Technology and Investment

Vol.3 No.3(2012), Article ID:22084,6 pages DOI:10.4236/ti.2012.33026

Research on Influence of Manager’s Innovation Preference on Innovation-Decision Making

1University of Electronic Science and Technology of China, Chengdu, China

2Technology and Business College of Sichuan, Dujiangyan, China

Email: free620@sohu.com

Received May 25, 2012; revised June 26, 2012; accepted July 3, 2012

Keywords: Innovation Preference; Principal-Agent Model; Disruptive Innovation; Profits from Innovation

ABSTRACT

It is one of the key factors which cause “innovation dilemma” that managers prefer to support the sustaining innovation project. From the view of the manager’s innovation preference, the main propose of the paper is to study why it happened. The manager’s innovation preference will guide and motivate the staffs how to innovate, therefore it is appropriate to analyze it by using the principal agent theory. Conclusions can be got by establishing and analyzing a multi-task principal-agent model. First of all, the model basically explains why incumbent enterprises prefer adopting sustaining innovation and entrant enterprises are inclined to disruptive innovation project. Secondly, the selection rights of middle managers towards innovation projects determine the strategic direction of enterprises. Manager’s innovation preference is consistent with the innovation types of employees. At last, the paper suggests that incumbent enterprises should indeed establish self-organizations or spin-off organizations to better carry out disruptive business.

1. Introduction

When a manager faces multiple ideas, he definitely needs choose some of them and then turn them into formal innovation projects. Because the resources are limited, in practice, middle managers are usually responsible for doing these works, and then the result will be delivered to senior managers after selection. Generally, middle managers will subconsciously avoid proposing an idea which may not be approved by top manager. Obviously the top manager’s innovation preference is on behalf of an enterprise’s innovative strategy. So if the middle manager’s innovation preference is consistent with top manager That is to say, when middle managers can determine which project can become formal innovative project with strategic value to enterprise, to some extent, the middle managers guide the strategic direction of the enterprise.

Over the years, the middle managers haven’t got enough attention on enterprise innovation. Nanaka (1995) sharply points out that middle managers should never be “disappearing level”, they are the intersection of vertical and horizontal information flows and of great significance in the process of organizing knowledge creation [1]. Christensen (2003) also agrees that middle managers play a key role in creativity stereo-type process [2]. From the perspective of disruptive innovation, the innovation strategy of enterprise which focuses on the core business that enterprise input all resources support, is called sustaining innovation strategy, instead of targeting at consumers of the main market, disruptive innovation strategy is more inclined to new consumption market or even low consumption market. Why incumbent enterprises prefer sustaining innovation compared with disruptive innovation favored by new enterprises? Some scholars argued that the reason is incumbent enterprises have formed a relatively stable core conventional business, which has a competitive advantage, especially core competitive advantage [3], their managers need to pay more attention to maintain it [4]. The sustaining innovation strategy aiming at core customers and because sustaining innovation won’t change the existing value net-works of the enterprise, therefore its risks are relatively controllable and profits predictable. Thus, incumbent enterprises prefer supporting sustaining innovation projects. Comparatively, entrant enterprises haven’t formed their core business. The limited profits from core business push them to encourage innovation. Under the circumstances of opening creative minds and tolerant for failure, the idea proposed by employees to face new consumption market or even low consumption market will easily be adopted. That is to say, the distinguished features of diverse enterprises determine that the middle managers in incumbent enterprises prefer sustaining innovation projects, and the managers of entrant enterprises like disruptive innovation projects.

Core advantage often means “core rigidity” [5]. Under the guidance of sustaining innovation strategy, an enterprise’s innovations focus on high-end market, thus innovation consequence may be highly concentrated on specific areas. The innovation scope seems too narrow in the technological era, which is a sign of lacking innovations in essence. Christensen (2003) thought that the overemphasis on core customers would probably result in the ignorance of disruptive opportunities. When the products performance overshoots over time, core customers would be reluctant to pay for the performance premium. On the other hand, in the early stage, although the produce of entrant enterprises could not meet the requests of core customers, they keep improving products performance and ultimately deprive market of incumbent enterprise. This is the key reason why some enterprises run well and allocate resources with profits maximization theory but still lost market competitiveness.

In reality, the managers in incumbent enterprises have negative attitude towards even oppose the disruptive innovation projects innately, which results in strategic failures, such as Kodak bankruptcy. Kodak devoted itself to various imaging technique researches and was equipped with strong ability to develop and promote various imaging techniques, but the vast resources put in core film business by managers results in the unfavorable position of digital imaging techniques research and promotion. As a consequence, when a series of digital products appear in the market, Kodak declined rapidly, ending up with bankruptcy.

The structure of this paper is: After introduction, from the view of the innovation preference of middle managers, a principal-agent model will be established, then comparative static analysis would be done. After that, the author thinks that further discussions are necessary based on human capital theory and dynamic capability. The last is the section of conclusions.

2. Hypothesis and Solution of the Model

The paper names sustaining innovation activity and disruptive innovation activity as conventional business and innovative business. It assumes that the choices of middle managers towards innovative projects are consistent with those of supreme decision-making level. Managers are principals and employees are agents. Under the standard principal-agent model, agents have two specific tasks: conventional task and innovative task. The following hypothesis can be got based on the above analysis. Firstly, the standard multi-task principal-agent model assumes that principal and agent sign a contract based on performance: S = α + β1x1, α represents the fixed salary of agent; β1 represents the sharing coefficient produced by the accomplishment of the conventional task or incentive factor given by principal to agent, x1 is the output that can be confirmed. Then x1 = e1 + ε1, e1 shows the efforts agent spends in finishing conventional task, ε1 is random variable which is independent from the efforts of the agent ε1 → (0, σ2). Both principal and agent are riskneutral, the reservation utility of agent is zero. Further hypotheses on this basis:

Hypothesis 1 Assume that the principal innovation preference is continuous and represented by parameter k (0 < k ≤ 1). The principal is reluctant to invest resources in developing innovation products when k is large, and willing to put existing resources into core business. The principal is cautious when get involved in new business, thus those ideas concerned with traditional core business are more easily get support from principal, using existing resources and knowledge to finish conventional core business. The sense of innovation of the principal is stronger when k is smaller. The principal supports noncore business ideas, having strong desire to explore new market, motivating agent to use new knowledge and paying more attention to the expected profits from the accomplished innovative tasks.

