Open Journal of Social Sciences

Vol.04 No.03(2016), Article ID:65072,7 pages

10.4236/jss.2016.43029

A Study on High Valuation of Industrial Capital Investment

―Based on the Viewpoint of Strategic Benefit

Sen Li

Institute of Industrial Economics, Jinan University, Guangzhou, China

Copyright © 2016 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 1 March 2016; accepted 26 March 2016; published 29 March 2016

ABSTRACT

Different from the pure financial investors, investors of established company not only take financial returns into account, but also strategic benefits. The existence of strategic benefits distorts the behavior of industrial capital for investment. And high valuation is one of its manifestations. This paper constructs a model to illustrate the high valuation of industrial capital investment. If a complementary relationship exists between invested projects and industrial capital investor’s core business (i.e. strategic benefit is positive), then the industrial capital investment will result in high valuation; besides, if a substitute relationship exists between the invested projects and industrial capital investor’ score business (i.e. strategic benefit is negative), high valuation problem also appears. This paper highlights the origin of high valuation problem, and puts forward corresponding proposals to solve this problem.

Keywords:

Industrial Capital, Strategic Benefits, High Valuation

1. Introduction

Industrial capital investment refers to the equity investment made by subsidiary units of non-financial enterprise or investment institutions with the purpose of seeking for appropriate investment opportunities that adapt to the strategic technology of the holding company or is beneficial to the cost saving. Since its appearance in America in 1960s, industrial capital investment has become a crucial participant in equity investment market. And the domestic activities in this field also develop rapidly under the foreign demonstration effect.

Industrial capital investment abroad not only pursues the financial income but also the strategic benefits. Particularly when the strategic benefits reach a high level, industrial capital investors willing to receive lower returns. Industrial capital generates financial income for its parent company via successful withdrawal from the invested enterprises. There are various kinds of forms of strategic benefits, including new technology purchase, new client or supplier retention, complementary products and services development, new market penetration and so on. Even the experience of know new products, technologies and practice or the project failure can be reviewed as valuable strategic benefits acquired from industrial capital investment.

For instance, Tencent Collaboration Fund reaches maximum level in the field of foreign investment in BAT1. The number of Tencent fund investment projects has over 200 with more than RMB 10 billion Yuan by the beginning of 2014. Tencent will take self business situations into consideration in overseas investment, equipping with strategic property. Someone, who has closely contacted with Tencent before, remains that Tencent, taking the industry as the viewpoint, will make investment in the fields of its business weakness with the purpose of purchasing high-qualified resources and entrepreneur team to cover its shortages.

The differences between the industrial capital investor and the pure financial investor lie in their pursuing goals. Therefore, industrial capital investors will make fierce competition with pure financial investors to acquire the financing from entrepreneurs and then further gain strategic benefits of projects. One point that determines the choosing of financing party for entrepreneurs is what kinds of supports that investor can offer. Thus, investors make competition with equity price (evaluation) for one hand and also with their reliable support level.

The remainder of the paper is organized as follows. Section 2 makes literature review in the related fields. Section 3 introduces the basic model. Section 4 explores the difference valuation between industrial capital investors and pure financial investors. Section 5 puts proposals to solve the problems illustrated above. Section 6 concludes.

2. Literature Review

Gompers and Lerner (2000) have provided some evidences about the price of the industrial capital invest abroad. It is found that the main difference between industrial capital investors and pure financial investors is that the formers are willing to pay higher price so as to acquire strategic benefits [1] .

The main reason why industrial capital investors would like to pay higher evaluation is that the successful invested project may exert positive or negative influences on the current business of industrial capital investors who belong to companies in some certain kinds of fields and own their own main business. And their technologies relied on by the main business is the true influenced ones [2] [3] .

Henry Chesbrough (2000) considers that industrial capital investors are equipped with some advantages over pure financial investors. These advantages come from industrial capital investors’ ownership of important basic knowledge and some other intangible assets. Actually these assets can’t be traded freely to some certain extent for the reason that they belong to the investors’ company to own or control. Hence, compared with pure financial investors, industrial capital investors enjoy structural advantages in the development of coordinating and complementary technology. When there exists complementary relationship between the main business run by industrial capital investors and those invested technologies and assets, industrial capital investors can able to gain rather high potential benefits from complementary technologies and assets than pure financial investors [4] .

