Paper Menu >>

Journal Menu >>

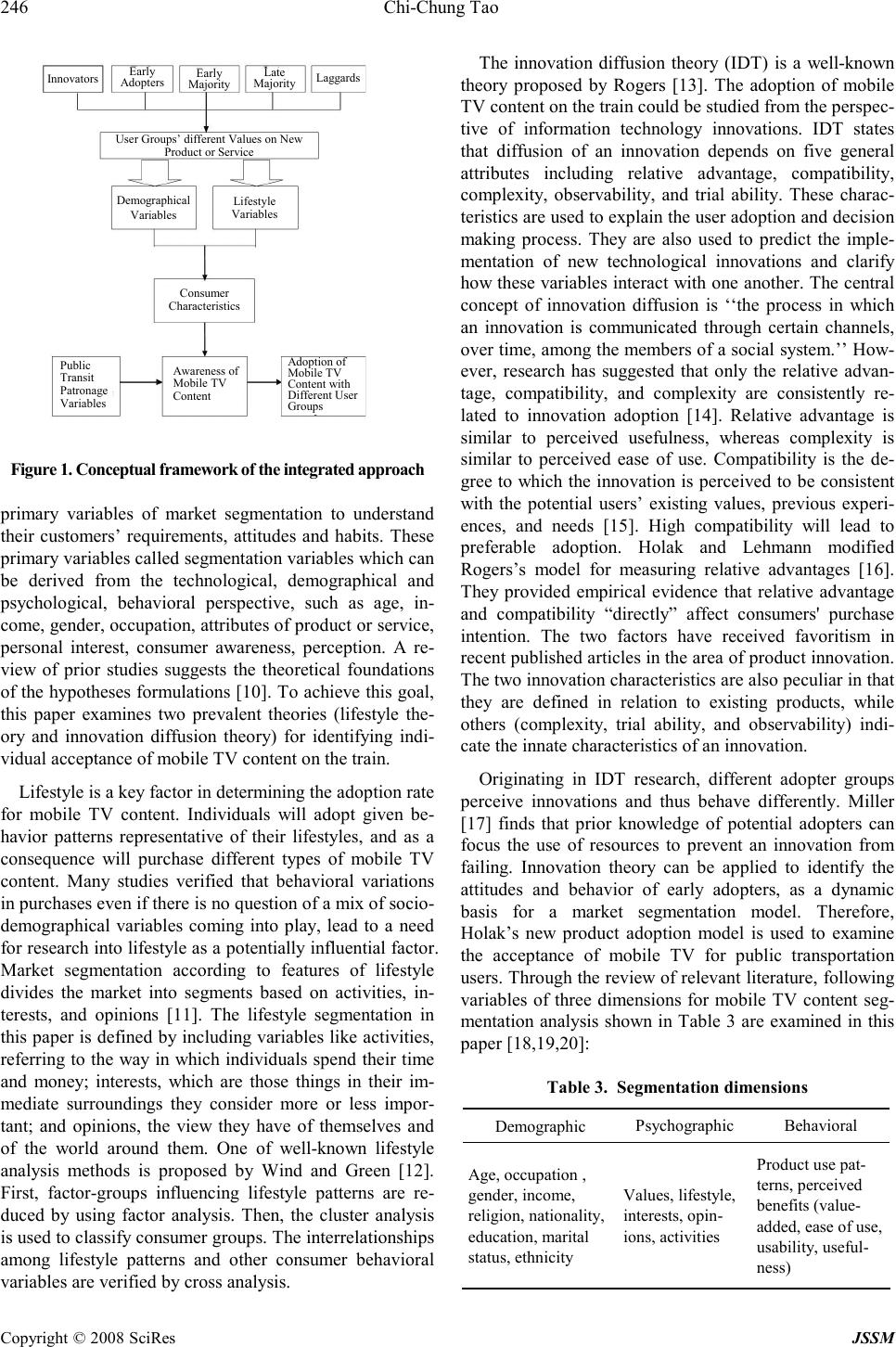

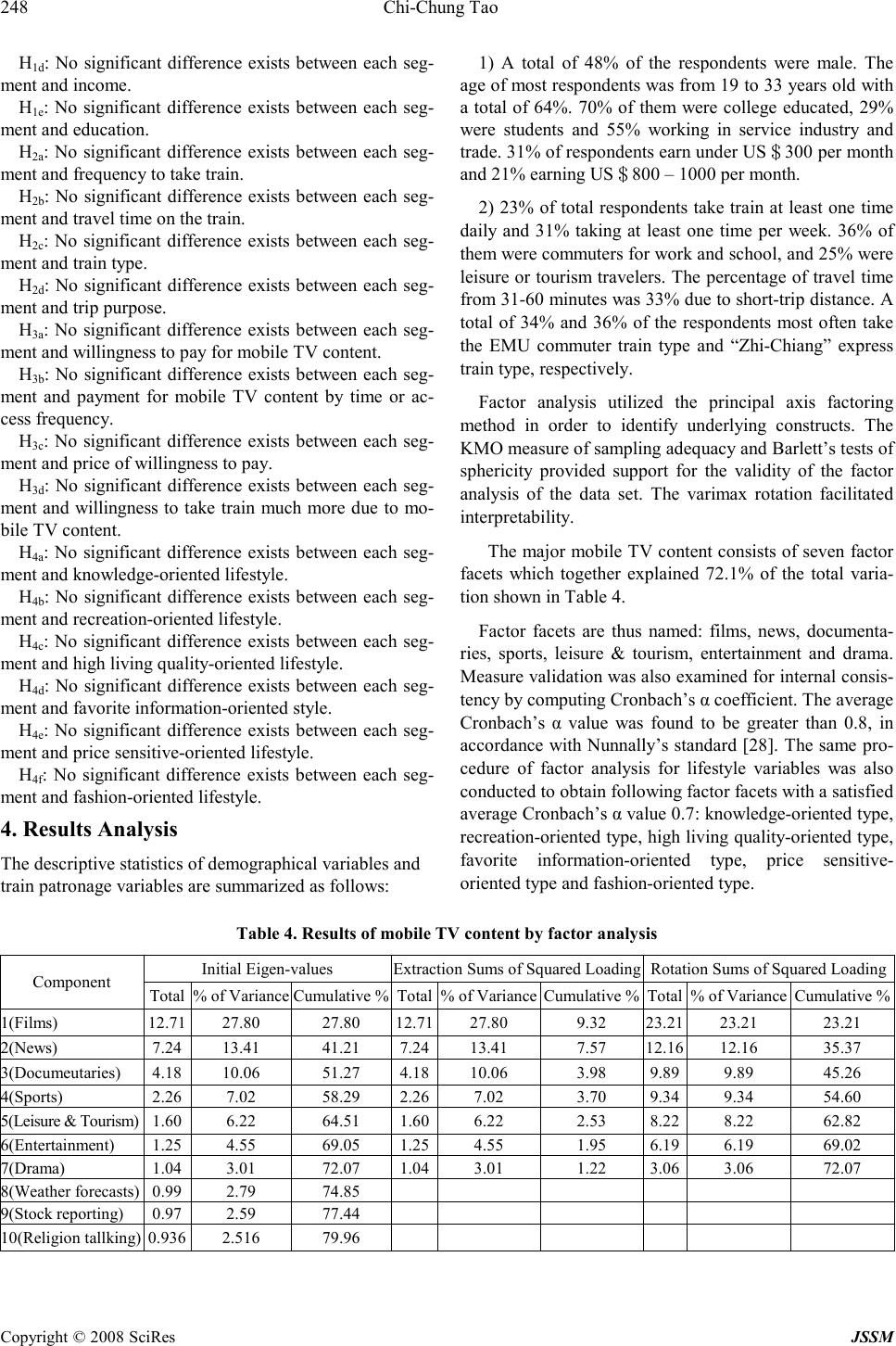

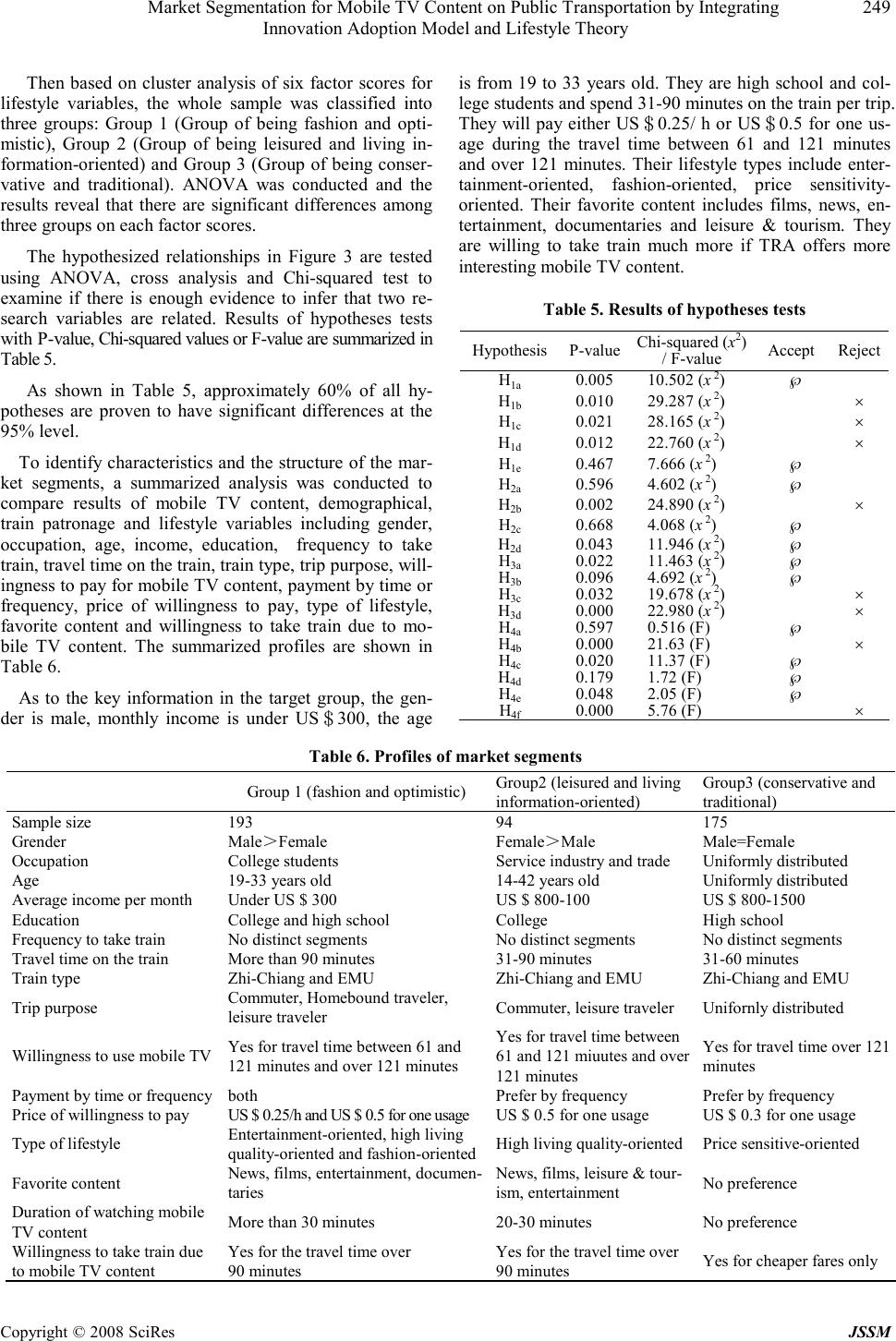

J. Serv. Sci. & Management, 2008,1: 244-250 Published Online December 2008 in SciRes (www.SciRP.org/journal/jssm) Copyright © 2008 SciRes JSSM 245 Market Segmentation for Mobile TV Content on Public Transportation by Integrating Innovation Adoption Model and Lifestyle Theory Chi-Chung Tao Tamkang University, Taipei County, Taiwan, R.O.C. Email:cctao@mail.tku.edu.tw Received June 20 th , 2008; revised August 10 th , 2008; accepted September 16 th , 2008. ABSTRACT An integrated approach based on innovation adoption model and lifestyle theory for customer segmentation of mobile TV content on public transportation using multivariate statistical analysis is proposed. Due to high daily trips and dif- ferent train types Taiwan Railway Administration is chosen as the case study. Firstly, the content of mobile TV on the train are identified as the segmentation variable and key factor facets for mobile TV content are renamed by using fac- tor analysis. Then, the cluster analysis is used to classify customer groups which are named by analysis of variance (ANOVA) and market segmentations are described with demographic, lifestyle and train patronage variables by using cross analysis and Chi-squared independence tests. Finally, this paper discusses empirical results to provide valuable implications for better mobile TV content marketing strategies in the future. Keywords: mobile TV, market segmentation, multivariate statistical analysis 1. Introduction Mobile TV has been widely discussed among different players in the telecommunications and media industry. Mobile operators, which face the saturation of voice ser- vices and a declining ARPU (Average Revenue Per User), hope that the TV concept in the mobile phone will be the next killer application. According to analysts’ predictions, mobile TV will become a service with significant market size. The valuations of the global mobile TV market vary across different analysts, from US$ 5.5 billion in 2009 to US$ 28 billion in 2010. A list of different analysts’ pre- dictions is shown in Table 1[1,2]. There are many trial projects confirming future success of mobile TV worldwide using different technologies and business models [3,4,5]. Currently three standards are competing with each other: Digital Video Broadcasting Transmission System for Handheld Terminals (DVB-H), MediaFLO and Digital Multimedia Broadcasting (DMB) Table 1. Global mobile TV market values Analyst firm Year Prediction of market size Datamonitor 2009 US$ 5.5 billion Strategy Analytics 2009 US$ 6.4 billion ABI Research 2010 US$ 27 billion Pyramid Research 2010 US$ 13 billion – 28 billion Frost & Sullivan 2011 US$ 8.1 billion which are listed in Table 2[6]. AT&T has announced that its MediaFLO based mobile TV service will be going live in May 2008. While Qualcom is in a position to leverage other technologies or use it for open access technologies such as WiMAX or use them for mobile services. It looks like that despite the EU having embraced a single stan- dard for mobile TV, the US market will remain frag- mented with multiple technologies. According to mobile TV usage patterns identified in many worldwide trials TV content must adjust to mobile context of use [3,4,5]. Results of a Finnish study show that mobile TV users spent approximately 20 minutes a day watching mobile TV and more active users watched between 30 to 40 minutes per session [7]. Typical usage environments include transportation terminals (airport, train station, bus stop, etc.), in the moving vehicles, work- ing places or at home. It is also found that smaller screens and the duration of usage may have significant influences on the types of mobile TV content as well as the way us- ers’ willingness to pay for mobile TV. In Taiwan, a handheld TV experimental project was launched in October 2006. There were five teams partici- pating