Journal of Mathematical Finance

Vol.06 No.01(2016), Article ID:63864,10 pages

10.4236/jmf.2016.61015

The Risk Premium of Treasury Bonds in China

Xiaowei Wu

School of Finance, Shanghai University of Finance and Economics, Shanghai, China

Copyright © 2016 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 18 January 2016; accepted 23 February 2016; published 26 February 2016

ABSTRACT

This paper studied the macroeconomic and the term structure of treasury bonds in the Shanghai Stock Exchange Market. Different from previous studies, we used a group of 122 observed macroeconomic data to construct our model’s macro factor. Therefore the macro factor contained more information than previous studies in predicting the excess return of Treasury bond. Based on the Kalman-Filter estimation, the results show that the macro factor’s risk was compensated through the level factor and slope factor, especially the level factor. Further, based on the decomposition of the yield curve into expected future short rate part and risk premium part, we find that there is some correlation between the variability of the risk premium and monetary policy to some extent.

Keywords:

Macro Dynamic Term Structure Models, Macro Factor, Yield Decomposition

1. Introduction

Since the appearance of Ang and Piazzesi [1] , a flood of research has tempted to study the connection between bond price and macroeconomic. Since their introduction of the macro variable into the Gaussian Dynamic Term Structure Models, this leads to an explosion of macro-finance research. This literature is not designed to produce more accurate term structure models, but rather to explicitly link the term structure to its fundamental determinants. Based on the Fisher’s theory that the nominal interest is the expected future inflation and real interest, there are mainly two sets of macro variable used in the empirical study. One is the price index of the inflation variable, such as CPI and PPI; the other is the economic growth, like unemployment rate, industry production or consumption. They were used either in one variable or the first principal component of each group.

There are a lot of variables which affect the bond pricing in the literature, and also affect the bond risk premium which we mean the compensation for holding the bonds as an asset. In financial variables, Fama and Bliss [2] found that the forward interest rate can predict the risk premium of bond. Then Cochrane and Piazzesi [3] [4] found one factor which was based on forwards rates’ prediction. The no-arbitrage affine model says that the low of one price holds. It doesn’t tell us the fundamental determinants of bond risk premium. In CCAPM, by linking the stochastic discount factor to marginal utility of consumption, it shows that the consumption is the determinants of the bond risk premiums. Put one step further, in the New Keyesian Models not only the consumption, but also the other macro variables implicitly affect the economy, and thus influence the bond pricing.

But it may be difficult to uncover a direct link between macroeconomic activity and bond risk premium. As some macro variables may be latent and impossible to be summarized. And macro variable are imperfectly measured. On the other hand, the models may imperfect descriptions of the price dynamic, and the set of variable used was not perfectly spanned the information the market price showed.

In order to contain more information about the macro variable’s predictability in bond pricing, we form the macro factor based on a group of 122 macro observation according to Ludvigson and Ng [5] . Recent research on dynamic factor analysis finds that the information in a large number of economic time series can be effectively summarized by a relatively small number of estimated factors, affording the opportunity to exploit a much richer information base than what has been possible in prior empirical study of bond risk premium. The factor was constructed based on the prediction regression of the holding period excess return on macro factors.

Following Dufee [6] , we set the risk premium parameters according to the empirical findings. The Dynamic Term Structure Model’s parameters were consistent of by the P dynamic parameters, Q dynamic parameters and the risk premium parameters. Each group parameters can be express in the other two. We chose the models Q dynamic parameters according to Joslin, Singleton and Zhu [7] , and set the risk premium parameters according to the empirical findings. Thus we limited the models’ parameters.

We first form the macro factors based on a group of 122 macro variables. We constructed the macro factor based on the prediction regression of the holding period excess return on the macro factors which is the principle of these group data. According to our results, macro factors can account for about at least 39% of the excess returns, and 62% at most. And the most significant variables among the macro variables which predict excess return were the price index of alcohol and tobacco in CPI, Monetary supply in US, non-staple food processing and short-term loans in the banking and financial institutions.

