Paper Menu >>

Journal Menu >>

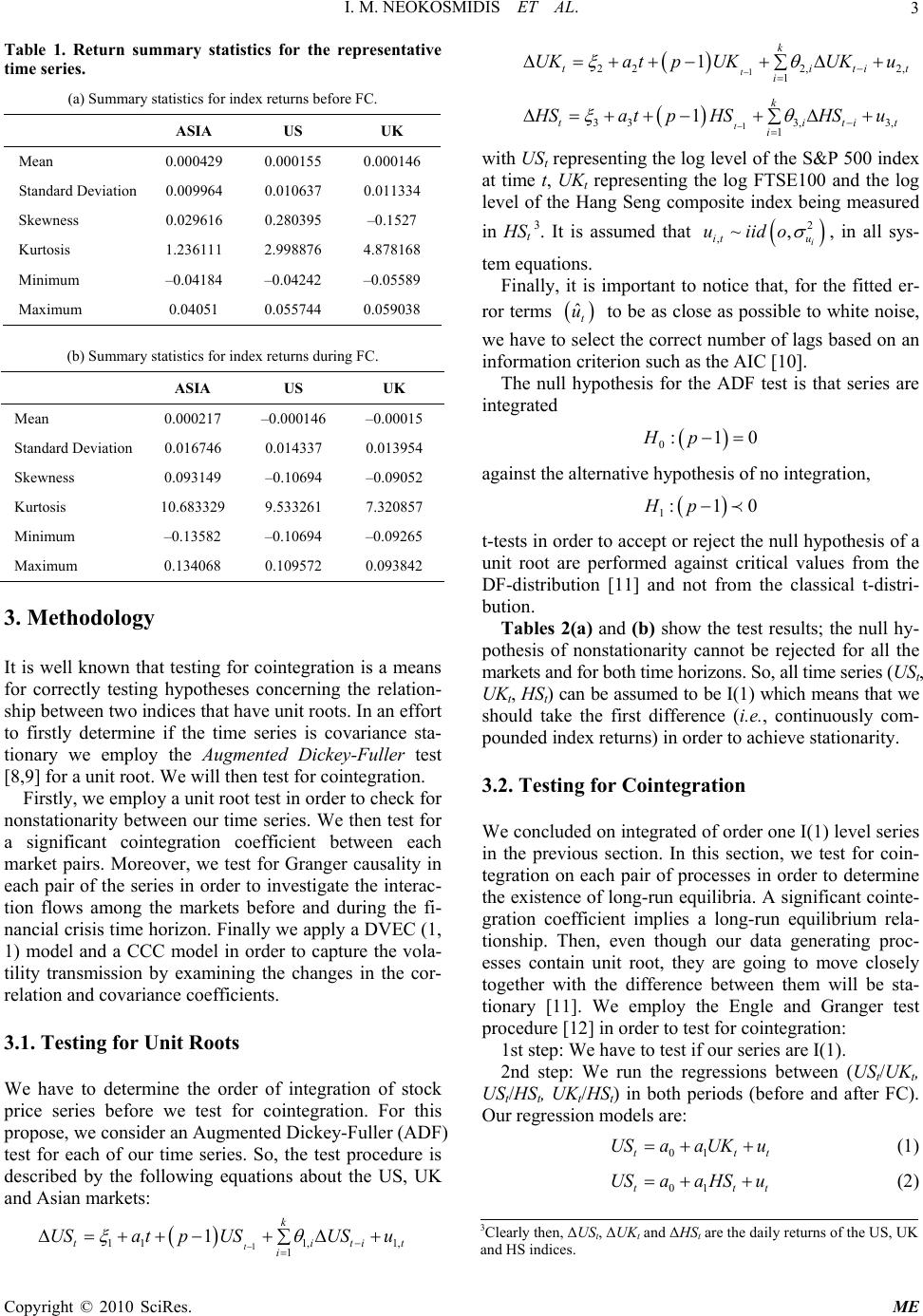

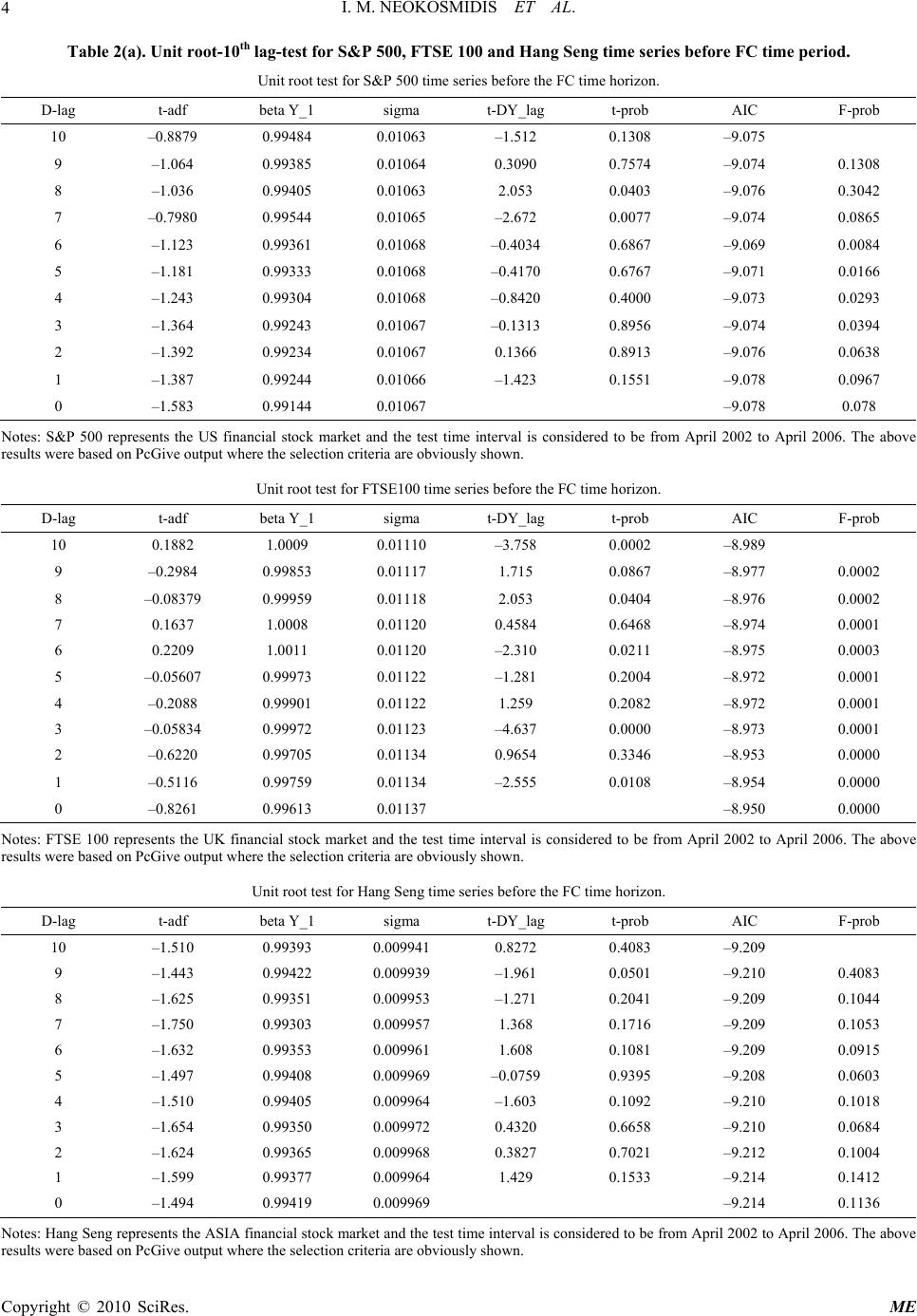

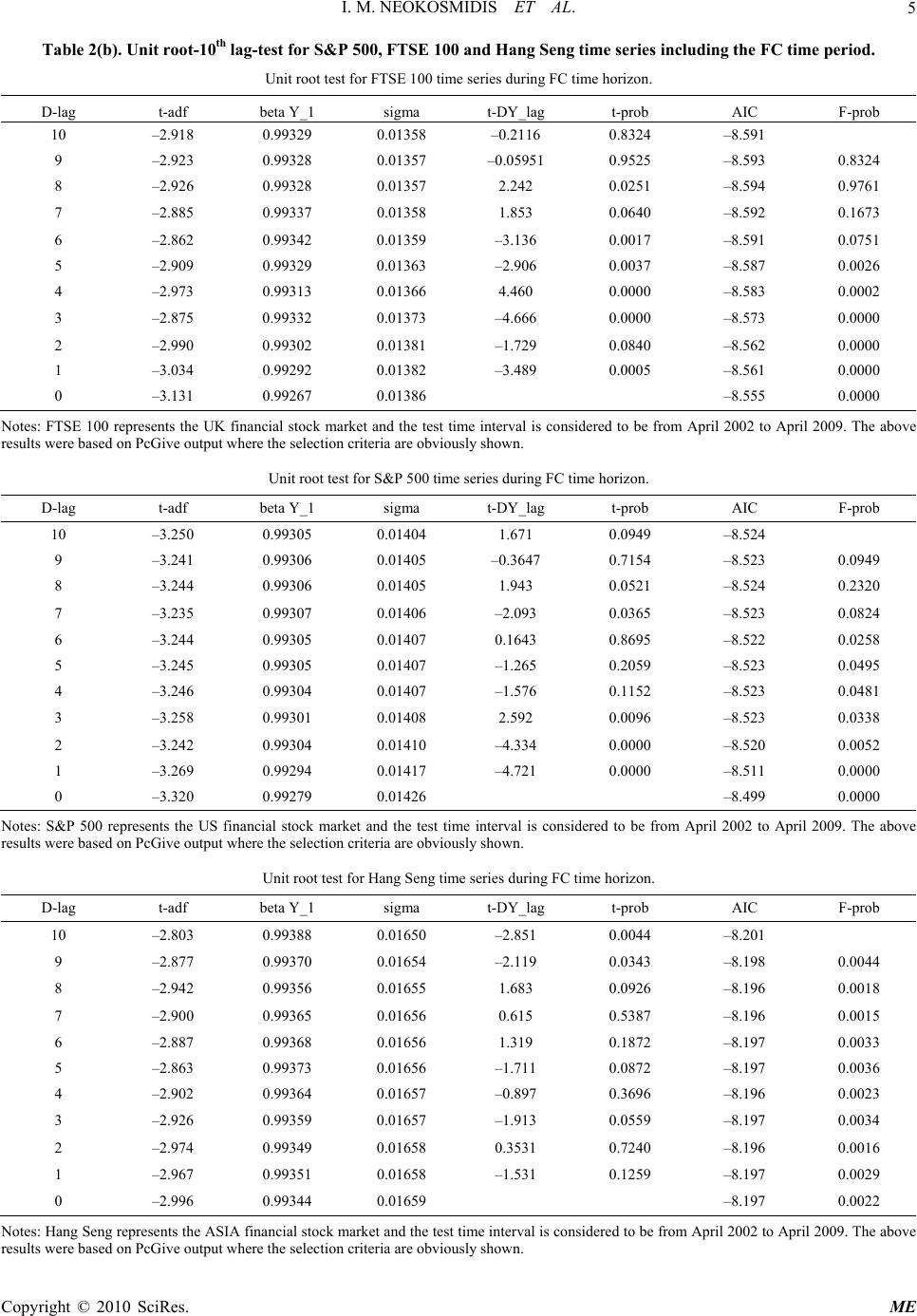

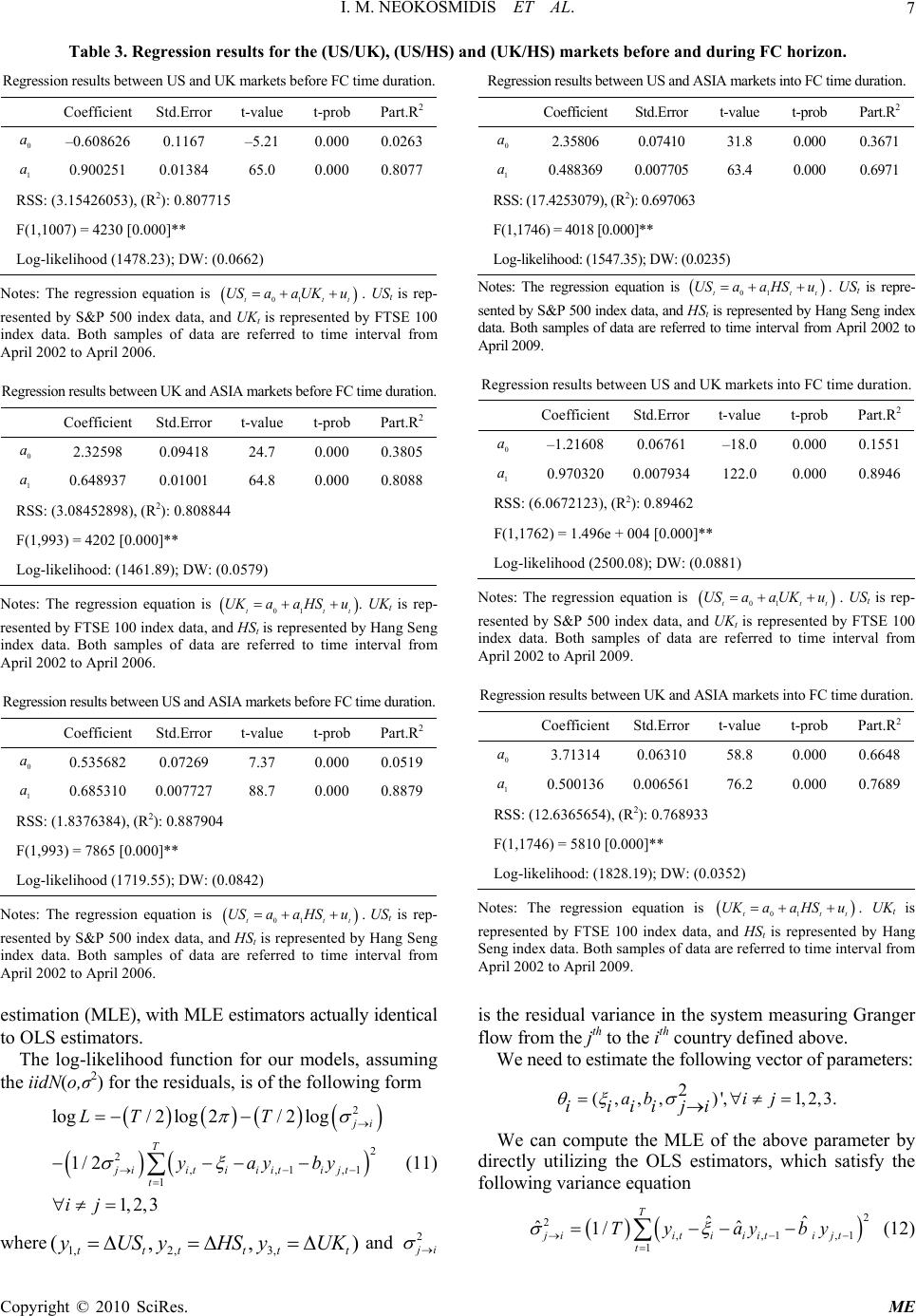

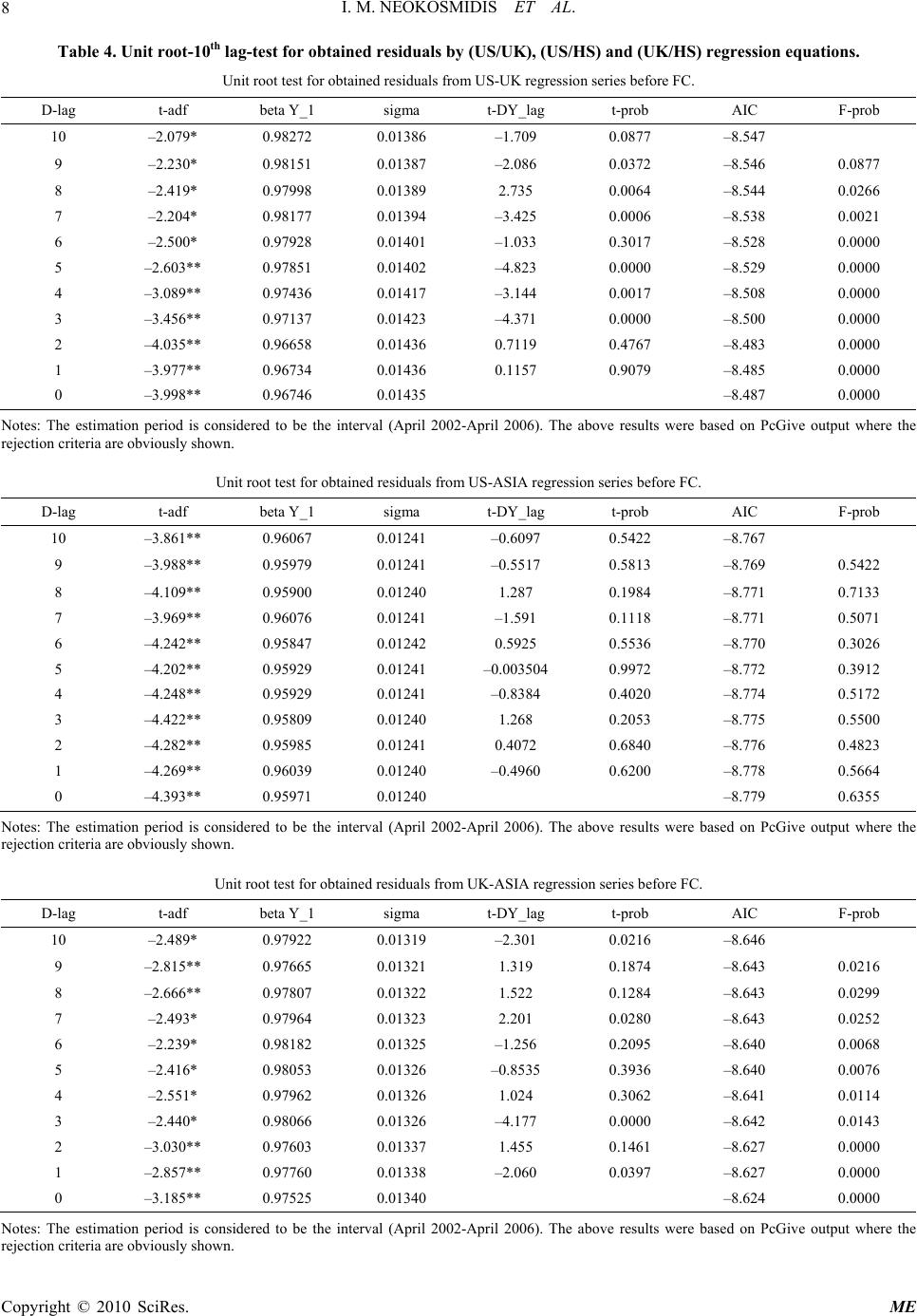

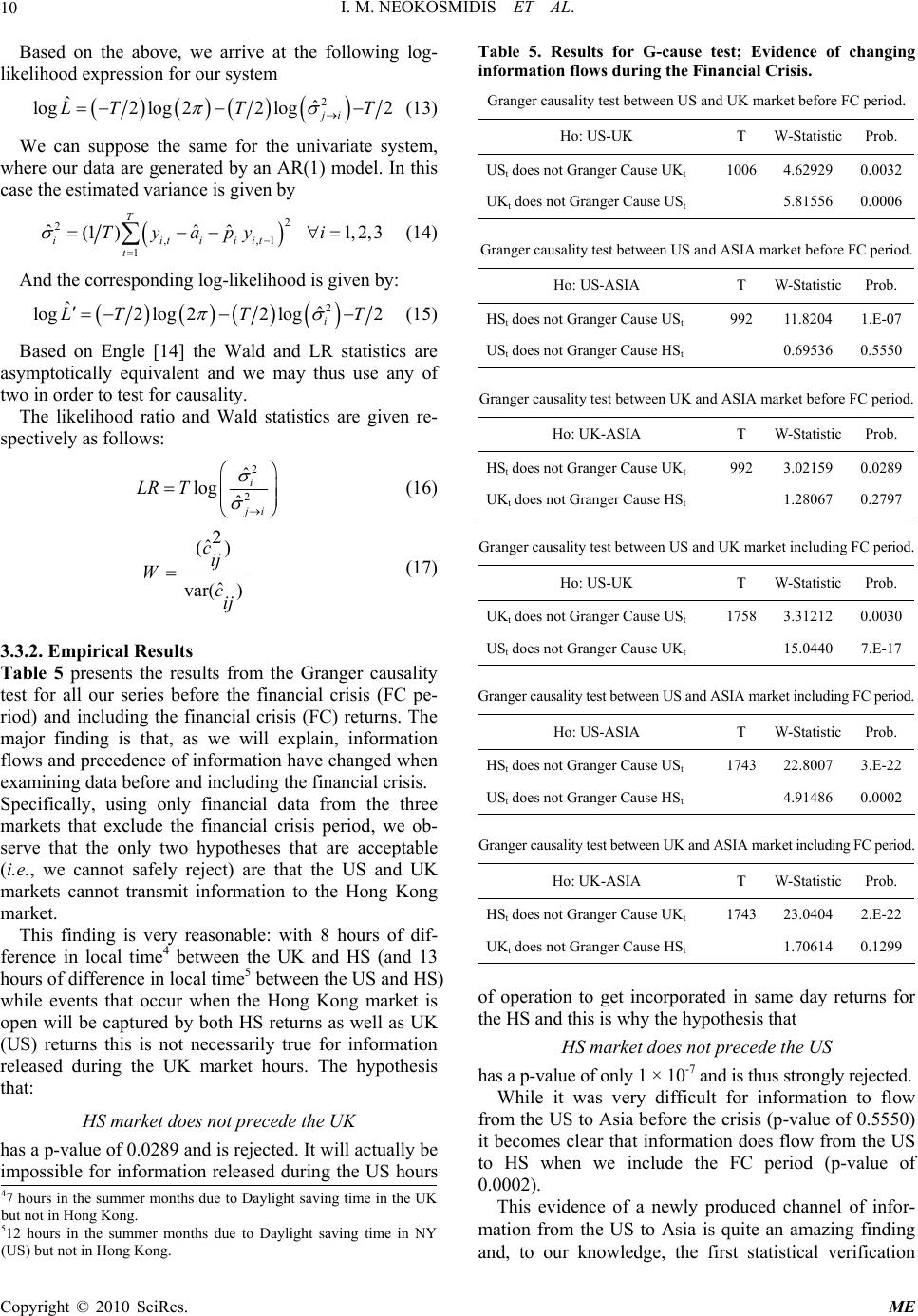

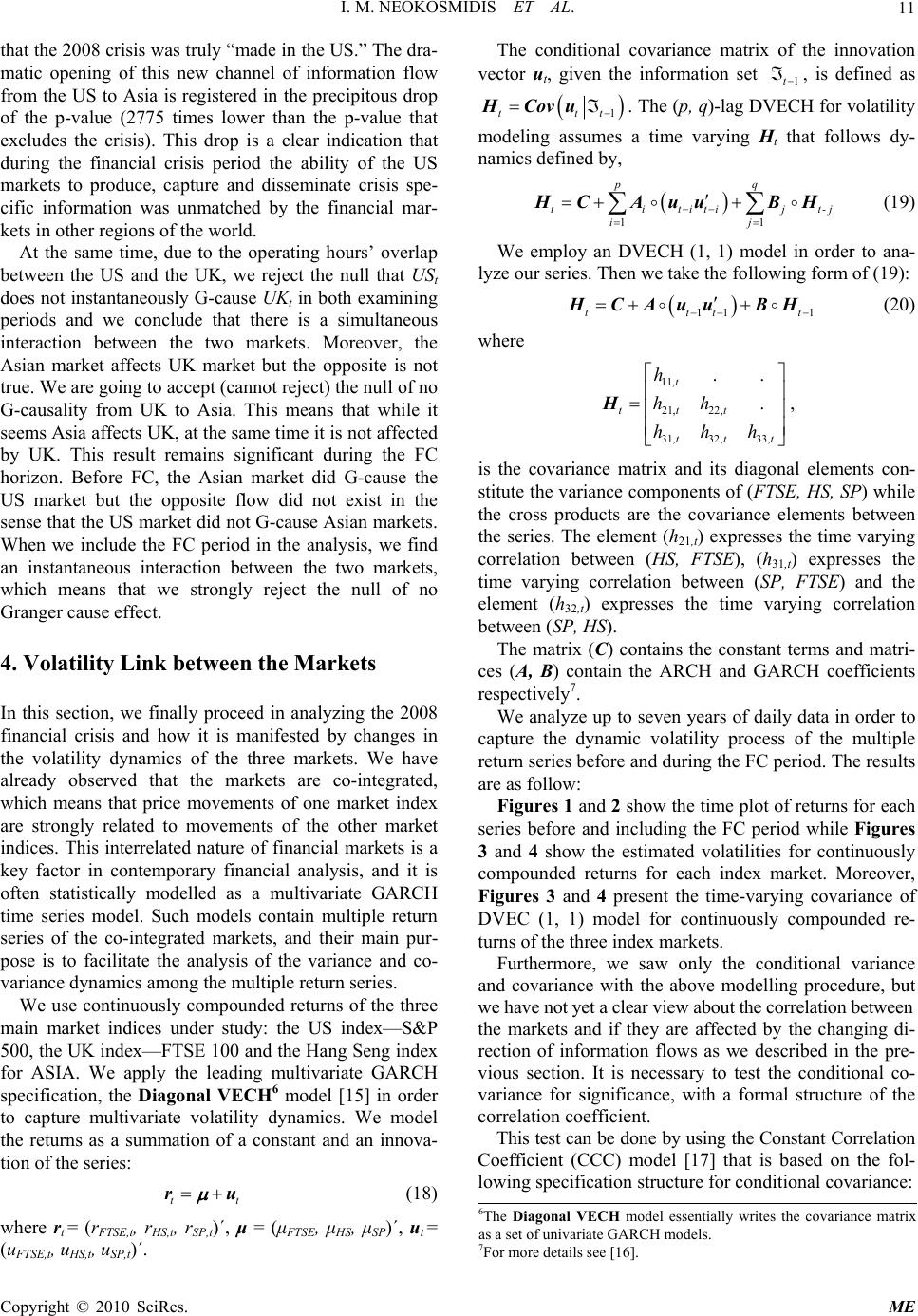

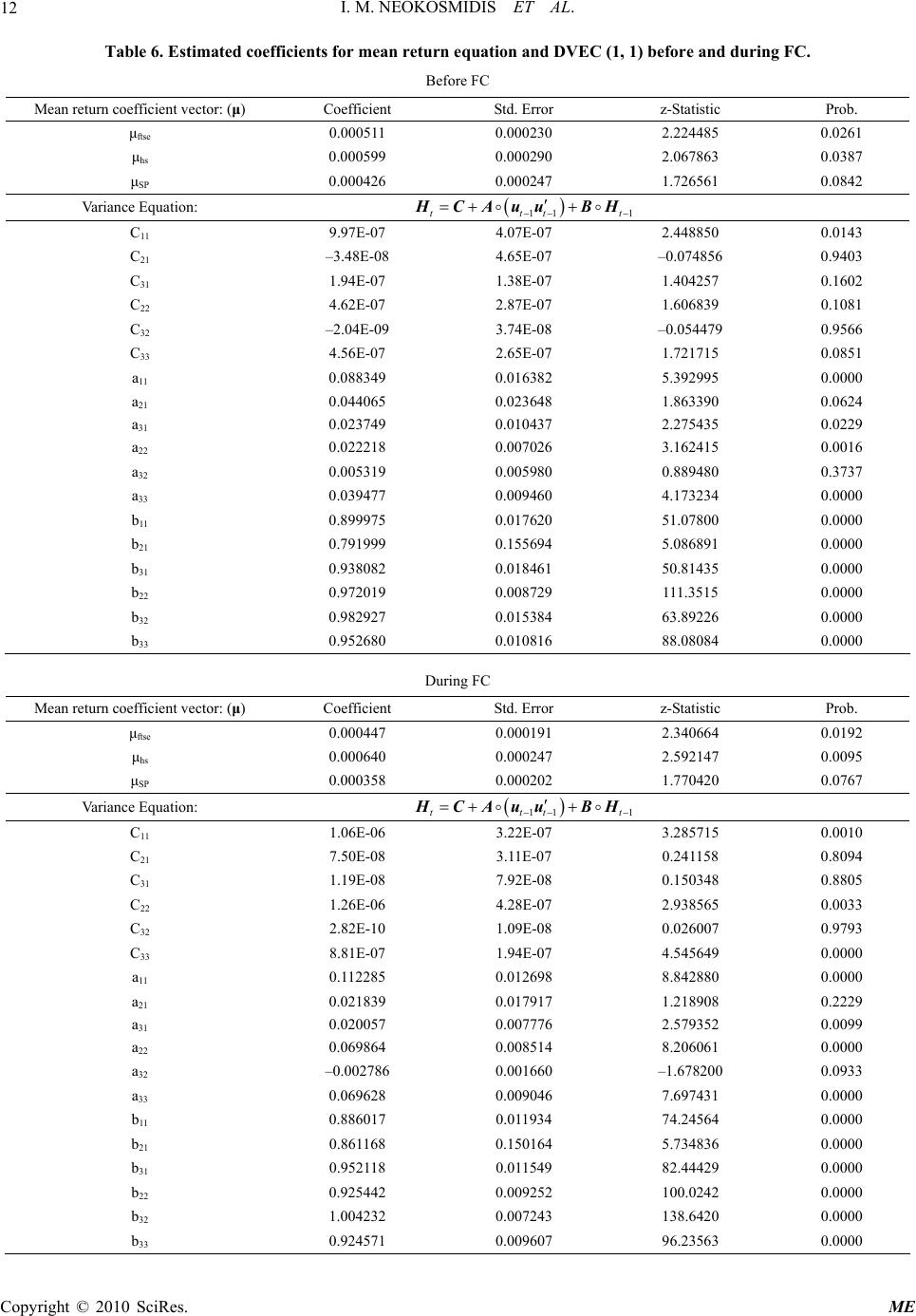

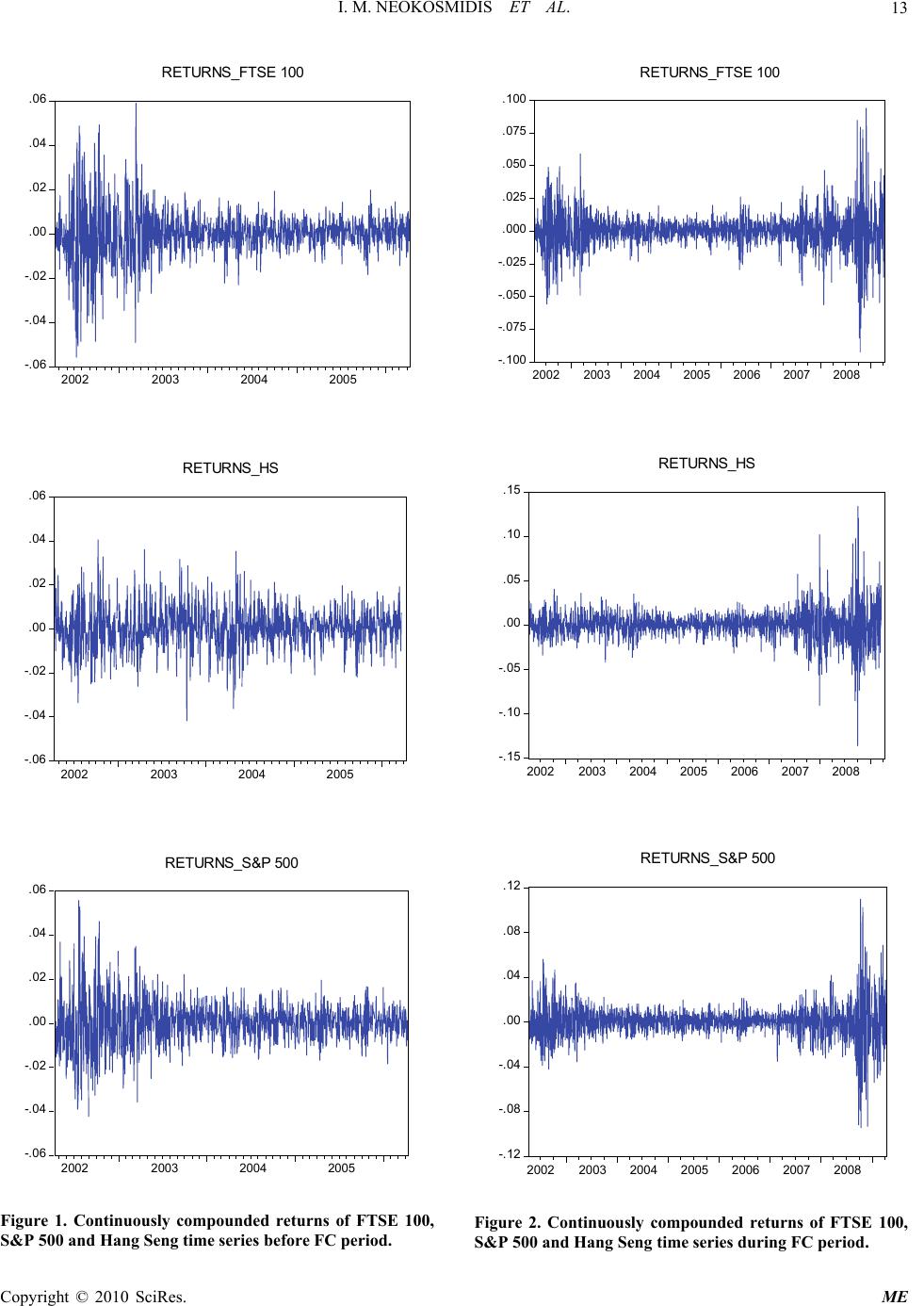

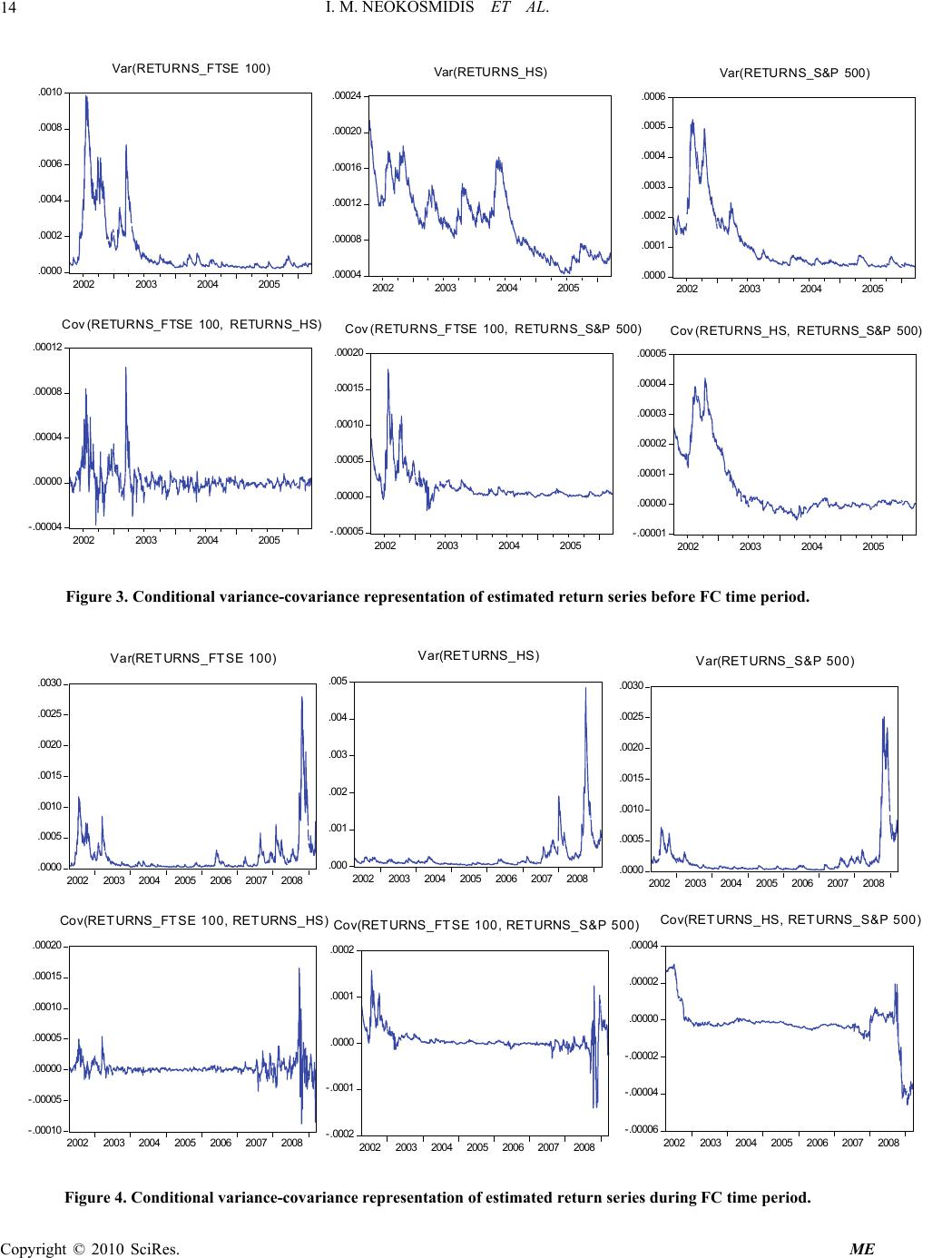

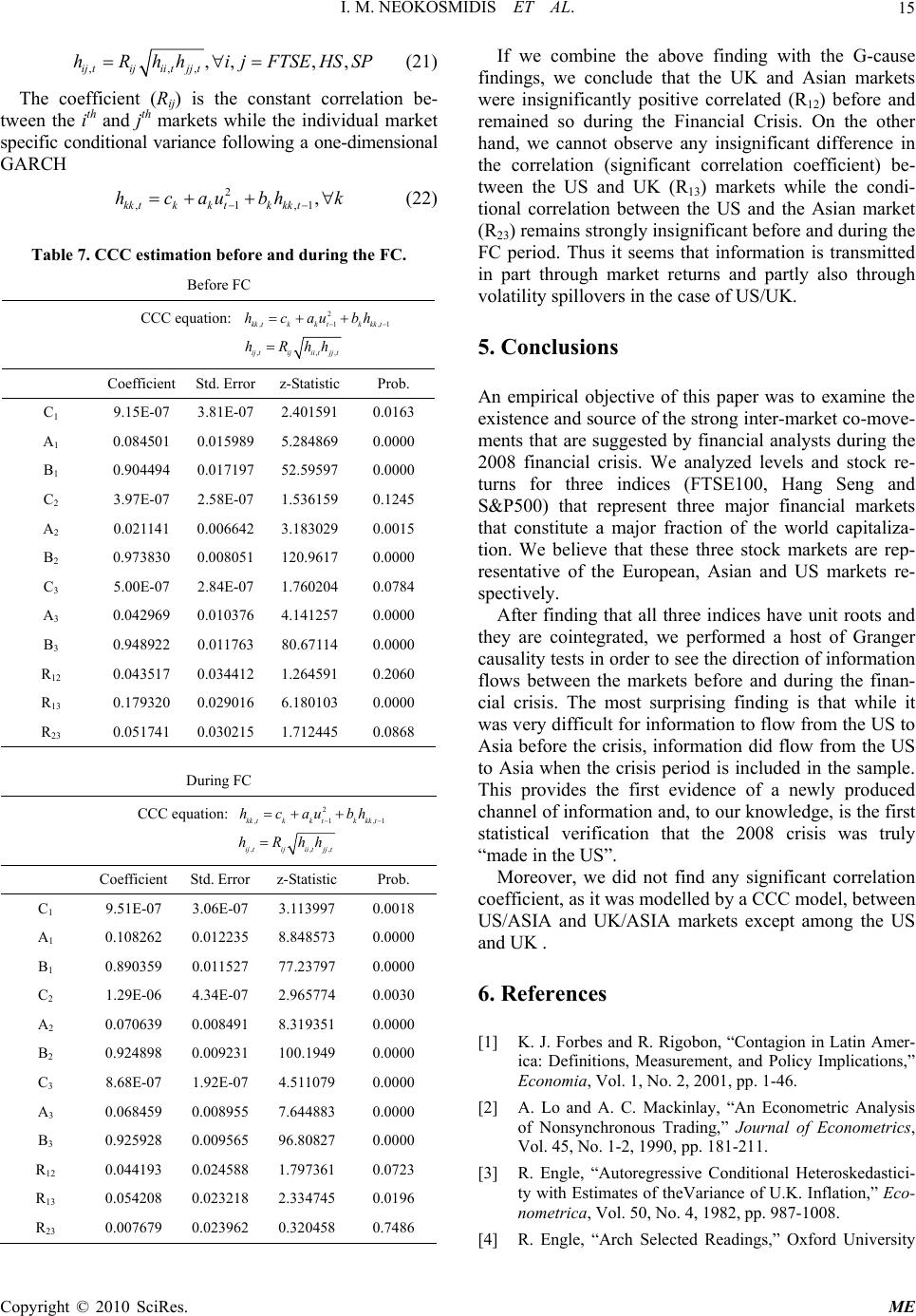

Modern Economy, 2010, 1, 1-16 doi:10.4236/me.2010.11001 Published Online May 2010 (http://www.SciRP.org/journal/me) Copyright © 2010 SciRes. ME Dynamic Interactive Cycles during the 2008 Financial Crisis Ioannis M. Neokosmidis, Vassilis Polimenis Department of Economics, Aristotle University of Thessaloniki, Thessaloniki, Greece E-mail: ineokosm@econ.auth.gr, polymen@econ.auth.gr Received February 16, 2010; revised March 20, 2010; accepted March 30, 2010 Abstract This paper focuses on the analysis of the 2008 financial crisis and how it affects the global financial markets. We analyze three major markets (US, UK, and ASIA) that are represented by the levels of three broad stock indices S&P 500, FTSE 100 and Hang Seng respectively. Our methodology is based on cointegration analy- sis and Granger causality test in order to examine the interaction between the markets (information flows). Additionally, we study the volatility transmission based on multivariate GARCH analysis. We find significant changes in information flows before and during the financial crisis. Keywords: Unit Root Test, Cointegration, Granger Causality, Multivariate Volatility Processes, Financial Crisis 1. Introduction Due to its surprising breadth and intensity, the analysis of the 2008 global financial crisis presents a major challenge for economists and financial experts. Policymakers now consider the definition of key policy responses and institu- tional rules in order to build mechanisms that will contain cross-market contagion and prevent a reoccurrence of the problem in the future. Most of the recent crises1 started from emerging markets, which are presumably more sen- sitive to liquidity shocks because of their underdeveloped and illiquid financial markets and their large public defi- cits. Besides the 1987 crash in Wall Street that was tech- nical and short-lived in nature, the 2008 crisis is the first to be labelled a US crisis on the basis that it seems to have started by the massive US real estate delinquencies. An important question related to an international finan- cial crisis is the existence of contagion (i.e., the interna- tional propagation of country- or region-specific shocks to other parts of the world). According to the more open definition adopted by Forbes and Rigobon [1], contagion is measured as any change in the transmission mecha- nisms that occurs during a volatile period. For example, contagion may establish itself by a significant increase in cross-market correlations. Yet to date, there is still a lot of disagreement as to what are the channels through which financial upheaval is transmitted across countries, and on the set of measurable factors that may be used for the precise identification of a contagion event. Understanding these factors is important because early recognition of the possibility of contagion may help reduce a country’s vulnerability to externally- originated shocks. In the wake of the current financial international crash, growing integration of financial markets has been of heig- htened interest because such integration is assumed to generate large, correlated price movements across most stock markets. Yet due to the complexity and global nature of the current financial crisis, it is difficult to move beyond the headlines of the financial press and provide an in depth analysis of the mechanism that links global financial mar- kets during the crisis and generates the phenomenon of contagion. The analysis may take place on both the economics of the crisis, as well as on a purely statistical manner. On the economic front, in the US for example, the fight has pro- duced what is termed “a highly accommodative monetary policy.” What is truly meant by this deceptively soft phr- ase is that since the onset of the financial crisis nearly two years ago, the Federal Reserve has reduced the cost of funds for big US banks nearly to zero. This has happened by adjusting the interest-rate target for overnight lending between banks (the so called Fed-funds rate). 1The most well known financial and currency crises that have occurred over the last 25 years with global consequences were, the 1992 Euro- p ean monetary unit problems, the peso effect of 1994, and the 1997 Asian “flu” crisis (which also triggered the 1998 Russian “cold”). The 1999 Brazilian devaluation, the 2000 Internet bubble burst, and the Jul y 2001 default of Ar g entina. Having brought the Fed-funds rate to almost zero, the US (and later the UK) switched to the more aggressive policy of Quantitative Easing, which is also described as  I. M. NEOKOSMIDIS ET AL. 2 “printing money out of thin air”. This led to an explosion of the size of the US Fed balance sheet, mainly through the purchase of long-term securities, initially aimed at restarting the flow of credit and to soften the economic impact of the financial crisis for the US. Such actions were not paralleled elsewhere in Europe or Asia so it is inter- esting to understand the linkage dynamics that were pro- duced. In the current paper we employ an intuitive and straight- forward statistical analysis for testing if contagion occurs by simply comparing cross-market linkages between mar- kets during a relatively stable period before the turbulent period, with linkages during the crisis. We examine the short-run dynamics of returns and volatility for stocks traded in the US, British and Hong Kong stock exchanges during the relatively short last six year period. The main focus of the study is Granger causality among the three markets, which is a statistical concept of causality that is based on prediction. According to Granger causality, if a market “Granger-causes” (or “G-causes”) another market, then past returns of the 1st market should contain informa- tion that helps predict returns of the 2nd above and beyond the information contained in past values of the 2nd market alone. We first find a strongly significant cointegration coeffi- cient for the index levels before and during the financial crisis period for all market pairs (US-UK, US-Asia and UK-Asia), which implies a long run equilibrium level of interaction. We then proceed to the main finding of the paper: a change in