Modern Economy

Vol.08 No.02(2017), Article ID:74432,25 pages

10.4236/me.2017.82022

The “Kondratieff Cycles” in Shipping Economy since 1741 and till 2016

Alexandros M. Goulielmos1,2

1Shipping Department, Business College of Athens (BCA), Athens, Greece

2BCA in Maritime Economics & Shipping Business Management, Athens, Greece

Copyright © 2017 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY 4.0).

http://creativecommons.org/licenses/by/4.0/

Received: December 30, 2016; Accepted: February 25, 2017; Published: February 28, 2017

ABSTRACT

The theory of “long waves”, due to Russian economist Kondratieff, which appeared in the 1920s, is presented, and a search whether a similar pattern exists in shipping economy since 1741 is made. Kondratieff believed in the existence ―inherent in capitalistic system―of at least 21/2 long cycles of a non-random duration of 54 years on average since 1780―with 27 years up and 27 years down. As we showed―using mainly a diagrammatic analysis―economic history verified―till end-2008―Kondratieff’s theories, though it rejected his claimed harmony in their duration. Given that history may be repeated, and only for this is useful, we tried a nonlinear dynamic forecasting model for dry cargo shipping market for 20 years ahead using “Rescaled Range Analysis” and “Kernel Density estimation method” and found that cycles are here to stay. Presented also is the merger-waves in capitalistic economies since 1893― a factor ignored by Joan Robinson in her macroeconomic analysis for the trade cycle in the 1960s. Further we confirm/reject previous analysts, including Schumpeter, who claimed: 1) that technology has created the long shipping cycles (since 1741); 2) that the impact of major wars since 1740 on freight markets was another cyclical cause; 3) that economies of scale play the significant role and 4) that the impact of risk emerged at a certain time though this outcome was too ignored by macroeconomists. The paper “discovered” the secular shipping cycles of a total duration of 139 years using the proper extra-long time data. This means that the discovery of unknown cycles is a matter of data’s longevity. We have also verified Kondratieff’s cycles―when data were divided in 3 separate technological periods: 1741-1871; 1872-1947 and 1947-today, but lasting longer i.e. 58 years on average. We saw that the great gift of capitalism, which is the “free will”, is to be accompanied by “rationality”, and by a deep knowledge of how capitalistic system functions―a warning placed by Kondratieff a century ago―so that to avoid crises like that at end-2008; also globalization has to be used for the benefit of all nations. This paper indicated new tools: the “Joseph effect”―for cycles and the “Hurst exponent” for long-term dependence; the “Noah effect”―for sudden catastrophes and the “alpha coefficient” for risk. We reckon that economists are there par excellence to protect people and business men from risks and cycles and from the “Noah effects”.

Keywords:

Kondratieff’s Long Waves, Shipping Long Waves, Shipping Secular Waves since 1741, Technology Impact, H Exponent, Risk, Companies’ Mergers, Globalization

1. Introduction

The Russian economist Kondratieff wrote a paper in 1926 about the long waves in economic life [1] , which appeared translated in the “readings in business cycle theory” ( [2] : RBCT). This published also in the “Review of Economic Statistics” in 1935 [3] . Americans considered it as a “peculiarly important” article (RBCT)…

Kondratieff wrote about “long waves”, which are the longest so far discovered “cycles”, lasting 54 years on average, with 27 years up and 27 years down. Certain writers said that the “secular trend”―another―“improper” for us―title of a long wave―is not a wave, but a steady and continuous trend of economic activity towards a rise or a fall.

Kondratieff (1892-1) dealt with agricultural economics and economic planning in the former USSR. He discovered 2.5 long economic cycles2: 1) from end-1780s to 1851; 2) from 1851 to 1896 and 3) an upswing from 1896 to 1920. For Kondratieff, long waves “are very probable” phenomenon of capitalism3.

Schumpeter [4] argued that Kondratieff nevertheless was the one who brought this phenomenon fully before the scientific community, and systematically analyzed all material available, characteristic of the capitalistic process. Schumpeter [4] further connected the 1st long wave with “industrial revolution4”; the 2nd with the use of both steam and steel5 and the 3rd with the use of electricity, advances in chemistry and the emergence of the motor car6.

Science is aware about “waves”, and in particular about “long waves”. In economic literature (Pearce, [5] ) long waves appear under the term “long cycles”, meaning a prolonged period of relatively prosperous times, followed by a period of hard times, of similar duration7.

Certain economists believe that: 1) “prices” and “interest rates” are only involved in long waves… 2) long waves are caused by wars related to high governmental expenditures on armaments during prosper times. Worth noting is that Kondratieff’s long waves are not “secular”, as they are shorter than 100 years… Interesting is that shipping cycles are!

This paper reviews the theory of “long waves” and examines its existence in shipping economy since 1741, (year we have data), and till today 2016. The indirect aim of this paper is to provide a medium term―20 years―forecast of shipping markets (freight rates), as this is the only way to test cycles―and to examine if risks exist in them and when.

The paper is organized as follows: next is a literature review. Then, Kondratieff’s theory is presented. Next, we deal with globalization (1900-2016), which is closely connected with the recent long wave. Then, we deal whether long waves are caused by wars. Next, we present the waves in companies’ mergers. Then, we search the existence of long waves in shipping economy since 1741, separating analysis in: 1) the Sail period, 1741-1871, 2) the Tramp period, 1872-1947, and 3) the Bulk era, 1947-2016+, to see technology’s impact. The next section analyzes the whole shipping picture covering almost 300 years or so. Then we connect past, present with future, trying to forecast dry bulk market for 20 years ahead. Next the important factor of risk in businesses is presented. Finally, the view of the famous macroeconomist Mrs. J Robinson is quoted. Then we conclude.

2. Literature Review

Cournot A A [6] (1801-1877) argued that it is necessary to recognize the secular variations-independent of the periodic ones. The French historian Braudel [7] argued that at the heart of the cyclical mechanism is the long-term cycle… with longevity, serenity and unobtrusiveness, driven by technical, economic or regional changes. He identified much longer cycles lasting 100 years or more. Europe e.g. peaked in 1315, 1650, 1817 and 1973. Long waves are of great importance he concluded.

Schumpeter J A [8] argued that the explanation of long waves is found in the technological innovations of the period. The up phase of the 1st Kondratieff cycle (1790-1813) is attributed to the dissemination of steam; the 2nd (1844-1874) to railways, and the 3rd (1895-1914) to motor car and electricity. The up phase in the 1950s, is attributed to the evolution of chemical industry, aircraft and electronics.

Hampton [9] expected a dramatic change in the economy after 1990, based on the application of the “Kondratieff cycle” (Figure 1) to shipping industry… Hampton [9] was the one to bring Kondratieff’s theory into shipping.

Figure 1. UK prices 1740-1950; 1950-2004-2031-2058 (est.). Source: Hampton, [9] , extended to 2058.

It is very interesting that economists have very early realized the existence of long waves and moreover Schumpeter [8] indicated their real causes.