in mobile TV trials in North and South Taiwan. The MediaFLO was tested in North Taiwan, while the DVB-H was chosen for South Taiwan. The experiment is expected  Market Segmentation for Mobile TV Content on Public Transportation by Integrating 245 Innovation Adoption Model and Lifestyle Theory Copyright © 2008 SciRes JSSM Table 2. Overview of mobile TV solutions Technology Major market Standard Group lndustrial players Comparisons DVB-H Europe, Asia, North America, Australia DVB OMA Nokia, BenQ - Siemens, Motorola, Samsung, LG, Alcatel, … etc. IP based; 90% power saving design, either use independent MUX, OR T-DMB South Korea DAB LG, Samsung some proprietary; bit rate 1.5Mbps, non-IP based; external antenna; less power saving; be con- structed based on existing DAB network S-DMB South Korea, Japan DAB LG, Samsung, Alcatel Some proprietary; non-IP based, big antenna; power saving; satellite transmission with terres- trial repeaters MediaFLO North America Qualcomm Qualcomm & CDMA manufacturers Proprietary; non-IP based; bandwidth efficiency ISDB-T Japan only Proprietary MBMS 3G service regions 3GPP, 3GPP2 Most 3G manufacturer Bit rate 345kbps~2Mbps, IP based; based on 3G network; standardization still in progress IPTV over WiMAX WiMAX service regions WiMAX Forum Intel…etc. standardization still in progress to end no later than June 2008 and the formal licenses for mobile TV operators will be permitted after NCC’s (Na- tional Communications Commission) official evaluations. Preliminary results of this experiment show that end-users will use mobile TV to fill in gaps in their daily schedules: waiting for the bus or subway, sitting in the train etc. In these situations mobile TV competes with other possibili- ties such as reading a book, listening to radio, playing a mobile game or just watching out the window. In these scenarios mobile TV might be an appealing choice, but only if it does not inflict significant costs. On the other hand, if the pricing is low enough, there might be quite large audiences awaiting the launch of mobile TV services. A logical choice might be to keep subscription prices as low as possible, thus maximize the popularity of mobile TV, and subsidize the lower subscription income with higher advertising revenue. In summary, these five teams together with three main telecommunication operators (CHT, TMT, FET) reach a consensus that a user-centered content design will contribute to future success of Tai- wan’s mobile TV market. To survive in competitive mobile TV services markets, the operators need to determine who the target customers are, what motivates them and why they pay for the mobile TV content. This process is called market segmentation, by which companies are able to understand their loyal customers and concentrate their limited resources into them. Although there are many studies covering critical variables for market segmentation of mobile TV content, until now only few papers focus on public transportation systems with high speed, especially on the train [8]. Cur- rently Taiwan Railway Administration’s (TRA) is con- ducting a BOT project to implement mobile commerce services on the train. In addition, TRA’s network is across north and south Taiwan, content diversity of mobile TV can be tested on the train countrywide. Theses advantages may attract the five teams to focus on certain killer appli- cations for mobile TV. The concept of segmentation in mobile TV marketing recognizes that consumers differ not only in the price they will pay, but also in a wide range of benefits they expect from the content. Good mobile TV content with compel- ling value-added services are provided by tight business and strategic partnership arrangements and by involving a large number of companies, with each influencing other parties in the value chain. Wang [9] identifies that power- ful actors, such as carriers and the media industry’s con- tent providers must agree on business models that support the new ecosystem of mobile TV. Carlsson and