the direction of the information flow during the financial crisis as this is established by Granger causality. As expected, due to overlapping operating hours and the strong ties between the markets, there is simulta- neous interaction between the US and UK. Since the Asian markets precede the US with no overlap, Asian re- turns today ought to include an unrevealed component also present in yesterday’s US returns.2 Yet, before the finan- cial crisis, we can reject the hypothesis of the US market causing the Asian markets (at a daily level); this shows a particularly weak pre-crisis interaction. Surprisingly, when we test the null that US G-causes Asia with a sample which includes the financial crisis, we find that the US market includes information about Asia. This provides evidence of a newly produced channel of information from the US to Asia and, to our knowledge, the first statis- tical verification that the 2008 crisis was a crisis truly “…made in the US.” The opening of this new channel of information flow from the US to Asia is a clear indication that during the financial crisis period the ability of the US markets to produce, capture and disseminate crisis specific information was unmatched by the financial markets in other regions of the world. We finally move to understand the volatility transmis- sion mechanism over time and across the three different markets during the crisis. Our methodology is to examine the dynamic relationship between the daily stock market returns and their volatilities, for the three markets above, using a multivariate generalized autoregressive conditional heteroskedastic (GARCH) model. This is essentially a family of statistical models originally developed by Engle [3-5] and Bollerslev [6,7]. We find that the markets inter- act not only in a returns level but to some extend through volatility spillovers. The UK and Asian markets were in- significantly correlated before and during the crisis. For the US and Asian markets, changing information flows due to the crisis, manifested through Granger causality for US→Asia, is not corroborated by a change in the signifi- cance of the correlation coefficient. Finally, the US and UK are the only significantly correlated markets. 2. Data Analysis and Descriptive Statistics The dataset used includes the closing levels of the daily stock market indices for three major stock markets (US, UK and Hong Kong). We use the S&P 500 index for the US, the FTSE100 for the UK and the Hang Seng index as a proxy for the Asian markets. Furthermore, we examine the econometrics of these series in two data samples. The first sample, with data not contaminated with the crisis, runs from April 2002 to April 2006; i.e., ends before the onset of the financial crisis. The second sample, from April 2002 to April 2009, includes at least the first 18 to 20 months of the crisis depending on when one places its beginning. We compute the daily stock returns for each index as the first difference of logarithmic levels. Tables 1(a) and (b) report return summary statistics for the two time intervals. Table 1(a) includes the time space before the financial crisis (FC from now on) and Table 1(b) pre- sents the results of summary statistics including the period of FC (2nd semester 2007-April 2009). As we can see from Table 1(a), Asia gives the highest mean return while it is characterized by lower volatility with positive skewness and no excess kurtosis in compare with US and UK. US gives the second higher mean return with the second lower volatility. Additionally, it is skewed to the right with no excess kurtosis. The most risky market is the UK market in the time interval before the FC, while it seems to give the lower mean returns with negative skewness and excess kurtosis. We get the results as they are shown in Table 1(b), including the time period of FC in our analysis. The FC gives the opposite side of the coin while ASIA, as it is represented by the Hang Seng index, is shown to be the most aggressive market in comparison with the US and UK. Asia gives the highest mean returns with the highest standard deviation, while it remained skewed to the right. US and UK both exhibit negative average returns when the FC period is included in the sample. Finally, all three markets exhibit excess kurtosis. 2This is also related to the non-synchronous trading theory of Lo and MacKinlay [2]. Copyright © 2010 SciRes. ME  I. M. NEOKOSMIDIS ET AL.3 Table 1. Return summary statistics for the representative time series. (a) Summary statistics for index returns before FC. ASIA US UK Mean 0.000429 0.000155 0.000146 Standard Deviation 0.009964 0.010637 0.011334 Skewness 0.029616 0.280395 –0.1527 Kurtosis 1.236111 2.998876 4.878168 Minimum –0.04184 –0.04242 –0.05589 Maximum 0.04051 0.055744 0.059038 (b) Summary statistics for index returns during FC. ASIA US UK Mean 0.000217 –0.000146 –0.00015 Standard Deviation 0.016746 0.014337 0.013954 Skewness 0.093149 –0.10694 –0.09052 Kurtosis 10.683329 9.533261 7.320857 Minimum –0.13582 –0.10694 –0.09265 Maximum 0.134068 0.109572 0.093842 3. Methodology It is well known that testing for cointegration is a means for correctly testing hypotheses concerning the relation- ship between two indices that have unit roots. In an effort to firstly determine if the time series is covariance sta- tionary we employ the Augmented Dickey-Fuller test [8,9] for a unit root. We will then test for cointegration. Firstly, we employ a unit root test in order to check for nonstationarity between our time series. We then test for a significant cointegration coefficient between each market pairs. Moreover, we test for Granger causality in each pair of the series in order to investigate the interac- tion flows among the markets before and during the fi- nancial crisis time horizon. Finally we apply a DVEC (1, 1) model and a CCC model in order to capture the vola- tility transmission by examining the changes in the cor- relation and covariance coefficients. 