Applied Mathematics

Vol.4 No.8A(2013), Article ID:35185,8 pages DOI:10.4236/am.2013.48A016

The Catastrophe Map of a Two Period Production Model with Uncertainty

1Department of Statistics, University College London, London, UK

2Department of Mathematics, University of Sussex, East Sussex, UK

Email: p.stiefenhofer@ucl.ac.uk

Copyright © 2013 Pascal Stiefenhofer. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Received June 5, 2013; revised July 5, 2013; accepted July 12, 2013

Keywords: Differential Topologyl; General Equilibrium; Uncertainty; Production

ABSTRACT

This paper shows existence and efficiency of equilibria of a two period production model with uncertainty as a consequence of the catastrophe map being smooth and proper. Its inverse mapping defines a finite covering implying finiteness of equilibria. Beyond the extraction of local equilibrium information of the model, the catastrophe map renders itself well for a global study of the equilibrium set. It is shown that the equilibrium set has the structure of a smooth submanifold of the Euclidean space which is diffeomorphic to the sphere implying connectedness, simple connectedness, and contractibility.

1. Introduction

This paper considers a two period production model with uncertainty. The time structure and associated uncertainty is described by a finite number of uncertain states of the world. It is assumed that all firms are owned by the consumers according to an exogenously determined ownership structure. This economic scenario describes the private ownership model discussed in Debreu [1] where the objective of each firm is to maximize profits. The seminal paper of this model without uncertainty dates back to the path breaking paper by Arrow and Debreu [2].

In this paper, we show that many economically interesting equilibrium properties of the two period production model with uncertainty can be derived from the catastrophe map. For that purpose we follow the mathematical approach discussed in Balasko [3] and in Dierker [4].

More specifically, we describe the set of solutions of all two period production economies and explore its structure. It is shown that this set is a smooth submanifold of the Euclidean space which is diffeomorphic to the sphere. A study of some of the properties of the catastrophe map enables us to characterize the set of economies into sets with various properties, such as economies with singular equilibria, economies with multiple equilibria, and economies with catastrophes, where equilibrium behavior is more difficult to study. Most of these properties have been studied in the context of exchange economies [5] or simple production economies [6-10] or Balasko (Preprint 2011) for example1. This paper generalizes the economic scenario by adding more structure to the model of the firm and thus moving towards a more realistic model where time and uncertainty is present.

The structure of the paper is as follows: Section 1 is an introduction. Section 2 introduces the economic scenario and states a definition of economic equilibrium. Section 3 explores the topological structure of the equilibrium set of all two period production economies with uncertainty. The next section states equilibrium properties of the model such as existence, efficiency and finiteness of equilibria. The final section is a conclusion.

2. The Long Run Private Ownership Production Model with Uncertainty

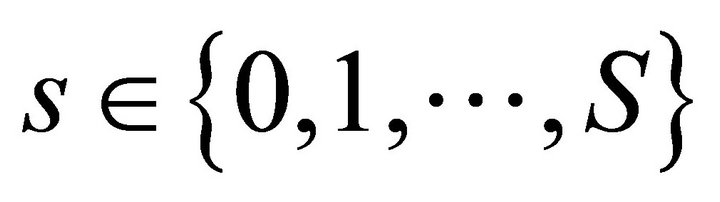

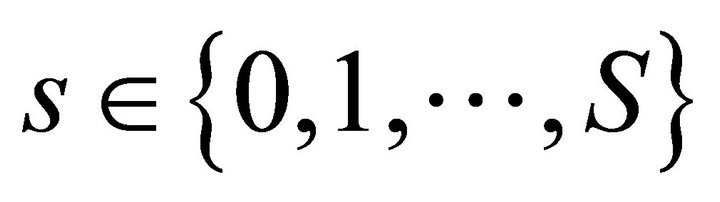

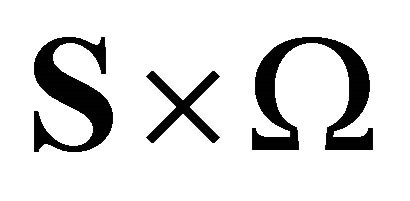

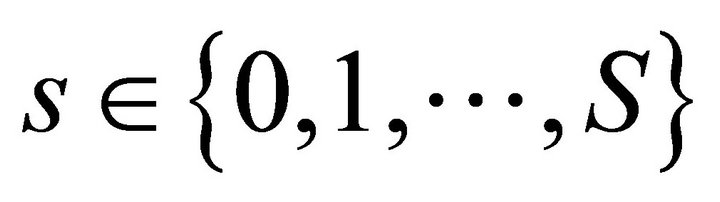

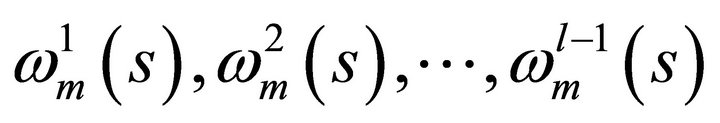

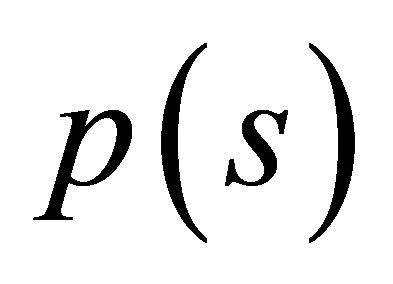

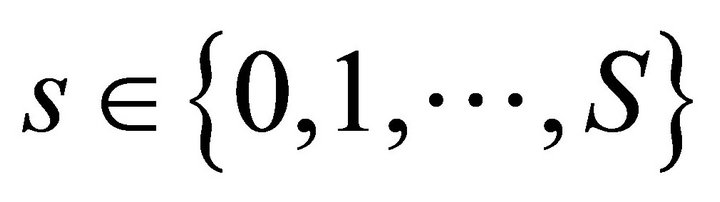

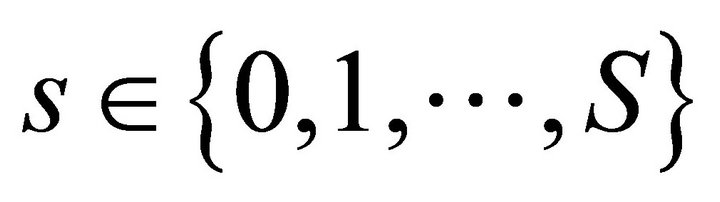

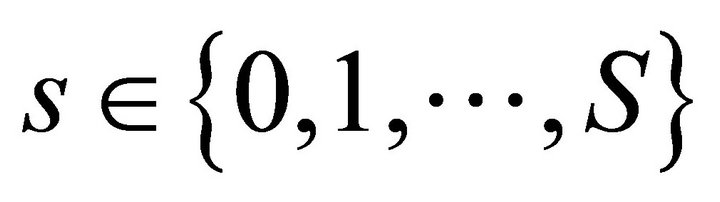

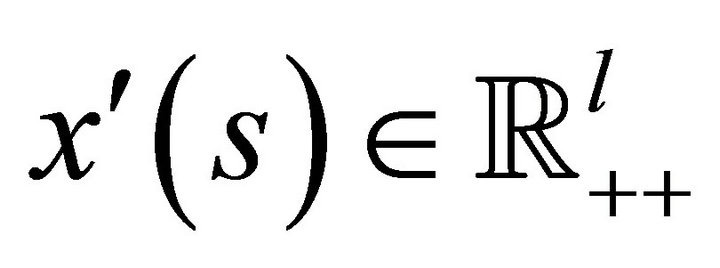

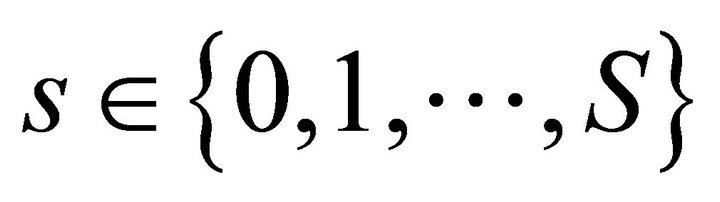

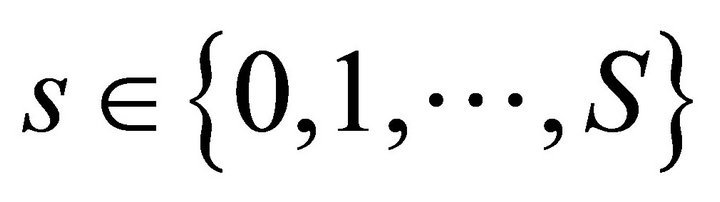

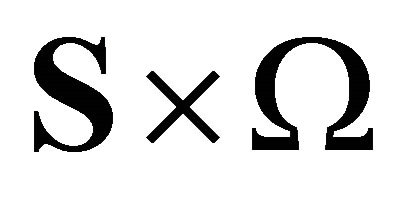

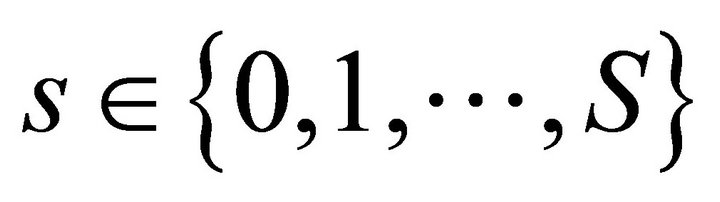

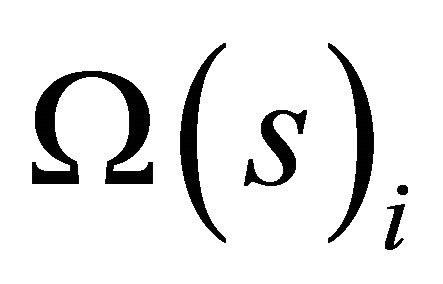

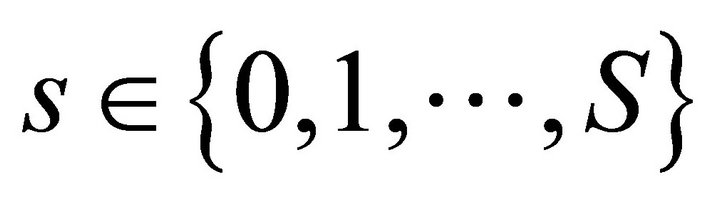

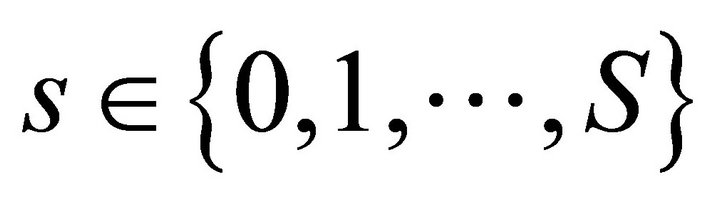

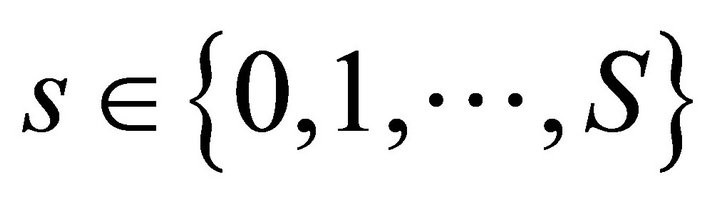

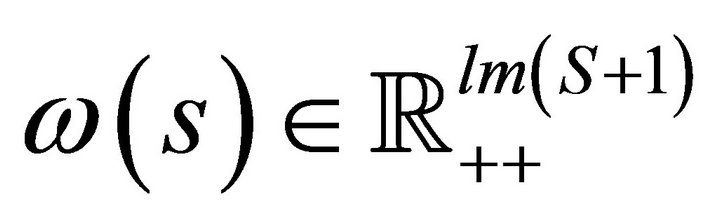

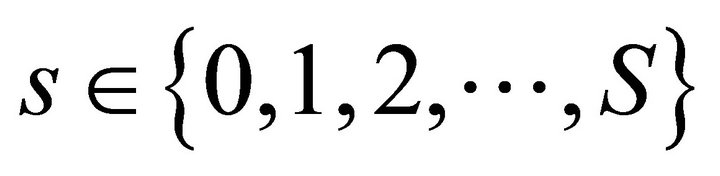

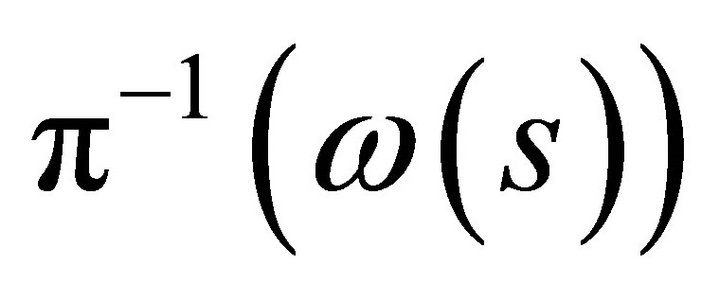

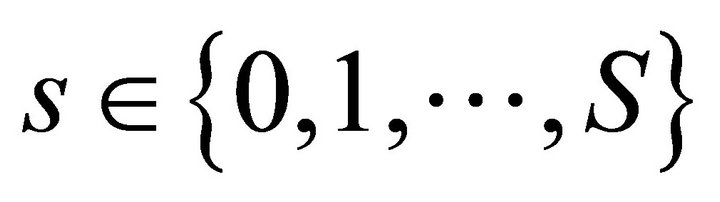

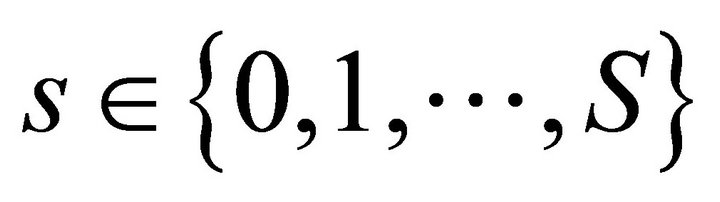

We describe the two period private ownership production model  introduced in Debreu ([1], chapter 7). Uncertainty is defined by a finite set of mutually exclusive and exhaustive states of nature denoted by

introduced in Debreu ([1], chapter 7). Uncertainty is defined by a finite set of mutually exclusive and exhaustive states of nature denoted by , where