Walden [7] conclude that mobile TV content is the key factor to de- termine the adoption and usage of mobile TV, especially when traveling with public transportation to and from work in order to relax or to keep up to date with the latest news. This paper is aimed on proposing an integrated ap- proach for market segmentation of mobile TV content on the train by integrating innovation adoption model and lifestyle theory. Figure 1 shows the conceptual framework of this integrated approach. First, the mobile TV content is identified as the seg- mentation variable. And key factor facets for mobile TV content are redefined by using factor analysis. Then, the cluster analysis is used to classify consumer groups which are named by analysis of variance (ANOVA) and market segmentations are described with demographic, lifestyle and train patronage variables by using cross analysis and Chi-squared independence tests. Finally, empirical results are analyzed and the conclusion follows. 2. Literature Review It is the first step for mobile TV companies to identify the  246 Chi-Chung Tao Copyright © 2008 SciRes JSSM Figure 1. Conceptual framework of the integrated approach primary variables of market segmentation to understand their customers’ requirements, attitudes and habits. These primary variables called segmentation variables which can be derived from the technological, demographical and psychological, behavioral perspective, such as age, in- come, gender, occupation, attributes of product or service, personal interest, consumer awareness, perception. A re- view of prior studies suggests the theoretical foundations of the hypotheses formulations [10]. To achieve this goal, this paper examines two prevalent theories (lifestyle the- ory and innovation diffusion theory) for identifying indi- vidual acceptance of mobile TV content on the train. Lifestyle is a key factor in determining the adoption rate for mobile TV content. Individuals will adopt given be- havior patterns representative of their lifestyles, and as a consequence will purchase different types of mobile TV content. Many studies verified that behavioral variations in purchases even if there is no question of a mix of socio- demographical variables coming into play, lead to a need for research into lifestyle as a potentially influential factor. Market segmentation according to features of lifestyle divides the market into segments based on activities, in- terests, and opinions [11]. The lifestyle segmentation in this paper is defined by including variables like activities, referring to the way in which individuals spend their time and money; interests, which are those things in their im- mediate surroundings they consider more or less impor- tant; and opinions, the view they have of themselves and of the world around them. One of well-known lifestyle analysis methods is proposed by Wind and Green [12]. First, factor-groups influencing lifestyle patterns are re- duced by using factor analysis. Then, the cluster analysis is used to classify consumer groups. The interrelationships among lifestyle patterns and other consumer behavioral variables are verified by cross analysis. The innovation diffusion theory (IDT) is a well-known theory proposed by Rogers [13]. The adoption of mobile TV content on the train could be studied from the perspec- tive of information technology innovations. IDT states that diffusion of an innovation depends on five general attributes including relative advantage, compatibility, complexity, observability, and trial ability. These charac- teristics are used to explain the user adoption and decision making process. They are also used to predict the imple- mentation of new technological innovations and clarify how these variables interact with one another. The central concept of innovation diffusion is ‘‘the process in which an innovation is communicated through certain channels, over time, among the members of a social system.’’ How- ever, research has suggested that only the relative advan- tage, compatibility, and complexity are consistently re- lated to innovation adoption [14]. Relative advantage is similar to perceived usefulness, whereas complexity is similar to perceived ease of use. Compatibility is the de- gree to which the innovation is perceived to be consistent with the potential users’ existing values, previous experi- ences, and needs [15]. High compatibility will lead to preferable adoption. Holak and Lehmann modified Rogers’s model for measuring relative advantages [16]. They provided empirical evidence that relative advantage and compatibility “directly” affect consumers' purchase intention. The two factors have received favoritism in recent published articles in the area of product innovation. The two innovation characteristics are also peculiar in that they are defined in relation to existing products, while others (complexity, trial ability, and observability) indi- cate the innate characteristics of an innovation. Originating in IDT research, different adopter groups perceive innovations and thus behave differently. Miller [17] finds that prior knowledge of potential adopters can focus the use of resources to prevent an innovation from failing. Innovation theory can be applied to identify the attitudes and behavior of early adopters, as a dynamic basis for a market segmentation model. Therefore, Holak’s new product adoption model is used to examine the acceptance of mobile TV for public transportation users. Through the review of relevant literature, following variables of three dimensions for mobile TV content seg- mentation analysis shown in Table 3 are examined in this paper [18,19,20]: Table 3. Segmentation dimensions Demographic Psychographic Behavioral Age, occupation , gender, income, religion, nationality, education, marital status, ethnicity Values, lifestyle, interests, opin- ions, activities Product use pat- terns, perceived benefits (value- added, ease of use, usability, useful- ness) Innovators Early Adopters Early Majority Late Majority Laggards User Groups ’ different Values on New Product or Service Demographical Variables Lifestyle Variables Consumer Characteri s tics Public Transit Patronage Variables Awar eness of Mobile TV Content Adoption of Mobile TV Content with Different User Groups  Market Segmentation for Mobile TV Content on Public Transportation by Integrating 247 Innovation Adoption Model and Lifestyle Theory Copyright © 2008 SciRes JSSM To identify links among what the mobile TV operators would know about their customers and the bundles of con- tent they could offer, clustering algorithms are generally used as the primary methodology for market segmentation. Clustering analysis techniques have been discussed in details in the literature [21,22,23]. The most popular is k- means algorithm which together with its modifications was broadly reviewed by different authors [24,25,26]. It is also found that algorithms using computational intelli- gence did not show better results than k-means, the com- binations of several algorithms are very often recom- mended as the conclusion. Zakrwska and Murlewski [27] investigated the shortcomings and advantages of three algorithms of clustering analysis: k-means, two-step clus- tering and density based spatial clustering of applications with noise. Their numerical tests showed that k-means is very efficient for large multidimensional data sets, how- ever depends strongly on the choice of input parameter k. However, it is not recommended in the case of data sets with noise. 