3. Kondratieff’s Theory

Kondratieff [2] believed that a 48- to 60-year cycle affects all aspects of (capitalistic) economy: prices, production, innovations, and most extraordinary, even the timing of major wars! He?admittedly-forecast the Great depression… He argued that the commodity prices make a peak every 48 to 60 years. True that rapid inflation arises from a war like the 1st World War; the recessions in turn cut-off inflation, like in 1920-1921 and in 1981-1982. This “peak prosperity”, as it is called, however, is accompanied by low commodity prices. Fall in commodity prices occurred in 2016 with par excellence the fluctuating oil prices8.

As shown, the “UK wholesale price index” fell in 1788, 1842, 1896, 1950 (and 2004), and a further fall is expected in 2058―following a boom lasting till 2031. The process is as follows: interest rates fall; people disinvest from land and natural resources and invest in financial assets. Cash goes into bonds, and then into equities. Profits are made much easier from trading shares, and this attracts many people. This is what happened in 1999 in Greece. As this is a “bubble”, is destined to burst [9] . The process described occurred also during the 1920s and in the 1930s.

Kondratieff’s theory is believed remained under-utilized and under-appre- ciated inside economics profession (Hampton [9] ; Goulielmos, [10] ). Stopford [11] also argued that long cycles deserve a place in our analysis.

Kondratieff [2] further argued that the dynamics of economic life in the social order is of a cyclical character and there is, indeed, a reason to assume the existence9 of “long waves” of an average length of about 54 years10… Kondratieff’s index number of commodity prices is reproduced below (for England, 1780- 1922) (Figure 2).

As shown, the price level exhibits long waves. The up phase lasted 25 years (from 1790 to 181511); the down lasted 30 years (1815 to 1845) (a total of 55 years). The 2nd long wave12 lasted 25 years (1845-1870). The down phase lasted 25 years (1870-1895) (a total of 50 years). The 3rd wave lasted 23 years (1895- 1918); the next decline lasted 21 years (1918-1939) (due to 2nd World War) and thus the 3rd wave lasted 44 years.

Kondratieff [2] denied that long waves arise out of random causes; he believed that long waves arise out of causes inherent in the capitalistic economy. Unfortunately, he had―as he stated―no intention of laying down the foundations for an appropriate theory of long waves… This was, however, the most important issue of all.

The causes identified for the existence of long waves are the: 1) population rise, 2) improved living standards, 3) technological progress, 4) major wars, 5) increase in agricultural production and 6) new lands brought-into the productive process at Kondratieff’s time. This list, however, could be improved if “globalization” (1990s) and “law of the sea” (1980s) are also examined. We turn now to globalization, which is now under doubt by USA’s new Presidency in 2017.

Figure 2. The index numbers of commodity prices (for England), 1780-1922. 1901-1910 = 100; data derived from: (a) Jevons (1782-1865); (b) Silberling for 1779-1850 & 1780- 1846; and (c) Sauerbeck for after 1846.

4. Globalization and the Long Wave 1900-2016

Globalization increased the worldwide integration of economic systems; it is a process, where the whole world is becoming one market. It is a par excellence phenomenon of the 1980s/1990s. It caused-no doubt-the acceleration of global technological change. Now, countries like USA, France, UK, S Arabia, Australia, Norway, Finland, Germany, Sweden and Hong Kong―by majority―and increasingly, doubt the good face of globalization13.

Goods and services, capital and labor are traded on a global basis; information and the results of research flow readily between countries. A fast worldwide transportation system (containerization; just in time; door-to-door) has been required. A major policy in one large economy may carry along with it the rest of national economies… One may imagine “securitization”14…

If the world is becoming one village, then villagers should be close neighbors and discuss their economic policies for the implications they may have one on to the other… The need for the various G5, G10 and G20 etc. has been arisen.

Globalization pursues the reduction of existing international trade regulations, and taxes, and other impediments to global trade. The economic globalization of production, markets, competition, technology, corporations and industries, is taking place. Current globalization trends can be largely accounted for by developed economies, which have been integrated with less developed economies through foreign direct investments, as well as other economic reforms, and, in many cases by immigration. Immigration today due to wars is surely destabilizing of economic development except for the countries that need labor.

History of globalization goes back to 1944, when 44 nations attended the “Bretton Woods Conference”, which established many of the organizations essentials towards a closer global economy and a globalized financial system with such institutions of: “World Bank”―WB, “International Monetary Fund”―IMF, and “International Trade Organization”―ITO.

Chinese economic reforms began to open China to globalization in the 1980s and it attained a degree of openness unprecedented among such large and populous nations, with competition from foreign goods in almost every sector of the Chinese economy. Foreign investment helped China to increase product quality and knowledge, and standards, especially in the heavy industries. China’s experience supports the assertion that globalization increased wealth. During 2005-2007, and again from 2010 to 2013, the “Port of Shanghai” was among world’s busiest ones.

In India, the “business process” outsourcing’ is the “primary engine of country’s development, contributing broadly to growth of country’s GDP, employment growth, and poverty alleviation”. Economic activities expanded across national boundaries by globalization, but also there is a transnational fragmentation. The production of goods is becoming increasingly global.

Globalization of any form did not help, however, either the global growth or trade15, the last 116 years (1900-2016) (Figure 3) or the avoidance of cycles. The modern global and national economies are all along full of short and medium cycles! Stopford [11] recorded 21.5 shipping cycles (1743-2007), which are 22, if we take into account 2007-2016. The mode (typical mean) of short and medium cycles found 12 years16. The Kondratieff cycles are superimposed on shorter cycles, as argued by Schumpeter [4] . The secular cycles―shown later―are superimposed on Kondratieff’s waves.

As shown, the 1929-1930 depression caused the “global GDP real growth” to fall from ~4% in 1900 to 1% in 1930. Next, it rose from 1% to ~5.8% (1930- 1945). After 1945, a continuous fall from 5.8% to 1.9% took place till end-2008; worth noting is that 2010 showed a turning point up; then a 2.2% rate up to 2014 occurred. The above picture suggests that capitalism helped growth by… creating the two World Wars… The real GDP grew in 1900 and stopped by 1930; its growth re-started in 1930 and ended in 1945. Moreover, the real GDP growth rate on average fell from 1934 to 2010: 6.7%: 1934-1938; 3.7%: 1976-1980; except, 4.6% for 1983-1987; and 2.2%: for 2010-2014.

The end-2008 crash: In end Sept. 2008, an unexpected worldwide market crash occurred. Analysts (Mandelbrot & Hudson, (preface) [14] ) blamed 4 causes: 1) greedy bankers, 2) lax regulations, 3) over-optimism and 4) investors, who were easy-to-be-convinced by bankers for new tools. An essential question, however, rose out of this crisis, which concerns also Academia: “Do capitalists understand how markets work, how prices and freight rates move and how risks

Figure 3. Global GDP real growth from 1900 to 2015 by decade. Source: Inspired from Logothetis G, [13] ; for 2015 = 2.2%.

evolve”? The market fell in Sept. 29, 2008 by 7% and in few hours more than $1.6 trillion from USA industry and $5 trillion globally, wiped out… This paper has the ambition to help Academia to find its way to get nearer to reality.

The “subprime mortgages” surely undermined the largest banks in USA, as they were written on the wrong assumption that what happened in the past, will persist into the future. Housing prices were expected to be rising, default cases to be forecastable and the hedging strategies to work.