3.1. Testing for Unit Roots We have to determine the order of integration of stock price series before we test for cointegration. For this propose, we consider an Augmented Dickey-Fuller (ADF) test for each of our time series. So, the test procedure is described by the following equations about the US, UK and Asian markets: 1 111, 1, 1 1t k t i USa tpUSUSu i tit tit tit 1 222, 2, 1 1t k ti i UKa tpUKUKu 1 3 33,3, 1 1t k ti i H Sa tpHSHSu with USt representing the log level of the S&P 500 index at time t, UKt representing the log FTSE100 and the log level of the Hang Seng composite index being measured in HSt 3. It is assumed that 2 ,~, i it u uiido , in all sys- tem equations. Finally, it is important to notice that, for the fitted er- ror terms ˆt u to be as close as possible to white noise, we have to select the correct number of lags based on an information criterion such as the AIC [10]. The null hypothesis for the ADF test is that series are integrated 0:1Hp0 against the alternative hypothesis of no integration, 1:1Hp0 tt t-tests in order to accept or reject the null hypothesis of a unit root are performed against critical values from the DF-distribution [11] and not from the classical t-distri- bution. Tables 2(a) and (b) show the test results; the null hy- pothesis of nonstationarity cannot be rejected for all the markets and for both time horizons. So, all time series (USt, UKt, HSt) can be assumed to be I(1) which means that we should take the first difference (i.e., continuously com- pounded index returns) in order to achieve stationarity. 3.2. Testing for Cointegration We concluded on integrated of order one I(1) level series in the previous section. In this section, we test for coin- tegration on each pair of processes in order to determine the existence of long-run equilibria. A significant cointe- gration coefficient implies a long-run equilibrium rela- tionship. Then, even though our data generating proc- esses contain unit root, they are going to move closely together with the difference between them will be sta- tionary [11]. We employ the Engle and Granger test procedure [12] in order to test for cointegration: 1st step: We have to test if our series are I(1). 2nd step: We run the regressions between (USt/UKt, USt/HSt, UKt/HSt) in both periods (before and after FC). Our regression models are: 01t USaa UKu (1) 01t USaa HSu tt (2) 3Clearly then, ΔUSt, ΔUKt and ΔHSt are the daily returns of the US, UK and HS indices. Copyright © 2010 SciRes. ME  I. M. NEOKOSMIDIS ET AL. Copyright © 2010 SciRes. ME 4 Table 2(a). Unit root-10th lag-test for S&P 500, FTSE 100 and Hang Seng time series before FC time period. Unit root test for S&P 500 time series before the FC time horizon. D-lag t-adf beta Y_1 sigma t-DY_lag t-prob AIC F-prob 10 –0.8879 0.99484 0.01063 –1.512 0.1308 –9.075 9 –1.064 0.99385 0.01064 0.3090 0.7574 –9.074 0.1308 8 –1.036 0.99405 0.01063 2.053 0.0403 –9.076 0.3042 7 –0.7980 0.99544 0.01065 –2.672 0.0077 –9.074 0.0865 6 –1.123 0.99361 0.01068 –0.4034 0.6867 –9.069 0.0084 5 –1.181 0.99333 0.01068 –0.4170 0.6767 –9.071 0.0166 4 –1.243 0.99304 0.01068 –0.8420 0.4000 –9.073 0.0293 3 –1.364 0.99243 0.01067 –0.1313 0.8956 –9.074 0.0394 2 –1.392 0.99234 0.01067 0.1366 0.8913 –9.076 0.0638 1 –1.387 0.99244 0.01066 –1.423 0.1551 –9.078 0.0967 0 –1.583 0.99144 0.01067 –9.078 0.078 Notes: S&P 500 represents the US financial stock market and the test time interval is considered to be from April 2002 to April 2006. The above results were based on PcGive output where the selection criteria are obviously shown. Unit root test for FTSE100 time series before the FC time horizon. D-lag t-adf beta Y_1 sigma t-DY_lag t-prob AIC F-prob 10 0.1882 1.0009 0.01110 –3.758 0.0002 –8.989 9 –0.2984 0.99853 0.01117 1.715 0.0867 –8.977 0.0002 8 –0.08379 0.99959 0.01118 2.053 0.0404 –8.976 0.0002 7 0.1637 1.0008 0.01120 0.4584 0.6468 –8.974 0.0001 6 0.2209 1.0011 0.01120 –2.310 0.0211 –8.975 0.0003 5 –0.05607 0.99973 0.01122 –1.281 0.2004 –8.972 0.0001 4 –0.2088 0.99901 0.01122 1.259 0.2082 –8.972 0.0001 3 –0.05834 0.99972 0.01123 –4.637 0.0000 –8.973 0.0001 2 –0.6220 0.99705 0.01134 0.9654 0.3346 –8.953 0.0000 1 –0.5116 0.99759 0.01134 –2.555 0.0108 –8.954 0.0000 0 –0.8261 0.99613 0.01137 –8.950 0.0000 Notes: FTSE 100 represents the UK financial stock market and the test time interval is considered to be from April 2002 to April 2006. The above results were based on PcGive output where the selection criteria are obviously shown. Unit root test for Hang Seng time series before the FC time horizon. D-lag t-adf beta Y_1 sigma t-DY_lag t-prob AIC F-prob 10 –1.510 0.99393 0.009941 0.8272 0.4083 –9.209 9 –1.443 0.99422 0.009939 –1.961 0.0501 –9.210 0.4083 8 –1.625 0.99351 0.009953 –1.271 0.2041 –9.209 0.1044 7 –1.750 0.99303 0.009957 1.368 0.1716 –9.209 0.1053 6 –1.632 0.99353 0.009961 1.608 0.1081 –9.209 0.0915 5 –1.497 0.99408 0.009969 –0.0759 0.9395 –9.208 0.0603 4 –1.510 0.99405 0.009964 –1.603 0.1092 –9.210 0.1018 3 –1.654 0.99350 0.009972 0.4320 0.6658 –9.210 0.0684 2 –1.624 0.99365 0.009968 0.3827 0.7021 –9.212 0.1004 1 –1.599 0.99377 0.009964 1.429 0.1533 –9.214 0.1412 0 –1.494 0.99419 0.009969 –9.214 0.1136 Notes: Hang Seng represents the ASIA financial stock market and the test time interval is considered to be from April 2002 to April 2006. The above results were based on PcGive output where the selection criteria are obviously shown.  I. M. NEOKOSMIDIS ET AL.5 Table 2(b). Unit root-10th lag-test for S&P 500, FTSE 100 and Hang Seng time series including the FC time period. Unit root test for FTSE 100 time series during FC time horizon. D-lag t-adf beta Y_1 sigma t-DY_lag t-prob AIC F-prob 10 –2.918 0.99329 0.01358 –0.2116 0.8324 –8.591 9 –2.923 0.99328 0.01357 –0.05951 0.9525 –8.593 0.8324 8 –2.926 0.99328 0.01357 2.242 0.0251 –8.594 0.9761 7 –2.885 0.99337 0.01358 1.853 0.0640 –8.592 0.1673 6 –2.862 0.99342 0.01359 –3.136 0.0017 –8.591 0.0751 5 –2.909 0.99329 0.01363 –2.906 0.0037 –8.587 0.0026 4 –2.973 0.99313 0.01366 4.460 0.0000 –8.583 0.0002 3 –2.875 0.99332 0.01373 –4.666 0.0000 –8.573 0.0000 2 –2.990 0.99302 0.01381 –1.729 0.0840 –8.562 0.0000 1 –3.034 0.99292 0.01382 –3.489 0.0005 –8.561 0.0000 0 –3.131 0.99267 0.01386 –8.555 0.0000 Notes: FTSE 100 represents the UK financial stock market and the test time interval is considered to be from April 2002 to April 2009. The above results were based on PcGive output where the selection criteria are obviously shown. Unit root test for S&P 500 time series during FC time horizon. D-lag t-adf beta Y_1 sigma t-DY_lag t-prob AIC F-prob 10 –3.250 0.99305 0.01404 1.671 0.0949 –8.524 9 –3.241 0.99306 0.01405 –0.3647 0.7154 –8.523 0.0949 8 –3.244 0.99306 0.01405 1.943 0.0521 –8.524 0.2320 7 –3.235 0.99307 0.01406 –2.093 0.0365 –8.523 0.0824 6 –3.244 0.99305 0.01407 0.1643 0.8695 –8.522 0.0258 5 –3.245 0.99305 0.01407 –1.265 0.2059 –8.523 0.0495 4 –3.246 0.99304 0.01407 –1.576 0.1152 –8.523 0.0481 3 –3.258 0.99301 0.01408 2.592 0.0096 –8.523 0.0338 2 –3.242 0.99304 0.01410 –4.334 0.0000 –8.520 0.0052 1 –3.269 0.99294 0.01417 –4.721 0.0000 –8.511 0.0000 0 –3.320 0.99279 0.01426 –8.499 0.0000 Notes: S&P 500 represents the US financial stock market and the test time interval is considered to be from April 2002 to April 2009. The above results were based on PcGive output where the selection criteria are obviously shown. Unit