an d how much power to distribute to consumers and what prices to charge. All these decisions are made with the optimal power flow (OPF) in mind. In spite of the fact that the ISO expects the bid to be a reflex of the true costs, the reality is different: the units, generally, increase their own bid, without the knowledge of the outside world, as the Figure 1 shows. This strategy has as main goal the increase of the units’ profit. The leader generator first decides and takes as input all the perceptions and information that it could have about the market (including predictable bids of the other firms, demand and supply functions) and it maximizes its profit inside a set of spatial price equilibrium constraints and Kirchhof f’s vo ltage and c ur ren t laws. The followers firm s make their own decisions taking into account the leader decision. 3.1 Formulation In [32] the electric power market was formulated as a bilevel problem. In the first level-the leader level-the parameter related with the bid curve corresponds to the first level variable. In the second level-the follower level - there is a simulation of the conjectures of the market promoted by ISO and can be described as a commodity spatial price equilibrium problem. The model tries to find the optimal bid for each company. Figure 1. Marginal cost and bid curves.  A MPCC-NLP Approach for an Electric Power Market Problem 57 Copyright © 2010 SciRes. SGRE Next we introduce the notation used in the mathe- matical formulation: Indices: i node in the network ij arc from node i to node j m number of Kirchhoff voltage loops in the net- work Sets: N set of all nodes A set of all arcs Sf set of generator nodes under control of leader firm f P set of all generators nodes D set of all demand nodes L set of Kirchhoff’ voltage loops m Lm set of ordered arcs (clockwise) associated with loop m Recall that, a node can be, simultaneously a generator and a consumer, so P and D are not necessarily disjoint and their union could be a proper subset of N. The uniqueness of the net flow on each arc is ensured by the Kirchhoff’s laws in the linearized DC models and, con- sequently, the number of (independent) loops is #A – #N + 1 (where #X is the set X cardinality). Parameters: ii a,b intercept and slope of supply function (marginal cost) for the generator at node iP ii c, d intercept and slope of demand function for consumer at node iD i αi α upper bound of the bid for the unit at node f iS i S Q upper bound of production capacity for the unit at node iP ij T maximum transmission capacity on arc ij A ij r reactance on arc ij A ijm s 1corresponding to the orientation of the arc ij A in loop mL (+1 if ij has the sam e orientation as t he loop m) First-Level decision variable i α bid for the unit at node iP In this model, it is assumed that the generate firms can only manipulate α (t he intercept in the bid function) and not the slope b, due to market and optimization as- sumptions. Let i α be fixed for the competitive firms (i.e. i α fixed f iP\S ) and variables for the leader firms (i.e. i α variable f iS ). Primal variables in the second-level: i S Q vector defined by quantity of power gener- ated by the unit at node i (ii SiiS Qa+bQ if iP and 0 i S Q if iP) i D Q quantity of power demanded at node i (ii D iiD Q=c dQ if iD and 0 i D Q=if iD) ij T matrix defined by MW transmitted from node i to node j Dual variables in the second-level i λ marginal cost at node i i μ marginal v alu e of generation capacity for unit at node i ij θ marginal value of transmission capacity on arc ij m γ shadow price for Kirchhoff voltage law for loop m Next, it is defined the second-level convex quadratic problem. The objective function is related with the maximization of social welfare: max 22 11 22 ii ii iDiDiS iS iD iP cQ dQαQbQ (5) This function reports a solution where the firms maximize their profits and the consumers maximize the utility of the product. The following constraints report to a spatial price equi- librium plus a constraint due to Kirchhoff voltage law. Nonnegative demand variables: 0, i D Q Di (6) Lower and upper bounds for transmission variables: 0, ij ij TTij A (7) Minimum and maximum capacity of production: 0, ii SS QQ iP (8) Conservation constraints: :: 0 ii DSij ij jij Ajij A QQT T (9) Kirchhoff voltage law: 0 ijm ijij ij Lm srT (10) If in Equation (8), by economic reasons, the minimum production level could not be zero , it is possi ble t o change the lower bound and still us e the same