Moreover, in 2006, a Dutch bank invented the so called “constant proportion debt obligations” and sold it to investors as a safe way to make money out of the booming market of corporate debts. Investors were promised to receive returns 2% over the standard, international, bank lending rate. In the case of losing money, bankers raised the bet to recover-but this had as a result to chase losses…

Trade between 1995 (2nd quarter) and 2007 (4th quarter) grew by 2.2%, and between 2011 (3rd quarter) and 2014 (3rd quarter) by only 1.1%. The post-1945 fall (Figure 3) lasted from 1945 to end-2008. This made us to think whether the Kondratieff long wave is in fact longer―with 65 years up and 65 years down… or 130 years long…?

This is so as we believe that the major wars coincided with long waves have cut-off whatever secular trend pre-maturely… Does this post-2nd World War long wave of 63 years or so (1945-2008) indicate a Kondratieff cycle? After 1930 Kondratieff stopped to write; according to his theory, the 3rd wave had to finish in 1939, at the outbreak of the 2nd World War (1918-1939 = 21 years), and then to be extended to 2004 (or really rather to end-2008, 61 years; 1947-2008).

5. Do “Major Wars” Cause Economic Depressions?

The World Wars, which occurred, firstly in 1918 and secondly in 1939, we believe made long waves shorter than otherwise. For this conclusion we took as a prototype range the first long wave, which lasted 56 years. Surely, the end-2008 depression was not caused by any world war, but by the causes we mentioned.

Modern writers―following Kondratieff―argued that the 3rd long wave cycle had to end in 2004 on average (Hampton, [9] ; 1950+ a long wave of 54 years = 2004), but it ended in end-2008 (a 9% delay). Also the “Vietnam War”17 (end-1955-early 1975) classified in Kondratieff’s list18 by Hampton [9] .

The first boom from 1790 to 1815 terminated by the Napoleonic wars; the next depression terminated in 1845. The 2nd wave boom started in 1870, with 3 wars: the Crimean, the American Civil and the French-German (1870). These started in 1871 and ended in 1895. From 1896 to 1918 is the boom connected with the 3rd wave, where 5 wars took place: 1) among Spain and America, 2) the Transvaal (in S Africa; for the Gold mines), 3) among Russia and Japan, 4) among Balkan nations, and 5) the major war of the 1st World War in 1918. The relevant recession lasted 20 years, between 1919 and 1939-when the 2nd World War took place. After the 2nd World War, a new cycle started in 1945, lasting till end-2008 (63 years).

Are long waves the characteristic of capitalist economies, as Kondratieff argued, or are also of capitalistic industries?

6. Waves in Mergers

The 1st “merger-wave” in USA was mainly horizontal, and achieved the integration of industries (Martin, [15] ). It followed―about the same time―in Britain and in Germany; it begun in 1893 (a depression year), peaked in 1901, and ended in 1903 (at a further depression). In 1904, over 300 industrial firms consolidated, with about 5000 plants (USA)… Economies of scale were behind, as well before it; the average factory size doubled between 1869 and 1899 and increased by ~25% between 1899 and 1919. The above proved Alfred Marshall [16] true in a certain degree. Trends were also noticed towards creation of near monopolies (notable is the “barber wire manufacturing” monopoly). Moreover, the rationalized production established. We may add also the expansion of the NY City as a financial center. It is obvious that capitalist firms strive to grow-the larger, the better…

The 2nd “merger-wave” started in ~1919/1921 ending during the 1929 stock market crash. The main industries this period were the: food, primary metals, petroleum refining, chemicals and the manufacturers of transportation equipment. It preceded by the technological change of the motor-car and the commercial radio19.

The 3rd “merger-wave” took-off in 1965, peaked in 1968, and fell back in 1972. This led companies towards conglomeration to face the risks involved. The bigger is the size of a company, the bigger is its risk, we believe. The 4th “merger- wave” emerged in late 1970s till 1980s and it cancelled the previous conglomeration trend. The 5th “merger-wave” started in 1990s and evolved till 2001 (11/09); ended in end-2008, perhaps being the longer.

Joan Robinson [17] did not conceive this particular process, i.e. the impact of mergers in capitalism, but she thought that every incoming capitalist shares a fixed pie of profits… In fact the pie per se grows and the piece for every one grows as the number of participants… diminishes by mergers and by fierce competition…

7. Long Waves, 1741-2016, in Shipping Economy

7.1. The Technological Innovations in Shipping and Their Impact on Long Waves

Shipping underwent 3 major technological innovations: 1) the Wind-Sails, 1741- 1871, lasting 130 years (Figure 420), 2) the Steam, 1872-1947, i.e. lasting 75 years (Figure 521); and 3) the Oil-internal combustion engine, 1947-today, 69 years so far. The fourth may be dominated by the “natural gas” in ships’ propulsion. The detailed technological advances of the first period were: the paddle steamers in 1830s; the Screw steamers in 1850s and the triple expansion engine in 1870.

7.2. Sea Transport and the Major Wars, since 1741

As shown (Figure 6), a series of wars benefited shipping between 1741―for which we have data only for the transport of dry cargoes―and 1871, which is considered (Stopford, [11] ) as the year-end of sailing ships.

The wars were: 1) for the Austrian succession, 1740-1748; 2) the American War for independence, 1775-1783; 3) the Napoleonic Wars, 1792-1813 and 4) the American civil war, 1861-1865.

As it is shown, since 1741, the 1st maritime long wave lasted 74 years; “deducting” the 21 years of the Napoleonic Wars (1792-1813), its peaceful period was ~53 years22. This is very close to Kondratieff’s long wave of 54 years on average! The 2nd “shipping long wave” started in 1815 and ended in 1870, lasting 55 years23. Worth noting is that the “shorter cycles’ range” fell over time and the booms were shorter than depressions24… Can this be attributed to the elasticity of demand and supply of ship space vis-à-vis the prevailing freight rate? If e.g. demand rises and supply cannot respond―due to inelastic shipbuilding25 supply or lack of finance or unclear foresight―or due to zero tonnage in lay-up, then a “boom” will be prolonged than otherwise (like in 1754; 1821; 1853; 1889; and 1918-26).

During the above 2 long periods, lasting together ~130 years, dominated by sails, 4 wars are marked on Figure 6 (numbered 1 - 4), which benefited shipping by boosting freights rates up. Important was not only, however, the wars per se, but also their duration: the 1st lasted 8 years (from 2nd to 8th year on graph 4); the second lasted 8 years (from 35th year to 43rd). The third had the greatest impact

Figure 4. “Odysseus”, 204 tons, brigantine from Ithaca island.

Figure 5. “Kassos” steam motorcargo 5215 grt, 1939, built UK.

Figure 6. The freight rates of dry cargo sailing shipping, 1741-1871. Source: Stopford’s data and excel. Trend: a 9-year Moving-Average.

and lasted 23 years (from 52nd year to 75th). The last war made Greek shipowners really rich26―certain of which were coming from Aegean Islands. The 4th war lasted only 4 years (121st year to 125th).