In addition, some kinds of technologies can produce values from as the complementary technology develops. And obviously industrial capital investors have more advantages over pure financial investors in the coordinating and complementary aspect. Gompers and Lerner (2000) have made a research with large-scale samples about industrial capital investors and pure financial investors comparison recently. It reveals that when the invested activities are relevant to their self business for industrial capital investors, the benefits acquired by them are much competitive than that of pure financial investors; In turn, they will gain lower returns [1] .

Herry W. Chesbrough (2002) believes that the self-resources owned by industrial capital investors may become barriers rather than abilities, particularly when confronting with new market or destructive technologies. That is to say, their self-resources can threaten company’s current survival ability. At such a moment, industrial capital investors prefer to pay higher premium to buy out such technologies [5] [6] .

3. Basic Model

Please imagine in a non-discounting and middle risk rate world. One entrepreneur wants to develop a new project with risk but unfortunately without capital. We suppose that he need the amount of capital I as the total financing. And this entrepreneur can ask help from the competitive pure financial investor (F) and also the industrial capital investor (S). The invested enterprises may succeed or failed. The success rate is set as q.

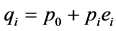

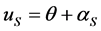

The success or the failure of the project is determined by the investor’s support. Investor can provide large quantity of value-added services in the condition of investment in foreign countries. These activities are rather subtle that can’t be concluded in a contract. Even some can concluded but some other still can’t be contracted. So, the endogenesis of the support level are decided by investors’ encourage. We can describe this via a simple linear model. If , then

, then  represents the basicsuccess probability and ei refers to the investor’s (I =

represents the basicsuccess probability and ei refers to the investor’s (I =

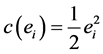

S,V) support level and  is taken as individual cost.

is taken as individual cost.

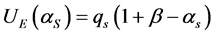

If the project fails, there will be no benefits; if the project is successful, it will produce the transferable benefits R, and we normalize it to 1. Besides, the non-transferable value (private benefits) β, which belongs to the entrepreneur, should follow this rule, that is, β ≥ 0. Suppose  expressed the investors’ share of benefits.

expressed the investors’ share of benefits.

There exists a significant difference between S and F in one dimension: S’s property will be influenced by the performance of the invested projects. We can consider the form of these properties from various aspects, but the most frequent form is the core business of industrial investors, meanwhile, it can be tangible assets, reference assets as well as human capital. We can use the parameter θ to express this influence. If the invested project is successful, θ will measure the change of industrial capital investors’ asset value. θ measures the net effect of strategic action between invested projects and industrial capital investors. It generalizes the influence of the invested projects’ success on S’s current property value. If θ > 0, we think there is the complementary relationship between them. If θ < 0, the invested projects partially substitute (shock) S’s assets, and we think there is the substitutional relationship between them. Most competition models deem θ < 0, because the industries vary from n corporateoligarchs to n + 1 corporate oligarchs. It is possible that the appearance of θ > 0 is the externality of demand, such as software and hardware (Katz and Shapiro, 1994), or the complementation of costs (such as the invested cost savings).

Except the possession of strategic target, there are a lot of differences between S and F in many other dimensions. The probability of the success of their offered supporting increase basis is also different between S and F, using pS, pF to describe. Generally, a mass of specific factors related to investors or transactions affect these parameters, such as experience, technology or conformity. This model considers the heterogeneity, and we suppose pS > pF, that is, S has more industrial ability than that of F, and S is more competent than F, thus advancing the success of the project.

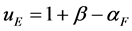

It should be first of all thinking about the situation when the entrepreneur and financial investor F sign the contract. If the project fails, it will be no benefits. To standardize the utility of hindsight, you will get uE = 0 and uF = 0. If the project is successful, the utility of hindsight of the project is uF = αF, . This simple stipulation excludes the consideration of capital structure. We will use stock rights to represent ownership in order to avoid the loss of generality.

. This simple stipulation excludes the consideration of capital structure. We will use stock rights to represent ownership in order to avoid the loss of generality.

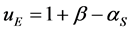

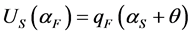

F is a pure financial investor, who only cares the benefits of the project. There is a significant difference between S and F in one dimension: S’s property will be influenced by the performance of the invested projects. If the entrepreneur signs the contract with S, the benefits obtained by the entrepreneur will be: if it fails, it will be uE = 0; if it succeeds, it will be ; the utility of hindsight of S: if it fails, it will be uS = 0; if it succeeds, it will be

; the utility of hindsight of S: if it fails, it will be uS = 0; if it succeeds, it will be . θ can be regarded as the simplified utility form between the invested projects and industrial capital investors, complex and interactional.