3. Research Methodology 3.1 Research Design The framework of research design is shown in Figure 2. After conducting an interview survey (face-to-face) with questionnaires, the mobile TV content on the train is iden- tified as the segmentation variable and key factor facets for mobile TV content are redefined by using factor analysis. Then, the cluster analysis (k-means) is used to classify consumer groups which are named by ANOVA. The market segmentations are described with content us- age, demographic, lifestyle and train patronage variables by using cross analysis and Chi-squared independence tests. Finally, each segment market can be targeted with precise customer characteristics and those results are used as the starting point for providing the market strategies. The first round survey with 90 questionnaires was conducted on the three train types from Taipei station to Taichung station from 22 nd to 28 th December 2007. After reviewing preliminary results, some question items were modified and new question items of lifestyle variables were supplemented. The second round survey with 500 questionnaires was conducted on the train from 18 th to 25 th January 2008. Two types of handheld devices NOKIA N77 and N92 were used to demonstrate mobile TV content. The valid sample consisted of 462 respon- dents. 3.2 Research Model and Hypotheses The research model tested in this paper is shown in Figure 3. With this integrated approach the mobile TV content may be regarded as segmentation variables including will- ingness to use, time of usage, price of willingness to pay, type of payment, incentives to take train. The demograph- ical variables (gender, occupation, age, income, educa- tion), lifestyle variables (knowledge-oriented, recreation- oriented, high living quality-oriented, favorite informa- tion-oriented, price sensitive-oriented, fashion-oriented), train patronage variables (frequency, travel time, train type, trip purpose) are chosen as descriptive variables to depict customer characteristics. The following hypotheses of the proposed constructs are based on prior studies in the relevant literature [10,14,15]: H 1a : No significant difference exists between each seg- ment and gender. H 1b : No significant difference exists between each seg- ment and occupation. H 1c : No significant difference exists between each seg- ment and age. Figure 2. Framework of research design Figure 3. Research model and hypotheses  248 Chi-Chung Tao Copyright © 2008 SciRes JSSM H 1d : No significant difference exists between each seg- ment and income. H 1e : No significant difference exists between each seg- ment and education. H 2a : No significant difference exists between each seg- ment and frequency to take train. H 2b : No significant difference exists between each seg- ment and travel time on the train. H 2c : No significant difference exists between each seg- ment and train type. H 2d : No significant difference exists between each seg- ment and trip purpose. H 3a : No significant difference exists between each seg- ment and willingness to pay for mobile TV content. H 3b : No significant difference exists between each seg- ment and payment for mobile TV content by time or ac- cess frequency. H 3c : No significant difference exists between each seg- ment and price of willingness to pay. H 3d : No significant difference exists between each seg- ment and willingness to take train much more due to mo- bile TV content. H 4a : No significant difference exists between each seg- ment and knowledge-oriented lifestyle. H 4b : No significant difference exists between each seg- ment and recreation-oriented lifestyle. H 4c : No significant difference exists between each seg- ment and high living quality-oriented lifestyle. H 4d : No significant difference exists between each seg- ment and favorite information-oriented style. H 4e : No significant difference exists between each seg- ment and price sensitive-oriented lifestyle. H 4f : No significant difference exists between each seg- ment and fashion-oriented lifestyle. 4. Results Analysis The descriptive statistics of demographical variables and train patronage variables are summarized as follows: 1) A total of 48% of the respondents were male. The age of most respondents was from 19 to 33 years old with a total of 64%. 70% of them were college educated, 29% were students and 55% working in service industry and trade. 31% of respondents earn under US$300 per month and 21% earning US$800 – 1000 per month. 