What happened during the Steam era: 1873-1946? (Figure 7)

Figure 7. Freight rates for dry cargo tramp shipping, the Steam era, 1873-1946 (73 years). Source: Stopford [11] and excel 1741 to 1936; 1937 and 1938 from Sturmey [18] ; 1911- 1913 = Great War; 1939-1946 = 2nd World War.

As shown, the third shipping long wave lasted 73 years; this is the period of the “tramp ships27” (1872-1947). We may “subtract” the years of the 2 World Wars, 9 years, and thus the 3rd shipping long wave lasted28 finally 64 peaceful years (73th - 79th). The freight rate market was depressed29 from 1875 to 188730. The 1918 peak-all periods high―was due to the massive destruction of ships caused by the Great War.

As argued by Stopford [11] the period from 1869 to 1914 saw a downturn in the levels of the freight rates caused by the increased efficiency of steamships, which phased out the less efficient sailing ships.

The post-2nd World War shipping long wave started in 1947 and ended at end-2008 (61 years31). This period is the “bulk era” (1947-2016+). The ultimate crisis is lasting 7 years, from 2009 to 2016+ (Figure 8). As shown in Figure 7, the exceptional boom in freight rates of the dry markets occurred par excellence after 2003, and till end-2008 (start of a depression = 2008); this depression was, however, not sustained, as China (40% share of all bulk trades) and India, did not curtail their imports of iron-ore, coal and grain between 2008 and 2014. Matters, however, have changed in 2015-2016.

From 1945 to 1995 mechanization of the “bulk fleet’’ (Stopford, [11] ) and of “liner shipping businesses”, using bigger ships and more efficient cargo handling technology, produced a fall in real freight rates. One is impressed by the fact that the bulk carrier type of ships―which eliminated the ships built for “Liberty” in

Figure 8. The freight rate market since 1947 and till 2015. 1947 = 100; Source: Stopford [11] and excel, 1947-2007; Clarkson’s Staff for 2008-2015; trend: 9-year moving average; a great boom after 2001 and till end-2008.

waters till the 1980s, being 6 times larger-, today32 reached the 400,000 dwt (~7 times larger) called “Valemax” (Figure 9). Again, strong economies of scale are behind the structural changes in shipping caused by technology/shipbuilding/ engineering. This is nothing else, but a manifestation of the great ship productivity in a single plant −400,000 dwt of cargo… Unbelievable 5 years ago.

The last era (1947+) may be better called the “era of economies of scale”, we reckon. Capitalists thus increase their profits―and their power of monopoly33― if they increase the difference between price and marginal cost, and one way of doing this is by either increasing freight rate34 or reducing cost or both. If we stop economies of scale, then you made capitalists almost totally inactive, we believe... Economies of scale are a two-edged sword however―it needs adequate demand. So, demand is the king in shipping economy and in capitalism.

However, the picture we presented by slicing the long period of 275 years or so in 3 technological distinct periods to assess the impact of technology on long waves is indeed misleading in our effort to find out “shipping secular waves”… We rectify this next.

8. The General Picture of Secular Waves in Maritime Economy, 1741-2016

As shown (Figure 10), the 266-year (1741-2015 = 274 - 8 years with no data) freight dry market index demonstrates only 1.5 (secular) maritime waves…

The “new” 1st full shipping wave shows an upward trend between 11th year (1752-1780; 28 years; 1781-1813; 32 years) and 71rd year, i.e. till “Napoleonic

Figure 9. The largest bulk carrier in the water, 2016, the Valemax, 362 m long. Source: https://www.google.gr/search?q=Valemax.

Figure 10. Maritime economics freight Index, 1741-2015, for dry bulk (266 years) (1741 = 100 = 1947 = 100). Source: for 1741-2007, Stopford [11] ; for years 1937 and 1938, Sturmey [18] ; for 2008-2015 from Clarkson’s staff-with thanks; the 2nd world war deprived us of 8 years of data, 1939-1946. The 6 “Noah”35 and 7 “Joseph effects”36 are shown.

Wars” (=60 years); one may subtract the 21 years of the Napoleonic Wars (so the up phase lasted 39 peaceful years). The down phase started in 1814 (72nd year) till 170th year (1911), lasting 97 years. The secular new shipping wave thus lasted 136 years (39 + 97)! The “new” 2nd shipping secular wave up started in 170th year (~1912) till end-2008 (259th) meaning ~89 years, and subtracting the 10 years of the two World Wars (=~79 years). The next down phase follows from end-2008 onwards. Till when?

Let us see what forecasting science can tell us…on this question.

9. Forecasting 20 Years of Future Shipping Freight Markets of Dry Cargo Shipping

9.1. The H Exponent

We took the data used for the construction of Figure 10, and run the computer program NLTSA (= “nonlinear time series analysis”37; V.2.0, 2000) to find out the H38 (Mandelbrot and Hudson, [14] ) coefficient. This coefficient found, for n = 10 years, equal to 0.69 rounded (Figure 11).

The distance travelled by a random time series is proportional to a power of the relevant time elapsed. Einstein [21] proved that this power is the square root of time or H = 1/2. Hurst [22] generalized it by defining H to vary from 0 to 1 to include time series of different speed. The exact value of H ? the maximum of which characterizes the entire time series-is not without meaning, because it produces different types of freight rate series.

If H > 1/2, freight rates will roam far with persistent motion and with an eventual reverse. Increments of freight rates may cluster together. If H < 0.5 = 1/2, the price will roam less. Each move will tend to be followed by another reversing direction; the action is furious, but constrained. The dry cargo freight rate market has H = 0.69―as mentioned―meaning it tended to move up and down in long persistent trends… and it did so over 265 or so years.

As a filter―for stationarity―we have used the first logarithmic differences39. The method used is the “Rescaled Range Analysis”-R/S and in particular the “Hurst-Mandelbrot” variation. The H40 exponent is estimated by regression, and we ignore the first 9 observations as suggested by Peters [25] . The calculations of the NLTSA were confirmed by MATLAB. The R/S method is presented in appendix 1. The Log(R/S) and LogE(R/S) are shown in Figure 12.

As shown, the red line indicates random walk (“Einstein’s line”). Starting at

Figure 11. The Hurst exponent for Stopford’s index, 1741-2015. Source: Data as in Figure 10; “Rescaled Range Analysis” using MATLAB.

Figure 12. The H exponent of the dry bulk industry 1741-2015. Source: MATLAB; data described in Figure 10.

N = 10 or log 1, the blue line of the index of dry cargoes since 1750 and till 2015 runs at a slower speed―after N = 18 years (log 1.25) and occasionally near there, and at log 2.25 (178 years)―than random. The blue line stays below random walk most of the years.

The maximum value of H is found at N = 10 and this indicates that there are strong short run dependencies41, which obstruct us to find out a longer term memory beyond 10 years; this phenomenon has been met also in financial time series quite frequently. To eliminate the bias due to small samples, we followed the variation of Hauser [24] , where the Range is divided by auto-covariance, and q42 = 2; H then fell from 0.69 to 0.66.