, where  is the certain event in time period one and

is the certain event in time period one and  are the uncertain events in time period two. In total there are

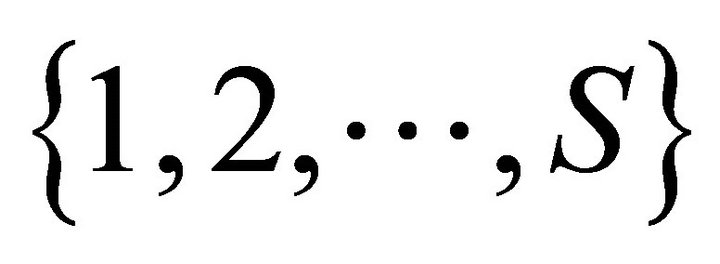

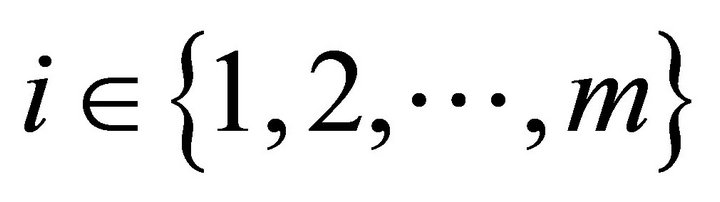

are the uncertain events in time period two. In total there are  states of nature. There are

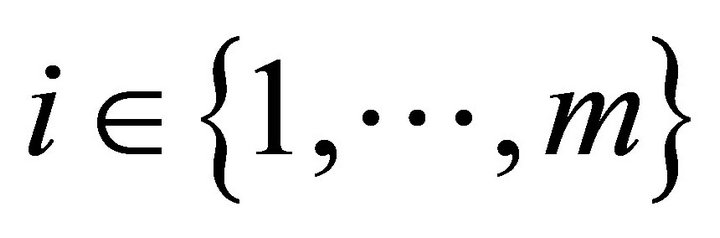

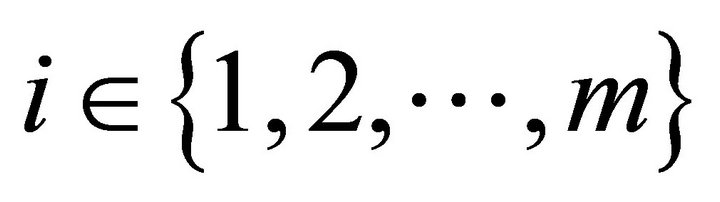

states of nature. There are  consumers,

consumers,  producers, and

producers, and  physical goods. For all consumers

physical goods. For all consumers

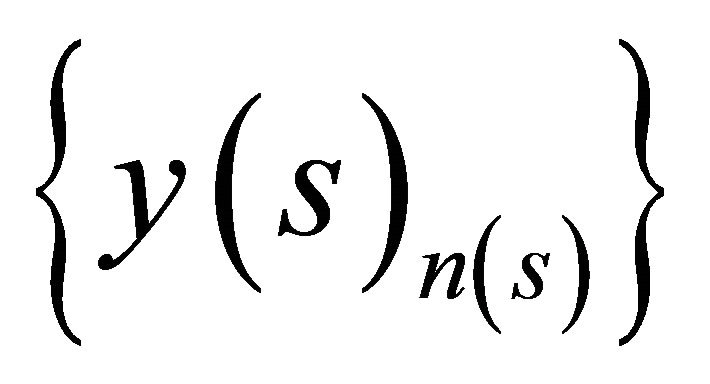

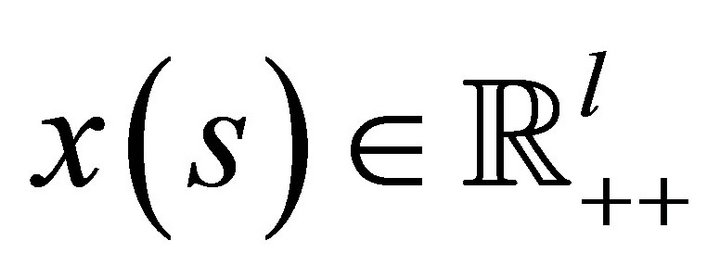

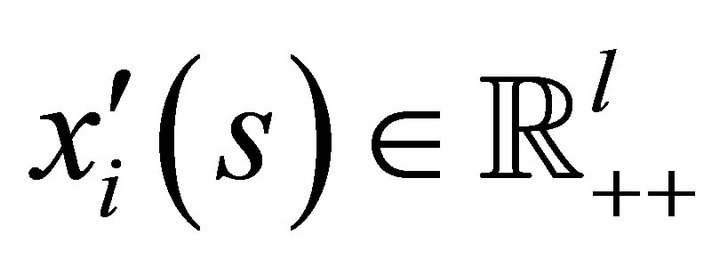

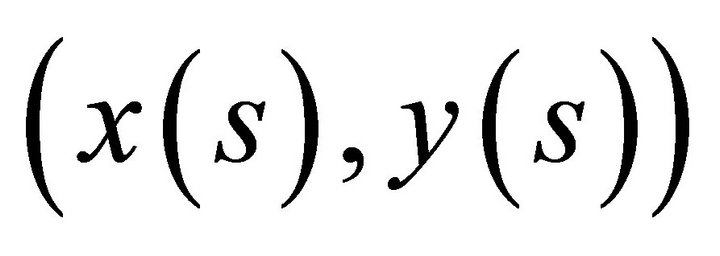

, a consumption bundle is a collection of vectors

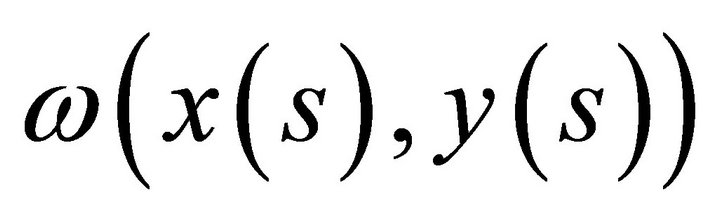

, a consumption bundle is a collection of vectors![]() where consumption in a particular state

where consumption in a particular state  is a vector

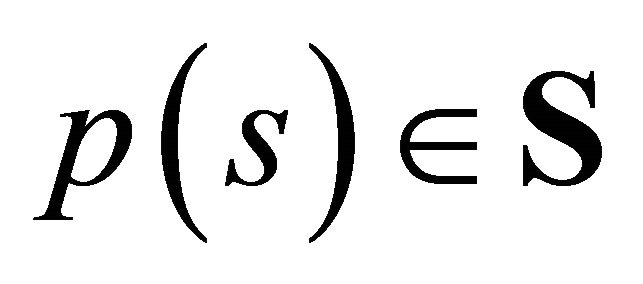

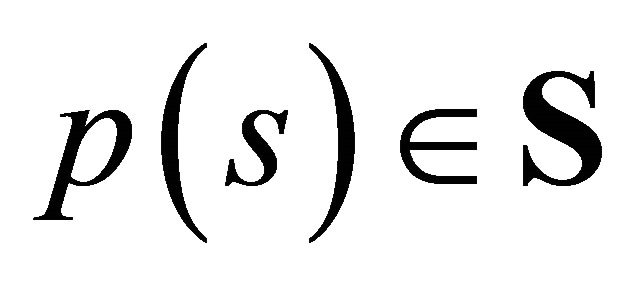

is a vector . Associated with physical commodities is a set of normalized pricesdenoted

. Associated with physical commodities is a set of normalized pricesdenoted .

.

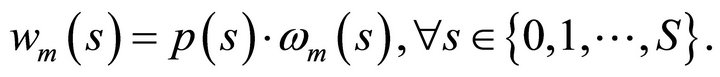

Consumers are further endowed with a fraction  of the profits of each firm.

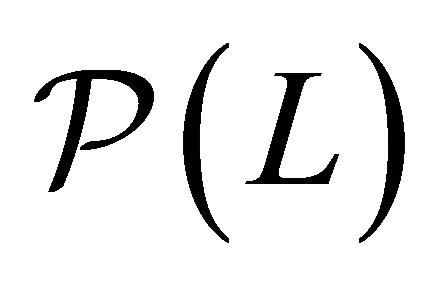

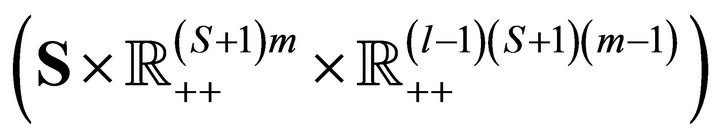

of the profits of each firm.  represents the exogenously determined ownership structure of the private ownership production economy. It satisfies for each

represents the exogenously determined ownership structure of the private ownership production economy. It satisfies for each  and

and , 0 ≤ θij ≤ 1, and

, 0 ≤ θij ≤ 1, and . Denote the set of ownership structures

. Denote the set of ownership structures

.

.

