Paper Menu >>

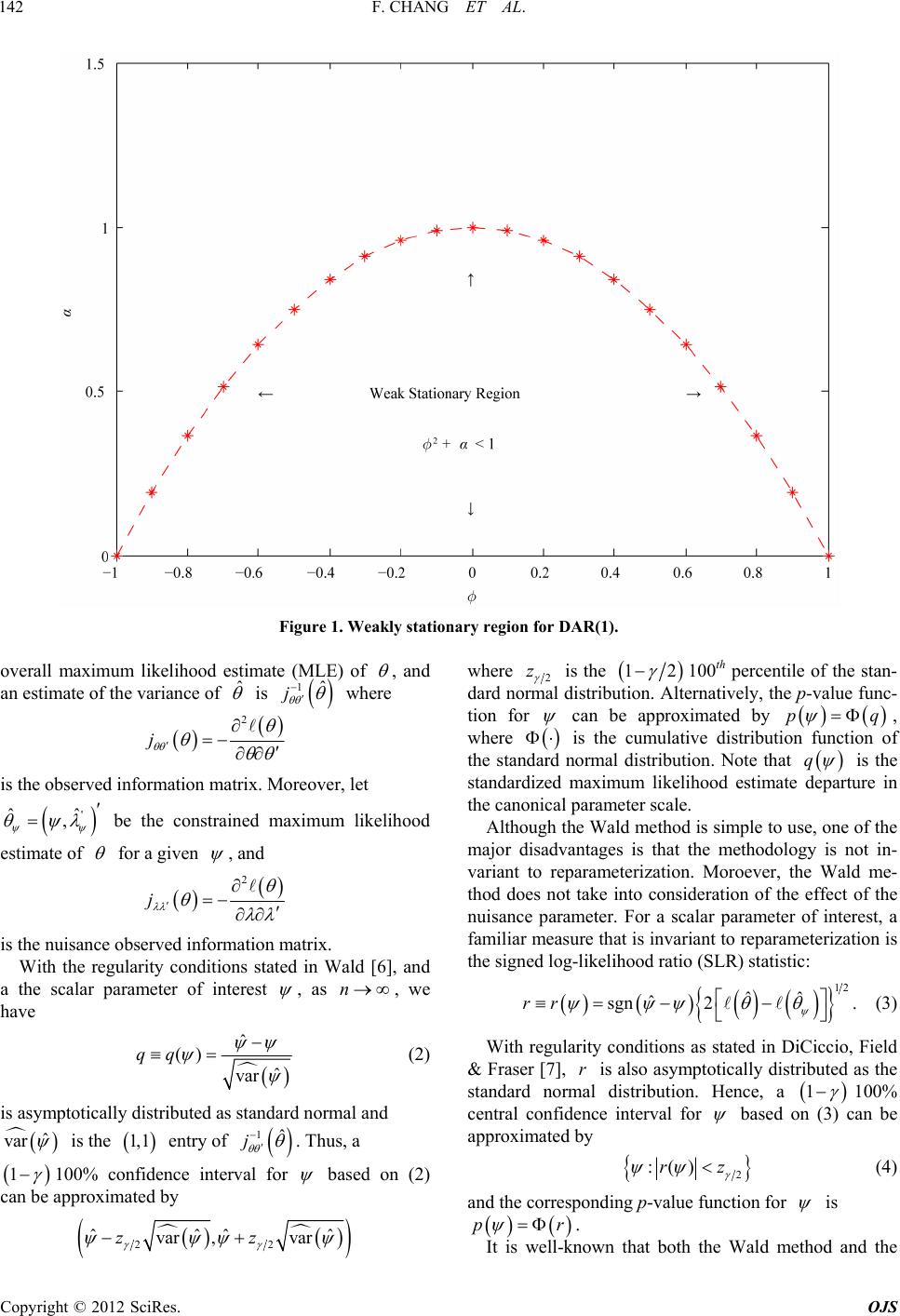

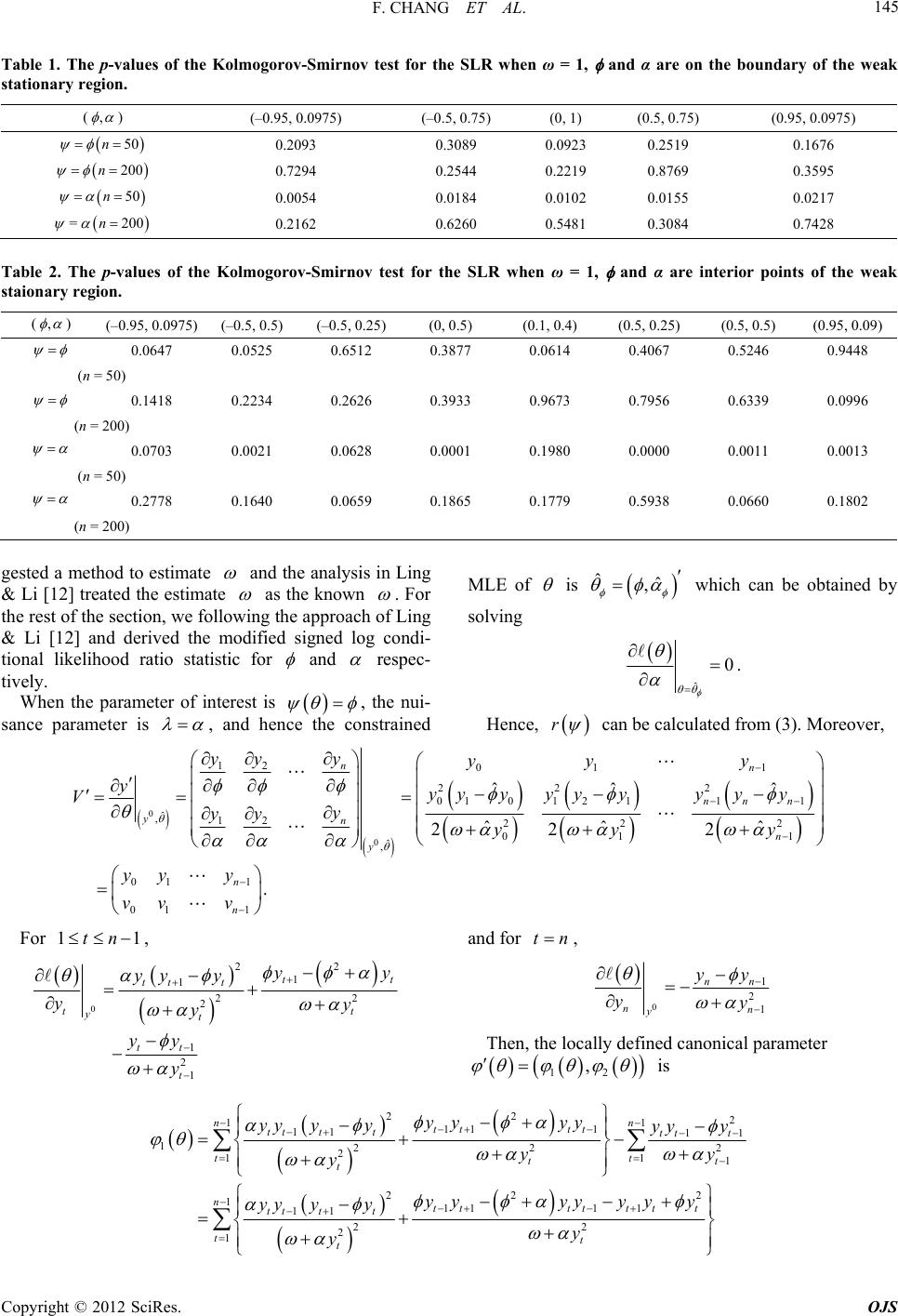

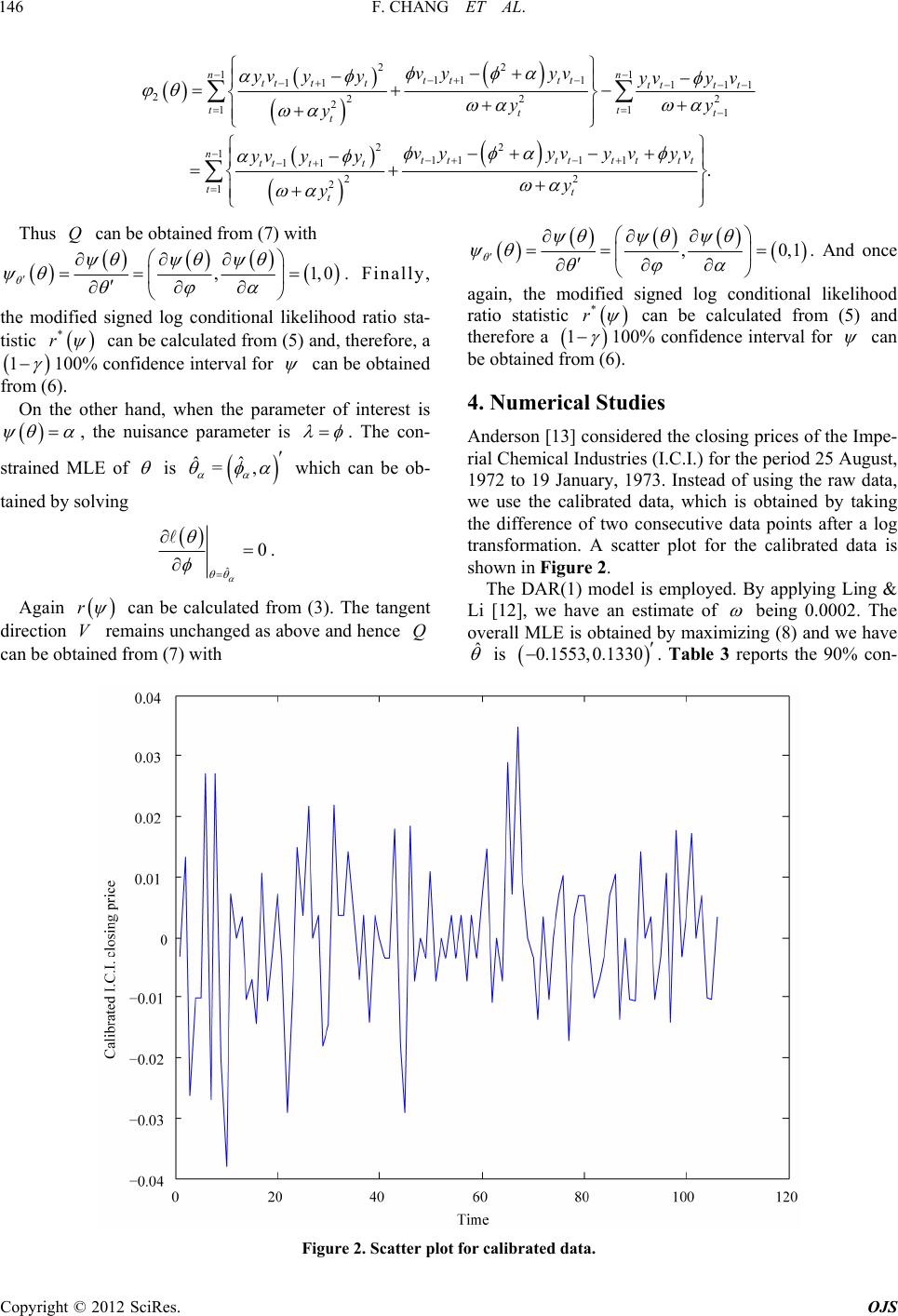

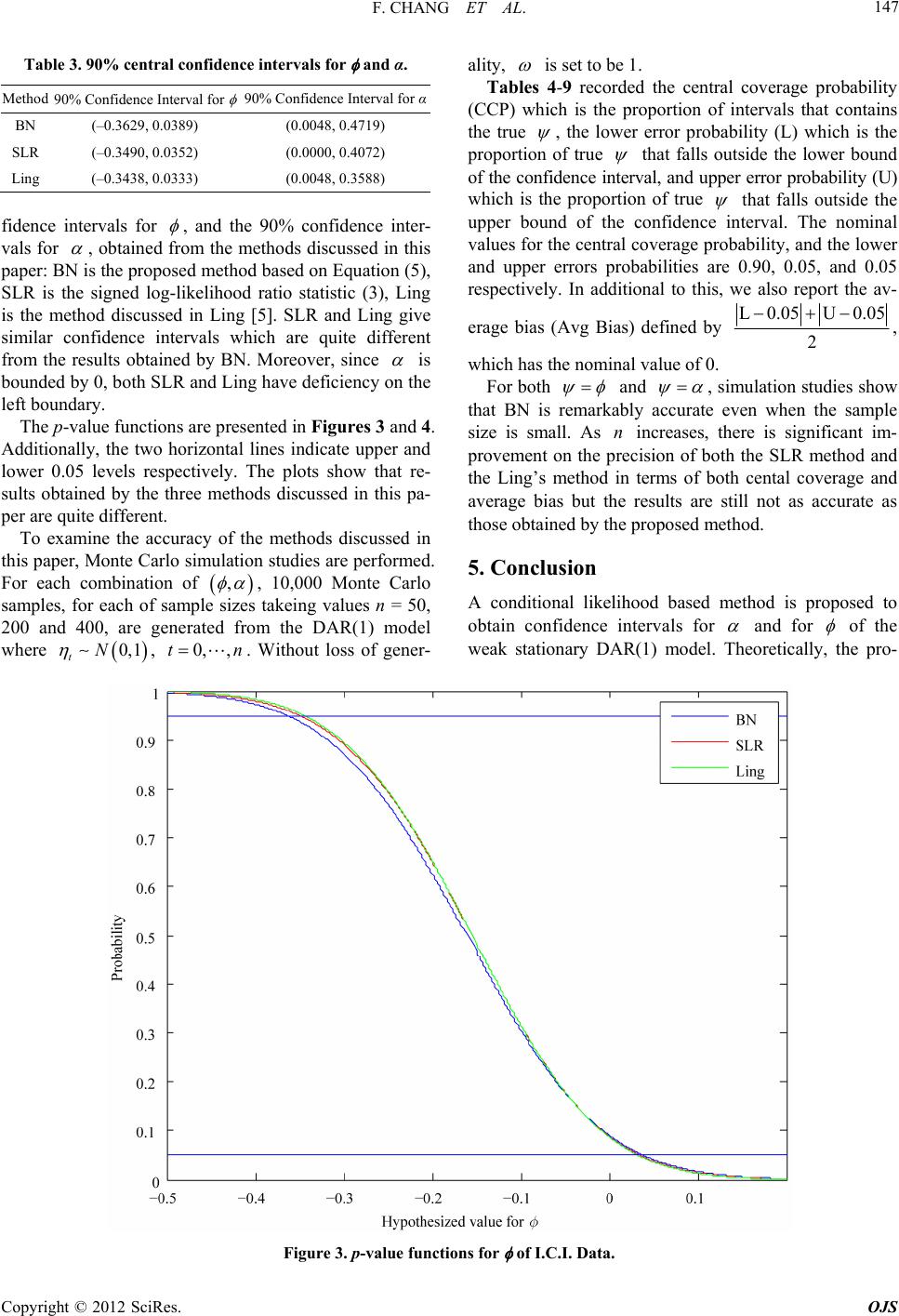

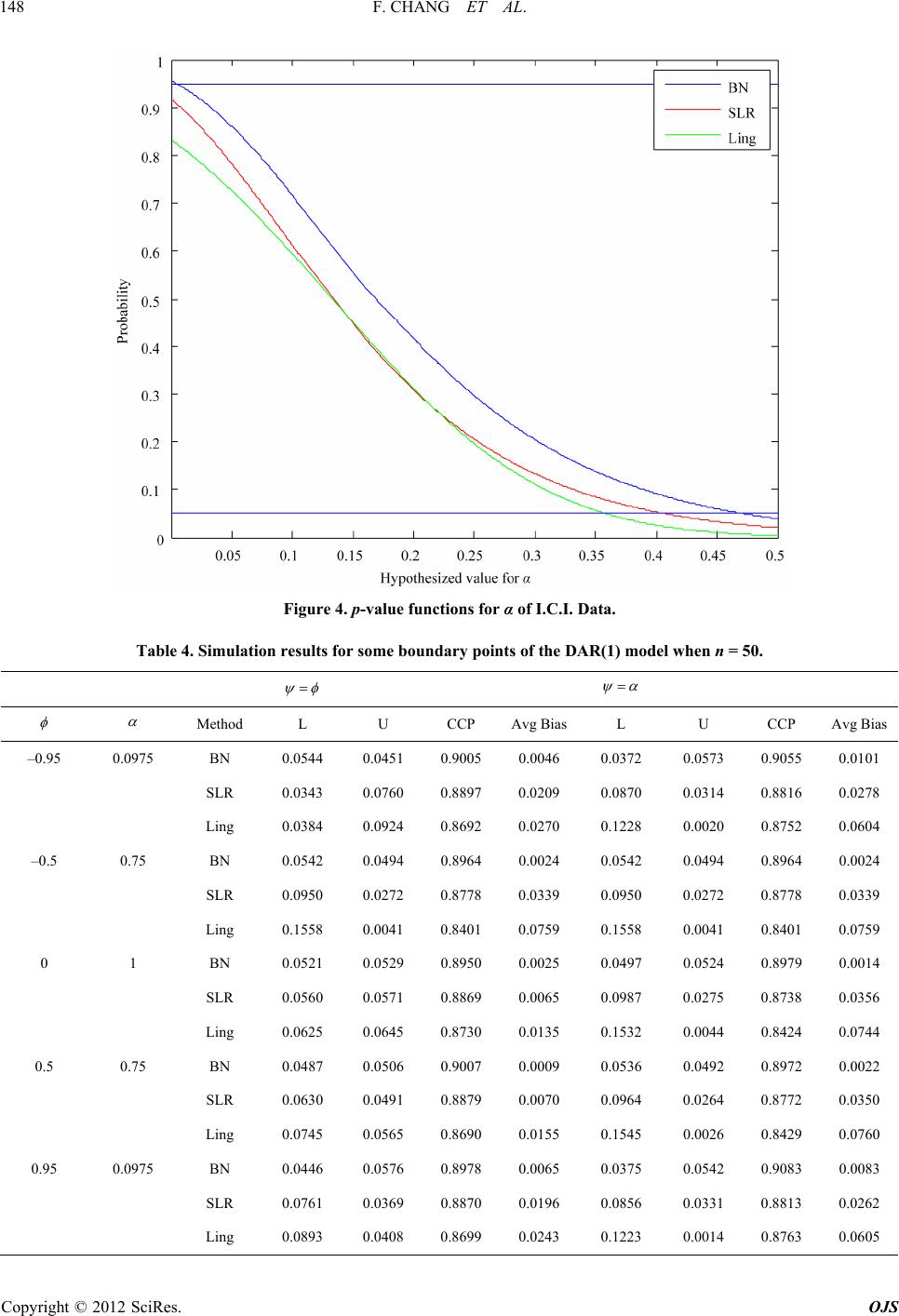

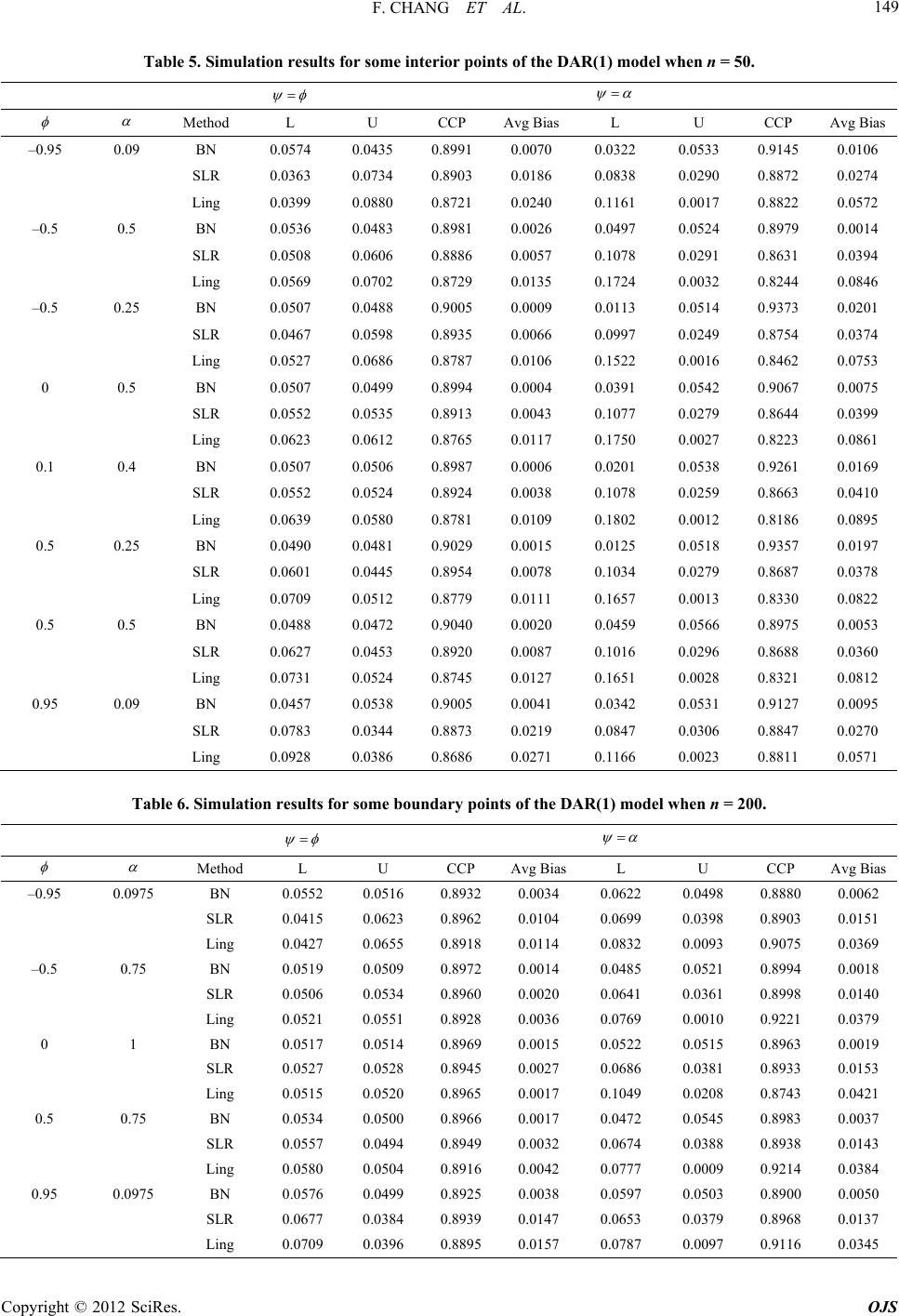

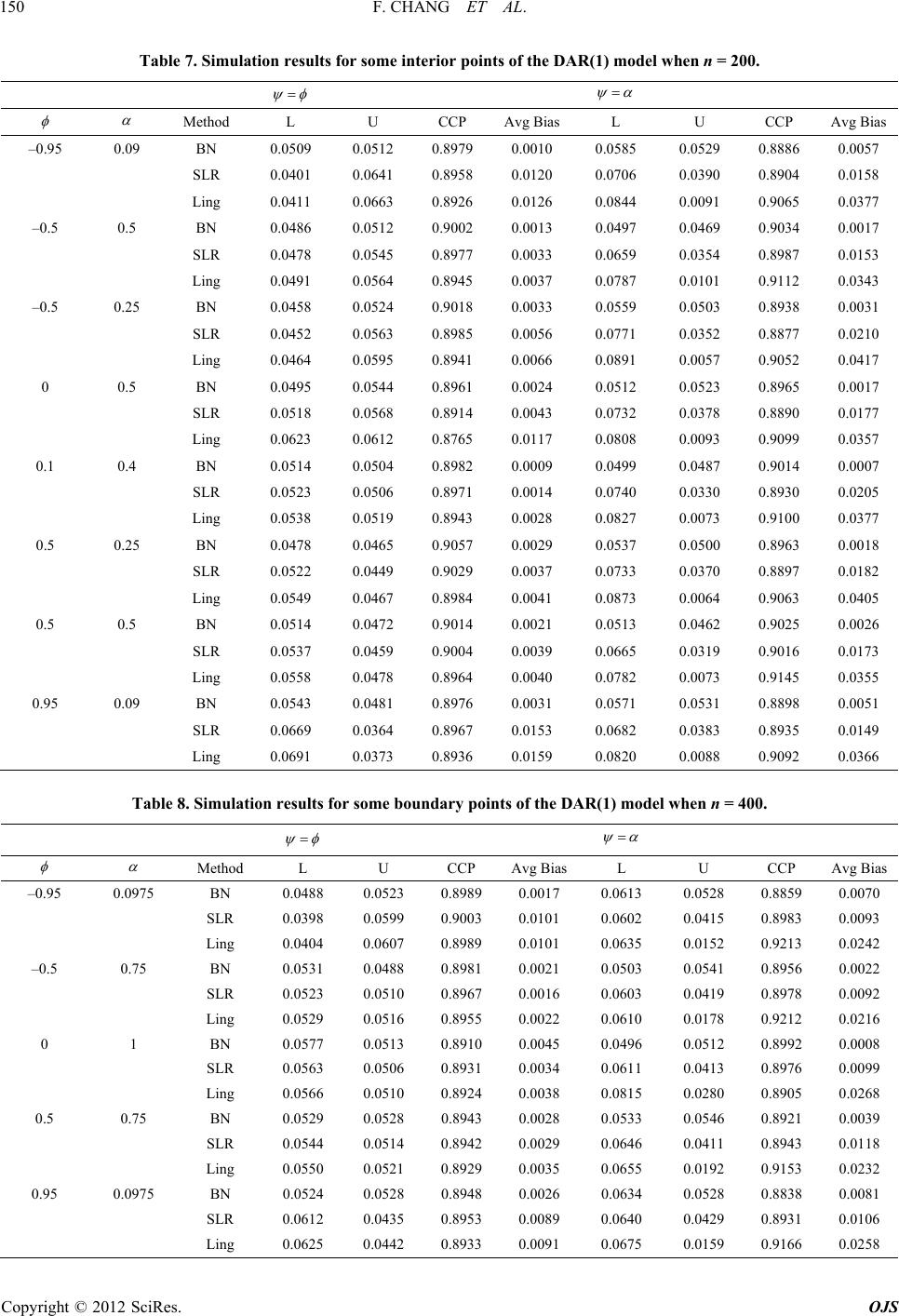

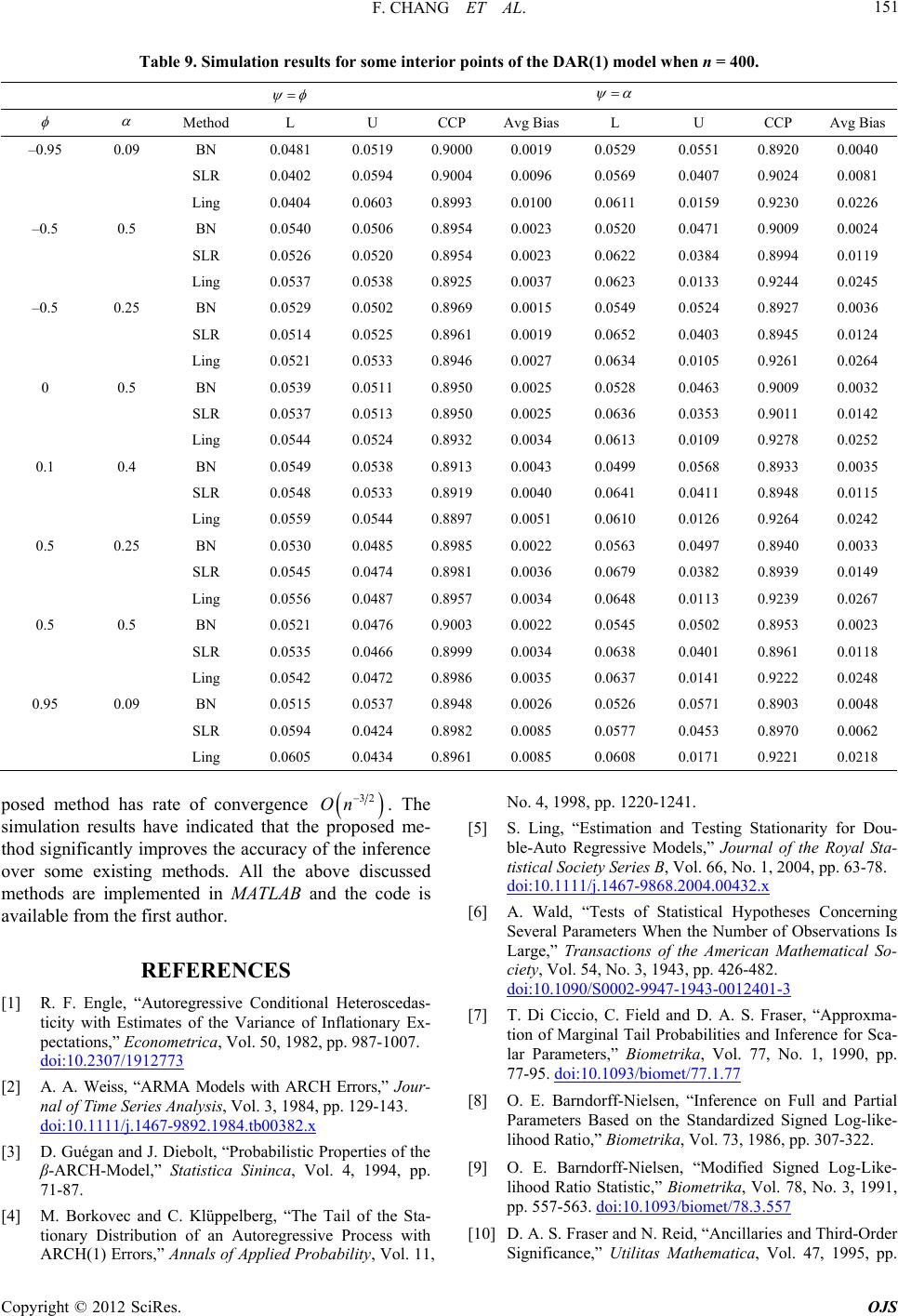

Journal Menu >>

Open Journal of Statistics, 2012, 2, 141-152 http://dx.doi.org/10.4236/ojs.2012.22016 Published Online April 2012 (http://www.SciRP.org/journal/ojs) 141 Asymptotic Inference for the Weak Stationary Double AR(1) Model Fang Chang, Augustine C. M. Wong*, Yanyan Wu Department of Mathematics and Statistics, York University, Toronto, Ontario, Canada Email: {changf, *august, minna}@yorku.ca Received November 11, 2011; revised December 15, 2011; accepted December 30, 2011 ABSTRACT An AR(1) model with ARCH(1) error structure is known as the first-order double autoregressive (DAR(1)) model. In this paper, a conditio nal likelihood based meth od is proposed to obtain inferen ce for the two scalar parameters of inter- est of the DAR(1) model. Theoretically, the proposed method has rate of convergence 32 On . Applying the pro- posed method to a real-life data set shows that the results obtained by the proposed method can be quite different from the results obtained by the existing methods. Results from Monte Carlo simulation studies illustrate the supreme accu- racy of the proposed method even when the sample size is small. Keywords: Canonical Parameter; Double Autoregressive Model; p-Value Function; Signed Log-Likelihood Ratio Statistic 1. Introduction ARCH error structure was first introduced to economet- ric models by Engle [1] as a way of unleashing the con- stant variance assumption. Weiss [2] studied the AR models with ARCH error structure. A special case of Weiss [2] model is the AR(1) model with ARCH(1) error structure, which is also known as the first-order double autoregressive (DAR(1)) model. The DAR(1) model can be expressed as: 00 Y , 21t t Y 1, ,tn 1tt YY , (1) where ,0 and 0n ,, r is a sequence of inde- pendent standard normal random variables. Then and 0 Yva 1 2 var YY Y 1, ,tn 11tt t , 1 , which is varying over time. This nonlinear time series model is also a special case of β-ARCH model investi- gated in Guégan & Diebolt [3] with 1 . This type of model is widely used for fitting financial time series data because the influence of the empirical observations is part of the source for volatility. Guégan & Diebolt [3] derived the sufficiency condition for the weak stationary DAR(1) model to be , and Borkovec & Klüp- pelberg [4] proved that it is also the necessity condition for the model. Figure 1 shows the weak stationary region for the DAR(1) model graphically. Note that, for the DAR(1) model, when 2 , reaches the boundary points , the model becomes a nonstationary AR(1) model. 1, 0 Ling [5] obtained a conditional likelihood function for the weak stationary DAR(1) model. Then he derived the asymptotic distribution for the maximum likelihood es- timate of the parameters based on this conditional likeli- hood function. In Section 2, some asymptotic likelihood-based infer- ence procedures for a general model are reviewed. In Section 3, a modified signed log conditional likelihood ratio statistic for the weak stationary DAR(1) model is derived. The proposed method, theoretically, has rate of convergence 32 On 0,,yyy . A real-life example is presented in Section 4 to illustrate the implementation of the pro- posed method and also to show that results obtained from the methods discussed in this paper can be quite different. Results from Monte Carlo simulation studies are also presented in Section 4 to illustrate the extreme accuracy of the proposed method even when the sample size is small. Some concluding remarks are given in Section 5. 