Applied Mathematics

Vol.06 No.06(2015), Article ID:56933,13 pages

10.4236/am.2015.66094

A Multinomial Theorem for Hermite Polynomials and Financial Applications

Francois Buet-Golfouse

Department of Mathematics, Ecole Normale Superieure de Cachan, Cachan, France

Email: Francois.Buet-Golfouse@gmail.com

Copyright © 2015 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 2 April 2015; accepted 2 June 2015; published 5 June 2015

ABSTRACT

Different aspects of mathematical finance benefit from the use Hermite polynomials, and this is particularly the case where risk drivers have a Gaussian distribution. They support quick analytical methods which are computationally less cumbersome than a full-fledged Monte Carlo framework, both for pricing and risk management purposes. In this paper, we review key properties of Hermite polynomials before moving on to a multinomial expansion formula for Hermite polynomials, which is proved using basic methods and corrects a formulation that appeared before in the financial literature. We then use it to give a trivial proof of the Mehler formula. Finally, we apply it to no arbitrage pricing in a multi-factor model and determine the empirical futures price law of any linear combination of the underlying factors.

Keywords:

Hermite Polynomials, Multi-Factor Model, Hilbert Space, Mehler Formula

1. Introduction

Hermite polynomials are widely used in finance, for various purposes including option pricing and risk man- agement. Madan and Milne [1] have built a framework applying functional analysis results to the particular case of Hermite polynomials and inferred pricing formulas for general payoffs expressed as linear combinations of Hermite polynomials. They applied their framework to the simple case of calls to determine the implicit basis prices in the market data and imply an empirical futures price law. More recently, a series of papers have de- veloped closed-form series expansions for various models: Tanaka, Yamada and Watanabe [2] developed ap- proximations of the prices of some interest derivatives; Schloegl [3] adapted this type of expansions to multi- period models. On the other hand, Buet-Golfouse and Owen [4] , Voropaev [5] , and Owen et al. [6] applied the Mehler formula and multivariate Hermite expansions to the allocation of risk measures in a portfolio of financial instruments.

The aim of this paper is to derive a theoretical framework that underlies many usages of Hermite polynomials in finance. In particular, the first main result of this paper is to have established a link between the probability distribution of the underlying factor and the empirical prices of Hermite functions. The second main result is a multinomial expansion theorem for Hermite polynomials (and its extensions). Both provide a solid foundation to derive the no-arbitrage price of a contingent claim stemming from a linear combination of factors.

The article is organised as follows: in the first section we state some basic facts about univariate and multi- variate Hermite polynomials; the second section is devoted to the justification of expansions on the basis of Hermite functions and demonstrates the link between implicit prices of Hermite polynomials and the probability distribution of the underyling assets under the forward probability measure; the third section states and proves a multinomial theorem for Hermite polynomials with extensions and examples provided in the fourth and fifth sections; the sixth and final sections are dedicated to the application of the multinomial theorem for Hermite polynomials to pricing under no-arbitrage. Finally, empirical applications of the described methodology can be found in [4] and [6] .

2. A Few Facts about Hermite Polynomials

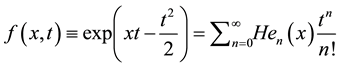

Our objective is not to give a full account of the literature on Hermite polynomials but simply to recall some definitions and properties (see Abramovitz and Stegun [7] for more information). Let  be the standard normal density and

be the standard normal density and  be the

be the  Hermite polynomial satisfying

Hermite polynomial satisfying  and for any

and for any ,

,

. An alternative definition is via the exponential generating function

. An alternative definition is via the exponential generating function

.

.

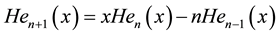

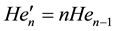

The two most important properties are the recurrence relationship and the orthogonality property. The re- currence relationship states that ,

, :

:

(1)

(1)

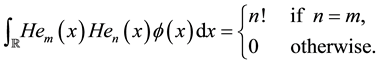

and , whilst the orthogonality property states that for all

, whilst the orthogonality property states that for all

(2)

(2)

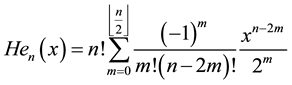

Explicit and inverse explicit expressions are available for Hermite polynomials: for all  and

and , the following identities hold:

, the following identities hold:

N-multivariate Hermite polynomials are usually defined as the product of N univariate Hermite polynomials. Let us first clarify some notations used in the rest of the paper:

The orthogonality property can readily be adapted to the multivariate case component by component:

Let us now consider the Hilbert space

An orthonormal basis

functions”)

Using standard arguments in functional analysis, an arbitrary claim

where the coefficients

To summarise, we have built an orthonormal basis in which to decompose functions that are square-integrable against the standard N-dimensional Gaussian distribution

but have actually made no assumption on the distribution of the vector of factors