root test for Hang Seng time series during FC time horizon. D-lag t-adf beta Y_1 sigma t-DY_lag t-prob AIC F-prob 10 –2.803 0.99388 0.01650 –2.851 0.0044 –8.201 9 –2.877 0.99370 0.01654 –2.119 0.0343 –8.198 0.0044 8 –2.942 0.99356 0.01655 1.683 0.0926 –8.196 0.0018 7 –2.900 0.99365 0.01656 0.615 0.5387 –8.196 0.0015 6 –2.887 0.99368 0.01656 1.319 0.1872 –8.197 0.0033 5 –2.863 0.99373 0.01656 –1.711 0.0872 –8.197 0.0036 4 –2.902 0.99364 0.01657 –0.897 0.3696 –8.196 0.0023 3 –2.926 0.99359 0.01657 –1.913 0.0559 –8.197 0.0034 2 –2.974 0.99349 0.01658 0.3531 0.7240 –8.196 0.0016 1 –2.967 0.99351 0.01658 –1.531 0.1259 –8.197 0.0029 0 –2.996 0.99344 0.01659 –8.197 0.0022 Notes: Hang Seng represents the ASIA financial stock market and the test time interval is considered to be from April 2002 to April 2009. The above esults were based on PcGive output where the selection criteria are obviously shown. r Copyright © 2010 SciRes. ME  I. M. NEOKOSMIDIS ET AL. Copyright © 2010 SciRes. ME 6 tt t 01t UKaa HSu (3) 3rd step: We obtain the fitted errors from the above regressions and we test if they include any sto- chastic trends or not. Then, if we find unit roots in the residuals we conclude that there is no cointegration be- tween the series. So, we apply an ADF test in the fitted errors, ˆt u 11 ˆˆ ˆ k tt iti i uau bu (4) where the null is: 0:0Ha against the alternative, 1:0Ha The results are shown in Tables 3 and 4, where we re- ject the null (no cointegration) at all lags for all market pairs. The financial crisis does not affect the existence of long-run relationship among the three markets. 3.3. Information Flow Even if the financial crisis did not affect the long-run relationship of the markets, it may still have affected the flow of information (the direction of interaction) between them. As we discussed already, we find cointegration between (US/UK), (US/HS) and (UK/HS) markets. Yet, we don’t know the direction of information flow (direc- tion of interaction) between the markets. As is well known Granger causality from X to Y does not indicate causality in the proper common use of the term (i.e., it does not imply that the Y series is the effect or the result of X series). Instead, Granger causality truly measures precedence and information flow, so that in our context here of the recent financial crisis Granger causal- ity from a country X to country Y implies that informa- tion during the crisis flows from X to Y. Alternatively, we may think of developments in X preceding develop- ments in Y. Our aim in this section is to describe the dynamic in- teraction between the markets and to see the independent movements before we proceed to volatility modelling. It is a crucial aspect of a proper analysis of the crisis to analyze the cycle of information before we move to the next level of volatility analysis. We separate our markets in three bi-variate VAR proc- esses [13] like following: 11,1 11,211 22,1 12,212 ttt ttt USc UScUKv UKc UScUKv t t t t t t (5) 11,111,2 11 22,112,2 12 ttt ttt UKc UKcHS HSc UKcHS (7) Alternatively, in the absence of Granger causality, our series are generated by an AR(1) process as follows: 11 11tt USap USu t (8) 22 1tt2t H SapHS u (9) 33 13tt UKap UKu t (10) We say that (Ri,t ) return series does not Granger cause (G-cause) the (Rj,t ) return series if and only if the best linear prediction of Rj,t given the information set { Ri,t-1, Rj,t-1) does not depend on Ri,t-1. Following the above modelling, we can test the null hypothesis against the alternative: UK does not G-cause US: 01,2 11,2 :0 :0 Hc Hc or alternatively, we may say that under the null hypothe- sis the residual variances in (5) and (8) above are the same since ΔUKt-1 does not have any significance in ex- plaining ΔUSt, i.e. 22 01 1 22 11 1 :()() :()() tt tt H Ev Eu H Ev Eu US does not G-cause UK: 02,1 12,1 :0 :0 Hc Hc or 22 02 3 22 12 3 :( )( ) :( )( ) tt tt H Ev Eu H Ev Eu HS does not G-cause US: 012 112 :0 :0 Hc Hc , , or 22 01 1 22 11 1 :( )( ) :( )( ) tt tt H EEu H EEu US does not G-cause HS: 02,1 12,1 :0 :0 Hc Hc or 22 02 2 22 12 2 :( )( ) :( )( ) tt tt H EEu H EEu HS does not G-cause UK: 01,2 11,2 :0 :0 Hc Hc or 22 01 3 22 11 3 :( )() :( )() tt tt H EEu H EEu UK does not G-cause HS: 02,1 12,1 :0 :0 Hc Hc or 22 02 2 22 12 2 :( )() :( )() tt tt H EEu H EEu 11,111,21 1 22,112,212 ttt ttt USc UScHS HSc UScHS (6) 3.3.1. Estimation and Testing We have already described an assumed regression structure for our series. We perform maximum likelihood  I. M. NEOKOSMIDIS ET AL.7 and (on. Table 3. Regression results for the (US/UK), (US/HS) Regression UK/HS) markets before and during FC horiz results between US and UK markets before FC time duration. 2 Coefficient Std.Error t-value t-prob Part.R 0 a –0.608626 0.1167 –5.21 0.000 0.0263 1 a 0.900251 0.01384 65.0 0.000 0.8077 RSS: (3., (R2 : (0.0662) 15426053) ): 0.807715 F( 1007) = 4230 [0.000]** 1, Log-likelihood (1478.23); DW Ν is rep- resented by S&P 500 index data, 100 d ASIA markets before FC time duration. 2 otes: Τhe regression equation is t US a 01t a UKu . and UKt is represented by are referred to time in t USt FTSE index data. Both samples of data terval from April 2002 to April 2006. Regression results between UK an Coefficient Std.Error t-value t-prob Part.R 0 a 2.32598 0.09418 24.7 0.000 0.3805 1 a 0. RSS: (3., (R2 : (0.0579) 648937 0.01001 64.8 0.000 0.8088 08452898) ): 0.808844 F( 993) = 4202 [0.000]** 1, Log-likelihood: (1461.89); DW Ν t UKt is rep- resented by FTSE 100 index data, and HSt is represented by Hang Seng are referred to time nd ASIA markets before FC time duration. 2 otes: Τhe regression equation is 01t UK at a HSu . index data. Both samples of data interval from April 2002 to April 2006. Regression results between US a Coefficient Std.Error t-value t-prob Part.R 0 a 0.535682 0.07269 7.37 0.000 0.0519 1 a 0.685310 0.007727 88.7 0.000 0.8879 RSS: (1.R2 : (0.0842) 8376384), (): 0.887904 F( 993) = 7865 [0.000]** 1, Log-likelihood (1719.55); DW Ν is rep- resented by S&P 500 index data, ation. Coe2 otes: Τhe regression equation is t US a 01t a HSu . and HSt is represented by Hang Seng are referred to time in t USt index data. Both samples of data terval from April 2002 to April 2006. Regression results between US and ASIA markets into FC time dur fficientStd.Error t-value t-prob Part.R 0 a 2.35806 0.07410 31.8 0.000 0.3671 1 a 0 0 RSS: (17. (R2): 0 : (0.0235) .488369.00770563.4 0.000 0.6971 4253079), .697063 F( 746) = 4018 [0.000]** 1,1 Log-likelihood: (1547.35); DW Νotes: Τhe regression equation is 01t USaa HSu . t nted by S&P 500 index data, and HSt is re t USt is repre- se presented by Hang Seng index ed to time interval from results between US and UK markets into FC time duration. 