2. Asymptotic Likelihood-Based Inference for a General Model Let 1n be a sample from a canonical ex- ponential family model with log likelihood function 0 ;y ,, where is the k-dimen- sional canonical parameter, with being the scalar parameter of interest and being the (k – 1)-dimen- sional nuisance parameter. Denote ˆˆ ˆ, be the *Corresponding a uthor. C opyright © 2012 SciRes. OJS  F. CHANG ET AL. 142 Figure 1. Weakly stationary region for DAR(1). overall maximum likelihood estimate (MLE) of , and an estimate of the variance of ˆ is 1ˆ j where 2 j is the on matrix. M observed informatioreover, let ' ˆˆ , be the constrained maximum likel ihood estimate of for a given , and 2 j is the information mtrix. With the regularity conditions stated in Wald [6], and nuisance observeda a the scalar parameter of interest , as n, we ha ve ˆ ()qq ˆ var (2) d as standar ˆ var is asymptotically distributed normal and is the of 1,1 entry 1ˆ j . Thus, a 1 1for 00% conce intervnfideal based pproxim by on (2) can be aated where 2 z is the 100th percentile of the stan- dard normal distribution. Alternatively, the p-value func- tion for 12 can be approximated by pq , where is the cumulative distribution function of the standard normal distribution. Note that q is the um likel se, one of th e Wa ar parameter of interest, a fa standardized maximihood estimate departure in the canonical parameter scale. Although the Wald method is simple to ue major disadvantages is that the methodology is not in- variant to reparameterization. Moroever, thld me- thod does not take into consideration of the effect of the nuisance parameter. For a scal miliar measure that is invariant to reparameterization is the signed log-likelihood ratio (SLR) statistic: 12 ˆˆ ˆ sgn 2 rr . (3) With regularity conditions as stated in DiCiccio, Field & Fraser [7], r is also asymptotically distributed as the standard normal distribution. Hence, a 1 100% central confidence interval for 2 ˆˆˆˆ varz 2 , varz based on (3) approximated by can be 2 :()rz (4) and the corresponding p-value function for is pr . It is well-known that both the Wald method and the Copyright © 2012 SciRes. OJS  F. CHANG ET AL. 143 SLR method are not very accurate e sample size is small. Theoretically, they only have rate of e specially when the con ncverge 12 n . In statistics literaturthere eOe, xis ts other methods that have higher rate of convergence. In particular, Barndorff-Nielsen ([8,9]) derived a modified signed log-likelihood ratio statistic for any scalar pa- rameter : ** 1log Q rrrrr (5) and provd that it is asymptotically distributed as the standard nrm e oal distribution with rate of convergence 32,On where r is the signed log-likeli tio statistic as defined i(3), and Q hood ra- n is a that needs to d for each model being quantity be specifically define considered. For the canonical exponential family model, and bein ete g a component parameter of the canonical r, Q param takes the form of 12 ˆ ˆˆ j Q j which is thdized maximum likelihe standarood departure in canonical parameter scale taking into consideration of removing the nuisance parama eter. Hence 1 100% central confidenrval for ce inte based on * r is *2 :rz (6) and the corresponding p-value function for is * pr . However, not every model longs to thonical bee can exponential family model, and even