Consumers are endowed with a collection of vectors of initial resources denoted by

![]() , where initial endowments in a particular state

, where initial endowments in a particular state  is a vector

is a vector . Consumer

. Consumer

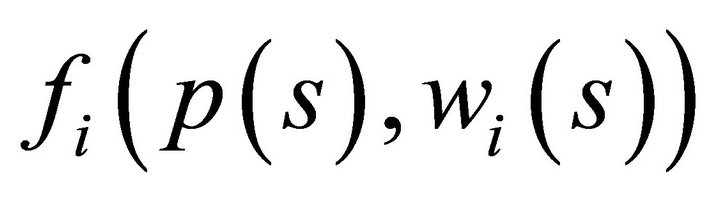

is further characterized by a smooth Marschallian demand function

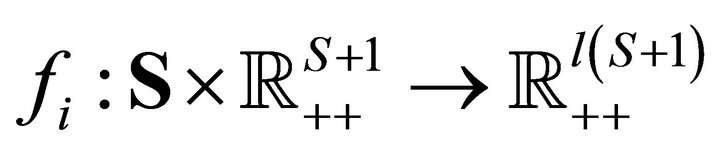

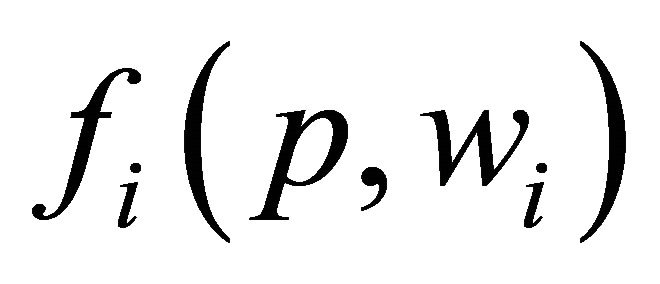

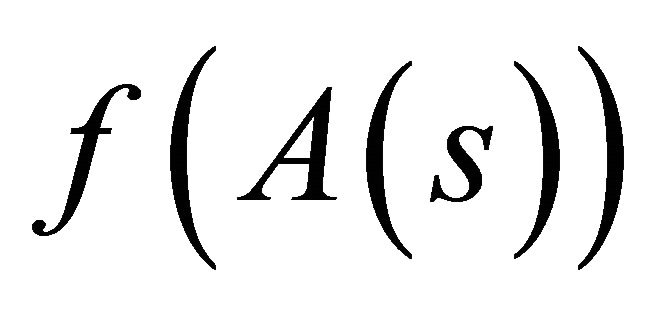

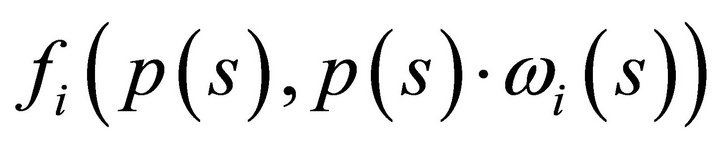

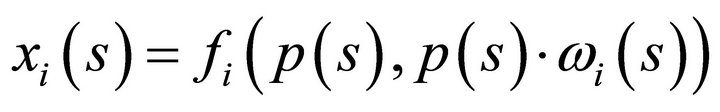

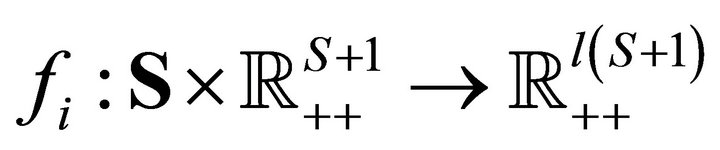

is further characterized by a smooth Marschallian demand function , where

, where

is defined for price vector

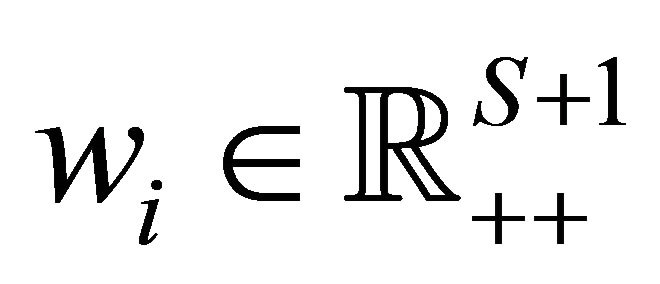

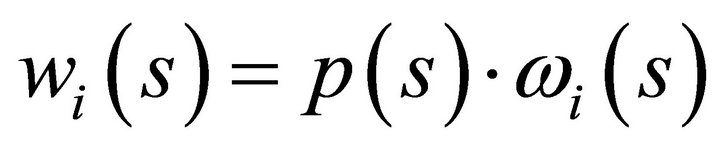

is defined for price vector  and wealth level

and wealth level , [11], where

, [11], where  for all

for all .

.

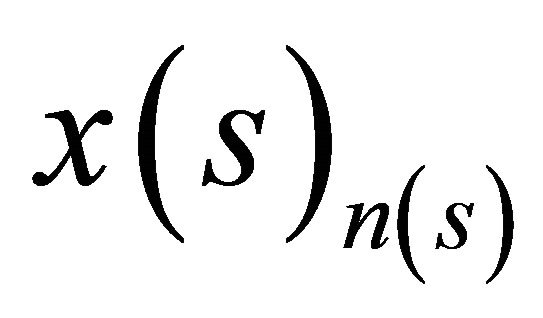

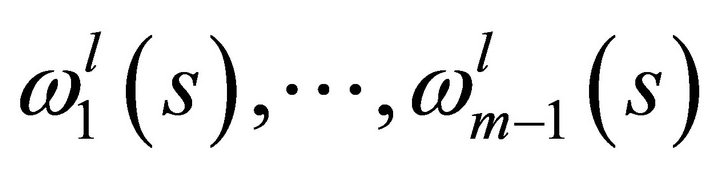

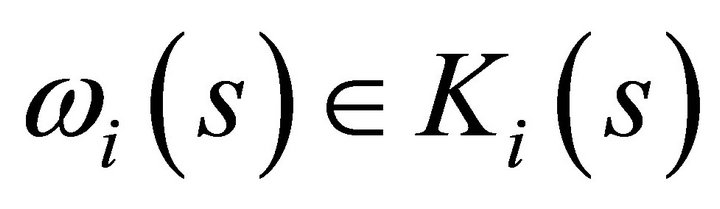

Producers are characterized by production sets and their smooth supply functions. The main property of the long run production model is that all activities of the firm are variable. An activity  is a collection of vectors

is a collection of vectors![]() , where an activity in state

, where an activity in state  is a vector of inputs

is a vector of inputs

, and

, and

is the associated vector of outputs in state

is the associated vector of outputs in state . Let

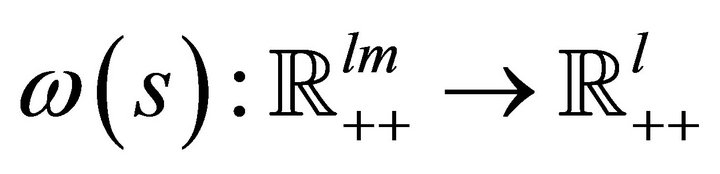

. Let  denote the smooth supply function of firm

denote the smooth supply function of firm , where

, where  is defined on the set of normalized prices. Standard assumptions of smooth production economies introduced in [1] hold for each production set

is defined on the set of normalized prices. Standard assumptions of smooth production economies introduced in [1] hold for each production set . In particular

. In particular  is convex,

is convex,  , and

, and  has a strictly positive Gaussian curvature for every

has a strictly positive Gaussian curvature for every . These assumptions imply that supply functions are smooth.

. These assumptions imply that supply functions are smooth.

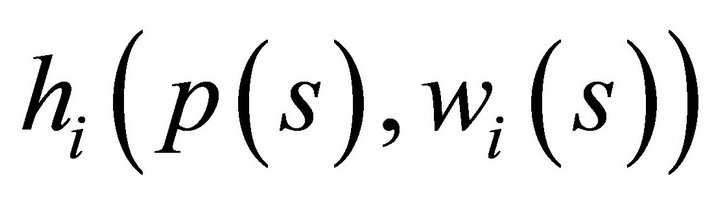

Equilibrium

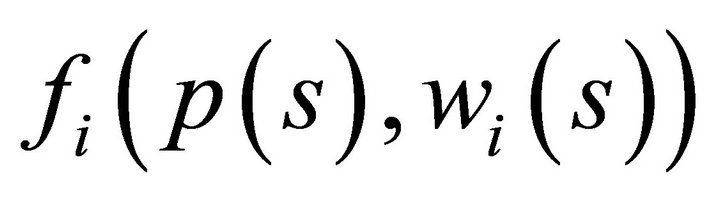

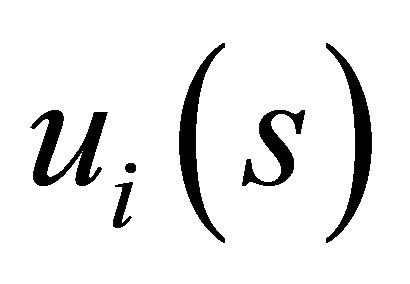

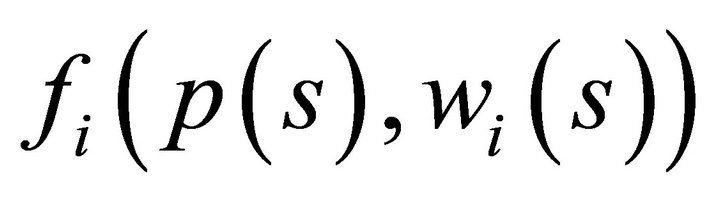

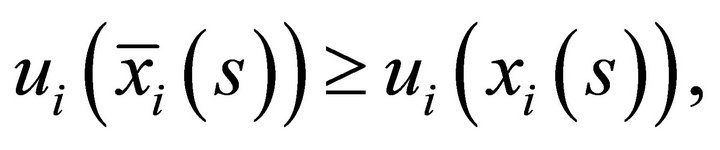

Each consumer  chooses a utility maximizing consumption bundle

chooses a utility maximizing consumption bundle  at fixed

at fixed  and

and  satisfying his budget constraints. Each producer

satisfying his budget constraints. Each producer  chooses profit maximizing net activities

chooses profit maximizing net activities  at competitive prices

at competitive prices . Let

. Let

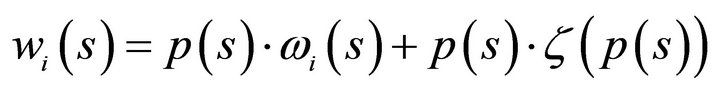

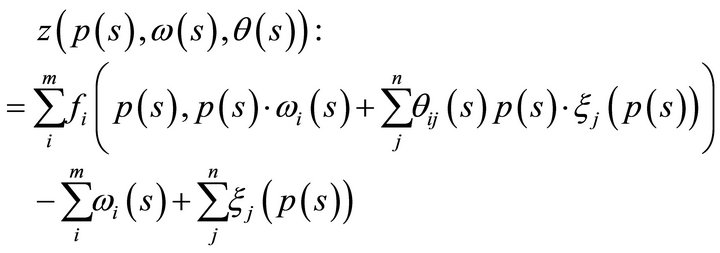

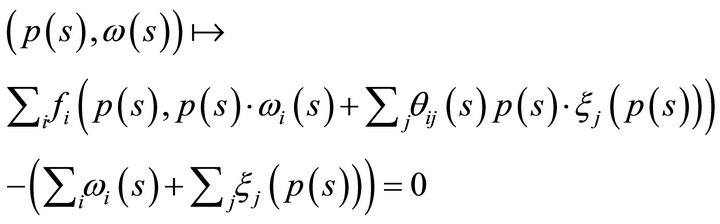

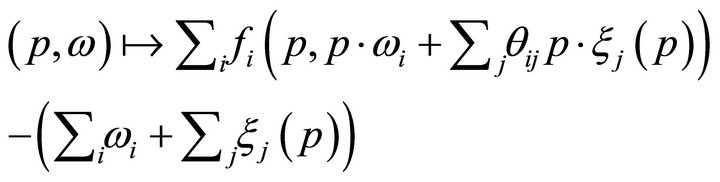

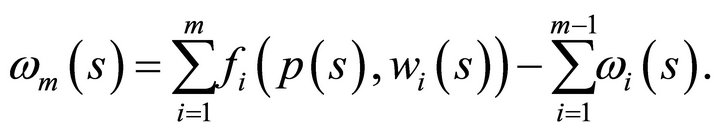

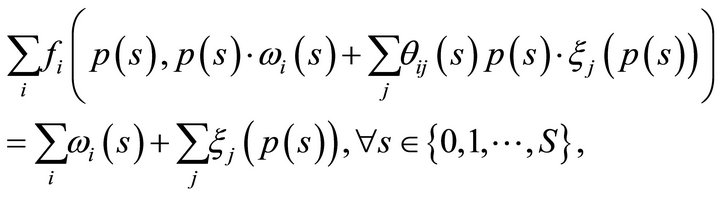

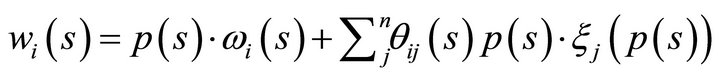

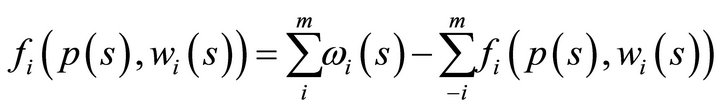

(1)

(1)

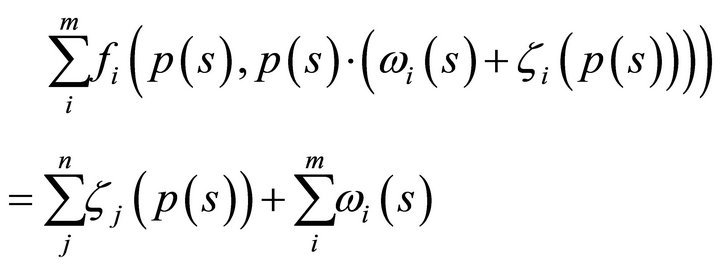

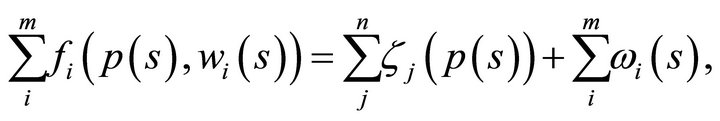

be the market excess demand function in state  . Then, market clearance requires demand to equal supply in each market and uncertain state of the world. Hence