2 data. Both samples of data are referr April 2002 to April 2009. Regression CoefficientStd.Error t-value t-prob Part.R 0 a –1.216080.06761 –18.0 0.000 0.1551 1 a 0.970320 0. RSS: (6., (R2 ** 007934122.0 0.000 0.8946 0672123) ): 0.89462 F( 1762) = 1.496e + 004 [0.000]1, Log-likelihood (2500.08); DW: (0.0881) Νt US resented by S&P 500 index data, 2 otes: Τhe regression equation is t US a t is rep- FTSE 100 01t a UKu . and UKt is represented by are referred to time iindex data. Both samples of data nterval from April 2002 to April 2009. Regression results between UK and ASIA markets into FC time duration. CoefficientStd.Error t-value t-prob Part.R 0 a 3.71314 0.06310 58.8 0.000 0.6648 1 a 0. 0. RSS: (12.), (R2 : (0.0352) 50013600656176.2 0.000 0.7689 6365654): 0.768933 F( 1746) = 5810 [0.000]** 1, Log-likelihood: (1828.19); DW Ν t UKt is represented by FTSE 100 index data, and HSt is represented by Hang ta are referred to time th MLE estimators actually identical OLS estimators. residuals, is of the following form 1 otes: Τhe regression equation is t UK 01t aa HSu . Seng index data. Both samples of da interval from April 2002 to April 2009. estimation (MLE), wi to The log-likelihood function for our models, assuming the iidN(o,σ2) for the 2 log/2log2 /2log 2 2 ,, 1, 1 1/2 1, 2,3 j i LT T T jiitii itijt t ya yby ij (11) where and ),,(,3,2,1 tttttt UKyHSyUSy 2 j i is the residual variance in the system measuring Granger flow from the jth to the ith country defined above. o estimate the following vector of paters: We can compute the MLE of the above parameter by directly utilizing the OLS estimators, which satisfy the following variance equation 1 (12) We need trame 2 (, ,,)',1,2,3.abi j iiiiji 2 2 ,,1, 1 ˆ ˆ ˆˆ 1/ T jiitii itijt t Ty ayby Copyright © 2010 SciRes. ME  I. M. NEOKOSMIDIS ET AL. 8 y (US om t-DY_lag t-prob AIC F-prob Table 4. Unit root-10th lag-test for obtained residuals b Unit root test for obtained /UK), (US/HS) and (UK/HS) regression equations. US-UK regression series before FC. residuals fr D-lag t-adf beta Y_1 sigma 10 –2.079* 0.98272 0.01386 –1.709 0.0877 –8.547 9 –2.230* 0.98151 0.01387 0.0877 6 7 –2.204* –8.538 0.0021 – 0– 0.0000 –2.086 0.0372 –8.546 8 –2.419* 0.97998 0.01389 2.735 0.0064 –8.544 0.026 0.98177 0.01394 –3.425 0.0006 6 2.500*0.97928 .01401 –1.033 0.3017 8.528 0.0000 5 –2.603** 0.97851 0.01402 –4.823 0.0000 –8.529 4 –3.089** 0.97436 0.01417 –3.144 0.0017 –8.508 0.0000 3 –3.456** 0.97137 0.01423 –4.371 0.0000 –8.500 0.0000 2 –4.035** 0.96658 0.01436 0.7119 0.4767 –8.483 0.0000 1 –3.977** 0.96734 0.01436 0.1157 0.9079 –8.485 0.0000 0 –3.998** 0.96746 0.01435 –8.487 0.0000 Notes: Tmationonsidered to be the interv002-Apr The abov were based on PcGive output where the rejection criteria are obviously. Unit roobtainedfrom US-gression sre FC. D t- he esti period is cal (April 2il 2006).e results shown ot test for residuals ASIA reeries befo -lag t-adf beta Y_1 sigma DY_lagt-prob AIC F-prob 10 –3.861** 0.96067 0.01241 –0.7 0.52 60942–8.767 9 –3.988** 0.95979 0.01241 –0.5517 0.5813 –8.769 0.5422 8 –4.109** 0.95900 0.01240 1.287 0.1984 –8.771 0.7133 7 –3.969** –8.771 0.5071 –* 0– – 0.3912 0.96076 0.01241 –1.591 0.1118 6 4.242*0.95847 .01242 0.5925 0.5536 8.770 0.3026 5 –4.202** 0.95929 0.01241 0.0035040.9972 –8.772 4 –4.248** 0.95929 0.01241 –0.8384 0.4020 –8.774 0.5172 3 –4.422** 0.95809 0.01240 1.268 0.2053 –8.775 0.5500 2 –4.282** 0.95985 0.01241 0.4072 0.6840 –8.776 0.4823 1 –4.269** 0.96039 0.01240 –0.4960 0.6200 –8.778 0.5664 0 –4.393** 0.95971 0.01240 –8.779 0.6355 Notes: Tmationonsidered to be the interv002-Aprhe abov were based on PcGive output where the rejection criteria are obviously. Unit roobtainedfrom UKgression sore FC. D he esti period is cal (April 2il 2006). Te results shown ot test for residuals -ASIA reeries bef -lag t-adf beta Y_1 sigma t-DY_lag t-prob AIC F-prob 10 –2.489* 0.97922 0.01319 –2.1 0.06 3021–8.646 9 –2.815** 0.97665 0.01321 1.319 0.1874 –8.643 0.0216 8 –2.666** 0.97807 0.01322 1.522 0.1284 –8.643 0.0299 7 –2.493* –8.643 0.0252 – 0– 0.0076 0.97964 0.01323 2.201 0.0280 6 2.239*0.98182 .01325 –1.256 0.2095 8.640 0.0068 5 –2.416* 0.98053 0.01326 –0.8535 0.3936 –8.640 4 –2.551* 0.97962 0.01326 1.024 0.3062 –8.641 0.0114 3 –2.440* 0.98066 0.01326 –4.177 0.0000 –8.642 0.0143 2 –3.030** 0.97603 0.01337 1.455 0.1461 –8.627 0.0000 1 –2.857** 0.97760 0.01338 –2.060 0.0397 –8.627 0.0000 0 –3.185** 0.97525 0.01340 –8.624 0.0000 Notes: Tmation onsidered to be the interv002-Apri. The abov were based on PcGive output where the rejection criteria are obviously. he estiperiod is c shown al (April 2l 2006)e results Copyright © 2010 SciRes. ME  I. M. NEOKOSMIDIS ET AL.9 Unit robtained rom US-ion seriing FC. D t- ot test for oresiduals fUK regresses includ -lag t-adf beta Y_1 sigma DY_lagt-prob AIC F-prob 10 –3.005** 0.97873 0.01646 –1.516 0.1297 –8.208 9 –3.123** 0.97795 0.01646 –1.2 0.05 –8.207 0.0726 –* 0– 0.0000 9946–8.208 0.1297 8 –3.278** 0.97690 0.01648 –0.8478 0.3967 –8.206 0.0438 7 –3.354** 0.97643 0.01648 –5.261 0.0000 6 3.804*0.97317 .01660 –3.494 0.0005 8.193 0.0000 5 –4.134** 0.97088 0.01665 –1.669 0.0954 –8.187 4 –4.313** 0.96975 0.01666 –0.7336 0.4633 –8.186 0.0000 3 –4.407** 0.96924 0.01666 –0.8469 0.3972 –8.187 0.0000 2 –4.517** 0.96864 0.01666 –4.029 0.0001 –8.188 0.0000 1 –4.991** 0.96542 0.01673 –9.822 0.0000 –8.180 0.0000 0 –6.328** 0.95547 0.01718 –8.127 0.0000 Notes: Tmationonsidered to be the interv002-Aprhe abov were based on PcGive output where the rejection criteria are obviously. oobtained rom US-Aession serding FC. D t- he esti period is c shown al (April 2il 2009). Te results Unit rt test for oesiduals frSIA regries inclu -lag t-adf beta Y_1 sigma DY_lagt-prob AIC F-prob 10 –3.372** 0.98750 0.01492 –0.9 0.81 17858–8.403 9 –3.378** 0.98748 0.01492 0.6637 0.5070 –8.404 0.8581 8 –3.365** 0.98754 0.01492 0.6143 0.5391 –8.405 0.7897 7 –3.351**–8.406 0.8376 –* 0– 0.5520 0.98759 0.01492 –1.759 0.0788 6 3.399*0.98741 .01492 –0.2129 0.8314 8.406 0.4147 5 –3.407** 0.98739 0.01492 –2.020 0.0435 –8.407 4 –3.459** 0.98719 0.01493 –2.055 0.0400 –8.405 0.2343 3 –3.527** 0.98694 0.01495 –0.7434 0.4573 –8.404 0.0922 2 –3.558** 0.98683 0.01495 –4.667 0.0000 –8.405 0.1183 1 –3.760** 0.98602 0.01503 –6.006 0.0000 –8.394 0.0001 0 –4.101** 0.98463 0.01519 –8.374 0.0000 Notes: Tmationonsidered to be the interv002-Apr The abov were based on PcGive output where the rejectioniteria are obwn. oottained rom UK-Aression seding FC. D t- he esti cr period is c viously sho al (April 2il 2009).e results Unit r test for obesiduals frSIA regries inclu -lag t-adf beta Y_1 sigma DY_lagt-prob AIC F-prob 