Hypothesis 2 Principal and agent are players in a game, the time sequence of the game is: the first stage, principal has innovation preference, which is reflected on the expected profits of the principal. Then there is an explicit incentive contract, focusing on conventional task, between principal and agent. The second stage, agent has an idea of facing new market and exploring new customers, principal considers whether to change the idea into a formal innovative project according to his own orientation. The support of the principal means that agent has to decentralize efforts to improve the innovation idea under the premise of having original schedule tasks. Thus, the choice of the principal would lead the energy allocation of the agent. The third stage, according to the performance signal, principal pays salary to the agent according to the contract. If there are innovation achievements, the two parties proportionally allocate them according to the innovation value.

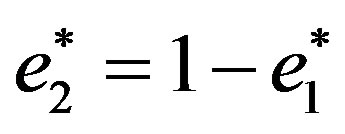

Hypothesis 3 Changing innovative idea into an innovation achievement needs agent’s efforts, innovative efforts, represented by e2, unit effort cost is c2, and e1 is conventional effort, the corresponding unit effort cost is c1, and e1 + e2 = 1. If principal wants to put his idea to practice, he must face the choice between innovative effort and conventional effort. When agent implements e2 and gets innovative achievement, the achievement value is: μe2, m represents the innovative ability parameter (0 ≤ μ ≤ 1), or marginal output of the innovative efforts. The results can be observed, but cannot be confirmed by the third party. The allocation ratio is λ (0 ≤ λ ≤ 1). Then the expected innovative profits of principal and agent are λμe2 and (1 – λ)μe2 respectively.

Hypothesis 1 is the central hypothesis of this article. Hypotheses 2 and 3 are about innovation achievement sharing, Aghion and Tirole (1994) assume that there can be renegotiation after innovation achievement [6]. The result of the renegotiation can be a Nash Equilibrium Solution. In the case of repeated game, agents can perform a ruthless strategy to ensure negotiations. The negotiating capacity of the agent is determined by whether the essential human resource capital is general or specific. Base on this, from the view of the appropriable ability of innovation, (Helleman 2011) studies the incentive problem [7].

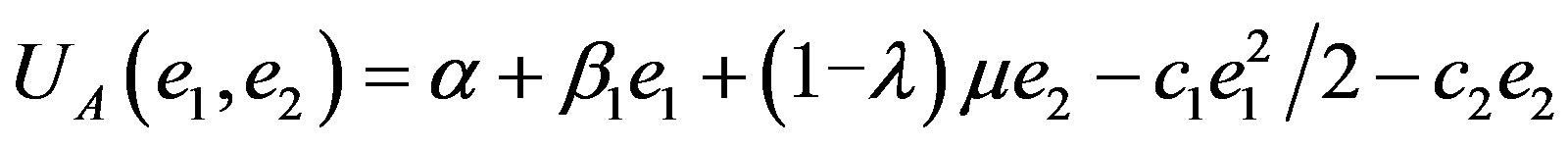

Under the above hypotheses, the profits of agent’s conventional efforts and innovative efforts are α + β1e1 and (1 – λ)μe2 the efforts are , c2e2 respectively. The agent’s certain earning in the third stage is

, c2e2 respectively. The agent’s certain earning in the third stage is

(1)

(1)

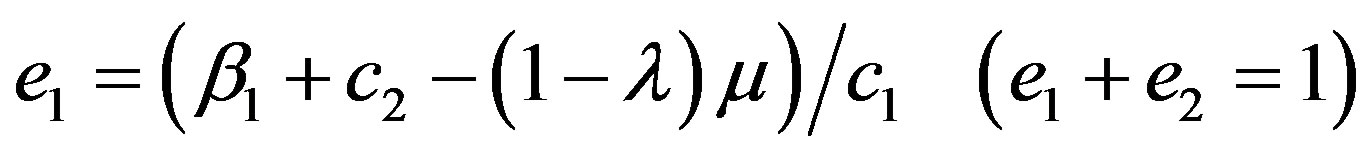

The derivation of UA(e1, e2) to e1:

(2)

(2)

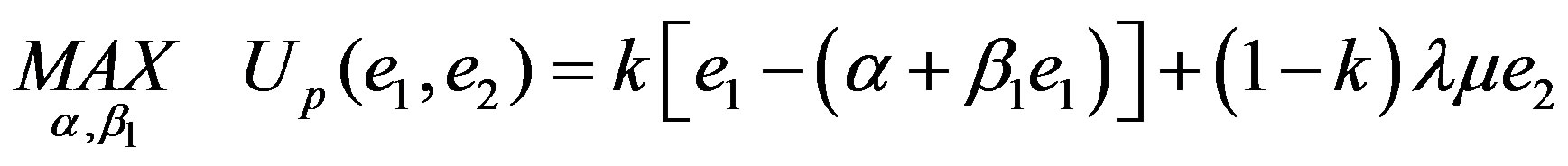

Under the previous circumstances, take principal’s innovation preference into consideration and combine agent’s incentive constraints and participation constraints, the expected profits of the principal in the second stage is:

(3)

(3)

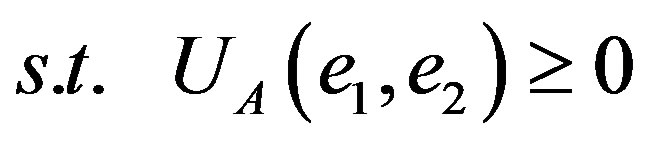

(IR)