Then we study the Macro Dynamic Term Structure Model in Shanghai Stock Exchange markets using the constructed macro factors. We find that the macro factor’s risk premium was mainly compensated through the level factor and slop factor. Based on further decomposition of the yield curve, we find that the monetary policy affects the yield curve risk premium. The rest of the paper was organized as follows: the second part demonstrates the model’s set up and estimation procedure. The third part analyses the estimation results, the decomposition of yield curve and impulse response analysis. The last part is summary.

In summary, there seem a lot of macro variables which can be used as factors in Macro Dynamic Term Structure Model, but it seems that they don’t contain so much macro information predicting the excess return. And the macro variable itself seems that it doesn’t contain the same meaning as the theoretic model implied. So the main contribution of this paper is that it contains more information about the macroeconomic and its impact on the term structure and the risk premium of treasury bonds, especially in a transferring economic like China when there might exist some kind of restrictions in the markets.

2. The Model

Following Joslin, Le and Singleton [8] , we use The Macro Dynamic Term Structure Model (MTSM) to construct the estimation model. According to Joslin, Singleton and Zhu [7] , suppose that the portfolio of bond yields with weights was priced perfectly by GDTSM, then, any canonical GDTSM is observationally equivalent to a unique GDTSM whose pricing factors are the portfolios of yields. And they called it the “JSZ” canonical representation. And Joslin, Le and Singleton [8] (hereafter we use “JLS” for short) put one step further and shown that each MTSM with latent factors and macro variables as factors can be rotated into a MTSM in which the factors was consistent of yield portfolios and macro variables.

To fix notation, suppose that there are N risk factors  in a MTSM, which consistent of M macroeconomic factors

in a MTSM, which consistent of M macroeconomic factors  and L latent factors

and L latent factors . And the one period interest rate is an affine function of the macro factors and the latent pricing factors.

. And the one period interest rate is an affine function of the macro factors and the latent pricing factors.

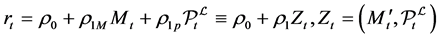

(1)

(1)

Some treat  in Equation (1) as a set of latent risk factors, while others include portfolios of latent factors. Fixing and the dimension of these two theoretical formulations are observationally equivalent.

in Equation (1) as a set of latent risk factors, while others include portfolios of latent factors. Fixing and the dimension of these two theoretical formulations are observationally equivalent.

Suppose that the P dynamic of the factors  follows the Gaussian process:

follows the Gaussian process:

(2)

(2)

where  is nonsingular. And the Q dynamic of the factors

is nonsingular. And the Q dynamic of the factors  follows the Gaussian process:

follows the Gaussian process:

(3)

(3)

Absent arbitrage opportunities imply the affine pricing of bonds of all maturities according to Duffie and Kan [9] . The loading coefficient satisfies the difference equations. The bond portfolios  can be express as

can be express as

(4)

(4)

where the loadings  on the risk factors

on the risk factors are known functions of the parameters

are known functions of the parameters

governing the risk neutral distribution of yields. A key implication of Equation (4) is that matrix

governing the risk neutral distribution of yields. A key implication of Equation (4) is that matrix

where some conformable

to the canonical form in terms to

Suppose the market price of risks is affine, and satisfies:

where

Therefore the physical dynamic parameters could expressed in the risk premium parameters

observation equation is:

where

And therefore the model’s parameters need to estimated is

The above specification can reduce the models parameters when chosen the appropriate risk premium parameters. Therefore the MLE estimation of the Karlman-Filtering model can quickly reach the global maximization.

3. Empirical Results

Our monthly data extends from March 2006 through April 2015. The data were from National Bureau of Statistic of PRC, Federal Reserve Bank, WIND and CSMAR. The data consisted of groups of data that can represent an aspect of the economic activities or the situations in China. Such as international data about the world commodity price index, the US monetary supply, exchange rate among the main trading partners, domestic industrial production, price index including CPI and PPI, consumption, investment, PMI and so on. All the macro cyclical data was seasonal adjusted.