Why do we insist on long term memory of time series? For if it exists―in the freight rates―then the efficient market hypothesis-EMH (in its weak form) fails; moreover, the stochastic procedures used for pricing maritime derivatives are incompatible and finally the return distribution from shipping businesses is not normal (Gaussian). So, this is a very important diagnostic test. The picture is not clear, however, as the time series have a long period (1741-1981 = 240 years) of random behavior and a shorter period of increased risk (1982-2016 =34 years) and with a nonrandom behavior. As shown in appendix 4, 20 values of the distribution were outliers and its shape was not normal.

9.2. Forecasting

There are available 5 forecasting nonlinear methods; we have chosen―after making the required tests―the most successful―nearer to reality―method: the “Kernel density estimation”―described in appendix 3. The method requires the embedding dimension―which after a test determined at number 9―the time delay at 1 (standard), and the number of near neighbors at number 10. Forecasting has been done for the next 20 years (Table 1), as this is maximum allowed by the program.

As shown, the freight market index for dry cargo vessels is falling from 216 units in 2015 to 114 in 2036.This is in line with the secular shipping cycle theory advanced above.

10. Risk in Shipping Industry, 1741-2015

We examined the existence of risk in shipping business. For this we used coefficient alpha43 (=α). The measurements of risk are done by 2 only―most common ―tools: alpha = volatility and β = beta = the degree to which freight rate changes correlate to those of the market overall44 (Mandelbrot & Hudson, [14] in another context). The alpha exponent measures how wildly freight rates vary, or how “fat” the tails of the relevant distribution/curve of freight rates changes are. If alpha = 1.70, this suggests strong variation in the freight rates―as defined by Mandelbrot & Hudson (in another context; [14] ).

As shown in Figure 13, at year 224 (1982)45 alpha fell below 2 (2 = alpha for normal distribution), from 1.99 (1982) to 1.46 in 2015. So, different alphas appear over time. So, different distributions hold over the same market overtime. For normal distribution alpha is equal to 2; for Cauchy alpha = 1; for shipping markets is 1.50 (1982-2016).

Table 1. Forecast values of the Maritime economics freight index, 2017-2036.

Source: Data as in Figure 10; used NLTSA program and “Kernel Density Estimation”. Index: 1947 = 100.

Figure 13. Coefficient alpha calculated for dry cargo freight market, 1741-2015. Source: Data as in Figure 10 & Figure 12 and excel.

Alpha = 2 in shipping time series indicates a fair risk and holds for most of the above period (1741-1982); it varied from 1.91 to 1.95 (48th year - 155th year; 1806-1913) and from 2.11 (180th year; 1938) to 2 (223rd year; 1981). Exceptional is the 1981-1987 depression and the period after it, including the 2008-2015 crisis. This matter is discussed further in appendix 4. Risk, as mentioned, was ignored by macroeconomists; as shown by the analysis was not always present in shipping economy and emerged in a tragic way in 1982 and thereafter. We may say that economies of scale created risk and the probability of a depression introduced it into ship-owners’ hearts…

11. The View of a Famous Macro-Economist about the Trade Cycle

Robinson (1903-1983) [17] argued that the products of investment accumulate in a continuous manner―buildings, equipment, ships, improvements to land, and durable capital goods, are continuously added by capitalists. Competition of each new arrival reduces the level of existing profits46. The expansion of investment slows down as a result. The rate of profit falls off.

Once investment begins to decline, ―and the multiplier works undesirably-, consumption falls off, unemployment increases and activity and profits decline. The depletion of the stock of capital is the mechanism for a turning point up (via obsolescence, wear and tear). For Joan Robinson the rhythm of investment is the main force governing a cycle.

In the case of the capitalistic system―in our opinion―it seems to be crucial47 that people save their income, and that capitalists only invest, as there may be a discrepancy between the two. Underinvestment is thus one cause of a depression, but this leads also to under-consumption, and the two may act together in a spiral. So there is a tragedy of the capitalistic system to have a propensity to save by all those who earn income (including governments; governmental companies; savings made by companies in the form of depreciation and of undistributed profits etc.) and not to spend all income to buy goods and services produced during the current year.

Moreover, the banking system―including Stock exchanges―may fail to attract all savings into deposits, or shares, destined to finance new investments― perhaps due to low rates of interest, low dividends, risk of a haircut―and for the reason that some savings are kept at home (= hoarding). All income out of the production of current GDP―with the exception of that consumed―should pass over to entrepreneurs, and to others, who are willing to spend them even over current consumption (e.g. in the form of consumers’ loans) through the banking system and stock exchange.

Capitalistic system is in need of spending, as GDP = Consumption + Investment − Imports + Exports. As shown imports reduce national GDP and this connects the international economies with globalization. Space programs, research spending and wars, plus state investments, are ways of creating the “proper” spending for an improved GDP, where savings set free appropriate resources as a strong psychological propensity of the human element governed by the insecurity of future. Unfortunately, inflation will punish those who spend above of what is available at low current prices.

12. Conclusions

Despite what Stopford argued about technology in shipping economy as creating the long Kondratieff waves―influenced by the opinion of Schumpeter―we have indicated that technology just lowered the level of the freight rates, but it did not create the long waves.

Moreover, with the argument that major wars have created long waves, we know that the 2nd World War boosted incomes of people working in the war-industry in USA. So, after the end of a major war, economies had to increase spending greatly and thus a boom was triggered. This is a manifestation of the role of “effective demand” in capitalism48.

The traditional theory in an attempt to explain long waves failed to estimate the impact of two-three other major factors, which appeared in between: “globalization”; the “law of the sea49” and the increasing “risk” in businesses due to economies of scale.

The pursuit of capitalistic companies since 1893 was to increase their size by merging with other companies, and at the same time eliminating competitors― killing two birds with one stone. This was over sighted by Joan Robinson. In business world, 5 merger waves have been recorded in the USA and elsewhere since 1893 of 10 years duration on average, except the last one (1990s-end 2008), characterized by strong economies of scale.

Economies of scale50 no doubt increase profits and monopoly power. But economies of scale in shipping, and in general, depend on the level of particular demand to fill out a large vessel… Half the number of Capes (~200,000 dwt) will be soon redundant in the appearance of the “Valemax” of 400,000 dwt as mentioned.

Capitalism is not a system of a civilized club of gentlemen as Robinson thought where capitalists share their fixed profits among all, and thus profit is falling for everybody… as more and more take part into the same businesses.

Kondratieff’s theory, as shown, influenced Hampton who used it to argue that a shipping and world crisis had to be expected by 2004. The great surprise is that the global depression in fact took place in end-2008… This strange coincidence is the second in a row―as the 1929 depression was also predicted by Kondratieff… Forecasting of the dry cargo freight rate market using Chaos theory, however, denied this, because falling freight rates will prevail from 2016 to 2036…

Combining the theory of Joan Robinson with that of Kondratieff, a depression is caused by the decline in profits, and in investment, due to many competitors; this should supposedly take place some 27 years ahead on average, including the evolution of obsolescence, wear and tear.

Marx, Keynes and Kondratieff, as well as others, recognized certain defects of the capitalistic system; for us, the main defects are based on “man’s free will with no rationality”. It is also the obligation of Governments to create the suitable “level of confidence”―as mentioned by Keynes in 1936―and to undertake public works, when business-men refuse to invest. Reducing demand for consumer’s goods and services inactivates the scope of investors and profits.