10 –2.636** 0.98807 0.01538 –1.4 0.08 9550–8.343 9 –2.729** 0.98766 0.01540 0.2572 0.7971 –8.342 0.0508 8 –2.720** 0.98772 0.01539 1.151 0.2500 –8.343 0.1436 7 –2.666**–8.343 0.1574 –* 0– 0.0016 0.98798 0.01539 0.06629 0.9472 6 2.667*0.98799 .01539 –3.789 0.0002 8.344 0.2663 5 –2.886** 0.98698 0.01545 –3.279 0.0011 –8.337 4 –3.099** 0.98600 0.01549 2.248 0.0247 –8.332 0.0000 3 –2.960** 0.98664 0.01551 –6.017 0.0000 –8.330 0.0000 2 –3.406** 0.98452 0.01567 –2.834 0.0046 –8.311 0.0000 1 –3.641** 0.98348 0.01570 –4.886 0.0000 –8.307 0.0000 0 –4.102** 0.98135 0.01580 –8.295 0.0000 Notes: Tmationonsidered to be the interv002-Apri. The abov were based on PcGive output where the rejectioniteria are obwn. he esti cr period is c viously sho al (April 2l 2009)e results Copyright © 2010 SciRes. ME  I. M. NEOKOSMIDIS ET AL. Copyright © 2010 SciRes. ME 10 Based on the a arrivfollow likelihd expressir syste bove, wee at the ing log- ooon for oum 2 lo 22 ji T TT We can suppose the for tivariate syste, ˆ gLˆ log log 2 2 (13) e samhe unm where our data are generated by an AR(1) model. In this case the estimated variance is given by 2 2 ,,1 ˆˆˆ (1 ) T iitiiit Tyapy 1t (14) 1, 2, 3i And the corresponding log-likelihood is given by: 2 ˆˆ log2 log22log2 i LTT T (15) Based on Engle [14] the Wald and LR statistics are asymptotically equivalent and we ma thus use two in order to test for causality. re- sp yany of The likelihood ratio and Wald statistics are given ectively as follows: 2 2 logˆ ˆi j i LR T (16) ) ˆ var( ) 2 ˆ (c ij c 3.3.2. Empirical Results Table 5 presents the results from the Granger causality test for all our series before the financial crisis (FC pe- riod) and including the financia major finding is that, as we will explain, information flows and precedence of information have changed when xamining data before and including the financial crisis. financial data from the three uring the UK market hours. The hypothesis th Tults-cause tedence og information flow the Financial Crisis. y ten US andket beforeod. Ho: US-UW-Statistb. able 5. Res for Gst; Evif changin s during Granger causalitest betwe UK mar FC peri K T icPro USt does not Granger Cause UKt 1006 4.62929 0.0032 UKt does not Granger Cause USt 5.81556 0.0006 Granger causality test between US and ASIA market before FC period. Prob. Ho: US-ASIA T W-Statistic HSt does not Granger Cause USt 992 11.8204 1.E-07 USt does not Granger Cause HSt 0.69536 0.5550 G Ho: UK-ASIA ranger causality test between UK and ASIA market before FC period. T W-StatisticProb. HSt does not Granger Cause UKt 992 3.02159 0.0289 UKt does not Granger Cause HSt 1.28067 0.2797 Granger causality test between US and UK market including FC period. ij W (17) Ho: US-UK T W-StatisticProb. UKt does not Granger Cause USt 1758 3.31212 0.0030 USt does not Granger Cause UKt 15.0440 7.E-17 Granger causality test between US and ASIA market including FC period. l crisis (FC) returns. The Ho: US-ASIA T W-StatisticProb. HSt does not Granger Cause USt 1743 22.8007 3.E-22 USt does not Granger Cause HSt 4.914860.0002 e Specifically, using only markets that exclude the financial crisis period, we ob- serve that the only two hypotheses that are acceptable (i.e., we cannot safely reject) are that the US and UK markets cannot transmit information to the Hong Kong market. This finding is very reasonable: with 8 hours of dif- Granger causality test between UK and ASIA market including FC period. Ho: UK-ASIA T W-StatisticProb. HSt does not Granger Cause UKt 1743 23.0404 2.E-22 UKt does not Granger Cause HSt 1.70614 0.1299 ference in local time4 between the UK and HS (and 13 hours of difference in local time5 between the US and HS) while events that occur when the Hong Kong market is open will be captured by both HS returns as well as UK (US) returns this is not necessarily true for information released d of operation to get incorporated in same day returns for the HS ane hypoth HS market does not precede the US h ands r. ult for inf om the US to Asia before the crisis (p-value of 0.5550) to HS when we include the FC period (p-value of 0.0002). prd o- mation from the US to Asia is quite an amazing finding and, to our knowledge, the first statistical verification d this is why thesis that as a p-value of only 1 × 10-7 is thu stronglyejected While it was very difficormation to flow at: HS market does not precede the UK has a p-value of 0.0289 and is rejected. It will actually be impossible for information released during the US hours fr it becomes clear that information does flow from the US This evidence of a newlyoducechannelf infor 47 hours in the summer months due to Daylight saving time in the UK but not in Hong Kong. 512 hours in the summer months due to Daylight saving time in NY (US) but not in Hong Kong.  I. M. NEOKOSMIDIS ET AL.11 tmade in t T atic opening of this new channel of information flow ation that during thef the US ci antaneously G-cause UK in both examining pe een the two markets, w e analysis of the variance and co- s. e three ain market indices under study: the US index—S&P hat the 2008 crisis was truly “he US.”he dra- m from the US to Asia is registered in the precipitous drop of the p-value (2775 times lower than the p-value that excludes the crisis). This drop is a clear indic financial crisis period the ability o markets to produce, capture and disseminate crisis spe- fic information was unmatched by the financial mar- kets in other regions of the world. At the same time, due to the operating hours’ overlap between the US and the UK, we reject the null that US t does not instt riods and we conclude that there is a simultaneous interaction between the two markets. Moreover, the Asian market affects UK market but the opposite is not true. We are going to accept (cannot reject) the null of no G-causality from UK to Asia. This means that while it seems Asia affects UK, at the same time it is not affected by UK. This result remains significant during the FC horizon. Before FC, the Asian market did G-cause the US market but the opposite flow did not exist in the sense that the US market did not G-cause Asian markets. When we include the FC period in the analysis, we find an instantaneous interaction betw hich means that we strongly reject the null of no Granger cause effect. 