The full bond price data is calculated from the net transaction price in the last of the month in the CSMAR added up with the accrue interest. The interest is calculated based on the par value and the coupon accrued since the last coupon date. Then we delete the data when the time to maturity of the bond in the transaction is less than 6 months. Thus, based on the data we could get the Fama-Bliss yield data. We chose the following 10 maturity as the regression data, the maturities was 1 to 10 integer years.

We use the dynamic factor analysis as an application of statistical procedures for the cased study here. The presumption of dynamic factor analysis is that the covariance among economic time series is capture by a few unobserved common factors. Stock and Watson [10] show that consistent estimates of the space spanned by the common factors may be constructed by principle component analysis. Stock and Watson [10] find that predictions of real economic activity and inflation are greatly improved relative to low dimensional forecasting regressions when the factors are based on the estimated factors of large datasets. Several authors have combined dynamic factor analysis with a VAR framework to study the monetary or global economic comovement (Bernanke, Boivin, and Eliasz, [11] ; Boivin, and Giannoni, [12] ). Suppose we observe a

where

where

We estimated factor from a balanced panel of 122 monthly economic series, each spanned the period March 2006 through April 2015. Table 1 presents the statistics for the estimated factors and the four macro series which has the largest absolute correlation coefficients with the factors and the corresponding coefficients, the number of factor is set to 8. The result shows that the first 8 factors cumulatively accounts for 78.47% of the total macro series variation. And the first three account for about 58.5%. The first factor explains the largest fraction, and the second factor explains the second largest controlling the first one, and so on. And the four macro series that has the largest correlation with the factors was demonstrated in four lines below. We can see that as the fraction of total variance explained by the factor decrease the correlation coefficients of the macro variable’s decreasing. This implies that there is less information and less economic interpretation of the factor, as the fraction of total variance explained by the factors decrease. Table 1 shows that factor 1 loads heavily on production (the value added industry production of general equipment, woods and paper). Factor 2 loads heavily on the price index (PPI and M2). And factor 3 on consumption, factor 4 on funding (loan and loan rates), and so on. We caution that labeling of the factors is imperfect, because each is influenced to some degree by all the variables in our large datasets and the orthogonality means that no one of them will correspond exactly to a precise economic concept.

Table 2 presents the prediction regression of bonds one year holding period excess returns with selected maturities on the above factors, and a constant is included in the regression even though its estimated is not report in the table. Estimated standard errors are in parentheses.

For each regression, the R2 increase as the bonds maturities goes up, from 38.9% to 62.1%. This shows that the macro factors have more prediction information about the short maturity bonds than the longer maturity

Table 1. Summary statistic for factors.

VAI: value added industry production, PPI: Producer Price Index, CFFI: Credit Funds of Financial Institutions, IAC: Investment Actually Completed. IPI: International Markets Price Index. CSI: consumer satisfaction index.

Table 2. Regression of excess return on factors.

Notes: the table reports the regression of excess bond holding period returns on model factors.

bond. Table 2 shows that there are two significant macro factors, factor 3 and factor 5, that predict the excess return across all the maturities. As we can see from Table 1, factor 3 loads heavily on the IVA of food process, and CPI of Tobacco and Liquor. The positive correlation coefficients in Table 1 shows that factor 3 could stand for the consumption. It may contain information about the consumption stance in the economic. Thus it is a natural result that in the regression in Table 2 all the coefficients of factor 3 are negative. And factor 5 is negative correlated with total loans of the CFFI in Table 1. It is a can be seemed as negative correlatives the risk of the bonds markets. So in Table 2 we can see the positive coefficients. Table 2 also shows that the absolute value of the coefficient of the two significant factors is increasing as the maturity goes up.

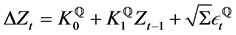

This is also the case for the other factors. The other factors have a rising coefficients in absolute, even though they were significant only in some of the short maturities bonds’ regressions. We show that the coefficients in Table 2 have some kind of consistence. And we show it in Figure 1.