(IR)

(IC)

(IC)

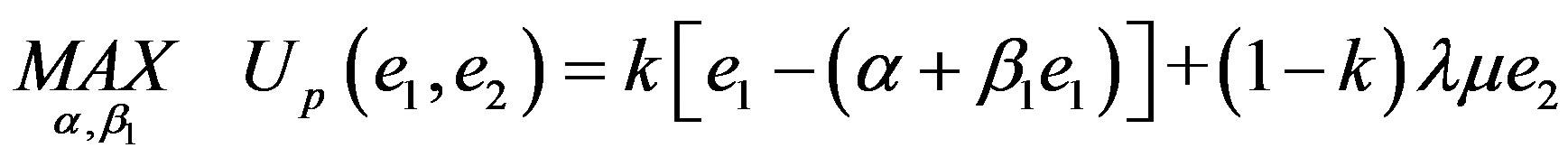

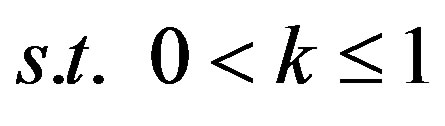

The principal’s decision in the first stage is:

(4)

(4)

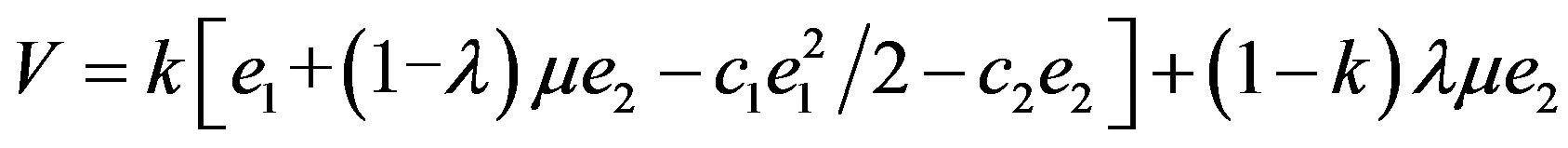

We can assume that V stands for total certain earnings, put IR into the objective function:

(5)

(5)

Then put IC into the objective function, and the derivation is:

(6)

(6)

(7)

(7)

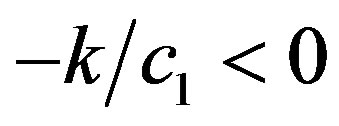

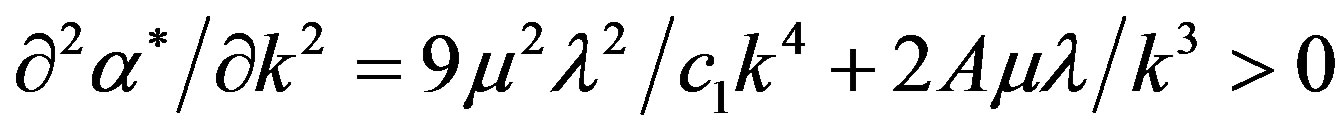

After simple calculation, from the principal’s objective function, we can get that the second derivative of β1 is , and the second order derivative of e1, e2 is –c1 < 0. Thus, the objective function V of principal is the strictly concave function of β1, e1, e2.

, and the second order derivative of e1, e2 is –c1 < 0. Thus, the objective function V of principal is the strictly concave function of β1, e1, e2.

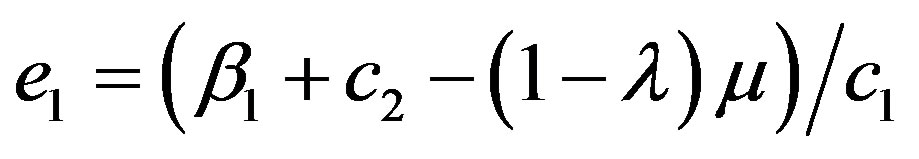

Then put (6) into IC, effort level can be got under equilibrium situation:

(8)

(8)

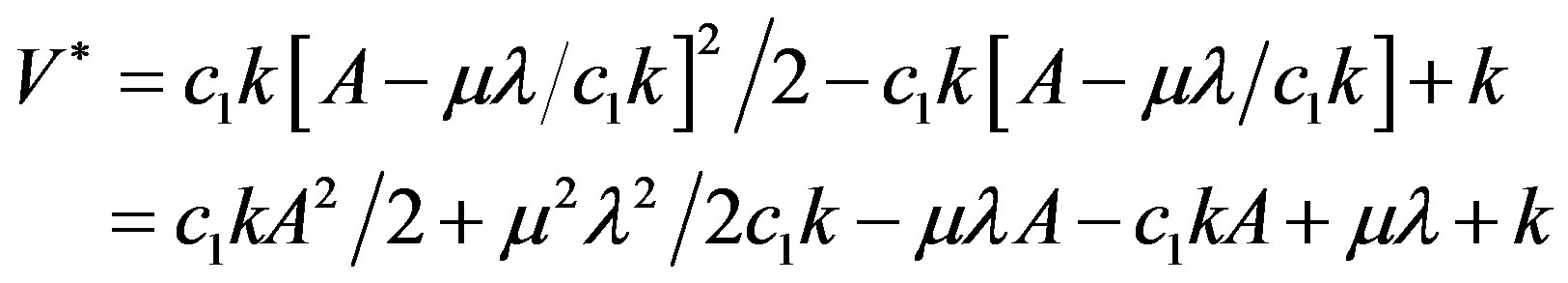

. Put (6), (7) into (5), explicit function of V can be got:

. Put (6), (7) into (5), explicit function of V can be got:

(9)

(9)

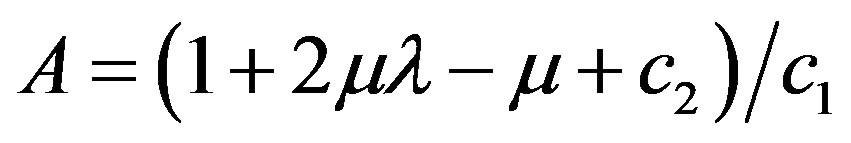

Here assume .