To investigate the impact of technology on long waves we had first sliced the period since 1741 into 3 technologically distinct sub-periods: sail, 1741-1871; steam, 1872-1947 and oil, 1947-2016+. These periods were characterized by technological advances and economies of scale. The analysis showed 4 Kondratieff shipping long waves… of 58 years on average, i.e. 4 years longer!

The surprise, however, came when the whole shipping period has been analyzed―some 275 years. There, 1 and a half secular wave discovered of 136 years and 79 years… These waves we have recognized as true “secular” ones… This means that if the last very long wave started in 1919 and ended in end-2008, i.e. 89 years (less 7 years of the 2nd World War = 82 years) and this is 1/2 of a very long maritime wave, then the other half downwards will be between 2009 and 209151… i.e. 82 years.

Technology in the form of economies of scale influenced the level of risk in shipping business, but latest depression (1981-1987) increased risk greatly. Risk has been identified by the coefficient alpha in this paper―though Joan Robinson ignored this factor too. Modern capitalism is thus affected by risk, and many methods have been invented to protect capitalism from risk, one of which―as shown―was merging.

The tragedy, however, of capitalism is the permanent misunderstanding of economic reality by ignoring two essential characteristics of the capitalistic system: trends and cycles (the “Joseph effects”) and abrupt rises or falls (the “Noah effects”) and the use of wrong analytical tools like “normal distribution” together with standard deviation (=risk) as the safe guidelines. So, capitalism is a system that moves in cycles towards up and towards down. This in nonlinear terminology is called an economy full of “Joseph effects”. Worth noting is that our century created a serious depression due to the sub-prime house loans in USA in 2007 and in 2008 indicating lack of rationality. In this last case we cannot blame capitalism, but capitalists… and especially the capitalistic institution of bankers.

Acknowledgements

We thank an anonymous experienced referee for his/her valuable suggestions for a better manuscript.

Paper’s Main Contribution

We have discovered “secular waves” in “dry cargo shipping economy” since 1741 of 136 years on average with 68 years up and 68 years down. This opens to research the discovery of cycles of various durations―beyond the ones established by the so far research, including those of Kondratieff―provided the proper time series are available. A similar contribution is the discovery that risk varies over various parts of one and the same time series. An indirect main contribution was―based on the last great capitalistic crisis at end 2008―the use of Chaotic, dynamic, and nonlinear tools including nonlinear forecasting, as a way to combat cycles; cycles that have flood capitalistic economies from today to tomorrow and in near and distant future…

Paper’s Limitations and Future Research Directions

Paper would be more proud if it could provide a full and convincing shipping secular waves theory, something, however, that even Kondratieff did not provide. Paper’s responsibility should be how to avoid cycles of whatever duration… Surely, a strong weapon against cycles is forecasting and forecasting in this paper was possible only for 20 years…

Cite this paper

Goulielmos, A.M. (2017) The “Kondratieff Cycles” in Shipping Economy since 1741 and till 2016. Modern Economy, 8, 308-332. https://doi.org/10.4236/me.2017.82022

References

- 1. Kondratieff, N. (1926) Die langen Wellen der Konjunktur. Archiv fur Sozialwissenschaft und Sozialpolitik, 56, 573-609.

- 2. Kondratieff, N. (1950) The Long Waves in Economic Life. Translated from Russian, Readings in Business Cycle Theory, American Economic Association’ Series, London.

- 3. Kondratieff, N. (1935) The Long Waves in Economic Life. Review of Economic Statistics, 17, 101-115.

https://doi.org/10.2307/1928486 - 4. Schumpeter, J.A. (1939) Business Cycles: A Theoretical, Historical and Statistical Analysis of the Capitalist Process, Abridged with an Introduction by R Fels. Porcupine Press, Philadelphia.

- 5. Pearce, D.W. (1992) Macmillan Dictionary of Modern Economics.

- 6. Cournot, A.A. (1927) Research into the Mathematical Principle of the Theory of wealth. Macmillan, New York.

- 7. Braudel, A.E. (1979) Civilization and Capitalism 15th-18th Century. Vol. 1-3, Collins, London.

- 8. Schumpeter, J.A. (1954) History of Economic Analysis. Allen & Unwin, London.

- 9. Hampton, M.J. (1990) Long and Short Shipping Cycles: The Rhythms and Psychology of Shipping Markets. A Cambridge Academy of Transport Monograph, 2nd Edition.

- 10. Goulielmos, A.M. (2013) Keynes Economics of Depression: The Shipping Industry as a Case-Study. Research in Economics and International Finance, 2, 13-28.

- 11. Stopford, M. (2009) Maritime Economics. 3rd Edition, Routledge, London.

https://doi.org/10.4324/9780203891742 - 12. Blaug, M. (1997) Economic Theory in Retrospect. 5th Edition, Cambridge University Press, Cambridge.

- 13. Logothetis, G. (2016) Is the Slow-Down of China’s Growth Incriminated for Shipping Crisis? Naftika Chronica.

- 14. Mandelbrot, B.B. and Hudson, R.L. (2004) The (Mis)Behavior of Markets: A Fractal View of Risk, Ruin, and Reward. Basic Books, New York.

- 15. Martin, S. (2010) Industrial Organization in Context. Oxford University Press, Oxford.

- 16. Marshall, A. (1920) Principles of Economics. MacMillan, London.

- 17. Robinson, J. (1960) Introduction to the Theory of Employment. Macmillan, London.

- 18. Sturmey, S. (1962) British Shipping & World Competition.

- 19. Mandelbrot, B.B. (1972) Statistical Methodology for Nonperiodic Cycles: From the Covariance to R/S Analysis. Annals of Economic and Social Measurement, 1, 259-290.

- 20. Siriopoulos, C. and Leontitsis, A. (2000) Chaos: Analysis and Forecasting of Time Series. Anikoula Editions, Salonica, Greek.

- 21. Einstein, A. (1905) With Reference to the Movement of Small Particles, Which Hover in Stagnant Liquids-By the Molecule/Kinetic Theory of Heat. Title Translated by Present Author Here from German, Annals of Physics No. 322.

- 22. Hurst, H.E. (1951) The Long-Term Storage Capacity of Reservoir. Transactions of the American Society of Civil Engineers 116, Paper 2447, Published in 1950 as Proceedings-Separate No. 11.

- 23. Moody, J. and Wu, L. (1996) Improved Estimates for Rescaled Range and Hurst Exponents. World Scientific, Singapore.

- 24. Hauser, M. (1997) Semiparametric and Nonparametric Testing for Long Memory: A Monte Carlo Study. Empirical Economics, 22, 247-271.

https://doi.org/10.1007/BF01205358 - 25. Peters, E.E. (1994) Fractal Market Analysis: Applying Chaos Theory to Investment & Economics. Wiley, Hoboken.