Figure 1 shows that the regression coefficient curve show some consistent to some extent. Following Cochrane and Piazzesi [4] , we can describe the expected excess return of bonds on all maturities in terms of one single macro factor. We constructed the model factor based on the principle component of the expected excess returns, as follows:

where excess return

where

To specific the risk premium parameters in Equation (8), we follow Cochrane and Piazzesi’s [4] procedure to match the cross-section of bond excess returns. The expected returns follow:

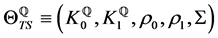

Figure 2 depicts the covariance term in the right hand side of Equation (14) along different maturities. The figure shows that the level factor and slope factor has the highest correlation with

Figure 1. Macro factor coefficients.

Figure 2. Covariance of the macro-factor and bond excess returns.

On the other hand, Table 2 shows that the macro factor can explain 62% at most. This means that there is still left part of the information unexplained by the macro factors. That means part of the risk premiums may be specified by the level and slop factors. Thus, based on the results, we specify the models time varying risk premium factors has the following form:

Thus we finished the four factors Gaussian Dynamic Term Structure model’s set up. The state space model is estimated by Kalman-Filtering, and the parameters’ standard error was calculated through outer product and delta method. The result is presented in Table 3.

As is shown in Table 3, the eigen values are in negative value and very close to 0. It is the eigen value in equation (3)’s dynamic transition matrix

The second line of Table 3 is the macro factor loading on the yield PCs, the results shows that the macro factor loads significantly on the PC factors expect for the slope factor. The last two lines is the risk premium parameters, i.e. it says that how much an expected return must rise to compensate for covariance of that return with a given shock of the factors. The results shows that the model risk premium of the macro factor is compensate through the level factor. This is consistent with the results in Figure 2, where we depict the covariance of macro shock across different maturities of bond excess return.

Table 4 reports the P dynamic transition matrix of the model. As the table shows that the models factor is significant in the level factor. According to the transition matrix, we can see that the macro factor is persistent in the macro factor.

According to the above Q parameters and P dynamics, we can decompose the yield curve into average of expected future short term rates and yield risk premium. According to expectation hypothesis, the yield curve

Table 3. Estimated model parameters.

Note: standard errors are in parenthesis.

Table 4. The P dynamic parameters.

Note: standard errors are in parenthesis.

follows:

where

Thus, we can get the yield curve decomposition. Figure 3 depicted the 3-year yield curve decomposition. Figure 3 shows the fluctuation in 3-year yield, one year yield and the average of expected future one year yield. The distant between 3-year yield and expected one year yield is the yield curve risk premium.

We can see that normally that the 1-year yield is below the 3-year yield, but it seems that 1-year yield sometimes is greater than 3-year yield after the second quarter of year 2011. And the risk premium is large in that period.

The relationship between monetary policy and yield risk premium is important for the policy maker. When the risk premium component is high, it suggests the weak economic condition for policy easing.

It seems that the risk premium is affected by the monetary policy measures in Figure 3. We can see that when the risk premium is especially high or low in some periods there has some important monetary policy measures

Figure 3. 3-year yield curve decomposition.

has been token before or lasting to the observed month. We can see that in March to August in 2006, the distant between the 3-year yield and 1-year yield is large, it means the risk premium is large. And we find that in this period the central bank has rose the Require Reserve Ratios for several times. They also rose the bank lending rate and deposit rate. We can see sharp increase in the first half of 2007. In year 2007, central banks continues to increase the RRR and rose the loan rate and deposit rate. We can see large risk premium in second half of 2007 to early 2008. Then in the fourth quarter of 2008 the central bank turn from the restraint policy to easing policy, so after the decreasing of the Require Reserve ratio, decreasing of bank loan rate and deposit rate, we can see sharp decrease in both in interest rate and the risk premium. This is the same situation for the period from April 2011 to August 2011 when the risk premium is high for the period.

4. Conclusions

This paper uses a canonical macro dynamic term structure model (MTSM) to study the term structure of treasury bonds in the Shanghai Stock Exchange Market, and the macro factor’s effect on the risk premium. The canonical form has the advantage of separation of the P dynamic and Q dynamic into different sets of parameters relatively less and easily estimated. We set the model in parameters by the Q dynamic parameters and the risk premium parameters for our study. And we set the risk premium parameters according to the empirical relationship between the model factors factor loadings and covariance matrix with the excess returns. And different from the specification where the risk parameters is only in level factors, we include more free parameters regarding the level and slope factor because the models’ macro factor just explains part of the excess holding period return of the bond.