. θ can be regarded as the simplified utility form between the invested projects and industrial capital investors, complex and interactional.

Table 1 generalizes the benefits distribution of participants when the project succeeds or fails.

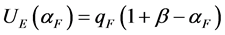

Therefore, we can get the following participants’ expected revenue naturally:

If the financial investor F is a financier, all the participants’ expected revenue is:

Table 1. Benefits of participants in different conditions.

(1)

(1)

(2)

(2)

(3)

(3)

thereinto, 。

。

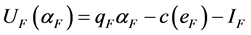

If S is a financier, all the participants’ expected revenue is:

(4)

(4)

(5)

(5)

.

.

We make some assumptions about parameter values. Firstly, we suppose

new risk project can be always positive when it succeeds. Secondly, we suppose

that the project can always have access to finance through the competitive F. Finally, we suppose

Meanwhile, we suppose 0 ≤ Ij ≤ I, j = S,F, and three participants don’t have any transfer payment during the time of 0. This assumption is standard in the ethical risk model. We can testify it through a simple non-free profit assumption, which indicates that any imposter cannot get the profit by pretending to be the participants. More specifically, suppose that there are a lot of imposters, the reservation utility is 0. They can get the benefits by imitating the recipients at any time as long as there is the positive transfer payment. And the result is that any participant will not make payment in advance. Besides, we suppose

In addition, the information of all the participants should be symmetrical.

Similarly, we need to limit how the contract is generated. As a basis of analysis, we use a simple game, that is, E possesses all the bargaining power. The time series of game is as follows: the entrepreneur provides S with the receiving and rejective contracts, and S can accept it or refuse. If E doesn’t want to provide S with the contract or the contract is refused, E can make contact with F, which is in the perfect competition market (if E provides this contract to the competitive financial investors, we can get the same result). Sign the contract at phase 0. The investors offer the non-contracting support at phase 0 and 1. At phase 1, the project shall be either successful or unsuccessful, and the benefits will also be paid.

4. Appraisement

Now we use this model to make the illustration of the stock rights under the equilibrium condition. In the risk capital industry, the calculation of contract indicates the businesses’ potential value. The so called enterprise value calculated after the investment is based on the stock rights purchased by the investors. If the investors use the investment, which amounts to I, to get the stock α, the appraisement V will be determined by

amounting to I. So the appraisement of risk project is lower, which can be expressed as

Suppose that the financial investment market is competitive, so it can only get the competitive return, which also conforms to the current situation. If the pure financial investors offer the finance, the entrepreneurs will maximize the expected revenue. We can get the stock ratio under the financing condition:

s.t

We can get

from the condition in the formula (6).

Plug the formula (7) into formula (6), and you will get the stock ratio:

From the formula (8), we can get

If the industrial capital investors conduct the financing, the entrepreneurs can choose

s.t

The formula (9) is the participated restraint when the industrial capital investors carry through the investment, showing that the benefits acquired from the financing by the industrial capital investors should at least equal to the benefits acquired from the investment by the pure financial investors. Among this, the formula

Plug the formula (10) into formula (9), and you will get the stock ratio acquired by the industrial capital investors when they carry through the investment:

From the formula (11),

Therefore, we can get the following results:

1)

Because the conditions of

The results of the above conclusion (1) can be easily understood intuitively. The higher project’s success rate is, the lower equity ratio willingly given up by entrepreneurs with the purpose of acquirements benefits I becomes. That is to say, the lower

2)

Thus, the equation

gressively reduces as

The conclusion that

3) To any conditions of

simplified form as

5. Policy Suggestions

High valuation problemexist in the investment abroad made by industrial capital investors are mainly about the mutual pursuit of financial income and strategic benefits at the same time but with more attachments to the latter [7] [8] . Therefore, to reduce the proportion of strategic benefits in investment assessment or to require the rate of financial income is a powerful strategy to solve high valuation. The detail explanations are summarized in detail as follows:

5.1. The Adoption of Professional Management or Investment Method

Industrial investors can separate investment apartments and establish professional investment companies or management companies with the evaluation modes involving financial performance indexes and other elements. Such a kind of operation way keeps the original strategic goal of the parent company in one hand and in the other hand endows the invested company with more investment autonomous rights so as to make effective investment [9] .