. Then, market clearance requires demand to equal supply in each market and uncertain state of the world. Hence

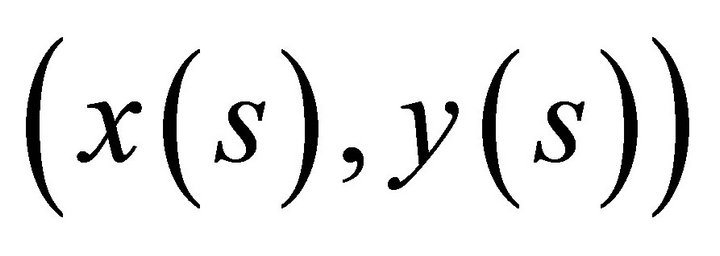

An equilibrium is a price vector  which satisfies this equation for a fixed distribution of initial resources and exogenously given ownership structure. An equilibrium pair is an equilibrium price vector

which satisfies this equation for a fixed distribution of initial resources and exogenously given ownership structure. An equilibrium pair is an equilibrium price vector  with associated

with associated . An equilibrium allocation is an allocation

. An equilibrium allocation is an allocation  associated with an equilibrium price

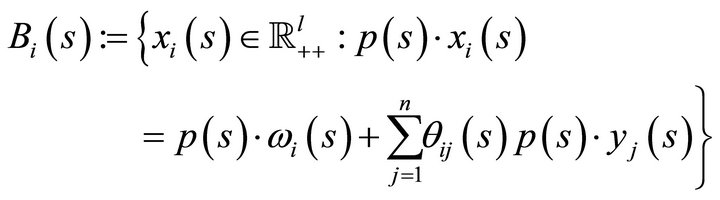

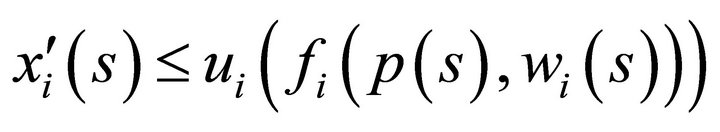

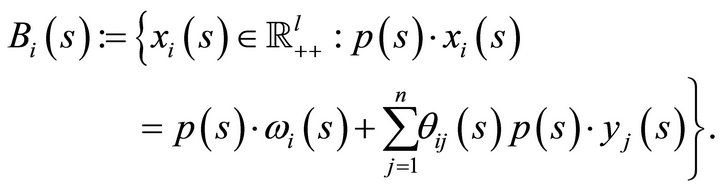

associated with an equilibrium price . The model of the consumer is to solve a constraint optimization problem. This requires a consumer to maximize utility subject to a sequence of

. The model of the consumer is to solve a constraint optimization problem. This requires a consumer to maximize utility subject to a sequence of  budget constraints. Hence, each consumer

budget constraints. Hence, each consumer

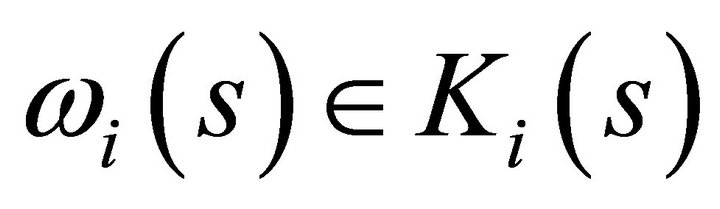

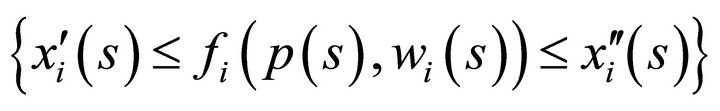

where  is the consumer’s smooth2 utility function. The production adjusted consumer budget set is defined by

is the consumer’s smooth2 utility function. The production adjusted consumer budget set is defined by

The model of the producer is to maximize profits. Each producer solves a constraint optimization profit maximization problem. Hence, each

where the state dependent production set  for all

for all  satisfies the assumptions of Debreu [1].

satisfies the assumptions of Debreu [1].

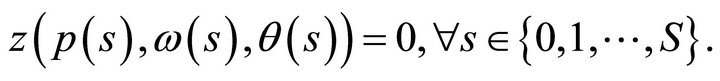

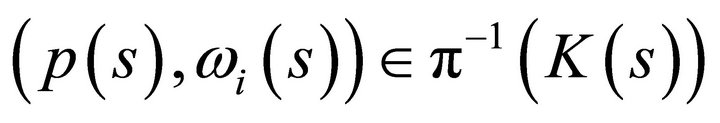

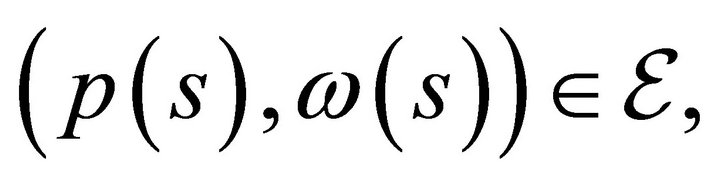

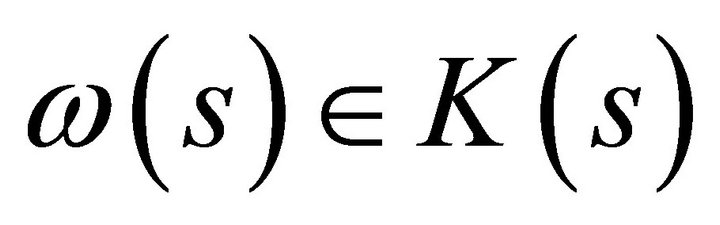

Definition 1. An equilibrium of the two period private ownership production model with uncertainty  is a price vector

is a price vector  at fixed pair

at fixed pair  if for utility maximizing consumers

if for utility maximizing consumers  and profit maximizing producers

and profit maximizing producers

(2)

(2)

An equilibrium allocation is a pair  associated with an equilibrium price vector

associated with an equilibrium price vector  for fixed parameters

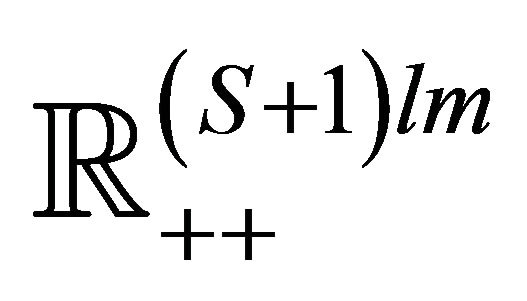

for fixed parameters . Let denote the mathematical operation defined by a state by state inner product. There are

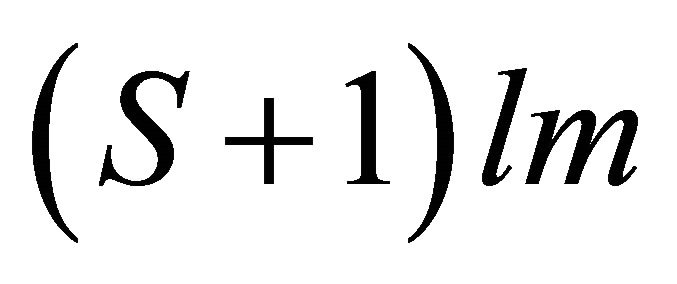

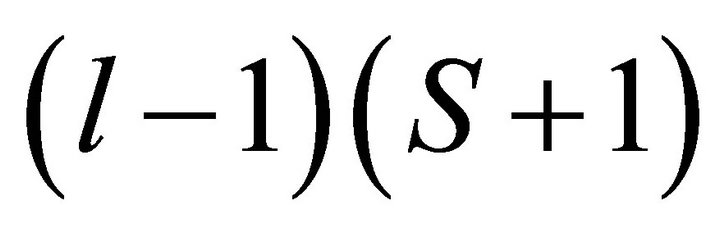

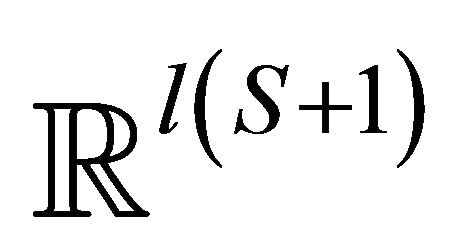

. Let denote the mathematical operation defined by a state by state inner product. There are  equilibrium equations less

equilibrium equations less  equations satisfying Walras’ law

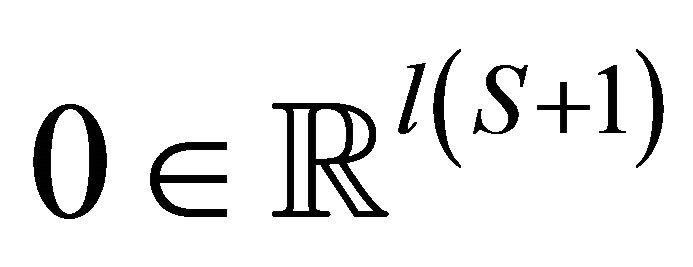

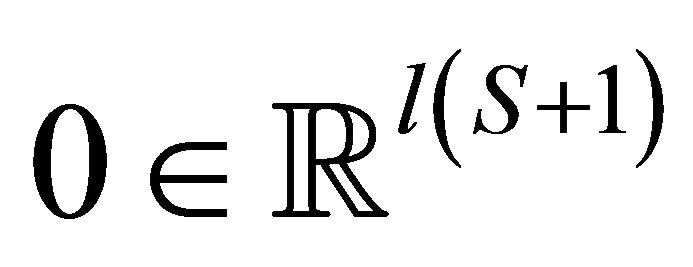

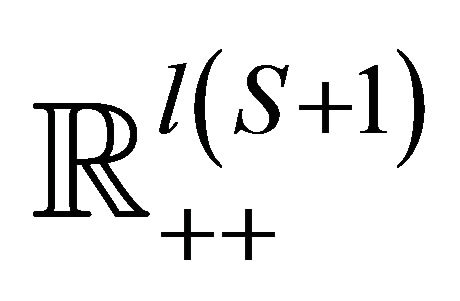

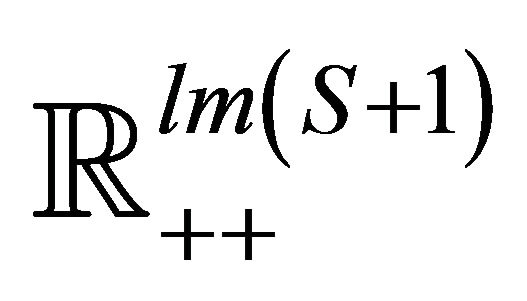

equations satisfying Walras’ law , hence we have a system of l(S + 1) − (S + 1) linearly independent equations. This amounts to the number of unknowns, given the number of normalized prices of

, hence we have a system of l(S + 1) − (S + 1) linearly independent equations. This amounts to the number of unknowns, given the number of normalized prices of .

.

A study of the qualitative equilibrium structure of the two period private ownership production model with uncertainty amounts to a study of the structure of the solution set of the equilibrium Equation (2).

3. Equilibrium Structure  of the Model

of the Model

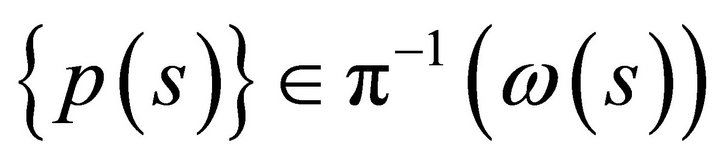

Let  denote the set of equilibrium solutions of the two period production model with uncertainty

denote the set of equilibrium solutions of the two period production model with uncertainty . This set consists of pairs

. This set consists of pairs  satisfying the equilibrium equations

satisfying the equilibrium equations  for all

for all . Formally, we have

. Formally, we have

For the proof of the next theorem we need the following result.