.

3. The Model Analysis

3.1. Analysis on the Influence of Principal’s Innovation Preference on Innovation Decision Making

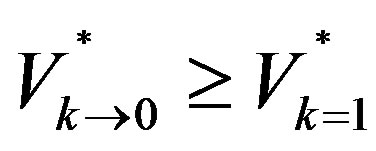

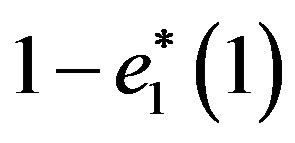

Proposition 1 Under the previous hypotheses, in the first stage of the game, principal can choose to support traditional innovation, principal pays attention to the profits brought by conventional task (k → 1). He can also choose those innovations facing new market and customers, that is to say, principal focuses on the profits brought by innovative task (k → 0). Under the equilibrium, the optimal value of objective function was got at the peak (k → 0 or k = 1). Besides, the target expected profits of innovative task efforts are higher than those of conventional efforts .

.

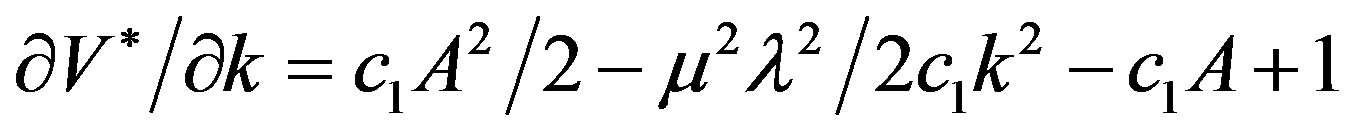

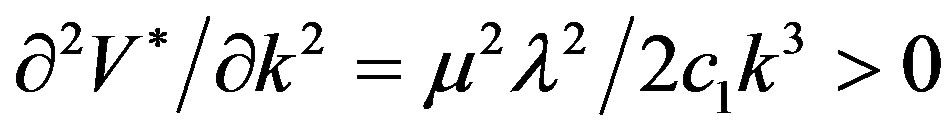

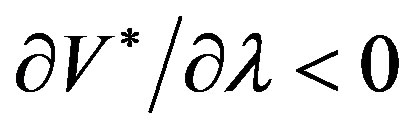

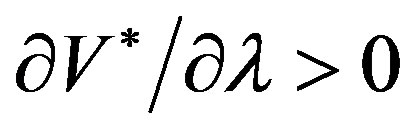

Proof: Using (8) to get the derivation:

, so

, so

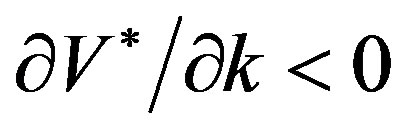

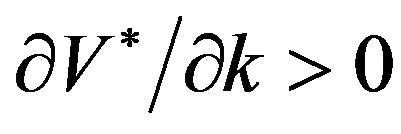

So V* is a strictly concave function of k. That is to say, the optimal value of the objective function can be got at the peak point. Where exists a k*, when k* > k, ; when k* < k,

; when k* < k, .

.

This means that preference coefficient (k) will enter the upward moving channel (k → 1), the principal tends to support the tasks related with traditional core business. When k* > k, the preference coefficient (k) will enter the downward moving channel, the principal tends to focus on innovations facing new market and customers; he cares about the profits brought by new innovation tasks. From (5) we can know that this task is risky and at the expense of losing traditional business profits.

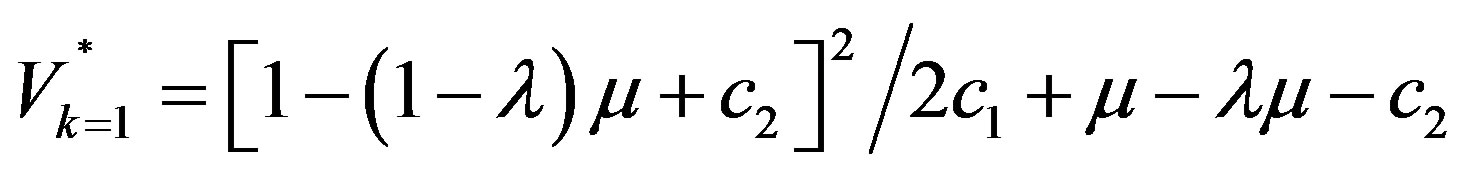

At last, when k = 1, the objective function is:

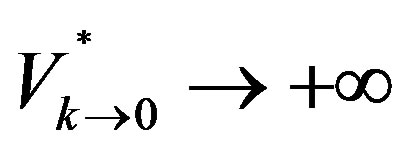

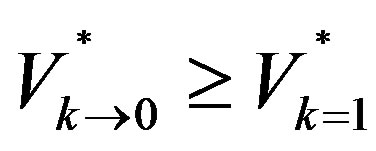

Similarly, when k → 0, the objective function is:

From the assumption c1, μ > 0, if λ ≠ 0, then , thus

, thus .

.

Proposition 1 points out that the principal is not quite willing to innovate new business under certain circumstances (k* < k), he likes to use the existing knowledge and experience to engage in less risky innovation. When (k* > k), the innovation is risky because the innovation result is uncertain.