rameter of interest may not be a component parameter of al par that any statistical own density function de- pe if it does, the pa- the canonicameter. Fraser & Reid [10] showed model with a kn nding on a natural parameter can be approximated by a tangent exponential model with a locally defined canonical parameter, : 0 y V y where 0ˆ ,y ' y V is considered as the tangent direc- tion. Differentiating the locally defind canonical pa- rameter e with respect to the eter natural param , e we hav By chg the parameter space from . angin to , the maximum likelihood estimure ˆ ate depart in scale is equivalent to ˆˆ ˆ sgn in the locally defined canonical parameter scale, where ˆ ˆ , factor is the unit row vector version of the gra- dient vector, which is obtained from with first 1 1 . Moreover, by the chain rule in differentiation, deter- minant of the observed information matrix in scale, ˆ j , expressed in scale is 2 ˆˆˆ jj and simminanisance observed information matrix, ilarly, the detert of the nu ˆ j , expressed in scale is 1 ˆˆ ˆˆ jj . Hence Q in scale d as can be expresse 12 2 ˆˆ ˆ sgn ˆˆ ˆˆˆ QQ j j 1 (7) Hence * r, which has rate of convergence 32 On , can be obtained. Thus a 1 100% c dence interval for onfi- , and also the p-value function for can be obtained. 3. A Modified Log Conditional Likelihood Fol given in (1), Ling [5] obtained the conditional likelihood function for the weak stationary Ratio Statistic for the DAR(1) Model r the DAR(1) mode DAR(1) model. Moreover, assuming is known, Li ([5,11]) studied the asymptotic distribution for the ma ng xi- mum likelihood estimate of , , ˆˆˆ based on the conditional likelihood function. More specifically, the log conditional likelihood function for DAR(1) model with known is: 0 2 1 212 1 ,; 1 log. 2 ntt t t y yy yy (8) 1 t Copyright © 2012 SciRes. OJS  F. CHANG ET AL. 144 Hence, , where 11 21 ttt t yy y y , (9) 1 n t 2 1 (1 21 122 111 1 2 ntt t ttt yy y yy 0) and the ˆˆˆ , overall MLE, , solving can be obtained by ˆ 0 , ˆ () 0 . atriThe observed informax tion m j is (see the bottom of the page) Ling [5] showed that the epectation of ˆ x is asymp- totically equal to , and instnead of usig 1ˆ j as the asympotitic variance for ˆ , he showeat d th 1 2 , ( where 20 t Y nE 2 0nA C B ˆ var2 t Y A 11) 2 2 1 t Y , AE 2 2 2 t t Y Y , BE 4 2 2 t t Y CE Y Since this asymptotic variance of ˆ still involves the unknarameter own p , Ling [5] further proposed to use 1 2 2 1 2 varˆ 2 0ˆˆˆ A 0 ˆ ˆ n t tt y y A CB , te of as an estima ˆ var , where 2 2 1 1 ˆn t A ˆt y , 2 2 2 1 ˆˆ n t tt y B y , 4 2 2 1 ˆˆ n t tt y C y . Then inference concerning , and can be ob- tained by the Wald method. ) model pointed out that it is s undeconditions on the pa- rameters. Therefore, by Tayr expansion, we ha For the DAR(1, Ling [5] an ergodic procesr suitable lo ve 1 ˆˆ ˆˆ 2 . Hence ˆˆ ˆˆ 22j 1 is asymptotically distributed as a 2 distribution with p degrees of freedom. Thus, when dim 1p , the signed log conditional likelihood ratio statistic for and for of the DAR(1) model is asymptotically dis- tributed as 0,1N with rate of convergence 12. We performed some simulation studies for testing the no the log conditional likelihood ratio statistics for thodel. The Kolmogorov-Smirov test is employed. We considered a medium sample size of 50n On rmality of e DAR(1) m and a large sample size of 200n. For each ple ameter values. o sample size, we generate 10,000 sams from the D AR (1 ) model for each combination of par For each generated sample, the signed log conditional likeli- hood rati statistic for and for are calculated. The simulatults