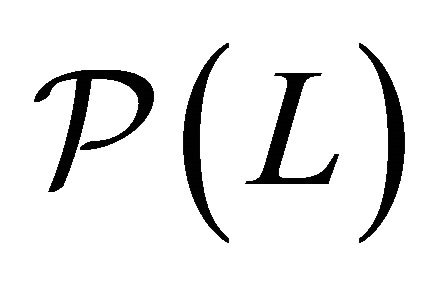

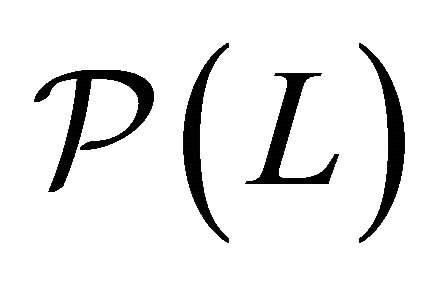

Lemma 1 (Properness of a mapping). Suppose M(s) is a compact space and  is a Hausdorff space for every

is a Hausdorff space for every . Then every continuous map

. Then every continuous map  for all

for all  is proper.

is proper.

Proof. We need to show that for every compact set  the inverse image

the inverse image  is compact for every

is compact for every .

.

1) Let us show that the direct image  of any closed subset

of any closed subset  of

of  is closed in

is closed in  for all

for all . To show this let

. To show this let

, for all

, for all , where

, where

belongs to the set

belongs to the set . From the convergence property of the sequence

. From the convergence property of the sequence  we see that the set

we see that the set  is compact. From that it follows that

is compact. From that it follows that  is compact for every

is compact for every .

.

2) Let us show that inverse image  is compact. We take

is compact. We take  in

in  such that

such that

. Clearly, the sequence

. Clearly, the sequence

belongs to the compact set defined by the inverse image

. Therefore, there exists a subsequence

. Therefore, there exists a subsequence

for all

for all  such that

such that

([12], p. 41), where

([12], p. 41), where

. Since

. Since  is the limit of a subsequence of elements belonging to

is the limit of a subsequence of elements belonging to , we have

, we have . By continuity of the mapping

. By continuity of the mapping  we have

we have

![]()

This proves that  for every

for every  . ■

. ■

Theorem 1. The set ![]() of model

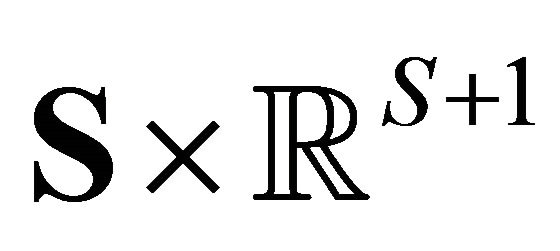

of model  is a closed subset of the Euclidean space defined by

is a closed subset of the Euclidean space defined by .

.

Proof. Note that continuity of the mapping

for all  is sufficient to show closedness of the set

is sufficient to show closedness of the set ![]() of model

of model .

. ![]() is the preimage of the vector

is the preimage of the vector  by the smooth mapping

by the smooth mapping

for all  which is closed by Lemma 1. Continuity of the equilibrium equation is satisfied by the assumptions of differentiability of demand and supply mappings [1,11]. ■

which is closed by Lemma 1. Continuity of the equilibrium equation is satisfied by the assumptions of differentiability of demand and supply mappings [1,11]. ■

Theorem 2. The set ![]() of model

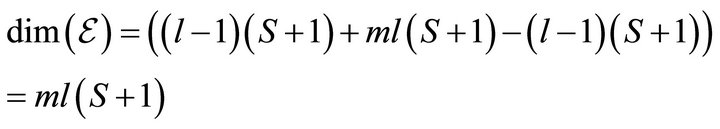

of model  is a smooth manifold of dimension

is a smooth manifold of dimension .

.

Proof. We consider the mapping  defined by the smooth mapping

defined by the smooth mapping

.

.

By the regular value theorem (Guillemin and Pollack [13], p. 21) ![]() is the preimage of

is the preimage of . We need to prove that this mapping does not contain critical points. This follows by showing that the linear tangent map

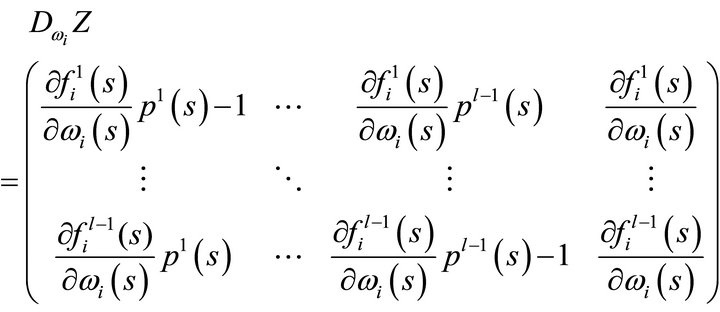

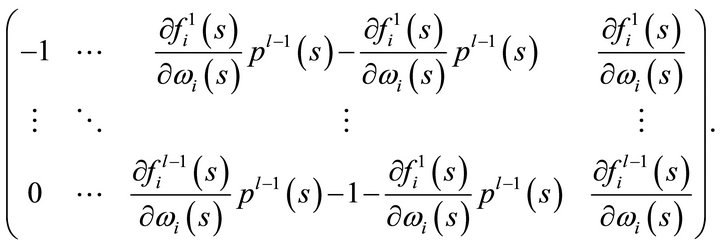

. We need to prove that this mapping does not contain critical points. This follows by showing that the linear tangent map  is onto. The onto property follows directly from the rank property of the Jacobian matrix chosen for any arbitrary individual

is onto. The onto property follows directly from the rank property of the Jacobian matrix chosen for any arbitrary individual  and state of nature

and state of nature . By the chain rule, we obtain

. By the chain rule, we obtain

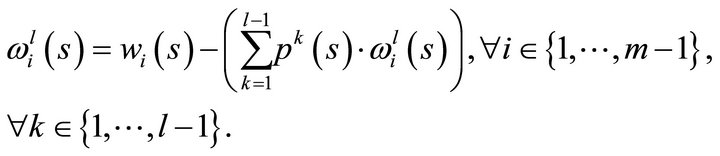

By simple algebraic manipulations we obtain the new matrices

Finally, we obtain

from which we extract the information required. Rank  is equal to

is equal to  in every state

in every state . By the regular value theorem ([13], p. 21)

. By the regular value theorem ([13], p. 21) ![]() is a smooth manifold. This manifold is parameterized by smooth coordinate functions

is a smooth manifold. This manifold is parameterized by smooth coordinate functions . From the regular value theorem it also follows that its dimension is equal to the dimension of

. From the regular value theorem it also follows that its dimension is equal to the dimension of  minus

minus , hence

, hence

. ■

. ■

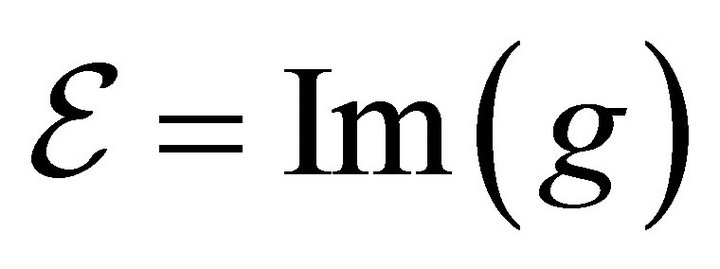

The following theorem illustrates a further economically interesting global property of the equilibrium manifold. It says that by construction of a diffeomorphism  restricted to the equilibrium manifold

restricted to the equilibrium manifold ![]() into

into

![]()

is diffeomorphic to the sphere in

is diffeomorphic to the sphere in  implying that the equilibrium manifold is arc-connected, simply connected, and contractible. These properties are particularly useful in applied work such as economic policy equilibrium analysis. For example, economic policy is often concerned with finding a path between a current point on

implying that the equilibrium manifold is arc-connected, simply connected, and contractible. These properties are particularly useful in applied work such as economic policy equilibrium analysis. For example, economic policy is often concerned with finding a path between a current point on ![]() and a desired point on

and a desired point on![]() . The following theorem proves that such a path always exists. In order to prove this result, we use a theorem given in (Hirsch [14], pp. 15-16).

. The following theorem proves that such a path always exists. In order to prove this result, we use a theorem given in (Hirsch [14], pp. 15-16).

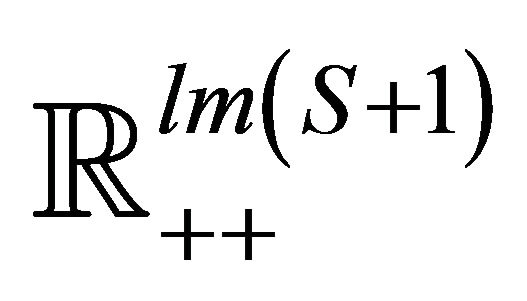

Theorem 3. The smooth equilibrium manifold ![]() of model

of model  is diffeomorphic to

is diffeomorphic to .

.

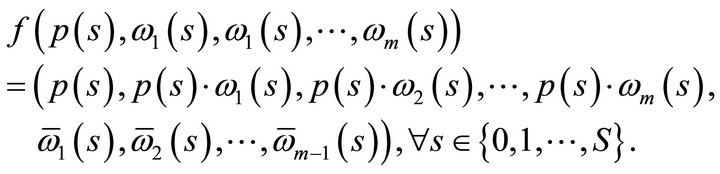

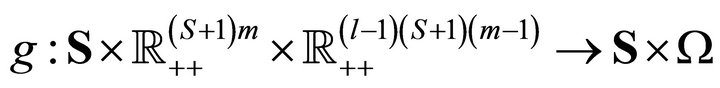

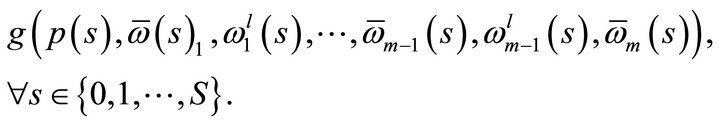

Proof. The aim of the proof is to define two smooth mappings between smooth manifolds such that we can apply the theorem given in (Hirsch [14], pp. 15-16). Hence, let

be smooth mappings defined by

Then, let

denote smooth mappings defined by

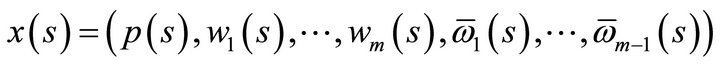

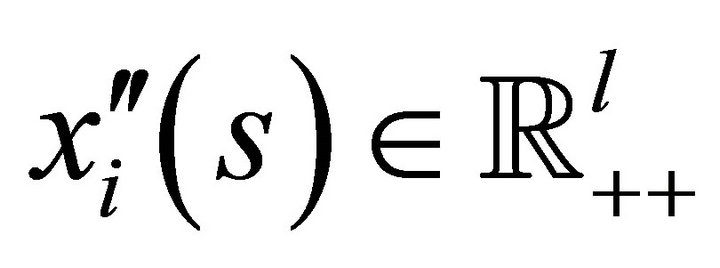

Observe that the coordinates for the  good of the

good of the  consumers in

consumers in ,

,  are defined

are defined

(3)

(3)

Also observe that the coordinates for the  consumer of the

consumer of the  goods in

goods in ,

,  are defined by

are defined by

(4)

(4)