As we all know, Tencent has already registered and established Tencent Industrial Investment Limited Company in Shenzhen and Ali has also already established its Ali Capital, and Lenovo establishes Legend Capital to ensure their normalized operation, which all provide better strategic invested companies for their parent companies for one thing, and for another thing and set pure financial investors’ investment standards as the assessment to effectively avoid high valuation.

5.2. The Introduction of Pure Financial Investors to Jointly Make Investment

Introducing pure financial investors and taking financial investors as positive investors all will make industrial capital investors give up the control right of invested projects but can also gain strategic benefits if invested projects succeed, which weakens the high valuation in the process of investment to some extent [10] .

6. Conclusions

Industrial capital investors play an active part in investment activities but without obtaining optimistic results [11] . This paper explains that the investment orientation of industrial capital investors is mainly the up-down stream of their industrial chains with the strategic investment goal from the perspective of strategic benefits. It is the huge differences exist between their investment goal and pure financial investors that makes the investment behavior twisty and then results in the high valuation and reduces the return rate brought by the whole project investment [12] .

Taking the main business relationship between the invested project and industrial capital investors as well as entrepreneurs’ bargaining abilities, this paper makes the following conclusions: If the relationship is a complementary one, industrial capital investors will pay higher valuation, aiming to acquire strategic benefits on the condition of successful invested projects. While if the relationship is an alternative one, industrial capital investors will also pay higher valuation with the purpose of transforming business or buying technology out to weaken the influence made by the new technology development on the main business of industrial capital investors.

Cite this paper

Sen Li, (2016) A Study on High Valuation of Industrial Capital Investment

—Based on the Viewpoint of Strategic Benefit. Open Journal of Social Sciences,04,236-242. doi: 10.4236/jss.2016.43029

References

- 1. Gompers, P. and Lerner, J. (2002) The Determinants of Corporate Venture Success: Organizational Structure, Incentives, and Complementarties. NBER Working Paper 6725.

- 2. Arping, S. and Falconieri, S. (2003) Strategic versus Financial Investors: The Role of Strategic Objectives in Financial Contracting. Tinbergen Institute Discussion Paper, No. 09-036/2.

- 3. Birkinshaw, J. and Hill, S. (2003) Corporate Venturing Performance: An Investigation into the Applicability of Venture Capital Models. London Business School.

- 4. Chesbrough, H. (2000) Designing Corporate Ventures in the Shadow of Private venture Capital. California Management Review, 42, 3.

- 5. Chesbrough, H.W. (2002) Making Sense of Corporate venture Capital. Havard Business Review, R0203G.

- 6. Hellmann, T. (2002) A Theory of Strategic Venture Investing. Journal of Financial Economics, 64, 285-314. http://dx.doi.org/10.1016/S0304-405X(02)00078-8

- 7. Riyanto, T. and Schwienbacher, A. (2006) The Strategic Use of Corporateventure Financing for Securing Demand. Journal of Banking and Finance, 30, 2809-2833.

http://dx.doi.org/10.1016/j.jbankfin.2005.11.005 - 8. Melberg, R.S. and Fast, N.D. (1980) Identifying New Business, Opportunities. SRI International, Business Intelligence Program, Guidelines No. 1053.

- 9. Hart, S. and Mas-Colell, A. (1996) Bargaining and Value. Econometrica, 64, 357-380.

http://dx.doi.org/10.2307/2171787 - 10. Woo, C.Y. and Cooper, A.C. (1981) Strategies for Effective Low Share Businesses. Strategic Management Journal, 2, 301-318. http://dx.doi.org/10.1002/smj.4250020307

- 11. Hardymon, G., DeNino, M. and Salter, M. (1983) When Corporate Venture Capital Doesn’t Work. Harvard Business Review, 114-122.

- 12. Brody, P. and Ehrlich, D. (1998) Can Big Companies Become Successful venture Capitalists? The McKinsey Quarterly, 2, 50-63.

NOTES

1BAT is short abbreviation of BaiduInc (Baidu), Alibaba Group (Alibaba), TencentInc (Tencent), three largest Internet tycoon in China.