Modern Economy

Vol. 3 No. 4 (2012) , Article ID: 21288 , 3 pages DOI:10.4236/me.2012.34059

The Return-Risk Performance* ——The Comparison of Asset Portfolio Performance of Institution Fund with That Based on Multifractal Detrended Fluctuation Approach

1Department of Information Management & Technology, Sichuan Tourism College, Chengdu, China

2School of Management and Economics, UESTC, Chengdu, China

3School of Computer Science, UESTC, Chengdu, China

Email: wxb_sc@hotmail.com, kay_wh@163.com, zhouzf@uestc.edu.cn. zhanghuapz@hotmail.com

Received December 8, 2011; revised January 3, 2012; accepted March 3, 2012

Keywords: Multifractal detrended Fluctuation; Asset allocation; Institution fund

ABSTRACT

In this paper, we compare the portfolio allocation model of multifractal detrended Fluctuation approach with the modern efficient frontier model and the asset allocation model from Chinese institution fund, the risk-return performance of the multifractal detrended Fluctuation turns out to be more optimal portfolio allocation than that from Chinese institution fund and the conclusions have implications for modern financial theory, it suggest that there is scope for more general multifractal portfolio selection models to be developed.

1. Introduction

Modern portfolio theory (MPT) usually be adopted to enable decision making for stock trading, the theory comes from 1952 Markowitz’s portfolio selection theory, the mean-variation model, which involves maximizing the portfolio return and minimizing the risk and feasible portfolio can be denotes by efficient frontier [1]. Based on that, many papers research on portfolio selection from different sides. Tang wengguang et al., present multiobjective programming model for asset portfolio selection, it’s a multi-objective programming model for the asset portfolio selection problem. They use the idea of fuzzy sets to set up membership function of the objective function for providing the satisfaction degree to the return and risk of the portfolio. [2] Kim Hin et al. show the examining fuzzy tactical asset allocation as an alternative to modern portfolio allocation [3], Raubenheimer H. et al. give a stochastic programming approach to managing liquid asset portfolio, they propose a multi-stage dynamic stochastic programming model for liquid asset portfolio management. The model allows for portfolio rebalancing decisions over a multi-period horizon, as well as for flexible risk management decisions [4], Xianli li et al. give the empirical research of stock selection and market timing of open-end securities investment funds in china under bull market, the research result shows that the most of open-end securities investment funds have some stock selection ability, but it isn’t notable in statistics; the most of open-end securities investment funds have some market timing ability; but it isn’t notable in statistics. [5] Muzy J.-F., Sornette D. D. et al. research on multifractal returns and hierarchical portfolio theory ,The multifractal description of asset fluctuations show that multifractal description is pertinent for financial modeling [6], Pantanella A. et al. presents minimum risk portfolios using MMAR [7], here we present portfolio selection based on multifractal detrended fluctuation approach, we minimize the risk measured by Hurst index got from multifractal detrended fluctuation approach to get the weights for each assets. We take Monte Carlo simulations to solve this asset portfolio problem [8] and it show more satisfied result for expected risk-return ratio than that disclosed by Chinese openend fund Chinaamc. And the result also better than that from modern efficient frontier mean-variance approach, so it suggest that there is scope for more general multifractal portfolio selection models to be developed.

2. Method

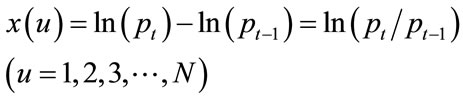

The multifractal detrended fluctuation analysis (MDFA) has been extensively used for many years (work by Stanley, Havlin, Bunde…). Therefore, we would like to provide a brief summary here. Use of the logarithmic unit for the price pt of stock share at time t is standard in such analysis. The price change from the previous close at a time step u is given by

(1)

(1)

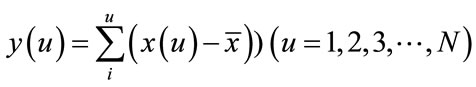

The running deviation in price change from a mean over an interval u is

(2)

(2)

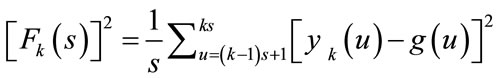

The length N of the time series is partitioned into n segments, each of length s, N = ns. A least square method can be used to identify trends in running deviation over each segment k by a polynomial g(u). The average fluctuation Fk(s) in each subregion k is

(3)

(3)

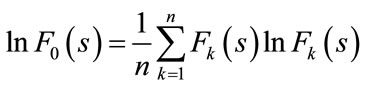

The average moment of the fluctuation of order q over n segments of the time series is

(4)

(4)

as

(5)

(5)

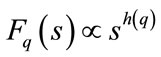

The power-law dependence of the q-th order moment of the fluctuation Fq(s) in interval s of the time series provides an estimate of the Hurst exponent h(q), i.e.,

(6)

(6)

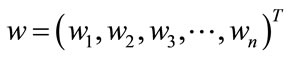

For a set of the available risky assets, a portfolio weights can be represented as a vector

(7)

(7)

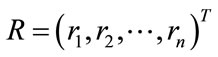

and

(8)

(8)

denotes the return for each asset in samples, R0 expected return for portfolio.