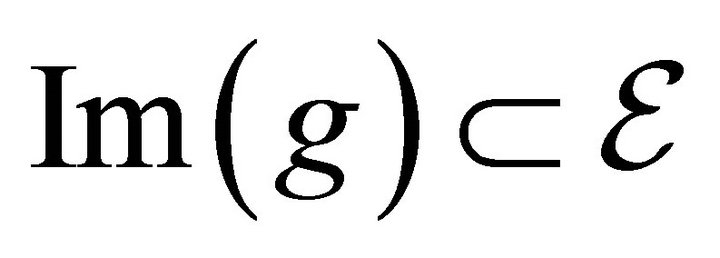

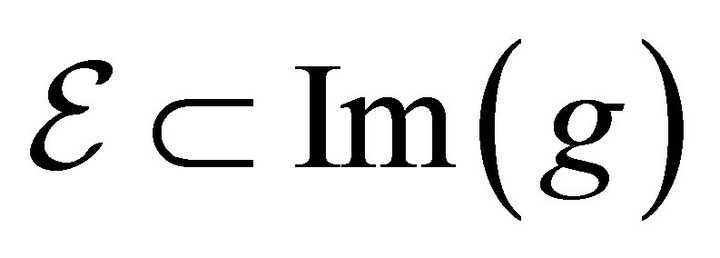

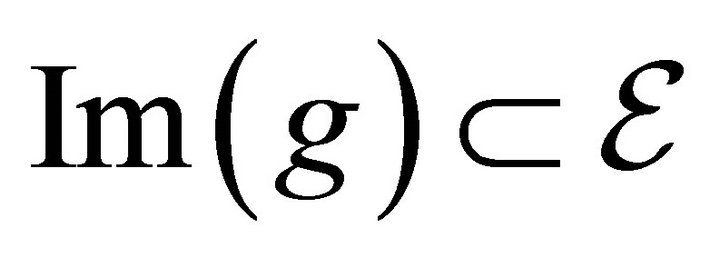

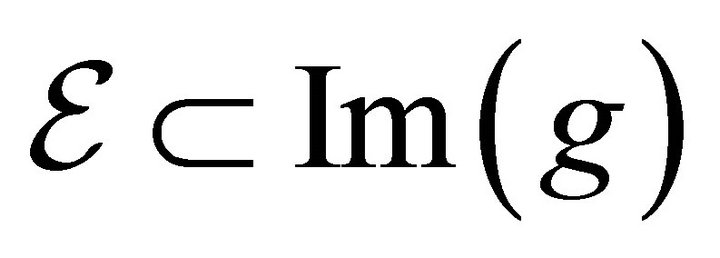

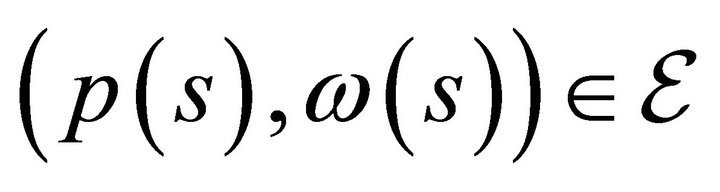

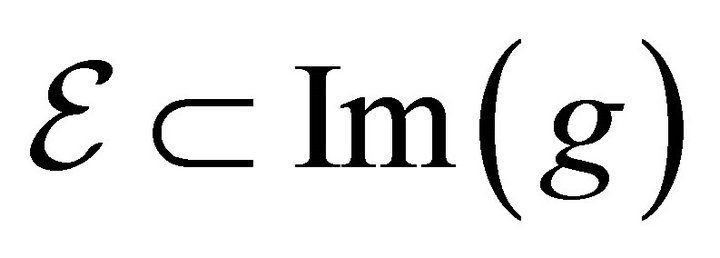

The application of the theorem in ([14]) requires to show that  and that

and that . The first part of the proof requires to calculate two inclusions, 1)

. The first part of the proof requires to calculate two inclusions, 1)  and 2)

and 2) . We start by showing the second part first. Now, to show that 1)

. We start by showing the second part first. Now, to show that 1) , take any consumption bundle

, take any consumption bundle  , and compute the inner product of (4) with

, and compute the inner product of (4) with

, and apply Walras’ law to obtain

, and apply Walras’ law to obtain

From that a reformulation of (4) readily follows in terms of the production equilibrium equation

hence . Next, we need to show that 2)

. Next, we need to show that 2) . Take any arbitrary

. Take any arbitrary . It is then trivial to do the computations proving following equality

. It is then trivial to do the computations proving following equality

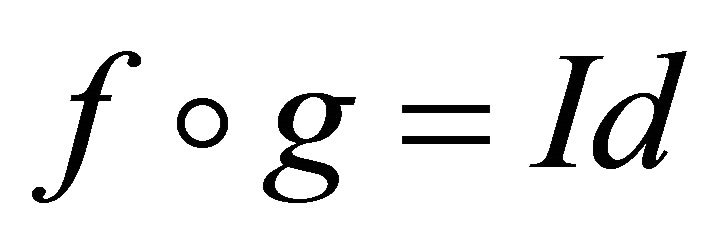

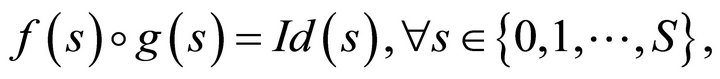

from which it readily follows that . Clearly we have constructed the two smooth relations such that

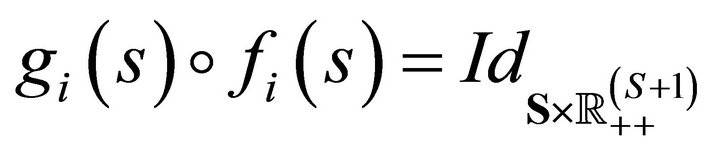

. Clearly we have constructed the two smooth relations such that

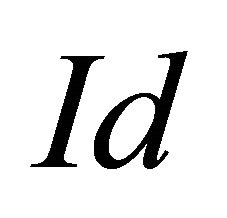

where  is the identity map defined on

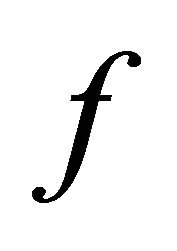

is the identity map defined on  . We have shown that the smooth mapping f restricted to the equilibrium manifold

. We have shown that the smooth mapping f restricted to the equilibrium manifold ![]() defines a diffeomorphism between

defines a diffeomorphism between ![]() and the sphere of dimension

and the sphere of dimension . ■

. ■

4. Existence, Efficiency, and Finiteness of Equilibria

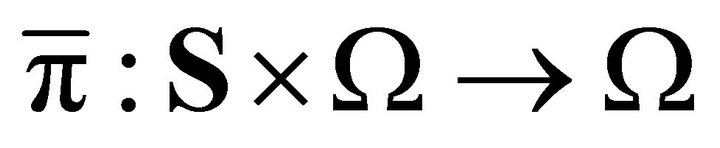

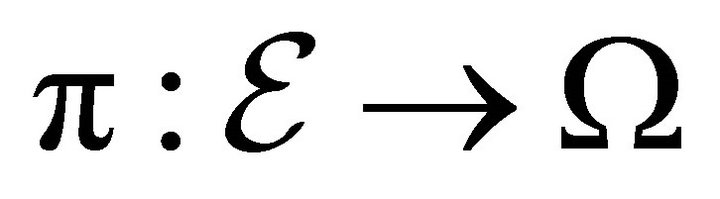

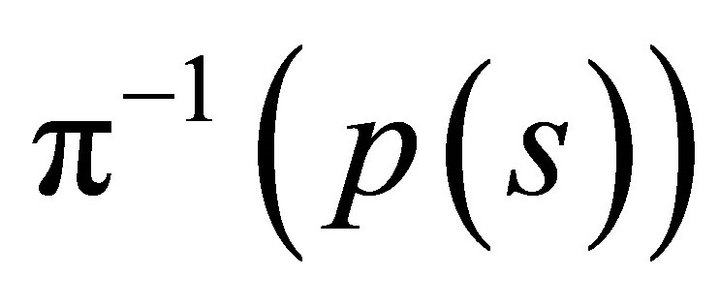

We now show that equilibria in the two period production model with uncertainty always exist. The strategy of the proof is to show that the catastrophe mapping  is smooth and proper. Existence of equilibria of this production model with uncertainty follows immediately from the smoothness proposition (1) and the properness proposition (2) below. The result of properness of

is smooth and proper. Existence of equilibria of this production model with uncertainty follows immediately from the smoothness proposition (1) and the properness proposition (2) below. The result of properness of ![]() provides a deep insight into the definition of economics itself. It implies that economic resources are scarce. The diffeomorphism

provides a deep insight into the definition of economics itself. It implies that economic resources are scarce. The diffeomorphism  for all

for all  between the spaces

between the spaces  and

and  suggests that the vector

suggests that the vector  tends to infinity in norm if prices tend to zero. It tends to zero if prices tend to infinity.

tends to infinity in norm if prices tend to zero. It tends to zero if prices tend to infinity.

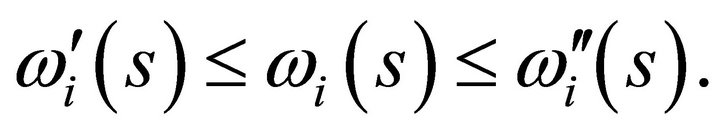

Axiom 4 (Bounded and strictly convex preferences). 1) The set of consumptions bundles indifferent or preferred to consumption bundle  for all

for all  is bounded from below for every

is bounded from below for every  for all

for all . The preordering

. The preordering  is then said to be bounded from below; 2) The set of consumptions bundles indifferent or preferred to consumption bundle

is then said to be bounded from below; 2) The set of consumptions bundles indifferent or preferred to consumption bundle  for all

for all  is strictly convex for every

is strictly convex for every  for all

for all  . The preordering

. The preordering  is then said to be strictly convex.

is then said to be strictly convex.

Theorem 5. Equilibria of the two period production model with uncertainty  always exist.

always exist.

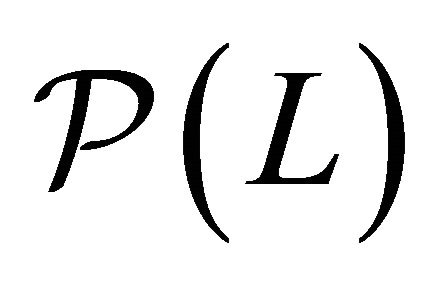

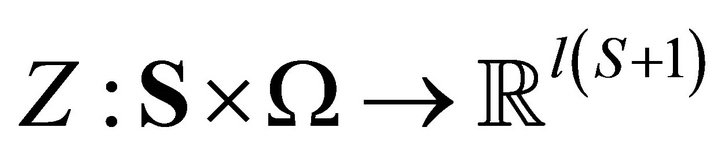

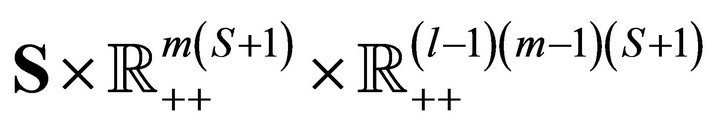

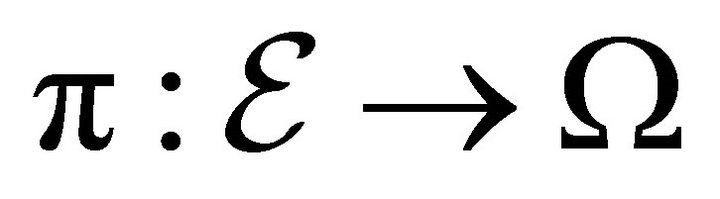

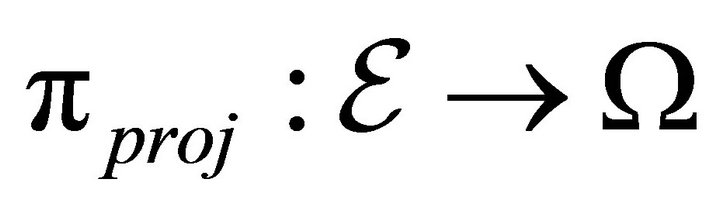

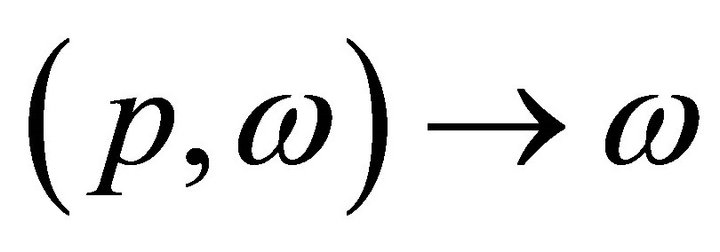

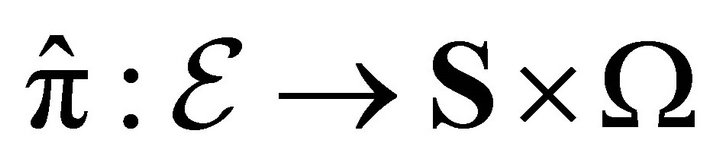

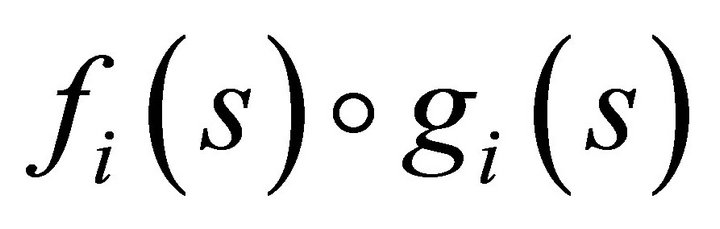

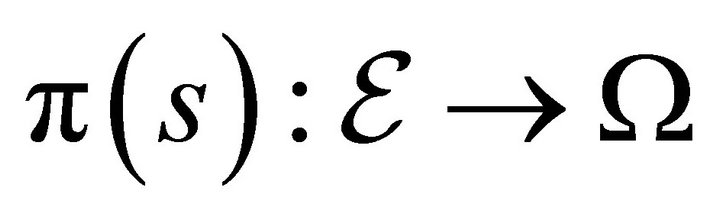

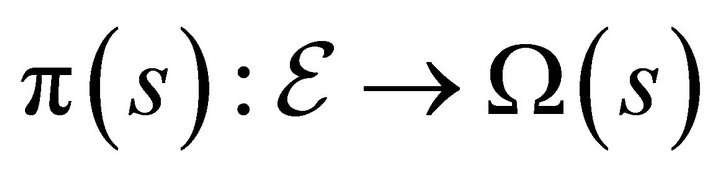

Definition 2. The catastrophe map ![]() is defined by the

is defined by the . It is the restriction of the projection

. It is the restriction of the projection  of the set of equilibria

of the set of equilibria  into the space of economies

into the space of economies .