2) 23% of total respondents take train at least one time daily and 31% taking at least one time per week. 36% of them were commuters for work and school, and 25% were leisure or tourism travelers. The percentage of travel time from 31-60 minutes was 33% due to short-trip distance. A total of 34% and 36% of the respondents most often take the EMU commuter train type and “Zhi-Chiang” express train type, respectively. Factor analysis utilized the principal axis factoring method in order to identify underlying constructs. The KMO measure of sampling adequacy and Barlett’s tests of sphericity provided support for the validity of the factor analysis of the data set. The varimax rotation facilitated interpretability. The major mobile TV content consists of seven factor facets which together explained 72.1% of the total varia- tion shown in Table 4. Factor facets are thus named: films, news, documenta- ries, sports, leisure & tourism, entertainment and drama. Measure validation was also examined for internal consis- tency by computing Cronbach’s α coefficient. The average Cronbach’s α value was found to be greater than 0.8, in accordance with Nunnally’s standard [28]. The same pro- cedure of factor analysis for lifestyle variables was also conducted to obtain following factor facets with a satisfied average Cronbach’s α value 0.7: knowledge-oriented type, recreation-oriented type, high living quality-oriented type, favorite information-oriented type, price sensitive- oriented type and fashion-oriented type. Table 4. Results of mobile TV content by factor analysis Initial Eigen-values Extraction Sums of Squared Loading Rotation Sums of Squared Loading Component Total % of Variance Cumulative % Total % of Variance Cumulative % Total % of Variance Cumulative % 1(Films) 12.71 27.80 27.80 12.71 27.80 9.32 23.21 23.21 23.21 2(News) 7.24 13.41 41.21 7.24 13.41 7.57 12.16 12.16 35.37 3(Documeutaries) 4.18 10.06 51.27 4.18 10.06 3.98 9.89 9.89 45.26 4(Sports) 2.26 7.02 58.29 2.26 7.02 3.70 9.34 9.34 54.60 5(Leisure & Tourism) 1.60 6.22 64.51 1.60 6.22 2.53 8.22 8.22 62.82 6(Entertainment) 1.25 4.55 69.05 1.25 4.55 1.95 6.19 6.19 69.02 7(Drama) 1.04 3.01 72.07 1.04 3.01 1.22 3.06 3.06 72.07 8(Weather forecasts) 0.99 2.79 74.85 9(Stock reporting) 0.97 2.59 77.44 10(Religion tallking) 0.936 2.516 79.96  Market Segmentation for Mobile TV Content on Public Transportation by Integrating 249 Innovation Adoption Model and Lifestyle Theory Copyright © 2008 SciRes JSSM Then based on cluster analysis of six factor scores for lifestyle variables, the whole sample was classified into three groups: Group 1 (Group of being fashion and opti- mistic), Group 2 (Group of being leisured and living in- formation-oriented) and Group 3 (Group of being conser- vative and traditional). ANOVA was conducted and the results reveal that there are significant differences among three groups on each factor scores. The hypothesized relationships in Figure 3 are tested using ANOVA, cross analysis and Chi-squared test to examine if there is enough evidence to infer that two re- search variables are related. Results of hypotheses tests with P-value, Chi-squared values or F-value are summarized in Table 5. As shown in Table 5, approximately 60% of all hy- potheses are proven to have significant differences at the 95% level. To identify characteristics and the structure of the mar- ket segments, a summarized analysis was conducted to compare results of mobile TV content, demographical, train patronage and lifestyle variables including gender, occupation, age, income, education, frequency to take train, travel time on the train, train type, trip purpose, will- ingness to pay for mobile TV content, payment by time or frequency, price of willingness to pay, type of lifestyle, favorite content and willingness to take train due to mo- bile TV content. The summarized profiles are shown in Table 6. As to the key information in the target group, the gen- der is male, monthly income is under US$300, the age