model. The description of the first level of the electric power is complete by taking into account that for the follower firms the bids are already fixed. The determination of the dominant company profit consists in finding a bid vector : f if ααiS , a vector of supplies S Q, a vector of demands D Q and a vector of transmission capacities T, by solving the following maximization problem. Maximize 2 (, )2 f i ii i iS f SiS iSS b QQaQQ (11)  58 A MPCC-NLP Approach for an Electric Power Market Problem Copyright © 2010 SciRes. SGRE s.t. 0, ii f iS where S Q, D Q and T for each value of : iiP , are the solution of the second-level problem (5-10). It is provided in [33] that, for each vector , there exists a unique globally optimal solution of the quadratic problem above. But, solving a bilevel problem is not an easy task. So, the approach is to replace the ISO’s lower-level optimi- zation problem by its stationa ry conditions that results in a system of equilibrium constraints. To write the above information into a vector-matrix notation, it is necessary to introduce two additional matrices. Let be the matrix which give us the information about the pair (node, arc) in the electric network: 1, 1, or 0, il iflijAforsome jN iflijAfsome jN other values (12) Let R be the matrix (arc, cycle) related with the reac- tance coefficients: , 0, ijm ijm ijm s rif ijL Rotherwise (13) So, the Karush-Kuhn-Tucker (KKT) optimality condi- tions of the lower problem are: 0SS QQ 0 0S Q 0 S λ+μ+α+diagbQ 0 D Q D0λc+α+diag d Q (14) 0θ 0TT 0T 0 Tλ+θ+Rγ free 0 DS QQ T free 0 T RT (14) where μ,θ, λ and are the dual variables. The nota- tion diag(w) represents the diagonal matrix whose di- agonal entries are the components of the vector w. Then, the second-level problem (5-10) can be replaced by the KKT conditions (14) and the MPCC problem is obtained by joining (11) and (14 ). For computational reasons the objective function needs to be reformulated, since it is neither convex nor concave due to the term i iS λQ. The equivalent objective function for solve the maximization of the leader firm profit is: fS ,Q 22 2 iii i f i iD iDiSS iD iS b cQ dQaQQ 2 iii f ijijiSiSi S ijAi P\S θTμQ+aQbQ (15) 3.2 Data The electric power network includes a circuit with 30 nodes, which 6 are nodes with generators-3 for the leader firm A and the 3 rem aining for the follower firm B-and 21 are demand nodes. Con necting t he nodes the re are 41 a rcs and 12 loops. Figure 2 shows a scheme that provides all the necessary information. Figure 1. Electric Network  A MPCC-NLP Approach for an Electric Power Market Problem 59 Copyright © 2010 SciRes. SGRE The dat a related with pr oduction, dem and, transmissi on values are based on [7]. The generator cost function, re- actance and upper bounds for supply and transmission flows values are also given. As a safety measure of the network the upper bounds values for the transmission capacity are 60% of the values assumed in [8]. To solve the dominant firm A problem it is assumed that the bids for the units of the company B are equals to their marginal costs, which means α=a. The demand curve for each costumer node is deter- mined by 40 i iiD PdQ where i d is chosen so that i P $30 / M Whwhen i D Q equals the value assumed in [34]. The code of this problem is in AMPL language and can be found in the MacMPEC [35] with the name mon- teiro.mod. It is a problem with 136 variables, 201 con- straints where 62 of them are complementarity con- straints. To solve the problem, the MPCC-NLP approach was used, meaning that all complementarity constraints were reformulated as nonlinear constraints according the defi- nition ( 4) . 4. Computational Results and Conclusions To solve the electric power problem it were used three nonlinear solvers th at have distin ct characteristics. Lancelot [36] is a standard Fortran 77 package for larg e scale nonlinear optimization, developed by Conn, Gould and Toint. The software uses an augmented Lagrangian approach an d com bines a trust regi on ap proach ada pted to handle the bound constraints. Loqo [37] was developed by Vanderbei and is a soft- ware for solving smooth constrained optimization prob- lems. It is based o n an infeasibl e primal-dual interior point method appl ied to a sequence of quadratic ap proximati ons. It uses line search to induce global convergence and the Hessia n is exact. The Snopt, developed by Gill, Murray and Saunders, is a software package for solving large-scale linear and nonlinear