.

Proposition 1 (Smoothness).  of model

of model  is smooth.

is smooth.

Proof. From Theorem (3) we know that ![]() of model

of model  is a smooth submanifold of

is a smooth submanifold of  which is diffeomorphic to the sphere of dimension

which is diffeomorphic to the sphere of dimension . It follows from the definition of a smooth submanifold ([15], p. 174) that its natural embedding

. It follows from the definition of a smooth submanifold ([15], p. 174) that its natural embedding  is smooth. It is clear that the projection mapping

is smooth. It is clear that the projection mapping  is itself smooth. It then follows that

is itself smooth. It then follows that ![]() the restriction of the natural projection to

the restriction of the natural projection to ![]() as the composition of two smooth mappings

as the composition of two smooth mappings  is therefore smooth. ■

is therefore smooth. ■

Proposition 2 (Properness).  of model

of model  is proper.

is proper.

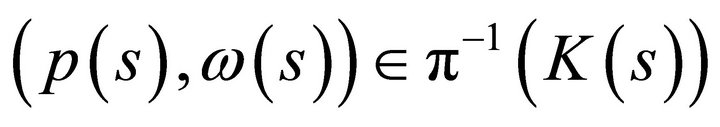

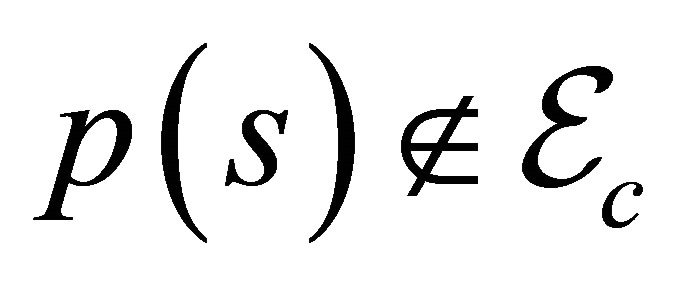

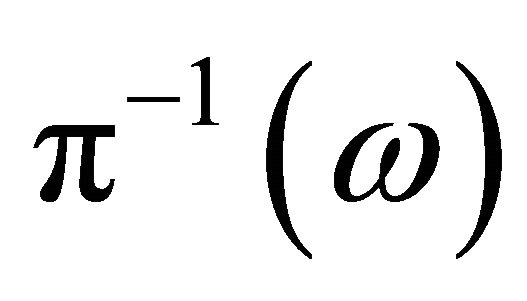

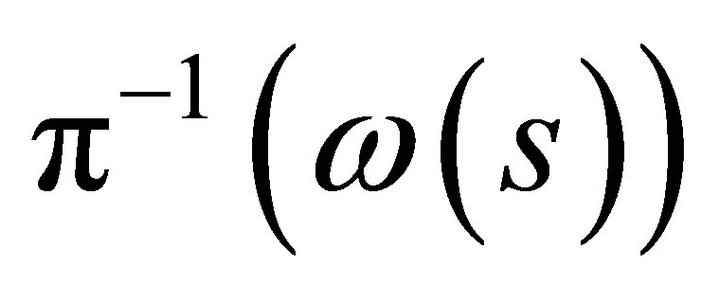

Proof. The strategy of the proof is to define the economic scenario such that lemma (1) can be applied to the model . Hence, we need to show that for all

. Hence, we need to show that for all  the inverse image

the inverse image , where

, where  is a compact set in the space of initial resources,

is a compact set in the space of initial resources,  , is compact.

, is compact.

We show that individual consumer demand is bounded below in every uncertain state of the world. To show this, consider any  and define the projection of initial resource into the

and define the projection of initial resource into the  coordinate and state

coordinate and state ,

,  defined by

defined by

Pick an arbitrary  for

for . Let

. Let  be an element in a compact set

be an element in a compact set . Note that

. Note that  is compact by the projection

is compact by the projection  of a compact set

of a compact set  on the

on the  coordinate space. Compactness of

coordinate space. Compactness of  in

in  implies for every

implies for every  that

that

1) Now, for every  and

and  and

and  need to show that

need to show that  is bounded from below. It then follows from standard assumptions of consumer theory that for all

is bounded from below. It then follows from standard assumptions of consumer theory that for all

where

and

and

for all .

.

By non satiation we also have

which by monotonicity of  implies that

implies that

Clearly, there exists some  for every

for every  and

and  for all

for all  satisfying

satisfying

by boundedness (Axiom 4) of indifference mappings from below for every .

.

2) We now show that for every ,

,  and

and ,

,  is also bounded from above. Consider the equilibrium price vector

is also bounded from above. Consider the equilibrium price vector  for any

for any . Then for all pairs

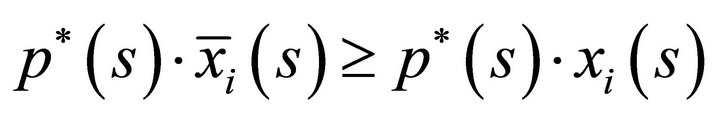

. Then for all pairs  we have

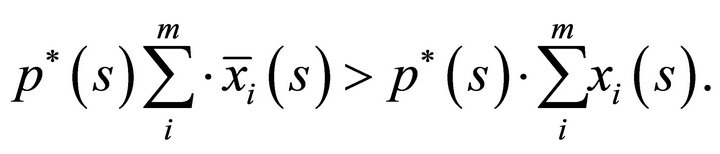

we have

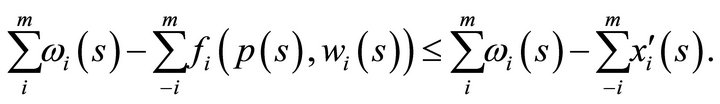

where3

Clearly,  , is bounded above by some

, is bounded above by some , since for

, since for

is bounded from above for every

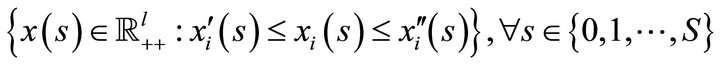

is bounded from above for every . Hence, we have established the upper and lower bounds for every consumer

. Hence, we have established the upper and lower bounds for every consumer  given by

given by

for every .

.

3) We now apply Lemma 1. For any arbitrary consumer , we have established the compact set

, we have established the compact set . Let

. Let  be a compact set defined by the preimage of the diffeomorphism

be a compact set defined by the preimage of the diffeomorphism  ([11]) projected onto

([11]) projected onto . Hence, we observe that

. Hence, we observe that  is a subset of the compact set

is a subset of the compact set . Lemma (1) requires to show that

. Lemma (1) requires to show that  is closed in

is closed in .

.

Now, by continuity of ,

,  , it follows that

, it follows that  is closed in

is closed in![]() , which by Theorem (1) is a closed subset of

, which by Theorem (1) is a closed subset of . Closedness of

. Closedness of  follows from closedness of

follows from closedness of . ■

. ■

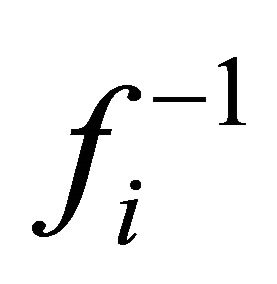

Lemma 2 (Individual demand: Diffeomorphism of ) For every

) For every  the individual demand mapping

the individual demand mapping  is a diffeomorphism for all

is a diffeomorphism for all .

.

Proof. The strategy of the proof is to show that  is smooth, bijective, and that

is smooth, bijective, and that  is also smooth.

is also smooth.

The problem of the consumer is to solve the constraint optimization given by

where

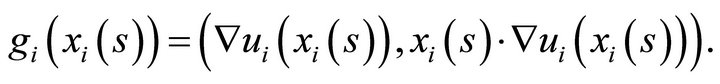

We can use the Lagrangean method to solve this problem. Hence the solution of this problem satisfies the first order conditions of the optmimzation problem and is given by  for all

for all . Hence the pair

. Hence the pair , where

, where  is the Lagrangian multiplier is a solution of the Lagrangian problem. Hence, to show smoothness of

is the Lagrangian multiplier is a solution of the Lagrangian problem. Hence, to show smoothness of  requires to show that

requires to show that  is a smooth function of

is a smooth function of  and

and . This is a consequence of the implicit function theorem applied to the solutions of the Lagrangian. Hence, we calculate the bordered Hessian matrix,

. This is a consequence of the implicit function theorem applied to the solutions of the Lagrangian. Hence, we calculate the bordered Hessian matrix,  for all

for all . Thus,

. Thus,

and the inverse of  at

at  exists since

exists since

We now show that  is also smooth. Let

is also smooth. Let  defined by

defined by

By assumptions of Debreu [11] all ingredients of this formula are smooth. Also the inner product of smooth functions is smooth. Hence we conclude that  is also smooth.

is also smooth.

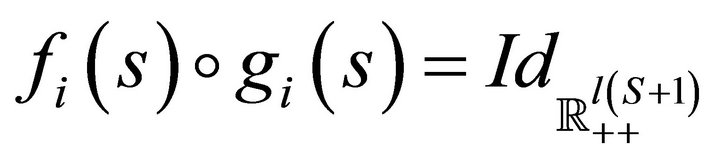

We now show that  and

and  are inverse mappings for all

are inverse mappings for all . Hence 1) We calculate the individual composite mapping

. Hence 1) We calculate the individual composite mapping  for all

for all  and show that

and show that . This condition is satisfied since

. This condition is satisfied since

As required, we have established

.

.

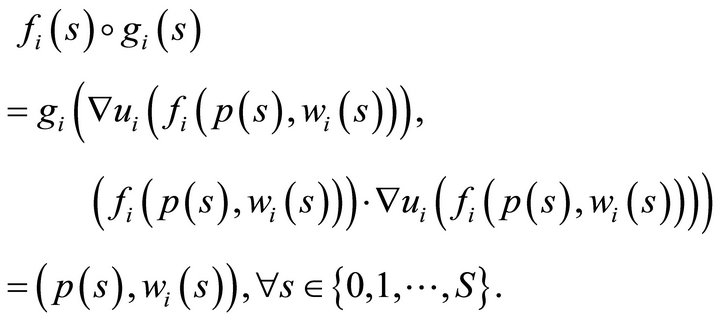

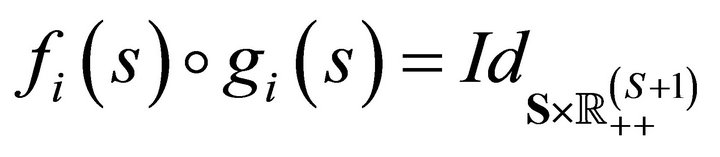

2) We calculate the individual composite mapping  for all

for all  and show that

and show that

. This condition is satisfied since by definition of

. This condition is satisfied since by definition of  we have

we have

As required, we have established

. We have proved the bijection property of the individual demand function4. ■

. We have proved the bijection property of the individual demand function4. ■

This proves existence of equilibria.

Definition 3. A feasible allocation

![]() associate with equilibrium price vector

associate with equilibrium price vector  and economy

and economy

is Pareto efficient for all

is Pareto efficient for all

if there is no other feasible allocation

if there is no other feasible allocation

![]() such that for all

such that for all

and

and

with at least one strict inequality.

Theorem 6 (Pareto efficiency of model ). Every economy

). Every economy  of the model

of the model  is Pareto efficient for all

is Pareto efficient for all .

.

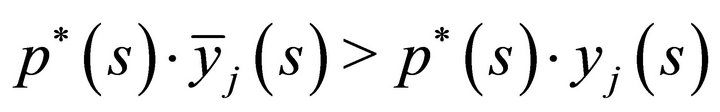

Proof. We proceed by contradiction. We show that if at equilibrium price  the economy

the economy , where

, where  is an allocation of consumption and production which is not efficient, then it must be that firms do not maximize profits. This contradicts the assumption that all firms maximize profits (Debreu, [1] Chapter 5) and implies that not all economies are Pareto efficient.

is an allocation of consumption and production which is not efficient, then it must be that firms do not maximize profits. This contradicts the assumption that all firms maximize profits (Debreu, [1] Chapter 5) and implies that not all economies are Pareto efficient.