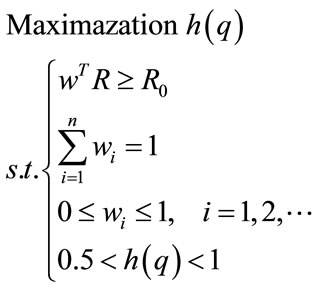

Optimized model

(9)

(9)

3. Data Analysis

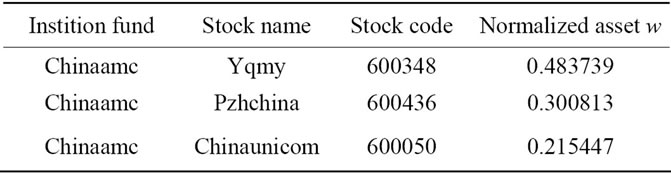

Sample data taken from portfolio allocation notice of Chinaamc in 2009.09.30. and historical data for correspondent portfolio asset comes from Csmar database . Hurst index was estimated from a Chinaamc close price data between 2008.01.01 to 2009.09.30. The top three position for Chinaamc is in Table 1.

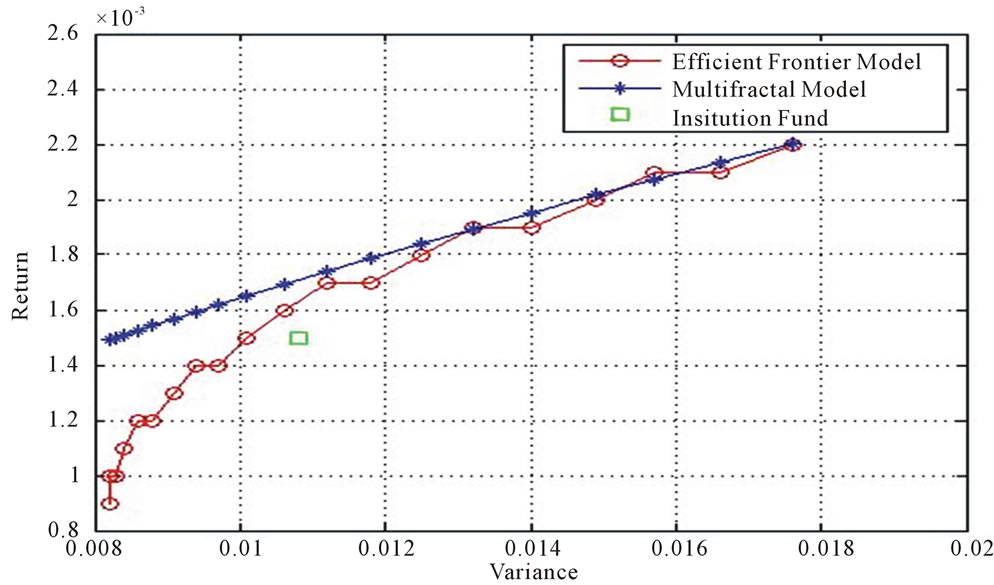

The return risk curve for Chinaamc show multifractal detrended Fluctuation approach better than that from modern efficient frontier theory, and also the result disclosed by Chinese institution fund Chinaamc. See Figure 1.

Table 1. Top 3 stock holding position for Chinese open-end fund Chinaamc company in 2009.9.30.

Figure 1. the return and variance curve for Chinaamc in three approach.

4. Summary and Conclusion

We developed technical to address the problem of portfolio selection under assumption of a multifractal market, we take the risk measurement hurst index h to get the asset allocation weights with Monte Carlo simulation, we do research on Chinese institution fund Chinaamc. The empirical result show the asset allocation performance of multifractal model have the advantage over that from efficient frontier theory and that disclosed by Chinaamc. So we think multifractal detrended trend approach may be an efficient approach for asset allocation in Chinese stock market. The conclusions have implications for modern financial theory, it suggest that there is scope for more general multifractal portfolio selection models to be developed.

REFERENCES

- R. Haugen, “Modern Investment Theory,” Prentice Hall, Saddle River, 1990.

- W. G. Tang and F. X. Zhao, “Multi-Objective Programming Model for Asset Portfolio Selection,” 2011 Fourth International Joint Conference on Computational Science and Optimization, Kunming & Lijing, 15-19 April 2011, pp. 455-457.

- K. Hin/D. Ho, E. C. M. Hui and H. Y. Su, “Examining Fuzzy Tactical Asset Allocation (FTAA) as an Alternative to Modern Portfolio Theory (MPT) Asset Allocation for International and Direct Real Estate Investment,” Journal of Financial Management of Property and Construction, Vol. 15, No. 1, 2010, pp. 71-94.

- H. Raubenheimer and M. F. Kruger, “A Stochastic Programming Approach to Managing Liquid Asset Portfolios,” Institute of Information Theory and Automation, Vol. 46, No. 3, 2010, pp. 536-547.

- X. L. Li and L. M. Xu, “The Empirical Research of Stock Selection and Market Timing of Open-End SecuritiesInvestment Funds in China under Bull Market,” The 2nd International Conference on Artificial Intelligence, Management Science and Electronic Commerce, Zhengzhou, 8-11 August 2011, pp. 6440-6443.

- J.-F. Muzy, D. Sornette, J. Delour and A. Arneodo, “Multifractal Returns and Hierarchical Portfolio Theory,” Quantitative Finance, Vol. 1, No. 1, 2001, pp. 131-148. doi:10.1080/713665541

- A. Pantanella and A. Pianese, “Minimum Risk Portfolios Using MMAR,” Proceedings of the 10th WSEAS International Conference on Mathematics and Computers in Business and Economics, Prague, 23-25 March 2009, pp. 64-71.

- A. K. Dixit, Optimization in Economic Theory,” Oxford University Press, Oxford, 1990

NOTES

*This research has been supported by National Natural Science Foundation of China (No. 70971015); the special research foundation of Ph.D. program of China (20110185110021).