Under the condition that innovation preferences of principal and enterprise are consistent, when k = 1, the principal type is named the optimal enterprise which allocates resources according to profits maximization [8]. When conventional core business relatively stabilizes, enterprise naturally orients its resources on conventional core business, which is reflected by k = 1. As to innovative strategies, the optimal enterprise also innovates and chooses conservative strategies. When k → 0, the principal type is called innovative enterprise, which focuses on the development opportunities in the future and stands for the profits loss in short period, motivating innovation and tolerating failure. In reality, the entrant enterprise hasn’t founded any core business, the profits from which are limited. Thus, encouraging staff innovation can bring more profits and aggressive innovative strategy is more likely to be adopted, such as disruptive innovation. k → 0 reflects this feature of newly established enterprise. The value of the innovation preference (k) proves that traditional incumbent enterprises like to focus on conventional core business, while newly established enterprise is willing to allot no effort in innovation business. From , we can know that the innovation which faces new market will be more risky, but it can bring more profits once it succeeds. This can briefly explain one question in disruptive innovation theory: why incumbent enterprise likes sustaining innovation, and why entrant enterprise prefers disruptive innovation. The lower the innovation preference is, the more the principal is willing to maintain core customers, which can be regarded as sustaining innovative strategy. The higher the innovation preference is, the more the principal is willing to adopt the innovative strategy facing new market and customers, which can be considered as disruptive strategy. As a principal, the innovative preference of middle managers influences the innovation decision-making and finally affects the strategic direction of the enterprise.

, we can know that the innovation which faces new market will be more risky, but it can bring more profits once it succeeds. This can briefly explain one question in disruptive innovation theory: why incumbent enterprise likes sustaining innovation, and why entrant enterprise prefers disruptive innovation. The lower the innovation preference is, the more the principal is willing to maintain core customers, which can be regarded as sustaining innovative strategy. The higher the innovation preference is, the more the principal is willing to adopt the innovative strategy facing new market and customers, which can be considered as disruptive strategy. As a principal, the innovative preference of middle managers influences the innovation decision-making and finally affects the strategic direction of the enterprise.

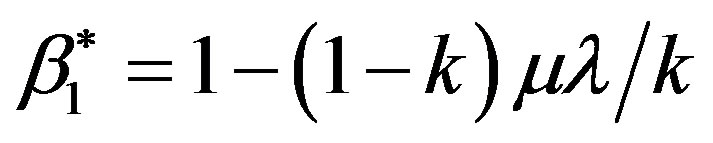

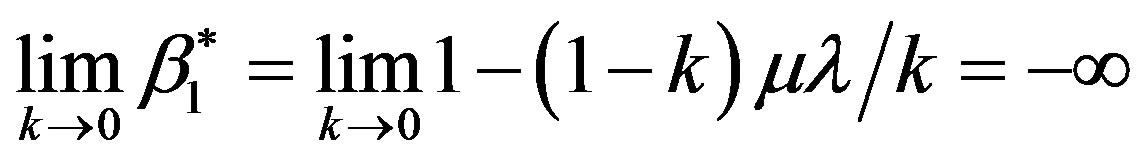

Proposition 2 Suppose all the other parameters unchanged under the previous assumption, when the preference coefficient (k) enters the upward channel (k → 1) the motivation of conventional business will be strengthened. The principal’s innovative efforts will decrease continuously if he gets less encouragement. On the contrary, the energy spent on conventional business will increase. When the principal totally tolerates innovation (k → 0), the optimal dominant performance motivation coefficient is negative, and the agent will assign no effort in innovative business. When the principal cannot tolerate the innovation of the agent (k = 1), the optimal dominant performance coefficient reaches the maximum, thus attracting agent to devote more in traditional core business.

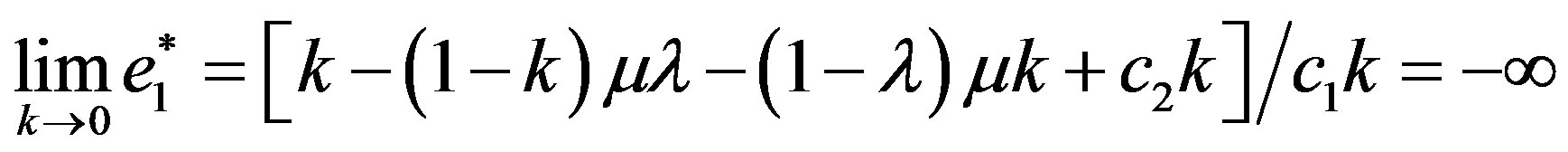

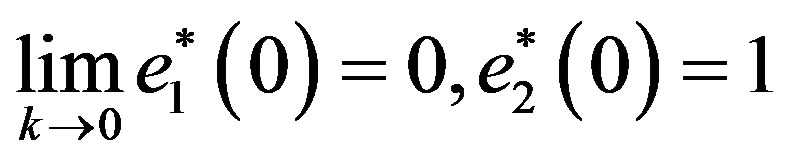

Proof: From (6), we can know that k is an increasing function of . When k → 0,

. When k → 0,

.

.

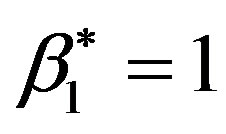

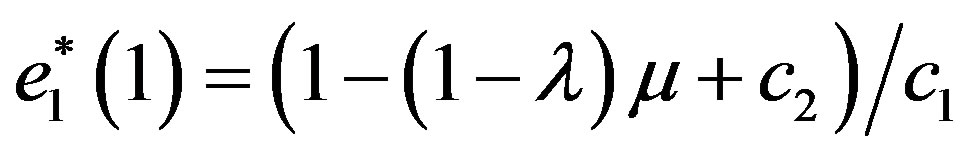

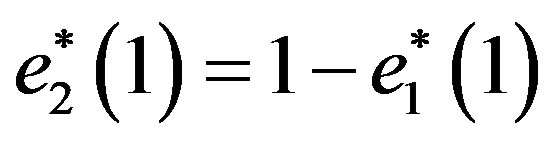

And when k = 1, . From (7), when k = 1,

. From (7), when k = 1,

,

,  when k → 0,

when k → 0,

from the assumption e1 ≥ 0, so

from the assumption e1 ≥ 0, so

.

.