are presented in Tables : Ta ion res 1 and 2 aluesea sta ble 1 records the p-values of the Kolmogorov-Smirov test when the parameters values are on the boundary of the weak stationary region; Table 2 records the p-values of the Kolmogorov-Smirov test when the parameters v are the interior points of the wktionary re- gion. From the tables, the p-values of the Kolmogorov- Smirov test of the signed log conditional likelihood ratio statistic for are large regardless of the sample sizes. Hence no evidence that th signed log onditional likeli- hood ratio statistic for e c is not distributed as 0,1N. On the other hand, the p-values of the Kolmogorov- Smirov test of the signed log conditional likelihood ratio statistic for are large only for 200n. Hence for n is sufficiently large, there is no evidence that the signed log conditional likelihood ratio statistic for is not distri buted as 0,1N. Note that when is unknown, Ling & Li [12] sug- 3 211 122 2 22 1 21 2 34 11 1 1 222 22 22 1 11 . 21 2 nn ttt t tt tt nn tt tt t t tt t tt yy y y yy yy yy y y y yy j Copyright © 2012 SciRes. OJS  F. CHANG ET AL. OJS 145 pe SL Table 1. The -values of the Kolmogorov-Smirnov test for thR when ω = 1, and α are on the boundary of the weak stationary region. (, ) (–0.95, 0.0975) (–0..755, 0) (0, 1) (0.5, 0.75) (0.95, 0.0975) 50n 0.2093 0.3089 0.0923 0.2519 0.1676 200n 0.7294 0.2544 0.2219 0.8769 0.3595 0.2162 0.6260 0.5481 0.3084 0.7428 50n 0.0054 0.0184 0.0102 0.0155 0.0217 =200n Table 2. The p-values of the Kolmogirnov test for the SLR when, andinterior points of the weak staionary region. (, orov-Sm ω = 1 α are ) (–0.95,.0975) (–0.5, 0.5, 0.25) ((0.1(0.5(0.5, 0.5) , 0.09) 05) (–0.0, 0.5) , 0.4) , 0.25) (0.95 0.0647 0.0525 0.6512 0.4067 0.5246 0.3877 0614 0.0.9448 (n = 50) 0.1418 0.2234 0.2626 0.3933 0.9673 0.7956 0.6339 0.0996 (n = 200) n = 50) 0.0703 0.0021 0.0628 0.0001 0.1980 0.0000 0.0011 0.0013 ( 2778 0.1640 0.0659 0.1865 0.1779 0.5938 0.0660 0.1802 n = 200) 0. ( gested a method ate to estim and the ann Ling & Li [12] tate alysis i reated the estim as Copyright © 2012 SciRes. the known . For the rest ofon, we followine approach of Ling & Li [12] an the msigncondi tional likratio statistic for the secti d dg th erivedodifieded log - elihood and respec- vely. er ti When the parameter of intest is , the nui- sance parameter is , anhence the consained d tr LE oMf is ˆ ˆ , whibe obby solving ch can tained ˆ 0 . Hence, r can be calculated from (3). Moreover, 0 0 ˆ ,12 ˆ ,2 y y 12 22 01 n y yy yy V 01 1 2 01 2111 22 2 01 1 01 1 ˆˆ ˆ ˆˆ ˆ 2 2 . n nn n n n n y y yyyyyy y yy yy y yy y vv v For 11tn , yy y 01 1n 0 1 1 22 2 1 21 tt tt t tt yt tt t yy yyy yy y yy y 22 and for tn, 0 1 21 nn nn y y y y y Then, the locally defined canonical parameter 12 , is 22 2 1 1 11 1 11 11 122 2 2 1 222 1111 1 11 22 2 1 n n tt tt tt tttt t tt ntttttt tt tt tt t yy yy yy yyyy y yy y yyyyy yy yy y y 11 t tt t y y  F. CHANG ET AL. 146 22 1 1 11 1 11 222 2 1 1 22 1111 1 11 22 2 1 n n tt tt tt tt t t t nttttt t tt tt tt t vy yv yv yyyv y vyyvy v yv yy y y 11 1 2 1 . tt t t tt tt y v yy yv Thus Q can be obtained from (7) with ,1,0 . Finally, nal likelihood ratio sta- tistic * r the modified signed log conditio can be calculated from (5) and, therefore, a 1 100% confidenterval for ce in can be obtained om f interest is fr (6). On theother hand, when the parameter o , the nuisance pter is arame strained MLE . The con- of is =, ˆˆ which can be ob- y tainedng bsolvi ˆ r 0 . Again can be calculated fromhe tangent (3). T inhanged as a om (7) wit h ,0,1 . And once again, the modified signed log connal likelihood ratio statistic direction V remas uncbove and hence Q can be obtai ned fr ditio * r can be calculated from (5) and therefore a 1100% confidence interval for can be obtaine d from (6). 