3. Implied Prices and Probability Distributions

In this section, we demonstrate the link between two notions that are used separately in the literature: the implicit prices of Hermite polynomials (as in Madan and Milne (1994), where the payoff is expanded in Hermite polynomials) and the risk-neutral distribution of the vector of factors

We consider a financial market on a period

Proposition 1. A self-financing strategy is admissible if its terminal value is a random variable whose second moment is well-defined (i.e., it is square-integrable), a contingent claim is attainable if there exists a self- financing strategy whose terminal value is equal to the contingent claim almost surely (in particular, it has to be square integrable), and the market is complete if all contingent claims are attainable. A system of prices V is an application from the set of contingent claims to

From now on, we assume the market to be complete and to satisfy the no arbitrage condition and consider

If

ing that

to express the contingent claim

with

Theorem 1. Under the assumption that V is continuous there exists a unique

Proof. We already know that V is a linear form on

can infer the existence of a unique

We now turn to the probability density function

so that, finally, we have

Definition 1. Under the same assumptions,

The meaning of the futures price law can be derived as follows: rewriting

it becomes clear that

Theorem 2. The following statements are equivalent:

i) There exists a sequence

ii)

iii) There exists a sequence

Remark 1. This result is a slightly different view of Madan and Milne’s Theorem 4.1 [1] because our set of assumptions is minimal and it was derived following the path of the Riesz representation formula. In particular Madan and Milne’s assumption that

Proof. Clearly, ii) implies iii). To prove that iii) implies ii), we apply Lemma 5.1. in Ch. 5 of Brezis [9] : the

sequence

so that

Then, noting

It now remains to prove that i) is equivalent to iii). iii) implies i) is a simple consequence of the inner product in a Hilbert space:

Starting from i), we have that

for any contingent claim

This theorem thus shows that under mild conditions (i.e. that the probability

where r is the risk-free rate.

Introducing the risk-neutral T-forward measure

where

that if r is assumed to be bounded, then

under either probability measure. As in Tanaka et al. [2] , the assumption is made that the probability distribution g of

A sufficient and necessary condition for g to be a valid density function is to have

・

・ and

Schloegl [3] discusses ways to ensure that the second condition is met in practice when the summation is taken over a finite number of Hermite functions. Now, using the pricing formula under the T-forward measure

When the various assumptions of the theorems above are verified, it comes

whence the following theorem linking the futures price law and the T-forward probability density function of the factors holds.

Theorem 3. The implied prices

for all

A direct application of this theorem is the determination of price elements

Lemma 1. Let

Proof. It suffices to use the explicit and inverse explicit formulas and perform some simple algebra to obtain both results. □

Since in the financial framework considered so far

implied from the prices of the orthonormal basis

4. Factor Models and the Hermite Multinomial Theorem

Considering several factors at the same time and linear combinations of those is at the core of many financial models: Fama and French’s three-factor model for asset returns, Brennan and Schwarz’ two-factor model, Lang- estieg’s multi-factor model for interest rates or the multi-factor Merton-Vasicek model for example. Supposing that we have a financial instrument depending on a linear combination

Let us start by considering the example of a two-factor model, i.e.

Let us now compute separately:

Hence, in the case where

The condition

Theorem 4. Let

Remark 2. The theorem can be restated in a more condensed form and in terms of Hermite functions as

We offer two proofs of the result, one based on the repeated application of the recursion property (see the Appendix) and the other on the generating function of Hermite polynomials to show how powerful and different these two tools are for analysing relationships involving Hermite polynomials. They offer different insights in the manipulation of Hermite polynomials and are a good exercise for the reader.

Let us now move to a demonstration based on the exponential generating function.

Proof. We have that

Hence, comparing the first and the last lines of this equation we must have

which yields the result. □

To show how powerful this simple tool is, we provide some direct extensions and examples in the next two sections.

5. Two Extensions of the Multinomial Theorem

It is possible to easily extend this result to multivariate Hermite polynomials and to weights which do not re- spect the factor loading condition.

Looking first at the case of multivariate Hermite polynomials, the idea is to consider a linear combination of

multivariate factors

Theorem 5. Let

with

Proof. It suffices to apply the multinomial theorem for Hermite polynomials to each of the univariate Hermite

polynomials

Another extension, perhaps more important for practitioners, is to consider the case where the factor loading condition is not verified. For the sake of simplicity, let us go back to the univariate case and suppose that

Theorem 6. Under the assumption that

In the proof, we make use of the following lemma from Schloegl (2013) [3] :

Lemma 2. Let

Proof. (Of the theorem) We can rewrite

We derive the following equality from the intermediary lemma:

□

Remark 3. In the same vein, it is also possible to infer a similar but even more general result for

where

6. Revisiting the Orthogonality Property and the Mehler Formula

Let us revisit the orthogonality property, but this time in presence of correlation. Our aim is to compute