The proposition 2 points out that when the principal’s innovative intention is weak (k → 0), its incentive towards traditional business is bigger compared with strong (k → 0). The combination of proposition 1 and 2 shows when the principal completely supports the agent’s innovation activity, the agent will get motivated and devotes all his energy to innovative task. When the principal doesn’t support agent’s innovation at all (k = 1), the efforts of agent on traditional business is , and

, and  is left to be used on innovation. Therefore, the innovation preference greatly influences the devotion degree of the agent, and further influences the output efficiency of the innovation.

is left to be used on innovation. Therefore, the innovation preference greatly influences the devotion degree of the agent, and further influences the output efficiency of the innovation.

Lemma 1 Assuming that there are two types of agents: the conventional type lacking creative spirits, or the aggressive innovative type. When the principal doesn’t know which type the agent belongs to, he can provide contract sets {(α, 0), (0, β)} for agent to choose, which reflects the type of the agent.

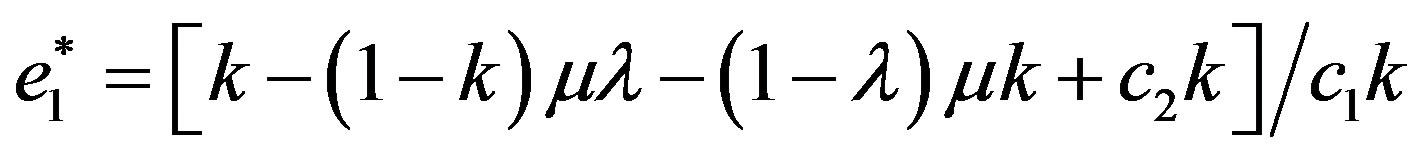

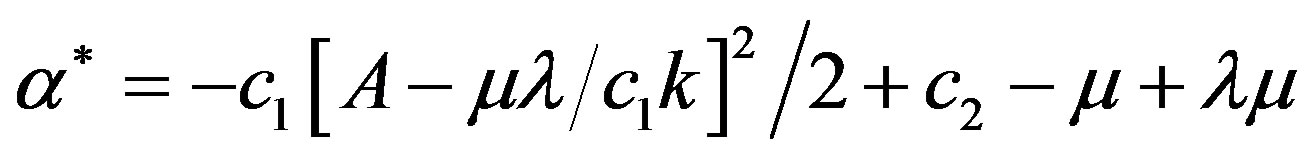

Proof: Put (6) and (7) into IR in (3), from the previous assumption , we can get the optimal fixed income:

, we can get the optimal fixed income:

The signal of  depends On:

depends On: , thus:

, thus:

,

,

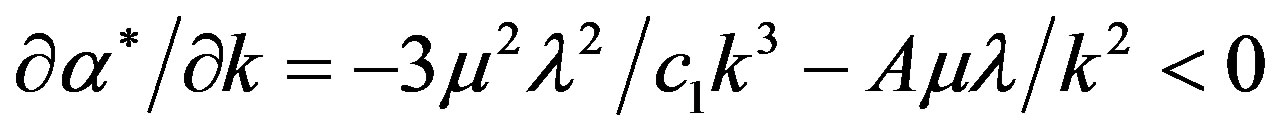

From Lemma 1, we can know that α*decreases as k increases. While from Proposition 1, the objective function gets the optimal value at the end point (k → 0 or k = 1). Thus, when the orientation of the principal is conservative (k = 1), principal will pay more attention to traditional business profits. At this moment, continuously reducing fixed wage is the optimal choice for principal. Because of the constraints of limited liability, α ≥ 0, as k increases, α* = 0 at last. When the principal wants to innovate (k → 0), from Proposition 2, the optimal  is negative. When k → 0. At this moment, the conventional task is not motivated; the profits of the principal and agent depend on the agent’s innovative efforts (e2). Because of the uncertainty of the innovation, the principal will not determine the profits of the agent solely by innovative achievements sharing coefficient (λ), thus there must be α* > 0. If assume that β ≥ 0 reasonably, then the optimal explicit contract given by principal to agent is (α, 0). When the principal’s orientation is conservative (k = 1), the optimal explicit contract given by the principal to the agent is (0, β). In reality, the enterprise recruitment pays more attention to whether the employees’ values are in consistent with the enterprises’. Employees who are willing to take risks are welcomed by enterprises encouraging innovation. Through different compensation designings, enterprises can easily find employees meeting its own culture. As the enterprise grows, it can get more and more innovative employees together. It is the opposite case for enterprises under the traditional culture.

is negative. When k → 0. At this moment, the conventional task is not motivated; the profits of the principal and agent depend on the agent’s innovative efforts (e2). Because of the uncertainty of the innovation, the principal will not determine the profits of the agent solely by innovative achievements sharing coefficient (λ), thus there must be α* > 0. If assume that β ≥ 0 reasonably, then the optimal explicit contract given by principal to agent is (α, 0). When the principal’s orientation is conservative (k = 1), the optimal explicit contract given by the principal to the agent is (0, β). In reality, the enterprise recruitment pays more attention to whether the employees’ values are in consistent with the enterprises’. Employees who are willing to take risks are welcomed by enterprises encouraging innovation. Through different compensation designings, enterprises can easily find employees meeting its own culture. As the enterprise grows, it can get more and more innovative employees together. It is the opposite case for enterprises under the traditional culture.