The other difference from other MTSMs is our model’s macro factors. In order to contain more information about the macro variable’s predictability in bond pricing, we constructed the model’s macro factor based on 122 observation series depicting different aspects of the economics.

Our results show that the constructed macro factor can explain 62.14% at most of the excess holding period returns. It shows that the macro variables can explain the bond excess returns. And further, the estimated MTSM results show that the compensation of the model’s macro factor is mainly through the level factor; this means that the macro factors affect the level factor dynamic and then the excess returns of the bonds.

Based on the study of the yield decomposition, we find some relation between the risk premium and the monetary policy. We find that the high risk premium in some periods may have some relationship with the central bank’s monetary measures in that period. This may be the results of the market structure of the economics, and can be thought as a further topic for researchers.

Acknowledgements

This work is support by Research Innovation Foundation of Shanghai University of Finance and Economics under Grant No.CXJJ-2013-327. And I am especially grateful to Professor Jianping Ding for his support and encouragement. All errors are my own.

Cite this paper

XiaoweiWu, (2016) The Risk Premium of Treasury Bonds in China. Journal of Mathematical Finance,06,156-165. doi: 10.4236/jmf.2016.61015

References

- 1. Ang, A. and Piazzesi, M. (2003) A No-Arbitrage Vector Autoregression of Term Structure Dynamics with Macroeconomic and Latent Variables. Journal of Monetary Economics, 50, 745-787.

http://dx.doi.org/10.1016/S0304-3932(03)00032-1 - 2. Fama, E.F. and Bliss, R.R. (1987) The Information in Long-Maturity Forward Rates. The American Economic Review, 680-692.

- 3. Cochrane, J.H. and Piazzesi, M. (2002) Bond Risk Premia (No. w9178). National Bureau of Economic Research.

http://dx.doi.org/10.3386/w9178 - 4. Cochrane, J.H. and Piazzesi, M. (2009) Decomposing the Yield Curve. In AFA 2010 Atlanta Meetings Paper.

http://dx.doi.org/10.2139/ssrn.1333274 - 5. Ludvigson, S.C. and Ng, S. (2009) Macro Factors in Bond Risk Premia. Review of Financial Studies, 22, 5027-5067.

http://dx.doi.org/10.1093/rfs/hhp081 - 6. Duffee, G.R. (2011) Information in (and Not in) the Term Structure. Review of Financial Studies, 24, 2895-2934.

http://dx.doi.org/10.1093/rfs/hhr033 - 7. Joslin, S., Singleton, K.J. and Zhu, H. (2011) A New Perspective on Gaussian Dynamic Term Structure Models. Review of Financial Studies, 24, 926-970.

http://dx.doi.org/10.1093/rfs/hhq128 - 8. Joslin, S., Le, A. and Singleton, K.J. (2013) Why Gaussian Macro-Finance Term Structure Models Are (Nearly) Unconstrained Factor-VARs. Journal of Financial Economics, 109, 604-622.

http://dx.doi.org/10.1016/j.jfineco.2013.04.004 - 9. Duffie, D. and Kan, R. (1996) A Yield-Factor Model of Interest Rates. Mathematical Finance, 6, 379-406.

http://dx.doi.org/10.1111/j.1467-9965.1996.tb00123.x - 10. Stock, J.H. and Watson, M.W. (2002) Forecasting Using Principal Components from a Large Number of Predictors. Journal of the American Statistical Association, 97, 1167-1179.

http://dx.doi.org/10.1198/016214502388618960 - 11. Bernanke, B.S., Boivin, J. and Eliasz, P. (2004) Measuring the Effects of Monetary Policy: A Factor-Augmented Vector Autoregressive (FAVAR) Approach (No. w10220). National Bureau of Economic Research.

http://dx.doi.org/10.3386/w10220 - 12. Boivin, J. and Giannoni, M. (2008) Global Forces and Monetary Policy Effectiveness (No. w13736). National Bureau of Economic Research.

http://dx.doi.org/10.3386/w13736