4. Numerical Studies Anderson [13] considered the closing prices of the Impe- ary, 1 calibra t secutive data points after a log transformation. A scatter plot for the calibrated data is rial Chemical Industries (I.C.I.) for the period 25 August, 1972 to 19 Janu973. Instead of using the raw data, we use the ted data, which is obtained byaking the difference of two con shown in Figure 2. The DAR(1) model is employed. By applying Ling & Li [12], we have an estimate of being 0.0002. The overall MLE is obtained by maximizing (8) and we have ˆ is 0.1553,0.1330 . Table 3 reports the 90% con- Figure 2. Scatter plot for calibrated data. Copyright © 2012 SciRes. OJS  F. CHANG ET AL. 147 Table 3. 90% central confidence intervals for and α. Method 90% Confidence Interval for 90% Confidence Interval for α BN (–0.3629, 0.03 89 ) (0.0048, 0.4719) SLR (–0.3490, 0.0352) (0.0 0 00 , 0.4072) Ling (–0.3438, 0.0333) (0.0048, 0.3588) fidervals for nce inte , and the 90% confidence inter- vals for , obtained from the methods discussed in this paper: is the proposed method based on Equatio n (5), SLR is te signed log-likelihood ratio statistic (3), Ling is the mhod discussed in Ling [5]. SLR and Ling give similar confidence intervals which are quite different from thlts obtained by BN. Moreover, since BN h et e resu is bounded by 0, both SLR and Ling have deficiency on the left boundary. The p-value functions are presented in Figures 3 and 4. Additionally, the two horizontal lines indicate upper and lower 0.05 levels respectively. The plots show that re- sults obtained by the three methods discussed in this pa- per are quite different. To examine the accuracy of the methods discussed in this paper, Monte Carlo simulation studies are performed. For each coon of , mbinati , 10,000 Monte Carlo samples, for each sample sizes takeing values n = 50, 200 and 4 are generated from the DAR(1) model , 0,,tn. Withou ality, of 00, 0, 1N where t is set to be 1. Tables 4-9 recorded the central coverage probability (CCP) which is the proportion of intervals that contains the true , the lower error probability (L) which is the proportion of true that falls outside the lower bound of the confidence interval, and upper error probability (U) which is the proportion of true that falls outside the upper bound of the confidence interval. The nominal values for the central coverage pro bability, and the lower and upper errors probabilities are 0.90, 0.05, and 0.05 respectively. In additional to this, we also report the av- erage bias (Avg Bias) defined by L0.05U 0.05 2 , which has the nominal value of 0. For both t loss of gener- and , simulation studies show that BN is remarkably accurate even when the sample size is small. As n increases, there is significant im- provement on the precision of both the SLR method and the Ling’s method in terms of both cental coverage and average bias but the results are still not as accurate as those obtained by the proposed method. 