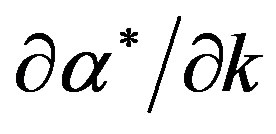

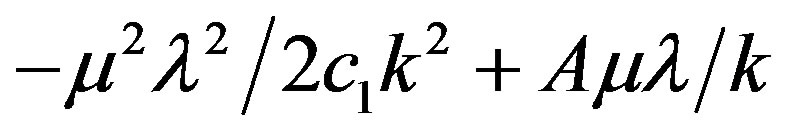

3.2. The Influence of Innovative Achievement Sharing Coefficient on Effort Level and Profits

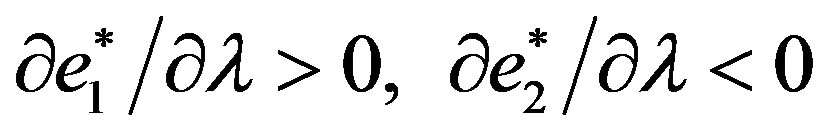

Proposition 3 Under the previous assumptions, suppose all the other parameters unchanged, as λ increases, the agent is more reluctant to engage in innovative activities, the effort level of the innovative task will continuously decrease, the motivation of conventional business is strengthened. On the contrary, the effort level of conventional task will increase constantly.

Proof: from (6), it is obvious that  is the increasing function of λ. From (7) we can know that

is the increasing function of λ. From (7) we can know that . According to the assumption, the more the principal is willing to motivate the agent to allot more innovative efforts, the less the agent gets profits from the innovative achievement. Thus, agent likes to engage in conventional activity instead of focusing on innovative efforts. Especially, when λ = 0 (or λ = 1), the agent (or the principal) gets all the innovative achievements. When λ = 0, agent gain all the returns, principal has nothing; when λ = 1, the principal got everything, and agent has nothing and finally gives up innovative efforts. Thus the optimal λ must be between (0, 1).

. According to the assumption, the more the principal is willing to motivate the agent to allot more innovative efforts, the less the agent gets profits from the innovative achievement. Thus, agent likes to engage in conventional activity instead of focusing on innovative efforts. Especially, when λ = 0 (or λ = 1), the agent (or the principal) gets all the innovative achievements. When λ = 0, agent gain all the returns, principal has nothing; when λ = 1, the principal got everything, and agent has nothing and finally gives up innovative efforts. Thus the optimal λ must be between (0, 1).

Proposition 1 to 3 say that principal can interfere with the innovation of agent; it can also lead the energy allocation by influencing the explicit motivation strength. Of course, on the basis of this, the energy allocation of agent is also determined by the of the principal’s appropriablity from innovation.

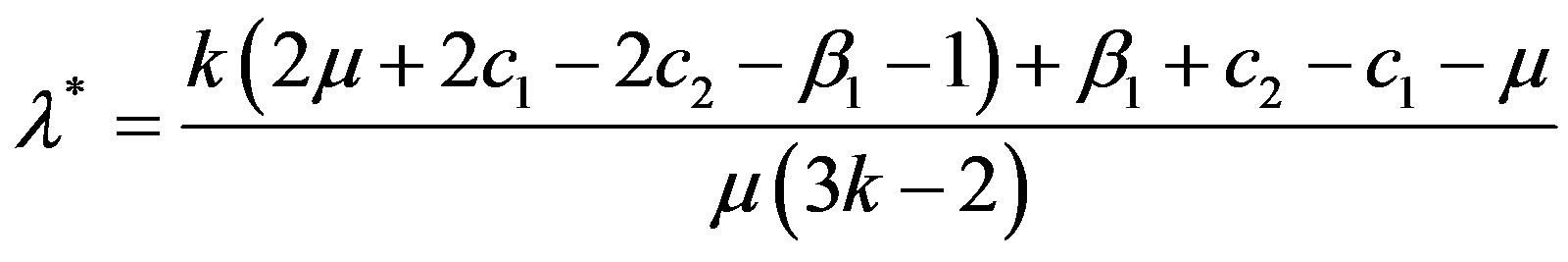

Proposition 4 suppose all the other parameters unchanged, there exists a threshold value λ under equilibrium condition, when λ* < λ, the objective function constantly increases as λ increases. When λ < λ*, the objective function will constantly decreases as λ increases.

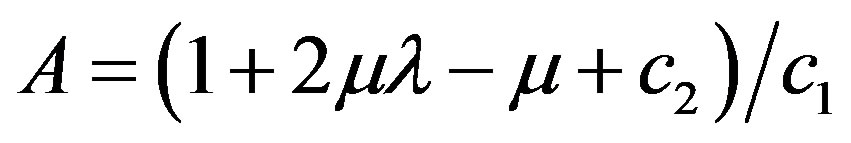

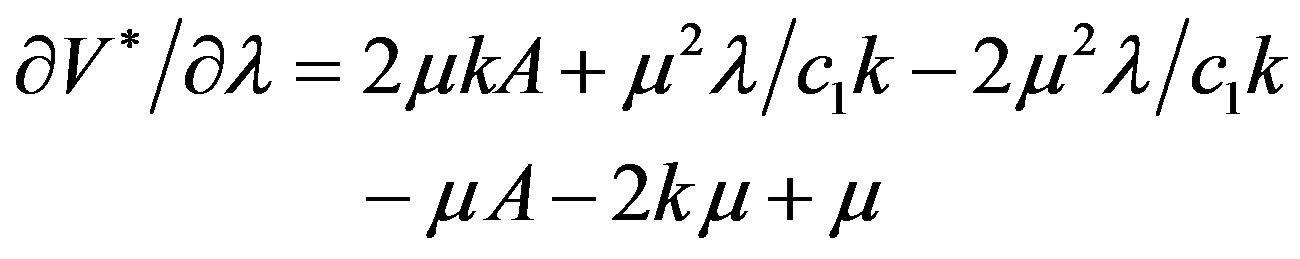

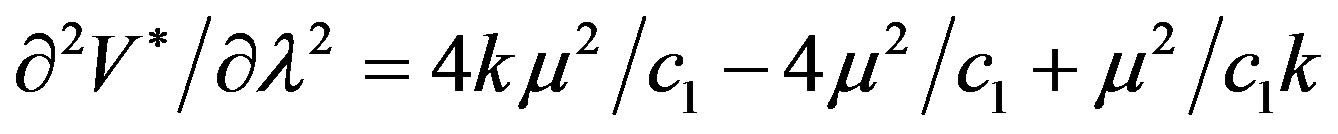

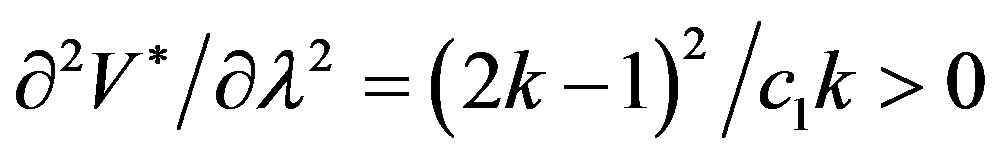

Proof: from (8)

then

then

Thus, the objective V* is the u-curve of λ. Therefore, there must exist a λ*, when λ < λ*,  , when λ* < λ,

, when λ* < λ, .