is from 19 to 33 years old. They are high school and col- lege students and spend 31-90 minutes on the train per trip. They will pay either US$0.25/ h or US$0.5 for one us- age during the travel time between 61 and 121 minutes and over 121 minutes. Their lifestyle types include enter- tainment-oriented, fashion-oriented, price sensitivity- oriented. Their favorite content includes films, news, en- tertainment, documentaries and leisure & tourism. They are willing to take train much more if TRA offers more interesting mobile TV content. Table 5. Results of hypotheses tests Hypothesis P-value Chi-squared (x 2 ) / F-value Accept Reject H 1a 0.005 10.502 (x 2 ) √ H 1b 0.010 29.287 (x 2 ) × H 1c 0.021 28.165 (x 2 ) × H 1d 0.012 22.760 (x 2 ) × H 1e 0.467 7.666 (x 2 ) √ H 2a 0.596 4.602 (x 2 ) √ H 2b 0.002 24.890 (x 2 ) × H 2c 0.668 4.068 (x 2 ) √ H 2d 0.043 11.946 (x 2 ) √ H 3a 0.022 11.463 (x 2 ) √ H 3b 0.096 4.692 (x 2 ) √ H 3c 0.032 19.678 (x 2 ) × H 3d 0.000 22.980 (x 2 ) × H 4a 0.597 0.516 (F) √ H 4b 0.000 21.63 (F) × H 4c 0.020 11.37 (F) √ H 4d 0.179 1.72 (F) √ H 4e 0.048 2.05 (F) √ H 4f 0.000 5.76 (F) × Table 6. Profiles of market segments Group 1 (fashion and optimistic) Group2 (leisured and living information-oriented) Group3 (conservative and traditional) Sample size 193 94 175 Grender Male>Female Female>Male Male=Female Occupation College students Service industry and trade Uniformly distributed Age 19-33 years old 14-42 years old Uniformly distributed Average income per month Under US $ 300 US $ 800-100 US $ 800-1500 Education College and high school College High school Frequency to take train No distinct segments No distinct segments No distinct segments Travel time on the train More than 90 minutes 31-90 minutes 31-60 minutes Train type Zhi-Chiang and EMU Zhi-Chiang and EMU Zhi-Chiang and EMU Trip purpose Commuter, Homebound traveler, leisure traveler Commuter, leisure traveler Unifornly distributed Willingness to use mobile TV Yes for travel time between 61 and 121 minutes and over 121 minutes Yes for travel time between 61 and 121 miuutes and over 121 minutes Yes for travel time over 121 minutes Payment by time or frequency both Prefer by frequency Prefer by frequency Price of willingness to pay US $ 0.25/h and US $ 0.5 for one usage US $ 0.5 for one usage US $ 0.3 for one usage Type of lifestyle Entertainment-oriented, high living quality-oriented and fashion-oriented High living quality-oriented Price sensitive-oriented Favorite content News, films, entertainment, documen- taries News, films, leisure & tour- ism, entertainment No preference Duration of watching mobile TV content More than 30 minutes 20-30 minutes No preference Willingness to take train due to mobile TV content Yes for the travel time over 90 minutes Yes for the travel time over 90 minutes Yes for cheaper fares only  250 Chi-Chung Tao Copyright © 2008 SciRes JSSM 5. Conclusions This paper identifies the new primary factors for mobile TV content on the train which may not found in the pre- vious studies. Additionally, this paper proposes a concise framework of research methodology for market segmen- tation and user preferences for mobile TV content on the train. However, the proposed approach is applicable to the case of “on the train”. The case of “railway networks” which fully represents mobile TV content anywhere and anytime in stations and trains needs to be researched fur- ther. It is also recognized that many other facets of indi- vidual differences (e.g., psychological type, cognitive processing skills etc.) may be candidate variables for lifestyle consideration. REFERENCES [1] N. Holland, et al., “Rescuing 3G with Mobile TV: Buins- ess Models and Monetizing 3G,” Pyramid Research, March 2006. [2] Wireless World Forum, “Mobile Youth 06 Video,” mobileYouth06–part one, July 2006. [3] J. Trefzger, “Mobile TV-launch in germany-challenges and implications,” working paper No. 209, Institute for Broadcasting Economics, Cologne University, Germany, 2005. [4] S. Orgad, “How will