program s. The fu ncti ons use d shoul d be sm ooth but not necessary convex and it is especially effective for problems whose functions and gradients are expensive to evaluate. The NEOS Server [38] platform was used to interface with the selected solvers. NEOS (Network Enabled Op- timization System) is an optimization service that is available through the Internet. It is a large set of software packages considere d as the state of the art in optim ization. The numerical results obtained by the used NLP solvers are presented in Table 1 where the objective functions together with the first level variables are shown. Curiously, although it has been reached an identical value for all solvers for the objective function, the same didn’t ha ppen for the bid variable, whic h take us to bel ieve for the existence of the several local maximum points. For the second-level variables the values are also dif- ferent, as the Tables 2 and 3 expose. There are some demand nodes that practically do not receive electric power. This may be explained for two reasons: economical ones because it is possible that the transportation of the energy for these places are too ex pensive and by the existence of large demander nodes close to the generator units that absorbed all the power Table 1. Objective function and bid results Solver Profit function () Bid f LANCELOT 37.53 (35.83, 40, 29.80) LOQO 37.53 (35.83, 36.09, 20) SNOPT 37.53 (35.83, 39.99, 0) Table 2. Demanded power Node Lancelot Loqo Snopt Node Lancelot Loqo Snopt 2 44.98 44.98 44.98 17 0 -1.37e-14 0 3 2.55 2.55 2.55 18 0 -4.54e-15 -2.28e-26 4 6.87 6.87 6.87 19 0 -4.55e-15 2.94e-13 5 41.04 41.04 41.04 20 0 -4.71e-15 -5.98e-26 7 0 -1.43e-14 0 21 0 0 0 8 10.01 10.01 10.01 23 0 -6.42 2.96e-13 10 0 -1.26e-14 8.08e-28 24 0 0 0 12 0 -1.41e-14 1.09 26 0 0 0 14 0 1.35e-14 0 29 0 0 0 15 0 -5.71e-15 -2.96e-13 30 0 0 0 16 1.32e-05 -4.32e-15 5.11e-13 Table 3. Generated power Node 1 2 5 8 11 13 Lancelot 44.30 10.09 41.04 10.01 1.29e-5 0 Loqo 44.31 10.09 41.04 10.01 1.60e-14 0 Snopt 44.31 10.09 41.04 10.01 -2-16e-13 0  60 A MPCC-NLP Approach for an Electric Power Market Problem Copyright © 2010 SciRes. SGRE produced. It has been s hown t hat M PCC-NL P appr oach should be considered to solve real problems. As future work it is proposed the study of this problem developed as a nash model, where both firms compete at the same level and with the same market information. EFERENCES [1] M. Willrich, “Electricity Transmission Policy for America: Enabling a Smart Grid, End to End,” The Electricity Journal, Vol. 22, No. 10, 2009, pp. 77-82. [2] “Third Benchmarking Report on the Implementation of the Internal Electricity and Gas Markets,” Tech Republic 1, Commission Draft Staff Paper, March 2004. [3] B. F. Hobbs and F. A. M. Rijkers, “Strategic Generation with Conjectured Transmission Price Responses in a Mixed Transmission Pricing Sy stem,” IEEE Transmissions on Power Systems, Vol. 19, No. 2, 2004, pp. 707-879. [4] Y. Smeers, “How Well Can Measure Market Power in Restructured Electricity Systems,” Tech Republic, Uni- versity Catholique De Louvain, November 2004. [5] S. A. Gabriel and F. U. Leuthold, “Solving Discretely- Constrained MPEC Problems with Applications in Electric Power Markets,” Energy Economics, Vol. 32, No, 1, 2010, pp. 3-14. [6] M. Crappe, “Electric Power Systems,” Wiley-ISTE, 2009. [7] C. B. Metzler, “Complementarity Models of Competitive Oligopolistic Electric Power Generation Markets,” Master’s Thesis, The Johns Hopkins University, 2000. [8] Z.-Q. Luo, J.-S. Pang and D. Ralph, “Mathematical Programs with Equilibrium Constraints,” Cambridge University Press, Cambridge, 1996. [9] L. N. Vicente and P. H. Calamai, “Bilevel and Multilevel Programming: a Bibliography Review,” Journal of Global Optimization, Vol. 5, No. 3, 1994, pp. 291-306. [10] S. Dempe, “Annotated Bibliography on Bilevel Program- ming and Mathematical Programs with Equilibrium Con- straints,” Optimi zation, Vol. 52, No. 3, 2003, pp. 333-359. [11] M. C. Ferris and J. S. Pang, “Engineering and Economic applications of Complementarity Problems,” SIAM Re- view, Vol. 39, No. 4, 1997, pp. 669-713. [12] M. F. Ferris and F. Tin-Loi, “Limit Analysis of Frictional Block Assemblies as a Mathematical Program with Com- plementarity Constraints,” International Journal of Mech- anical Sciences, Vol. 43, No. 1, 2001, pp. 209-224. [13] J. S. Pang, “Complementarity Problems,” In: R. Horst and P. Pardalos, Eds., Handbook in Global Optimization, K. A. Publishers, Boston, 