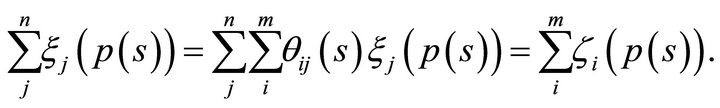

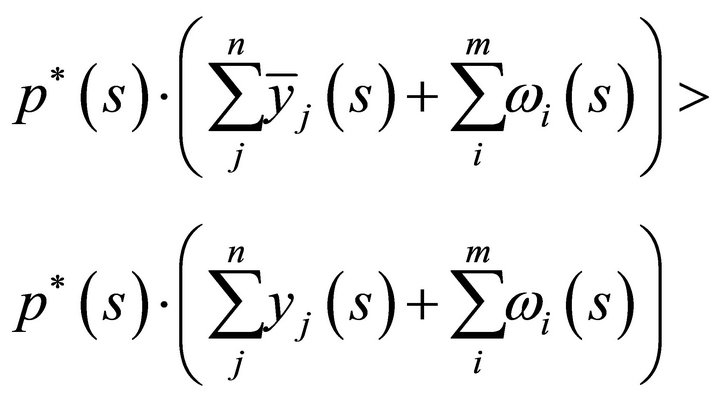

We have for all

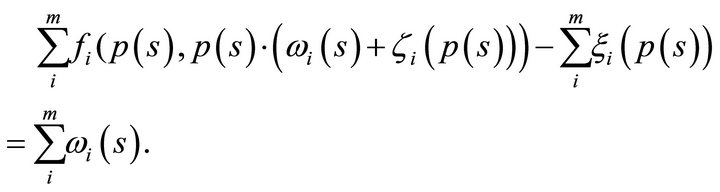

Hence,

Hence we obtain the equilibrium equation given by

We can now establish a contradiction.

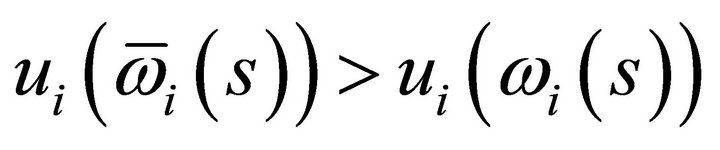

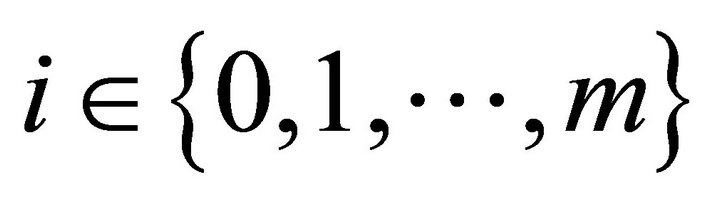

Now, let  be an equilibrium price vector for any arbitrary

be an equilibrium price vector for any arbitrary  and

and  an associated feasible equilibrium allocation which is not Pareto efficient. Since

an associated feasible equilibrium allocation which is not Pareto efficient. Since  is feasible we have

is feasible we have

hence

(5)

(5)

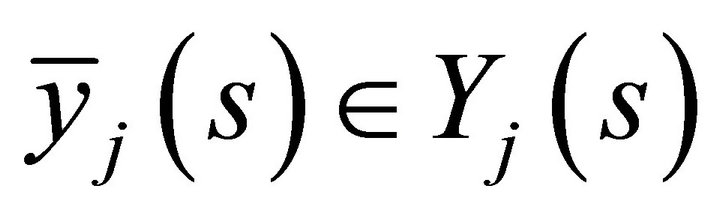

Since by assumption  is not Pareto efficient, there exists a feasible allocation

is not Pareto efficient, there exists a feasible allocation  associated with with

associated with with  and

and  such that

such that

with at least one strict inequality. This implies that

with at least one strict inequality. Aggregating consumption bundles we obtain together with the inner product the strict inequality

(6)

(6)

Substituting Equation (5) into strict inequality (6) and using the feasible allocation  we obtain

we obtain

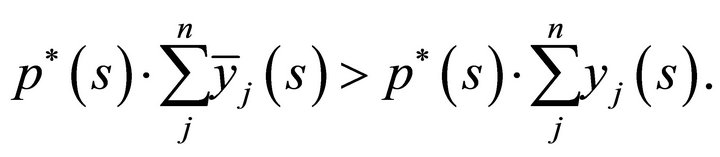

But this strict inequality says that for some  that

that  for feasible

for feasible

. Hence a violation that firms maximize profits. Clearly, since

. Hence a violation that firms maximize profits. Clearly, since  for at least one

for at least one ,

,  is a Pareto inefficient economy. ■

is a Pareto inefficient economy. ■

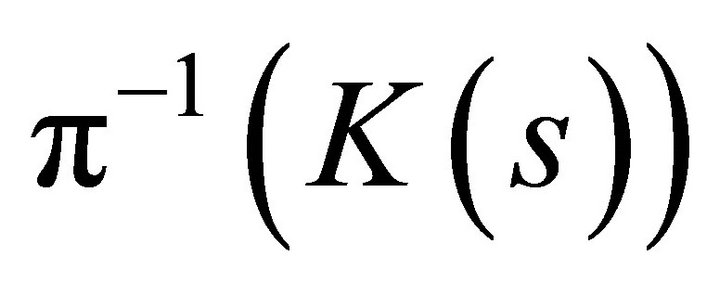

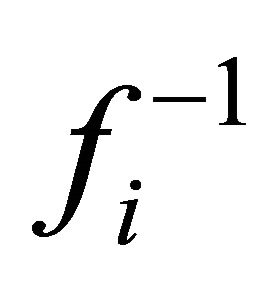

Theorem 7.  of model

of model  is a finite covering for every

is a finite covering for every , for all

, for all .

.

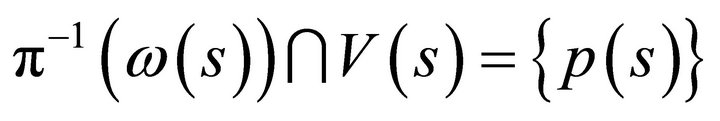

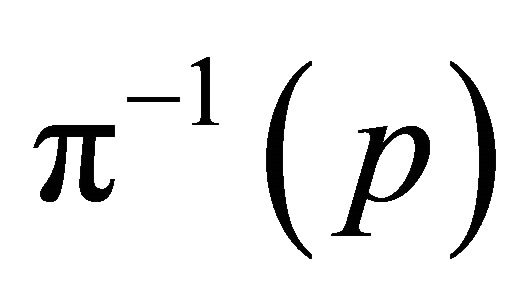

Proof. Let  consist of a single element of

consist of a single element of  for all

for all . Consider the tangent map of elements of

. Consider the tangent map of elements of ![]() not contained in the set of singular points,

not contained in the set of singular points, . Then as a non singular point in

. Then as a non singular point in ![]() there exists a bijective map

there exists a bijective map  which by the inverse function theorem implies that

which by the inverse function theorem implies that  is locally a diffeomorphism. By the inverse function theorem there exists an open set

is locally a diffeomorphism. By the inverse function theorem there exists an open set  of

of  and an open set

and an open set  of

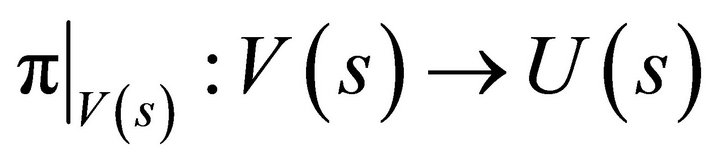

of  such that the restriction of the natural projection to

such that the restriction of the natural projection to ,

,  is a diffeomorphism for all

is a diffeomorphism for all . It follows from the one-to-one property of this map that

. It follows from the one-to-one property of this map that  . Since

. Since  is open in

is open in ![]() it follows from the definition of open sets of

it follows from the definition of open sets of  as intersections with

as intersections with  of open sets of

of open sets of ![]() that the subset

that the subset  is open in

is open in . The union of all open subsets

. The union of all open subsets  define an open covering

define an open covering  of

of . Compactness of the set

. Compactness of the set  follows from compactness of the preimage of a compact set

follows from compactness of the preimage of a compact set  by the proper mapping

by the proper mapping . It follows from compactness of

. It follows from compactness of  that the open covering has a finite subcovering defined by the unique element of

that the open covering has a finite subcovering defined by the unique element of . The union of a finite number of elements defines the set

. The union of a finite number of elements defines the set  which is therefore a finite set. This proves finiteness of the number of equilibria. ■

which is therefore a finite set. This proves finiteness of the number of equilibria. ■

5. Conclusion

This paper discusses local and global equilibrium properties of a production economy with a two period time structure and uncertainty. Adding uncertainty to the production model is a further step towards realism. It is shown that the equilibrium set of all production economies with uncertainty has the structure of a smooth submanifold of the Euclidean space which is diffeomorphic to a sphere. Beyond that, the paper shows that equilibria always exist, and that they are efficient and finite.

REFERENCES

- G. Debreu, “Theory of Value,” New York, Wiley, 1959.

- G. D. K. Arrow, “Existence of an Equilibrium for a Competitive Economy,” Econometrica, Vol. 22, No. 3, 1954, pp. 265-290.

- Y. Balasko, “Economic Equilibrium and Catastrophe Theory: An Introduction,” Journal of Mathematical Economics, Vol. 46, No. 3, 1978, pp. 557-569.

- E. Dierker, “Topological Methods in Walrasian Economics,” Vol. 92, Springer-Verlag, Berlin, 1974. doi:10.1007/978-3-642-65800-6

- Y. Balasko, “The Equilibrium Manifold: Postmodern Developments in the Theory of General Economic Equilibrium,” The MIT Press, Cambridge, 1988.

- E. Jouini, “The Graph of the Walras Correspondence: The Production Economies Case,” Journal of Mathematical Economics, Vol. 22, No. 2, 1993, pp. 139-147.

- G. Fuchs, “Private Ownership Economies with a Nite Number of Equilibria,” Journal of Mathematical Economics, Vol. 1, No. 2, 1974, pp. 141-158.

- S. Smale, “Global Analysis and Econmics IV: Finitness and Stability with General Consumption Sets and Production,” Journal of Mathematical Economics, Vol. 1, No. 2, 1974, pp. 107-117.

- T. Keho, “An Index Theorem for General Equilibrium Models with Production,” Econometrica, Vol. 48, No. 5, 1980, pp. 1211-1232.

- T. Keho, “Regularity and Index Theoy for Econmies with Smooth Production Technologies,” Econometrica, Vol. 51, No. 4, 1983, pp. 895-918.

- G. Debreu, “Smooth Preferences,” Econometrica, Vol. 40, No. 4, 1972, pp. 603-615.

- K. Binmore, “Mathematical Analysis,” 2nd Edition, Cambridge University Press, Melbourne, 1999.

- V. Guillemin and A. Pollack, “Differential Topology,” Prentice Hall, Upper Saddle River, 1974.

- M. Hirsch, “Differential Topology,” Springer, New York, 1972.

- J. Lee, “Introduction to Smooth Manifolds,” Springer, New York, 2000.

NOTES

1Discussion paper: The natural projection approach to smooth production economies, 2011.

2“Smoothness” follows from the assumptions stated in [11]. It essentially means that all functions are differentiable at any order required.

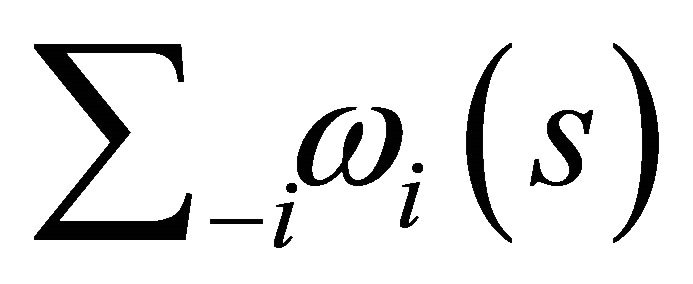

3−i is standard notation used in economic theory. It is equivalent to saying  such that

such that , hence

, hence ![]()

4We have assumed that supply functions are smooth. Hence