- 26. Grammenos, C. and Marcoulis, S.N. (1996) A Cross-Section Analysis of Stock Returns: The Case of Shipping Firms. Maritime Policy& Management, 23, 67-80.

https://doi.org/10.1080/03088839600000053 - 27. Kavussanos, M.G. and Marcoulis, S.N. (1998) Beta Comparisons across Industries—A Water Transportation Industry Perspective. Maritime Policy & Management, 25, 175-184.

https://doi.org/10.1080/03088839800000027 - 28. Steeb, W.-H. (2008; 2015) The Nonlinear Workbook. 4th Editions, World Scientific, Singapore.

- 29. Sugihara, G. and May, R. (1990) Nonlinear Forecasting as a Way of Distinguishing Chaos from Measurement Error in Time Series. Nature, 344, 734-741.

https://doi.org/10.1038/344734a0 - 30. Peters, E. (1991) Chaos and order in the Capital Markets. Wiley, Hoboken.

- 31. Lo, A. (1991) Long Term Memory in Stock Market Prices. Econometrica, 59, 1279-1313.

https://doi.org/10.2307/2938368 - 32. Mandelbrot, B.B. and Taqqu, M. (1979) Robust R/S Analysis of Long Run Serial Correlation. Bulletin of the International Statistical Institute, 48, 59-104.

- 33. Greene, M.T. and Fielitz, B.D. (1977) Long Term Dependence in Common Stock Returns. Journal of Financial Economics, 4, 339-349.

https://doi.org/10.1016/0304-405X(77)90006-X

Appendix 1: (Based on: Steeb [28] ; Peters [25] ; Mandelbrot & Hudson [14] )

Hurst [22] working hard on a Nile river dam plan faced the 847-year record that the Egyptians have kept. Was it a random process? But the data did not represent a random structure and there was no correlation among observations. Hurst extended Einstein’s formula from R = kT1/2 to R/S = kTH, where R is the distance covered, k a constant, R/S the rescaled range (Range divided by standard deviation), T an index of time or time/number of observations and H the Hurst exponent [29] . The long memory is manifested when the value of the variable at a time is determined from the preceding values of the system belonging to a distant past. The long memory is found using the Rescaled Range Analysis (Peters, [25] [30] ); variations: see Hauser, [24] ; Lo, [31] ; Moody & Wu, [23] . Mandelbrot, [19] [32] , interpreted R/S economically and Greene & Fielitz [33] applied it first to Stock exchanges. Lo [31] applied R/S in the stock exchanges of London and New York for a period of 300 and 200 years and confirmed the existence of long term memory.

Appendix 2: (Based on Peters, [25] )

Define the sum Rn as that of a stable variable in a particular interval n and let R1 be the initial value, and then: Rn = R1*n1/α [1] . This means that the sum of n values scales as n1/α times the initial value. Take logs and solve for alpha: α = log n/logRn-logR1 [2] and α = logn/logR/S = 1/H given that [3] H = log R/S/log n and Rn-R1~R/S, so α = 1/H. The characteristic function (Mandelbrot and Hudson [14] of the L-stable formula is: log f (t) = iδt ? γ |t|α [1 + ιβ(t/|t|) tan(απ/2] [5] . This means that the L-stable probability distributions have 4 parameters-the key variables that decide what the final shape of the curve will be. These determine whether we are describing a normal distribution, a Pareto style curve or something else.

(*) determines the magnitude of the probabilities overall; (**) if β = 0, we have a symmetrical curve; if α = 2 (and β = 0) the equation describes normal distribution; when α = 1 and β = 0, we have the Cauchy distribution with much fat in its tails. In our analysis above we found α to vary from ~2 to 1.46 since 1981 to 2015. As alpha as mentioned describes volatility, it is true that after the 1981-1987 depression in dry cargo sector and the end-2008 banking crisis, as well as the 2016 crisis in dry cargoes too, the industry became more volatile and more risky than used to be before 1982 and since 1741.

Appendix 3: Kernel Density Estimation Method―KDE

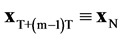

This method (bolds stand for vectors) in fact is a weighted average. For the last observation xT (which is defined by ), we choose the k nearest neighbors xj, where j = 1(1)k. We use the Euclidean norm. In the distances (ri) involved we add a weight of

), we choose the k nearest neighbors xj, where j = 1(1)k. We use the Euclidean norm. In the distances (ri) involved we add a weight of , where c is the mean of ri or any other weight, which decays fast to 0+ as the distance increases. The weights are so selected so that

, where c is the mean of ri or any other weight, which decays fast to 0+ as the distance increases. The weights are so selected so that ,

,

Appendix 4: Normal Distribution

The freight rate index 1741-2015, has a mean of 143.47 units and a standard deviation 102.31, median 115; also 25 outliers (right graph); 42 units is the minimum value and 795 units is the maximum value. The histogram of the index is shown below, where a right fat tail is shown. The width of the bins determined at 50 years. The spike is in 51 - 100 units with 38% of all observations, but not at 143.5 units (=mean) as it should. The curve is not symmetrical with a positive skew. The Pearson coefficient of skewness is found at 0.83 > 0. The mode is 58 units. The situation is as follows:

The values of the index extend to 7σ with 2.6% values there, away from 3σ.

Submit or recommend next manuscript to SCIRP and we will provide best service for you:

Accepting pre-submission inquiries through Email, Facebook, LinkedIn, Twitter, etc.

A wide selection of journals (inclusive of 9 subjects, more than 200 journals)

Providing 24-hour high-quality service

User-friendly online submission system

Fair and swift peer-review system

Efficient typesetting and proofreading procedure

Display of the result of downloads and visits, as well as the number of cited articles

Maximum dissemination of your research work

Submit your manuscript at: http://papersubmission.scirp.org/

Or contact me@scirp.org

NOTES

1Unknown year of death.

2Among writers there is no agreement of waves’ exact start or end. Schumpeter [4] placed the 21/2 “long waves” as: 1) 1787-18422 (55 years); coincidence with “American Revolution”; interrupted by “Napoleonic Wars”, (1893-1815), 2) 1843-1897 (54 years), characterized by the emergence of railways and “American Civil War”, and 3) 1893-1913 (20 years).

3Other chronological attempts classify long waves as follows: (1st) 1790-1815-1845 = 55 years; (2nd) 1845-1879-1895 = 50 years and (3rd) 1895-1918-1939 = 44 years; (4th) 1939-1966-1993 (54 years); (5th) 1993-2020-2047 (54 years/estimation).

41780s-1842 = 52 or 62 years.

51842-1897 = 55 years.

61898.

7This mistake of equal ups and downs is usually committed by all trade cycle analysts. But this is not confirmed by historical data or nonlinear statistical analysis. Good times are shorter. The reason remains to be explained. Why good times last less? Is this another weak point of capitalism?

8The recent action of OPEC―to reduce supply―will cause a rising in oil price no doubt given also the severe winter in 2016-2017.

9Kondratieff [2] “removed” shorter cycles―7 to 11 years, or even shorter, as well random fluctuations, from data―and smoothed secular trend using a 9-year moving average. He also divided annual figures by population.

10Kondratieff [2] encountered problems with the existence of appropriate data, (when no economic data existed before 1800). England and France had the most complete data and thus these were mainly used.

11The cycle was terminated by “Napoleonic Wars”. As argued, Mill J S (in Blaug, [12] ) was surprised by the growth of wealth during these wars.