5. Conclusion A conditional likelihood based method is proposed to obtain confidence intervals for and for of the weak stationary DAR(1) model. Theoretically, the pro- Figure 3. p-value functions for of I.C.I. Data. Copyright © 2012 SciRes. OJS  F. CHANG ET AL. 148 Figure 4. p-value functions for α of I.C.I. Data. Table 4. Simulation results for some boundary points of the DAR(1) model when n = 50. Me th od L U CCP Avg BiasL U CCP A vg Bias –0.95 0.0975 BN 0.0544 0.0451 0.9005 0.0046 0.0372 0.0573 0.9055 0.0101 SLR 0.0343 0.0760 0.8897 0.0209 0.0870 0.0314 0.8816 0.0278 Ling 0.0384 0.0924 0.8692 0.0270 0.1228 0.0020 0.8752 0.0604 –0.5 0.75 BN 0.0542 0.0494 0.8964 0.0024 0.0542 0.0494 0.8964 0.0024 SLR 0.0950 0.0272 0.8778 0.0339 0.0950 0.0272 0.8778 0.0339 Ling 0.1558 0.0041 0.8401 0.0759 0.1558 0.0041 0.8401 0.0759 0 1 BN 97 0.0524 0.8979 0.0014 SLR 0.0560 0.0571 0.8869 0.0065 0.0987 0.0275 0.8738 0.0356 Ling 0.0625 0.0645 0.8730 0.0135 0.1532 0.0044 0.8424 0.0744 0.5 0.75 BN 0.0487 0.0506 0.9007 0.0009 0.0536 0.0492 0.8972 0.0022 SLR 0.0630 0.0491 0.8879 0.0070 0.0964 0.0264 0.8772 0.0350 Ling 0.0745 0.0565 0.8690 0.0155 0.1545 0.0026 0.8429 0.0760 0.95 0.0975 BN 0.0446 0.0576 0.8978 0.0065 0.0375 0.0542 0.9083 0.0083 SLR 0.0761 0.0369 0.8870 0.0196 0.0856 0.0331 0.8813 0.0262 Ling 0.0893 0.0408 0.8699 0.0243 0.1223 0.0014 0.8763 0.0605 0.0521 0.0529 0.8950 0.0025 0.04 Copyright © 2012 SciRes. OJS  F. CHANG ET AL. 149 Table 5. Simulation results for some interior points of the DAR(1) model when n = 50. Method L U CCP Avg BiasL U CCP Avg Bias –0.95 0.09 BN 0.0574 0.0435 0.8991 0.0070 0.0322 0.0533 0.9145 0.0106 SLR 0.0363 0.0734 0.8903 0.0186 0.0838 0.0290 0.8872 0.0274 Ling 0.0399 0.0880 0.8721 0.0240 0.1161 0.0017 0.8822 0.0572 –0.5 0.5 BN 0.0536 0.0483 0.8981 0.0026 0.0497 0.0524 0.8979 0.0014 SLR 0.0508 0.0606 0.8886 0.0057 0.1078 0.0291 0.8631 0.0394 Ling 0.0569 0.0702 0.8729 0.0135 0.1724 0.0032 0.8244 0.0846 –0.5 0.25 BN 0.0507 0.0488 0.9005 0.0009 0.0113 0.0514 0.9373 0.0201 SLR 0.0467 0.0598 0.8935 0.0066 0.0997 0.0249 0.8754 0.0374 Ling 0.0527 0.0686 0.8787 0.0106 0.1522 0.0016 0.8462 0.0753 0 0.5 BN 0.0507 0.0499 0.8994 0.0004 0.0391 0.0542 0.9067 0.0075 SLR 0.0552 0.0535 0.8913 0.0043 0.1077 0.0279 0.8644 0.0399 Ling 0.0623 0.0612 0.8765 0.0117 0.1750 0.0027 0.8223 0.0861 0.1 0.4 BN 0.0507 0.0506 0.8987 0.0006 0.0201 0.0538 0.9261 0.0169 SLR 0.0552 0.0524 0.8924 0.0038 0.1078 0.0259 0.8663 0.0410 Ling 0.0639 0.0580 0.8781 0.0109 0.1802 0.0012 0.8186 0.0895 0.5 0.25 BN 0.0490 0.0481 0.9029 0.0015 0.0125 0.0518 0.9357 0.0197 SLR 0.0601 0.0445 0.8954 0.0078 0.1034 0.0279 0.8687 0.0378 Ling 0.7 0.0013 0.8330 0.0822 0.5 0.5 BN 0.0488 0.0472 0.9040 0.0020 0.0459 0.0566 0.8975 0.0053 88 0.0360 Ling 0.0731 0.0524 0.8745 0.0127 0.1651 0.0028 0.8321 0.0812 0.95 0.09 BN 0.0457 0.0538 0.9005 0.0041 0.0342 0.0531 0.9127 0.0095 0.0783 0.0344 0.0.0847 0.0306 0. Li 0.0.00 0709 0.0512 0.8779 0.0111 0.165 SLR 0.0627 0.0453 0.8920 0.0087 0.1016 0.0296 0.86 SLR 8873 0.0219 8847 0.0270 ng 0928 0386 .8686 .0271 0.1166 0.0023 0.8811 0.0571 Table 6. Simulation ror sundnts AR(1) model w 20esults fome boary poiof the Dhen n =0. M AAethodL U CCP vg BiasL U CCP vg Bias –0.0.0975 95 BN 0.0552 0.0516 0.8932 0.0034 0.0622 0.0498 0.8880 0.0062 SLR Ling 0.0415 0.0427 0.0623 0.0655 0.8962 0.8918 0.0104 0.0114 0. 0.0699 0832 0. 0.0398 0093 0.8903 0.9075 0.0151 0.0369 –0. 0 1 0.5 0.75 BN 0.0534 0.0500 0.8966 0.0017 0.0472 0.0545 0.8983 0.0037 0. 0.0975 SLR 0.0677 0.0384 0.8939 0.0147 0.0653 0.0379 0.8968 0.0137 0.5 75BN 0.0519 0.0509 0.8972 0.0014 0.0485 0.0521 0.8994 0.0018 SLR 0.0506 0.0534 0.8960 0.0020 0.0641 0.0361 0.8998 0.0140 Ling BN 0.0521 0.0517 0.0551 0.0514 0.8928 0.8969 0.0036 0. 0.0015 0. 0769 0. 0522 0. 