Theorem 7. For any

with

Proof. Another way of expressing this double integral is to write it as

Using the binomial formula, which is a particular case of the multinomial formula that we have proved, we have

Thus,

The “correlated orthogonality” property has been proved. □

Based on this simple observation, a simple and elegant proof of the Mehler formula can be given:

Corollary 1. (Mehler formula) The bivariate normal probability density function

Proof. It suffices to expand

and use the correlated orthogonality property. □

The Mehler formula is of special importance since it can be used as a foundation in credit-risk modelling, as in Voropaev [5] , to compute the expected value of a portfolio V of K financial instruments

Thus,

where we have defined

terms of Y and

7. The Multinomial Factorisation Theorem and Arbitrage

Going back to our framework where the market has no arbitrage and is complete, we wish to determine the relationship between the implied prices of the basis and those of a linear combination of the underlying factors. To make things clearer suppose that we are looking at a payoff

which can be restated in terms of Hermite functions as

On the one hand, we have the basis of Hermite functions to expand the payoff

where

On the other hand, we can express the payoff

where

Since

where

Thanks to the multinomial factorisation, we have that

By identifying terms in this multivariate polynomial function, we obtain

Turning to the prices, we see that

On the other hand, we have that

and infer the theorem:

Theorem 8. Since the function

Proof. We have shown that

Indeed, suppose that there exists

duplicated payoff at price

Since the payoffs

To summarise, we have shown that it was possible to express explicitly the coefficients

Theorem 9. We have determined the futures price law density of

8. Concluding Remarks

This paper proposes a simple way of expanding the Hermite polynomial of a linear combination of factors into simpler elements. This method allows us to prove the celebrated Mehler formula in a very simple way, but also enables us to derive the empirical prices of functions of linear combination of factors in a market with no arbi- trage and facilitates credit risk modelling. Practical illustrations of the theoretical framework developed in this paper can be found in [2] - [6] . We have built on the theory developed by Madan and Milne and highlighted the relationship that existed between their results and other recent results obtained in the field of pricing. Using a multinomial theorem for Hermite polynomials, we have shown how to tackle expressions including more than one factor.

The main assumption made throughout the paper is the existence of a payoff’s or probability density func- tion’s expansion in the basis of Hermite polynomials. Although this is quite restrictive (it implies the existence of all moments in the latter case for instance), it does allow for significant deviations from the benchmark case of standard Gaussian distributions. The computational approach at hand indeed permits to only consider a series of simple computations rather than a difficult and time consuming one. It offers a practical analytical alternative to full-fledged Monte Carlo simulations.

Acknowledgements

The author would like to thank Anthony Owen and James Bryers for initiating this work on the use of Hermite polynomials in finance and their insightful remarks. Thanks also go to Li Shanqiu and to two anonymous referees for their helpful comments.

References

- Madan, D. and Milne, F. (1994) Contingent Claims Valued and Hedged by Pricing and Investing in a Basis. Mathematical Finance, 4, 223-245. http://dx.doi.org/10.1111/j.1467-9965.1994.tb00093.x

- Tanaka, K., Yamada, T. and Watanabe, T. (2010) Applications of Gram-Charlier Expansion and Bond Moments for Pricing of Interest Rates and Credit Risk. Quantitative Finance, 10, 645-662. http://dx.doi.org/10.1080/14697680903193371

- Schloegl, E. (2013) Option Pricing Where the Underlying Assets Follow a Gram/Charlier Density of Arbitrary Order. Journal of Economic Dynamics and Control, 37, 611-632. http://dx.doi.org/10.1016/j.jedc.2012.10.001

- Buet-Golfouse, F. and Owen, A. (2015) The Application of Hermite Polynomials to Risk Allocation. Barclays Quantitative Credit, Working Paper.

- Voropaev, M. (2011) An Analytical Framework for Credit Portfolio Risk Measures. Risk, November, 72-78.

- Owen, A., Bryers, J. and Buet-Golfouse, F. (2015) Hermite Polynomial Approximations in Credit Risk Modelling with PD-LGD Correlation. Journal of Credit Risk, Accepted Paper.

- Abramowitz, M. and Stegun, I. (1964) Handbook of Mathematical Functions. Dover Publications, New York.

- Portait, R. and Poncet, P. (2009) Finance de marche. 2nd Edition, Dalloz, Paris.

- Brezis, H. (2011) Functional Analysis, Sobolev Spaces and Partial Differential Equations. Springer, New York.

Appendix

In this appendix we give an alternative proof of the multivariate theorem for Hermite polynomials

Proof. The cases

Using the recurrence formula

we can write that

We can split the above expressions into the three pieces:

Our aim is to demonstrate

We start by proving

Turning to

Similarly, in

Finally, the result has been proved. □