4. Volatility Link between the Markets In this section, we finally proceed in analyzing the 2008 financial crisis and how it is manifested by changes in the volatility dynamics of the three markets. We have already observed that the markets are co-integrated, which means that price movements of one market index are strongly related to movements of the other market indices. This interrelated nature of financial markets is a key factor in contemporary financial analysis, and it is often statistically modelled as a multivariate GARCH time series model. Such models contain multiple return series of the co-integrated markets, and their main pur- ose is to facilitate thp variance dynamics among the multiple return serie We use continuously compounded returns of th m 500, the UK index—FTSE 100 and the Hang Seng index for ASIA. We apply the leading multivariate GARCH specification, the Diagonal VECH6 model [15] in order to capture multivariate volatility dynamics. We model the returns as a summation of a constant and an innova- tion of the series: tt ru (18) where rt = (rFTSE,t, rHS,t, rSP,t)΄, μ = (μFTSE, μHS, μSP)΄, ut = (uFTSE,t, uHS,t, uSP,t)΄. The conditional covariance matrix of the innovation vector ut, given the information set 1t , is defined as H1ttt Covu . The (p, q)-lag DVECH for volatility modeling assumes a time varying Ht that follows dy- namics defined by, 11 pq tititijt-j ij H CAuu BH (19) We employ an DVECH (1, 1) model in order to ana- lyze our series. Then we take the following form of (19): 1 1t1ttt H CAuu BH (20) where 11, 21, 22, 31, 32, 33, .. . t ttt ttt h hh hhh H is the covariance matrix and its diagonal elements con- stitute the variance co , mponents of (FTSE, HS, SP) while the cross products are the covariance elements between the series. The element (h21,t) expresses the tim correlation between (HS, FTSE), (h31,t) expresses the tim between (SP, HS). The matrix (C) contains the constant term ) contain the ARCH and GARCH coefficients respectively7. We analyze up to seven years of daily data in order to capture the dynamic volatility processf the multiple return series before and during the FC period. The results are as follow: saw only the conditional variance an d if they are affected by the changing di- re icient. e varying e varying correlation between (SP, FTSE) and the element (h32,t) expresses the time varying correlation s and matri- ces (A, B o Figures 1 and 2 show the time plot of returns for each series before and including the FC period while Figures 3 and 4 show the estimated volatilities for continuously compounded returns for each index market. Moreover, Figures 3 and 4 present the time-varying covariance of DVEC (1, 1) model for continuously compounded re- turns of the three index markets. Furthermore, we d covariance with the above modelling procedure, but we have not yet a clear view about the correlation between the markets an ction of information flows as we described in the pre- vious section. It is necessary to test the conditional co- variance for significance, with a formal structure of the correlation coeff This test can be done by using the Constant Correlation Coefficient (CCC) model [17] that is based on the fol- lowing specification structure for conditional covariance: 6The Diagonal VECH model essentially writes the covariance matrix as a set of univariate GARCH models. 7For more details see [16]. Copyright © 2010 SciRes. ME  I. M. NEOKOSMIDIS ET AL. Copyright © 2010 SciRes. ME 12 equ ore F Table 6. Estimated coefficients for mean return Bef Mean return coefficient vector: (μ) Coefficient ation and DVEC (1, 1) before and during FC. C Std. Error z-Statistic Prob. μftse 0.000511 0.000230 2.224485 0.0261 μhs 0.000599 μSP 0.000426 0.000290 2.067863 0.0387 0.000247 1.726561 0.0842 Variance Equation: 11 1tttt Auu BH HC C11 9.97E-07 4.07E-07 2.448850 0.0143 C21 –3.48E-08 4.65E-07 –0.074856 0.9403 0. 22 –0. 0.044065 0.023648 1.863390 0.0624 C31 1.94E-07 1.38E-07 1.404257 1602 C4.62E-07 2.87E-07 1.606839 0.1081 C32 –2.04E-09 3.74E-08 054479 0.9566 C33 4.56E-07 2. 0.088349 0. 65E-07 016382 5. 1.721715 392995 0.0851 0.0000 a11 a21 a31 a22 0.023749 0.010437 2.275435 0.0229 0.022218 0.007026 3.162415 0.0016 a32 0.005319 0.005980 0.889480 0.3737 a33 b11 0.039477 0.009460 4.173234 0.0000 0.899975 0.017620 51.07800 0.0000 b21 0.791999 0.155694 5.086891 0.0000 b31 0.938082 0.018461 50.81435 0.0000 b22 0.972019 0.008729 111.3515 0.0000 b32 0.982927 0.015384 63.89226 0.0000 b33 0.952680 0.010816 88.08084 0.0000 During FC Mean return coμ) efficient vector: (Coefficient Std. Error z-Statistic Prob. μftse 0.000447 0.000191 2.340664 0.0192 μhs 0.000640 0.000247 2.592147 0.0095 μSP 0.000358 0.000202 1.770420 0.0767 Variancuation: e Eq 11 1tttt uu HCA BH C11 1.06E-06 3.22E-07 3.285715 0.0010 C21 7.50E-08 3.11E-07 0.241158 0.8094 0. 22 C31 1.19E-08 7.92E-08 0.150348 8805 C1.26E-06 4.28E-07 2.938565 0.0033 C32 2.82E-10 1.09E-08 0.026007 0.9793 C33 8.81E-07 1. 0.112285 0. 94E-07 012698 4.545649 8.842880 0.0000 0.0000 a11 a21 a 0.021839 0. 0.020057 017917 1. 0.007776 218908 2.579352 0.2229 0.0099 31 a22 0.069864 0.008514 8.206061 0.0000 a32 a –0.002786 0.001660 –1.678200 0.0933 33 b11 0.069628 0.009046 7.697431 0.0000 0.886017 0.011934 74.24564 0.0000 b21 0.861168 0.150164 5.734836 0.0000 b31 0.952118 0.011549 82.44429 0.0000 b22 0.925442 0.009252 100.0242 0.0000 b32 1.004232 0.007243 138.6420 0.0000 b33 0.924571 0.009607 96.23563 0.0000  I. M. NEOKOSMIDIS ET AL.13 -.0 6 -.0 4 -.0 2 .00 .02 .04 .06 20022003 2004 2005 RETURNS_FTSE 100 -.0 6 -.0 4 -.0 2 .00 .02 .04 .06 20022003 2004 2005 RETURNS_HS -.0 6 -.0 4 -.0 2 .00 .02 .04 .06 20022003 2004 2005 RETURNS_S&P 500 -.1 0 0 -.0 7 5 -.0 5 0 -.0 2 5 .000 .025 .050 .075 .100 Figure 1. Continuously compounded returns of FTSE 100, S&P 500 and Hang Seng time series before FC period. 20022003 2004 2005 2006 2007 2008 RETSE 100 TURNS_F -. 1 5 -. 1 0 -. 0 5 .15 .00 .05 .10 20022003 2004 2005 2006 2007 2008 RETURNS_HS -. 1 2 -. 0 8 -. 0 4 .00 .04 .08 .12 20022003 2004 2005 20062007 2008 RETURNS_S&P 500 Figure 2. Continuously compounded returns of FTSE 100, S&P 500 and Hang Seng time series during FC period. Copyright © 2010 SciRes. ME  I. M. NEOKOSMIDIS ET AL. 14 .0000 .0002 .0004 .0006 .0008 .0010 20022003 20042005 Var(RETURNS_FTSE 100) -.00004 .00000 .00004 .00008 .00012 20022003 20042005 Cov(RETURNS_FTSE 100, RETURNS_HS) .00004 .00008 .00012 .00016 .00020 .00024 20022003 20042005 Var(RETURNS_HS) -.00005 .000 00 .000 05 .000 10 .000 15 .000 20 20022003 2004 2005 Cov(RETURNS_FTSE 100, RETURNS_S&P 500) -.00001 .00000 .00001 .0006 .00002 .00003 .00004 .00005 20022003 2004 2005 Cov(RETURNS_HS, RETURNS_S&P 500) .0000 .0001 .0002 .0003 .0004 .0005 200220032004 2005 Var(RETURNS_S&P 500) Figure 3. Conditional variance-covariance representation of estimated return series before FC time period. .0000 .0005 .0010 .0015 .0020 .0025 .0030 20022003 2004 2005 2006 2007 2008 Var(RETURNS_FTSE 100) -.00010 -.00005 .00000 .00005 .00010 .00015 .00020 20022003 2004 2005 2006 2007 2008 Cov(RETURNS_FTSE 100, RETURNS_HS) .000 .001 .002 .003 .004 .005 20022003 2004 2005 2006 2007 2008 Var(RET URNS_HS) -.0002 -.0001 .0000 .0001 .0002 20022003 2004 2005 2006 2007 2008 Cov(RETURNS_FTSE 100, RETURNS_S&P 500) -.00006 -.00004 -.00002 .0030 .00000 .00002 .00004 20022003 2004 2005 2006 2007 2008 Cov(RETURNS_HS, RETURNS_S&P 500) .0000 .0005 .0010 .0015 .0020 .0025 20022003 2004 2005 20062007 2008 Var(RETURNS_S&P 500) Figure 4. Conditional variance-covariance representation of estimated return series during FC time period. Copyright © 2010 SciRes. ME  I. M. NEOKOSMIDIS ET AL.15 ,,, ,,, , ij tijii tjj t hRhh ijFTSEHSS If we combine the above finding with the G-cause findings, we conclude that the UK and Asian markets were insignificantly positive correlated (R12) before and remained so during the Financial Crisis. On the other hand, we cannot observe any insignificant difference in the correlation (significant correlation coefficient) be- tween the US and UK (R13) markets while the condi- tional correlation between the US and the Asian market (R23) remains strongly insignificant before and during the FC period. Thus it seems that information is transmitted in part through market returns and partly also through volatility spillovers in the case of US/UK. 5. Conclusions An empirical objective of this paper was to examine the existence and source of the strong inter-market co-move- ments that are suggested by financial analysts during the 2008 financial crisis. We analyzed levels and stock re- turns for three indices (FTSE100, Hang Seng and S&P500) that represent three major financial markets that constitute a major fraction of the world capitaliza- tion. We believe that these three stock markets are rep- resentative of the European, Asian and US markets re- spectively. After finding that all three indices have unit roots and nger causality tests toirinfn flows betweenrkets bh- cial s. Thurinatit was diffinfo tto Asia fore the crisis, in dromS to Asia when the crisis peri is included in the sample. This provides the first ef a newly produced channel of information knowledge, is the first statistical verifice 2008 crisis was truly “made in the US”. Moreover, we did noany significanrrelation coefficient, ao ael, en US/AIA eongS and UK . 6. Rren [1] J. For. RCo Latin Amer- : Defineas and plications,” nomi Nopp [2] Lo anaAntricis Nonsys TJournal of Econs, , No. 1-2, 1990, pp. 181-211. [3] itionaeroskedastici- ith Ete flato- metric , N, pp. 987-1008. [4] R. Engle, “Arch Selected Readings,” Oxford University P (21) The coefficient (Rij) is the constant correlation be- tween the ith and jth markets while the individual market specific conditional variance following a one-dimensional GARCH 1 k (22) Table 7. CCC estimation before and during the FC. Before FC CCC equation: ,1 2 ,1, , kk tkktkkk t hcaubh 2 ,1 kk tkktkkk t hcaubh ,, ij tijii tjjt hRhh , Coefficient Std. Error z-Statistic Prob. C1 9.15E-07 3.81E-07 2.401591 0.0163 A1 0.084501 0.015989 5.284869 0.0000 B1 0.904494 0.017197 52.59597 0.0000 C2 3.97E-07 2.58E-07 1.536159 0.1245 A2 0.021141 0.006642 3.183029 0.0015 B2 0.973830 0.008051 120.9617 0.0000 C3 5.00E-07 2.84E-07 1.760204 0.0784 A3 0.042969 0.010376 4.141257 0.0000 R12 0.043517 0.034412 1.264591 B3 0.948922 0.011763 80.67114 0.0000 0.2060 R13 0.179320 0.029016 6.180103 0.0000 R23 0.051741 0.030215 1.712445 0.0868 During FC CCC equation: 2 ,1 kk tkktkkk t hcaub ,1 h ,,,ij tijii tjj t hRhh Coefficient z-StStd. Error atistic Prob. C1 9.51E-07 3.06E97 0.0018 -07 3.1139 A0.10825 8.848573 0.0000 B1 0.890359 7 77.23797 0.0000 C 0. 0. 8 0. 0. R0. R0. R0. 1 62 0.30122 0.01152 2 1.29E-06 4.34E-07 2.965774 0.0030 A2 070639 0.008491 8.319351 0.0000 B2 924898 0.009231 100.1949 0.0000 C3 .68E-07 1.92E-07 4.511079 0.0000 A3 068459 0.008955 7.644883 0.0000 B3 925928 0.009565 96.80827 0.0000 12 044193 0.024588 1.797361 0.0723 13 054208 0.023218 2.334745 0.0196 23 007679 0.023962 0.320458 0.7486 they are cointegrated, we performed a host of Gra in order see the dection of ormatio the ma e most s efore a prising f nd during t ding is th e finan while crisi verycult for irmation to flow fromhe US beformationid flow f the U od vidence o and, to our ation that th t find t co s it was mdelled by CCC modbetwe SIA and UK/AS marketsxcept am the U efeces K.bes and Rigobon, “ntagion in ica Eco itions, M a, Vol. 1, urement, . 2, 2001, Policy Im . 1-46. A. d A. C. Mckinlay, “ Econome Analys of Vol. 45 nchronourading,” ometric R. Engle, “Autoregressive Condl Het ty wstimates of heVariancof U.K. Inion,” Ec no a, Vol. 50o. 4, 1982 Copyright © 2010 SciRes. ME  I. M. NEOKOSMIDIS ET AL. 16 ss, Ox5. [5] d W. A. Fuller, “Likelihood Ratio Statis- ressive Time Series with a Unit Root,” Econometrica, Vol. 49, No. 4, 1981, pp. 1057-1072. “Cointegration and metrics,” elihood Ratio and Lagrange Multi- al Economy, Vol. 96, No. 1, Preford, 199 R. Engle, “The use of ARCH/GARCH Models in Applied Econometrics,” Journal of Economic Perspectives, Vol. 15, No. 4, 2001, pp. 157-168. [6] T. Bollerslev, “Generalized Autoregressive Conditional Heteroscedasticity,” Journal of Econometrics, Vol. 31, No. 3, 1986, pp. 307-327. [7] T. Bollerslev, R. F. Engle and D. B. Nelson, “ARCH Models,” In: R. Engle and D. McFadden, Eds., Handbook of Econometrics, North Holland Press, Amsterdam, 1994. [8] D. A. Dickey and W. A. Fuller, “Distributions of the Estimators for Autoregressive Time Series with a Unit Root,” Journal of American Statistical Association, Vol. 74, No. 366, 1979, pp. 427-481. [9] D. A. Dickey an tics for Autoreg 198 [10] H. Akaike, “Information Theory and an Extension of the Maximum Likelihood Principle,” In: B. N. Petrov and Csaki, Eds., 2nd International Symposium on Information Theory, Academia Kiado, Budapest, 1973, pp. 267-281. [11] R. Harris and R. Sollis, “Applied Time Series Modelling and Forecasting,” John Wiley, New York, 2003. [12] R. F. Engle and C. W. J. Granger, Error Correction: Representation, Estimation and Test- ing,” Econometrica, Vol. 55, No. 2, 1987, pp. 251-276. [13] C. Gourieroux and J. Jasiak, “Financial Econo Princeton University Press, Princeton and Oxford, 2001. [14] R. Engle, “Wald, Lik plier Tests in Econometrics,” In: Z. Griliches and M. D. lntriligator, Eds., Handbook of Econometrics II, 1983, pp. 796-801. [15] T. Bollerslev, R. Engle and J. M. Wooldridge, “A Capi- tal-Asset Pricing Model with Time-Varying Covari- ances,” Journal of politic 8, pp. 116-131. [16] R. Tsay, “Analysis of Financial Time Series,” John Wiley & Sons, New Jersey, 2005. [17] T. Bollerslev, “Modeling the Coherence in Short-Term Nominal Exchange Rates: A Multivariate Generalized ARCH Approach,” Review of Economics and Statistics, 1990. Copyright © 2010 SciRes. ME |