mobile tv transform viewer’s experi- ence and change advertising,” Final report, Dept. of Me- dia and Communications, London School of Economics and Political Science, November 2006. [5] QuickPlayMedia, “Mobile TV and video survey 2008,” Toronto, Canada, 2008. [6] M. P. Shih, “Analysis of mobile TV and its key success factors: from the perspective of mobile operator,” Pro- ceedings of International Symposium on HDTV and Mo- bile TV, Taipei, Taiwan, 2007. [7] C. Carlsson and P. Walden, “ Mobile TV-to live or die by content,” Proceedings of the 40th Hawaii International Conference on System Sciences, IEEE, Hawaii, USA, 2007. [8] C. M. Tan and C. C. Wong, “Mobile broadband race: Friend or foe,” Proceedings of the International Confer- ence on Mobile Business, IEEE, ICMB’06, 2006. [9] G. Wang, “ Mobile TV value chain and operator strate- gies,” Master’s Thesis, Dept. of Communication Systems, School of Information and Communication Technology, KTH, Finland, February 2007. [10] T. M. Lee and J. K. Jun, “Contextual perceived usefulness? toward an understanding of mobile commerce acceptance”, Proceedings of the International Conference on Mobile Business, IEEE, ICMB’05, 2005. [11] J. T. Plummer, “The concept and application of lifestyle segmentation,” Journal of Marketing, pp. 33-74, January 1974. [12] Y. Wind and P. E. Green, “Some conceptual measurement and analytical problem in life style research,” Life style and Psychographics, Chicago, AMA, 1974. [13] E. Rogers, Diffusion of Innovation, Free Press, New York, 1962. [14] J. H. Wu and S. C. Wang, “What drives mobile commerce? An empirical evaluation of the revised technology accep- tance model,” Information & Management 42, pp.719– 729, 2005. [15] Y. Shin, H. Jeon, and M. Choi, “Analysis of the consumer preferences toward m-commerce applications based on an empirical study,” Proceedings of International Conference on Hybrid Information Technology, IEEE, ICHIT’06, 2006. [16] S. L. Holak and D. R. Lehmann, “Purchase intentions and the dimensions of innovation: An exploratory model,” Journal of Product Innovation Management, 7 (1), pp. 59- 73, 1990. [17] R. N. Miller, “Target marketing,” Multinational Market- ing , Vol. 13, No. 10, 1993. [18] A. L. Gilbert and J. D. Kendall, “A marketing model for mobile wireless services,” Proceedings of the 36th Hawaii International Conference on System Science (HICSS’03), 2003. [19] H. H. Lin and Y. S. Wang, “Predicting consumer inten- tion to use mobile commerce in taiwan,” Proceedings of the International Conference on Mobile Business (ICMB’05), 2005. [20] H. Feng, T. Hoegler, and W. Stucky, “Exploring the criti- cal success factors for mobile commerce,” Proceedings of the International Conference on Mobile Business (ICMB’06), 2006. [21] C. C. Aggarwal, C. Procopiuc, J. S. Wolf, P. S. Yu, and J. S. Park, “Fast algorithms for projected clustering,” Pro- ceedings of SIGMOD Conference, Philadelphia, 1999. [22] A. K. Jain, M. N. Murty, and P. J. Flynn, “Data clustering: A review,” ACM Computing Surveys, Vol. 31, No. 3, September 1999. [23] M. Zait and H. Messatfa, “A comparative study of cluster- ing methods,” FGCS Journal, Special Issue on Data Min- ing, 1997. [24] P. V. Balakrishnan, M. C. Cooper, V. S. Jacob, and P. A. Lewis, “Comparative performance of the fscl neural net and k-means algorithm for market segmentation,” Euro- pean Journal of Operational Research, No. 93, 1996. [25] H. Hruschka and M. Natter, “Comparing performance of feedforward neural nets and k-means for cluster-based market segmentation,” European Journal of Operational Research, No. 114, 1999. [26] C. Y. Tsai and C. C. Chiu, “A purchased-based market segmentation methodology”, Expert Systems with Appli- cations, No. 27, 2004. [27] D. Zakrzewska and J. Murlewski, “Clustering algorithms for bank customer segmentation”, Proceedings of the 5th International Conference on Intelligent Systems Design and Applications (ISDA’05), 2005. [28] J. C. Nunnally, Psychometric Theory, McGraw-Hill, New York, 1967. |