0010 0515 0.9221 0.8963 0.0379 0.0019 SLR 0.0527 0.0528 0.8945 0.0027 0.0686 0.0381 0.8933 0.0153 Ling 0.0515 0.0520 0.8965 0.0017 0.1049 0.0208 0.8743 0.0421 SLR 0.0557 0.0494 0.8949 0.0032 0.0674 0.0388 0.8938 0.0143 Ling 0.0580 0.0504 0.8916 0.0042 0.0777 0.0009 0.9214 0.0384 95BN 0.0576 0.0499 0.8925 0.0038 0.0597 0.0503 0.8900 0.0050 Ling 0.0709 0.0396 0.8895 0.0157 0.0787 0.0097 0.9116 0.0345 Copyright © 2012 SciRes. OJS  F. CHANG ET AL. 150 Table 7. Simulation results for some interior points of the DAR(1) model when n = 200. Method L U CCP Avg BiasL U CCP Avg Bias –0.95 0.09 BN 0.0509 0.0512 0.8979 0.0010 0.0585 0.0529 0.8886 0.0057 SLR 0.0401 0.0641 0.8958 0.0120 0.0706 0.0390 0.8904 0.0158 Ling 0.0411 0.0663 0.8926 0.0126 0.0844 0.0091 0.9065 0.0377 –0.5 0.5 BN 0.0486 0.0512 0.9002 0.0013 0.0497 0.0469 0.9034 0.0017 SLR 0.0478 0.0545 0.8977 0.0033 0.0659 0.0354 0.8987 0.0153 Ling 0.0491 0.0564 0.8945 0.0037 0.0787 0.0101 0.9112 0.0343 –0.5 0.25 BN 0.0458 0.0524 0.9018 0.0033 0.0559 0.0503 0.8938 0.0031 SLR 0.0452 0.0563 0.8985 0.0056 0.0771 0.0352 0.8877 0.0210 Ling 0.0464 0.0595 0.8941 0.0066 0.0891 0.0057 0.9052 0.0417 0 0.5 BN 0.0495 0.0544 0.8961 0.0024 0.0512 0.0523 0.8965 0.0017 SLR 0.0518 0.0568 0.8914 0.0043 0.0732 0.0378 0.8890 0.0177 Ling 0.0623 0.0612 0.8765 0.0117 0.0808 0.0093 0.9099 0.0357 0.1 0.4 BN 0.0514 0.0504 0.8982 0.0009 0.0499 0.0487 0.9014 0.0007 SLR 0.0523 0.0506 0.8971 0.0014 0.0740 0.0330 0.8930 0.0205 Ling 0.0538 0.0519 0.8943 0.0028 0.0827 0.0073 0.9100 0.0377 0.5 0.25 BN 0.0478 0.0465 0.9057 0.0029 0.0537 0.0500 0.8963 0.0018 SLR 0.0522 0.0449 0.9029 0.0037 0.0733 0.0370 0.8897 0.0182 Ling 0.0549 0.0467 0.8984 0.0041 0.0873 0.0064 0.9063 0.0405 0.5 0.5 BN 0.0514 0.0472 0.9014 0.0021 0.0513 0.0462 0.9025 0.0026 SLR 0.0537 0.0459 0.9004 0.0039 0.0665 0.0319 0.9016 0.0173 Ling 0.0558 0.0478 0.8964 0.0040 0.0782 0.0073 0.9145 0.0355 0.95 0.09 BN 0.0543 0.0481 0.8976 0.0031 0.0571 0.0531 0.8898 0.0051 SLR 0.0669 0.0364 0.8967 0.0153 0.0682 0.0383 0.8935 0.0149 Ling 0.0691 0.0373 0.8936 0.0159 0.0820 0.0088 0.9092 0.0366 Table 8. Simulation results for some boundary points of the DAR(1) model when n = 400. Me th od L U CCP Avg BiasL U CCP Avg Bias –0.95 0.0975 BN 0.0488 0.0523 0.8989 0.0017 0.0613 0.0528 0.8859 0.0070 SLR 0.0398 0.0599 0.9003 0.0101 0.0602 0.0415 0.8983 0.0093 Ling 0.0404 0.0607 0.8989 0.0101 0.0635 0.0152 0.9213 0.0242 –0.5 0.75 BN 0.0531 0.0488 0.8981 0.0021 0.0503 0.0541 0.8956 0.0022 SLR 0.0523 0.0510 0.8967 0.0016 0.0603 0.0419 0.8978 0.0092 Ling 0.0529 0.0516 0.8955 0.0022 0.0610 0.0178 0.9212 0.0216 0 1 BN 0.0577 0.0513 0.8910 0.0045 0.0496 0.0512 0.8992 0.0008 SLR 0.0563 0.0506 0.8931 0.0034 0.0611 0.0413 0.8976 0.0099 Ling 0.0566 0.0510 0.8924 0.0038 0.0815 0.0280 0.8905 0.0268 0.5 0.75 BN 0.0529 0.0528 0.8943 0.0028 0.0533 0.0546 0.8921 0.0039 SLR 0.0544 0.0514 0.8942 0.0029 0.0646 0.0411 0.8943 0.0118 Ling 0.0550 0.0521 0.8929 0.0035 0.0655 0.0192 0.9153 0.0232 0.95 0.0975 BN 0.0524 0.0528 0.8948 0.0026 0.0634 0.0528 0.8838 0.0081 SLR 0.0612 0.0435 0.8953 0.0089 0.0640 0.0429 0.8931 0.0106 Ling 0.0625 0.0442 0.8933 0.0091 0.0675 0.0159 0.9166 0.0258 Copyright © 2012 SciRes. OJS  F. CHANG ET AL. Copyright © 2012 SciRes. OJS 151 Table 9. Simulation results for some interior points of the DAR(1) model when n = 400. Method L U CCP Avg BiasL U CCP Avg Bias –0.95 0.09 BN 0.0481 0.0519 0.9000 0.0019 0.0529 0.0551 0.8920 0.0040 SLR 0.0402 0.0594 0.9004 0.0096 0.0569 0.0407 0.9024 0.0081 Ling 0.0404 0.0603 0.8993 0.0100 0.0611 0.0159 0.9230 0.0226 –0.5 0.5 BN 0.0540 0.0506 0.8954 0.0023 0.0520 0.0471 0.9009 0.0024 SLR 0.0526 0.0520 0.8954 0.0023 0.0622 0.0384 0.8994 0.0119 Ling 0.0537 0.0538 0.8925 0.0037 0.0623 0.0133 0.9244 0.0245 –0.5 0.25 BN 0.0529 0.0502 0.8969 0.0015 0.0549 0.0524 0.8927 0.0036 SLR 0.0514 0.0525 0.8961 0.0019 0.0652 0.0403 0.8945 