1994. [14] J. F. Rodrigues, “Obstacle Problems in Mathematics Phy- Sics,” Elsevier Publishing Company, Amsterdam, 1987. [15] M. C. Ferris and F. Tin-Loi, “On the Solution of a Minimum Weight Elastoplastic Problem Involving Dis- placement and Complementarity Constraints,” Computer Methods in Applied Mechanics and Engineering, Vol. 174, No. 1-2, 1999, pp. 107-120. [16] K. P. Oh and P. K. Goenka, “The Elastohydrodynamic Solution of Journal Bearings under Dynamic Loading,” Transactions of American Society of Mechanical En- gineers, Vol. 107, No. 3, 1985, pp. 389-395. [17] A. U. Raghunathan and L. T. Biegler, “Mathematical Pro- grams with Equilibrium Constraints (Mpecs) in Process Engineering,” Tech Republic, CMU Chemical Engine- ering, November 2002. [18] O. Drissi-Kaitouni and J. Lundgren, “Bilivel Origin-Dest- ination Matrix Estimation Using a Descent Approach,” Tech Republic, Linköping Institute of Technology, De- part-ment of Mathematics, Sweden, 1992. [19] M. Stohr, “Nonsmooth Trust Region Methods and their Applications to Mathematical Programs with Equilibrium Constraints,” Shaker Verlag, Aachen, 2000. [20] C. Ballard, D. Fullerton, J. B. Shoven and J. Whalley, “A General Equilibrium Modelfor Tax Policy Evaluation,” National Bureau of Economic Research Monograph, Chi- cago, 1985. [21] H. Ehtamo and T. Raivio, “On Aapplied Nonlinear and Bilevel Programming for Pursuit-Evasion Games,” Journal of Optimization Theory and Applications, Vol. 108, No. 1, 2001, pp. 65-96. [22] J. V. Outrata, “On Necessary Optimal Conditions for Stackelberg Problems,” Journal of Optimization Theory and Applications, Vol. 76, No. 2, 1993, pp. 305-320. [23] J. C. Carbone, C. Helm and T. F. Rutherford, “Coalition formation and International Trade in Greenhouse Gas Emission Rights,” MIMEO, the Sixth Annual Conference on Global Economic Analysis, Scheveningen, The Hague, The Netherlands, June 12-14 2003. [24] G. Hibino, M. Kainuma and Y. Matsuoka, “Two-Level Mathematical Programming for Analysing Subsidy Options to Reduce Greenhouse-Gas Emissions,” Tech Republic, Laxenburg, 1996. [25] M. Kocvara and J. V. Outrata, “Optimiz ation Problems w i t h Equilibrium Constraints and their Numerical Solution,” Mathematical Programs, Series B, Vol. 101, No. 1, 2004, pp. 119-149. [26] H. S. Rodrigues and M. T. Monteiro, “Solving Mathe- matical Program with Complementarity Constraints (MPCC) with Nonlinear Solvers,” Recent Advances in Optimization, Lectures Notes in Economics and Mathe- matical Systems, Springer, Berlin, Part 4, 2006, pp. 415- 424 [27] J. F. Bard, “Convex Two-Level Optimization,” Mathema- tical Programming, Vol. 40, No. 1, 1988, pp. 15-27. [28] J. Outrata, M. Kocvara and J. Zowe, “Nonsmooth App- roach to Optimization Problems with Equilibrium Cons- traints,” Kluwer Academic Publishers, Dordrecht, 1998. [29] M. C. Ferris, S. P. Dirkse and A. Meeraus, “Mathematical Programs with Equilibrium Constraints: Automatic Reformulation and Solution via Constrained Optimi- zation,” Tech Republic, Oxford University Computing Laboratory, July 2002. [30] H. Scheel and S. Scholtes, “Mathematical Programs with  A MPCC-NLP Approach for an Electric Power Market Problem 61 Copyright © 2010 SciRes. SGRE Complementarity Constraints: Stationarity, Optimality and Sensitivity,” Mathematics of Operations Research, Vol. 25, No. 1, 2000, pp. 1-22. [31] S. Scholtes, “Convergence Properties of a Regularization Scheme for Mathematical Programs with Complementarity Constraints,” SIAM Journal Optmization, Vol. 11, No. 4, 2001, pp. 918-936. [32] B. F. Hobbs, C. B. Metzler and J.-S. Pang, “Strategic Gaming Analysis for Electric Power Systems: An MPEC Approach,” IEEE Transactions on Power Systems, Vol. 15, No. 2, 2000, pp. 638-645. [33] V. Krishna and V. C. Ramesh, “Intelligent agents in Neg- otIations in Market Games, Part 2: Application,” IEEE Transactions on Power Systems, Vol. 13, No. 3, 1998, pp. 1109-1114. [34] O. Alsa and B. Scott, “Optimal Load Flow with Steady- State Security,” IEEE Transactions on Power Systems, Vol. 93, No. 3, 1973, pp. 745-751. [35] S. Leyffer, Macmpec, 2010. http://www.mcs.nl.gov/ leyffer/macmpec [36] Lancelot, 2010. http://www.numerical.rl.ac.uk/lancelot/blurb. html [37] H. Benson, A. Sen, D. Shano and R. Vanderbei, “Interior- Point Algorithms Penalty Methods and Equilibrium Prob- lems,” Tech Republic, Operations Research and Financial Engineering Princeton University, October 2003. [38] NEOS, 2010. http://www-neos.mcs.ang.gov/neos |