12This was influenced by the “civil war” (1866) in America.

13Company research, YouGOV/Oct.-Nov. 2016.

14This means to bundle “non-marketable” assets (e.g. mortgaged loans) and sell them. Claims on those they owe (an asset), e.g. may be used by the banks as a marketable security sold at a discount and used to obtain finance…

15There is a need for cycle classification. 1) Very short cycles-VSC of up to 3 years (0 - 3); 2) Short cycles-SC of up to 10 years (4 - 10); 3) medium cycles-MLC of up to 20 years (11 - 20); 4) long waves-LW of up to 50 years (21 - 50) and 5) secular waves-SW of up to 100 years or over (51 years-).

16Their average duration is 10.54 years and the median 11.03 years.

17This war started in 01/11/1955 and ended in 30/04/1975.

18Moreover, the latest wars are: 1) the “Afghanistan War”, which started in end 2001 and drew down in 2011 for USA, and NATO (involved since 2003), but this had a rather long process of 3 - 4 years of a final ending, if such a war ever ends, and 2) the “Syrian war”, which started in 2011, after the “Arab Spring”, and which is still in progress. The cause of the first war is due to the attack of the 11/09 to the twin towers of USA.

19This was important for commercial advertisements.

20Published by Greek Ministry of shipping.

21As in Figure 5.

22The long wave superimposed on 4 shorter cycles of 10-11-16-20 years respectively, between 1743 and 1796 (Stopford [11] ).

23These are superimposed on 3 shorter cycles of 15 and 17 years respectively.

24Stopford [11] associated this with technology and global communications in 1865.

25This includes also the number of shipbuilders in the global economy and the average delivery time of a vessel. The average delivery time of a vessel depends on the waiting time for a berth due to a prior acute demand for ship space. Among nations there is always a dream to establish one or more national shipbuilding yards (e.g. USA, UK, Germany, France, Sweden, Japan first, Korea next, and China now). The 1981-1987―a 7 years depression―destroyed a great number of shipbuilding yards especially in Europe and Japan and as a result supply of newly-built ships became inelastic. Talking, however, about the average time of delivering a vessel, technology played a great role passing from rivets to electro-welding, from a single vessel construction to series and massive ship constructions, to stronger crane capacities, to robotics and to computerization in ship construction and design. Large ship sizes and complex designs, however, are negative factors for fast delivery. One may add the average speed of ships-which increased and the so called ship productivity, i.e. including distances, which shape supply. As mentioned by Stopford [11] 1 dwt of floating space can carry 7.3 tons of cargo each year by 2009. In 2015 the global fleet was 1.75 billion dwt or capable to carry 12.775 billion tons of cargo each year.

26The lows of these medium cycles (<20 years each) were 7, from 1741 to 1873, in a duration of 127 years, and the peaks were 7 (but <11 years each). Scrapping is a low process removing 1/3 of tonnage surplus.

27These are ships with no specific destination acting as the taxis of the oceans. Greeks excelled in this type.

28This long wave superimposed on 6 shorter cycles lasting 6-7-11-13 years respectively.

29It had 7 peaks till 1936.

30One reason for this depression is the oversupply of ships (1874); one peak occurred in 1871-1873, one in 1880-1882, one in 1887-1889, one in 1898-1900, a 5th in 1911-1913, a 6th in 1919-1920 and a 7th in 1926-1927.

31This was superimposed on 8 shorter medium cycles of between 3 years minimum and 15 years maximum.

3230 were in time charter contract in Jan. 2016 to VALE…

33Power of monopoly = freight rate minus marginal cost of vessel/freight rate.

34In shipping in almost all markets price or hire/freight rate is determined by supply and demand and is given for the individual shipowner. In other industries capitalism uses various tricks to boost price by differentiation, or make user to pay what he is willing to than not exercising his buying right.

35The equivalent of a flood may be either of 2 kinds; either a freight rate change-up (or -down) is taken by certain shipowners as a sign to ride and by some charterers a sign of catastrophe (and vice versa), Mandelbrot [19] . This is the tendency of persistent time series (0.50 < H ≤ 1.00) to have abrupt and discontinuous changes―unlike normal distribution―skipping freight rates either up or down. The term was coined by Mandelbrot from Biblical fact.

36This is the tendency of persistent time series (0.50 < H ≤ 1.00) to have trends and cycles. Again this is due to Mandelbrot, borrowed from Biblical fact.

37This is a computer program in MS-DOS with a code written in language C/C++ in 2000 with a compiler GNU CC 2.8.0/1998 in RHIDE 1.4 (1997) of 3.8 MB and it can get 16,384 observations. Found in Siriopoulos C & Leontitsis A [20] .

38Established by Prof. Mandelbrot B since 1964 and 1965, but it has been round for some time before, due to Ludwig Otto Holder―a pure mathematician.

39So, we have lost one observation and 8 due to 2nd World War.

40H is estimated from R/S = cNH; taking logs: log(R/S)N = log c + H log N, where log(c) is a constant, N is the number of observations of a sub-period and H the exponent Hurst, R is the range of the observations from max. to min. value and S is the local standard deviation. The strongest memory corresponds to N, where H maximum is found (N = 10 years in the case of the freight market 1741- 2015).

41See Moody-Wu [23] and Hauser M [24] .

42The q is a function of N and the autocorrelation coefficient.

43The values of alpha have been derived from the formula found in Peters [25] , where alpha = 1/H as shown in appendix 2.

44Grammenos & Marcoulis [26] ; Kavussanos and Marcoulis [27] .

451741 + 9 yearly observations ignored + 8 years lost for the 2nd World War + 224 years.

46This is what we doubt.

47Classical economists dreamed the capitalistic system as they liked it to be, i.e. savings ≡ investment; “people investing are those who save, and the rate of interest creates the equality between savings and investment”. This is why classical writers believed in full employment.

48Capitalism knowing the importance of savings uses “advertising” and “new products” to convince people to spend. Banks do the same by providing loans―easily―to those they want to spend for various purposes including acquiring a house. The whole process is one based on satisfying human unlimited needs with limited resources. Inflation, however, checks overspending and reduces demand to what is available. Having a free will in capitalism does not mean that there is a rationality too… This further means that capitalistic institutions (government, banks, stock exchange, control bodies) must be rational to avoid the creation of bubbles. The Greek GDP per capita e.g. fell from ~?2,000 in 2008 to 16,000 in 2016; ?0b hoarded; house prices rose by 170% (1999-2008); bank loans rose from ?8b to 225 (1999-2008); Growth financed by loans of ?00b…

49“Law of the sea” brings into economy/exploitation vast areas of sea under exclusive economic zones and continental shelfs. Oil is found in continental shelfs…

50This reminds us of “Marshallian economics” (Blaug, [12] ), where on the phase of decreasing cost industries, the elasticity of supply of a commodity, which conforms to the law of increasing returns… is theoretically ∞ for long periods. This implies that there are no limits to growth in the size of the firms at the expense of maintaining competition in industry…

51Stopford [11] recorded medium cycles lasting collectively 73 years (1947-2007-2016; we have added one for 2008-2016, which Stopford could not fill-in).

53This is different than beta.