0.0124 Ling 0.0521 0.0533 0.8946 0.0027 0.0634 0.0105 0.9261 0.0264 0 0.5 BN 0.0539 0.0511 0.8950 0.0025 0.0528 0.0463 0.9009 0.0032 SLR 0.0537 0.0513 0.8950 0.0025 0.0636 0.0353 0.9011 0.0142 Ling 0.0544 0.0524 0.8932 0.0034 0.0613 0.0109 0.9278 0.0252 0.1 0.4 BN 0.0549 0.0538 0.8913 0.0043 0.0499 0.0568 0.8933 0.0035 SLR 0.0548 0.0533 0.8919 0.0040 0.0641 0.0411 0.8948 0.0115 Ling 0.0559 0.0544 0.8897 0.0051 0.0610 0.0126 0.9264 0.0242 0.5 0.25 BN 0.0530 0.0485 0.8985 0.0022 0.0563 0.0497 0.8940 0.0033 SLR 0.0545 0.0474 0.8981 0.0036 0.0679 0.0382 0.8939 0.0149 Ling 0.0556 0.0487 0.8957 0.0034 0.0648 0.0113 0.9239 0.0267 0.5 0.5 BN 0.0521 0.0476 0.9003 0.0022 0.0545 0.0502 0.8953 0.0023 SLR 0.0535 0.0466 0.8999 0.0034 0.0638 0.0401 0.8961 0.0118 Ling 0.0542 0.0472 0.8986 0.0035 0.0637 0.0141 0.9222 0.0248 0.95 0.09 BN 0.0515 0.0537 0.8948 0.0026 0.0526 0.0571 0.8903 0.0048 SLR 0.0594 0.0424 0.8982 0.0085 0.0577 0.0453 0.8970 0.0062 Ling 0.0605 0.0434 0.8961 0.0085 0.0608 0.0171 0.9221 0.0218 posed method has rate of convergence 32 On . The No. 4, 1998, pp. 1220-1241. simulation results have indat the proposed me- thod significantly improves the inference over sme existing methll theove dissed meented TL this available from the first auth EFER CE [1] . F. Engle,Autoregr ConHetas- ity with Estimates ofarianflat ctations,” nometric ol. 50p. 9. i:10.2307/1912773 icated th e accuracy of th oods. A abscu thods are implemin MA AB ande code or. RENS R “essiveditional erosced tic the Vce of Inionary Ex- pe Eco a, V, 1982, p87-1007 do [2] . A. Weiss,RMA M with Errr- :10.1111 00 A “Aodels ARCHors,” Jou nal of Time Series Analysis /j.1467-9892.1984.tb , Vol. 3, 1984, pp. 129-143. doi 382.x [3] . Guégan and J. Dieboobabope Stati Sinin. 4, p. 7. [4] . Borkovecd C. Klüppelberg,ail ota- nary Distrtion of an Autore Proith RCH(1) Errs,” Annappliebili [5] S. Lng, “Estimation and Testing Stationarity for Dou- ble-Auto Regressive Models,” Journal f the RoyaSta- ciety Ses B, Vol. 66, No. 14, p doi:10.1111/j68.432 Dlt, “Prilistic Prrties of the β-ARCH-Model,” stica ca, Vol1994, p 71-8 M an “The Tf the S tio Aibu ro gressive d Proba cess w ty, Vol. 11, ls of A i ol tistical Soeri, 200p. 63-78. .1467-98 2004.00.x [6] A, “TStaHypotheses Cog Se ramenrva Lrica ema- cl. 546-4 doi:10.1090/S 47- 124 . Waldests of tistical ncernin veral Pa arge,” Transactions of ters Whe the Numbe the Ame r of Obse n Math tions Is tical So iety, Vo, No. 3, 1943, pp. 4282. 0002-99 1943-0001-3 [7] T. Di Cicciod an S.“A- targ Pros anence for Sca- lete metr l. 71, 1990, pp. 7i:10ome 7 , C. Field D. A. Fraser, pproxma ion of M ar Paraminal Tail rs,” Bio babilitie ika, Vod Infer 7, No. 7-95. do.1093/bit/77.1.7 Orndsen,ncel anal Parameters Based on therdized - ltio, rika 3, 1 O. E. BarndlsenifieL- latio Statistic,” B, Vol. 78, No. 3, 1991, pp. 557-563. doi:10.1093/b [8] . E. Baorff-Niel “Infere on Fuld Parti Standaed SignLog-like ihood Ra” Biomet , Vol. 7986, pp. 307-322. [9] orff-Nie, “Modd Signed og-Like ihood Riometrika iomet/78.3.557 [10] D. Fraser Reid Third-Order S nce,s Mica7, . A. S. ignifica and N. ” Utilita , “Ancillaries and athemat, Vol. 41995, pp  F. CHANG ET AL. 152 33-53. [11] , “Aouble AR) Model: Struture andstima- Statistica Sinica, Vol. 17, 2007, pp. 161-175. [12] S. Ling and D. Li, “otic Innce for onsta- ka, Vol. 95, No. 1, 2008, pp. 257-263. /biomet/asm084 D. Ling tion,” D(pc E Asymptferea N tionary Double AR(1) Model,” Biometri doi:10.1093 [13] O. D. Anderson, “Time Ser Analysis Forecasting: -Jenkins Approachutterw976 ies and The Box,” Borth, 1. Copyright © 2012 SciRes. OJS |