.

Proposition 4 shows the influence of innovation result exclusivity (λ) on (V*). For certain innovative efforts, it is obvious that the stronger principal’s appropriable ability, the more profits he can get; the principal thus have strong motivation to encourage agent to innovate. But from proposition 3, when λ → 1, agent will not innovate at all, thus the innovation profits declines to 0. Therefore, when principal’s appropriable ability is strong, agent would not like to engage in innovation. On the contrary, when λ → 0, from proposition 3, if agent likes to innovate, but principal cannot get any innovative profits, thus, the weaker principal’s appropriable ability, the more reluctant for the principal to motivate the agent to innovate. So on the topic of innovation results sharing, proposition 4 gives the direct proof of the conflicts in innovation fruits allocation, both parties need to compromise to reach a balance.

4. Further Discussions

From the view of human capital theory, the principal’s negotiation ability depends on whether the human capital is general or specific. Specific human capital plays a key role in transaction cost theory [9] and property rights theory [10]. On the other hand, if agent’s innovation activity requires the principal’s specific assets, then this is the so-called appropriability problem. Nelson (1959), Arrow (1962), Teece (1986) had analyzed the problem from different views [11,12]. The PFI theory proposed by Teece provided a new view for analyzing appropriability problem [13]. One important concept in PFI theory is Complementary Assets, which is a key factor influencing enterprise’s innovative profits exclusivity. The strong complementary assets of an enterprise mean its strong ability to get profits from innovation. In the structure of this paper, the bargaining power of both principal and agent on innovation profits allocation depends on the human capital ability of the agent and the principal’s appropriable ability from innovation. From the view of complementary assets, combine the innovation preference coefficient, proposition 4 says when the principal’s innovative preference is high (k → 0); he is concerned with profits coming from innovative business. At this moment, if agent’s innovation must depend on the complementary assets of the principal, then the incentive on agent’s explicit performance is so-called low-level motivation. The principal can ask for high proportion of innovation profits allocation. The principal needs to reduce the sharing coefficient of the innovative returns to motivate the agent. On the contrary, because it is incredible to give agent high proportion of innovation results sharing, so the agent would probably decide to resign if agent’s innovation doesn’t need the principal’s complementary assets. The abundant evidence shows that the new enterprises engaging in disruptive business are constituted by turnover workers from incumbent enterprises. Thus, from the view of disruptive innovative theory, if principal still cares for the innovation achievement from agent, he needs to consider whether establish self-organization or spin off organization (Christencen 2003), making agent engage in disruptive business flexibly and eager to get innovative fruits. Otherwise, agent would leave.

5. Conclusions

The middle managers usually have innovative preference. We assume the preference is in accordance with innovation strategy of enterprise, from the view of the manager’s innovation preference, the author established a multi-task principal-agent model that explains how the manager’s innovation-decision to incentive the staffs for what kind of innovation. After analyzing the theoretic model, conclusions can be got as follows:

Under the framework of model, we can get that, on certain conditions, the selection rights of middle managers towards innovation projects determine the strategic direction of enterprises. The model briefly explains why incumbent enterprises like so-called sustaining innovation and entrant enterprises are inclined to disruptive innovation.

According to manager’s innovation preference, enterprise can design different employment contracts. The combination of different contracts can not only reflect manager’s innovation preference but also show employees’ innovation types. Providing different contract sets for employees, the type of risk avoidance employees would like to choose enterprise with innovative culture, and the type of risk avoidance tends to choose traditional enterprise.

Under the condition the principal’s appropriable ability to develop disruptive innovation project is not strong, if the manager’s innovation preference is inclined to sustaining innovation, enterprise won’t encourage employees to innovate disruptive projects, in this way employees either choose to leave, or give up disruptive projects and only focus on conventional task. When the manager’s innovation preference is more like sustaining innovation, if enterprise wants to share employees’ innovation achievement, he needs to play the role just as venture capitalist. This shows that incumbent enterprise should indeed establish self-organization or spin off organization to better finish disruptive task.

Regarding the innovation project team as an agent doesn’t influence the conclusions, but this paper analyzes the issue from individual aspect, neglecting the efforts conflicts among agents, which needs further research.

6. Acknowledgements

The research is financed by National Natural Science Foundation of China. No: 71172095, MOST of China Science and Technology Basic Tasks FANEDD No: 2011IM020100.

REFERENCES

- I. Nonaka and H. Takeuchi, “The Knowledge Creating Company,” Oxford University Press, New York, 1995.

- C. M. Christensen and M. E. Raynor, “The innovator’s solution,” Harvard Business School Press, Boston, 2003.

- C. K. Prahalad and G. Hamel, “The Core Competence of the Corporation,” Harvard Business Review, Vol. 68, No. 3, 1990, pp. 79-91.

- M. E. Porter, “Competitive Strategy,” Free Press, New York, 1980.

- D. Leonard-Barton, “Core capabilities and core rigidities: a paradox in managing new product development,” Strategic Management Journal, Vol. 13, No. S1, 1992, pp. 111-125.

- P. Aghion and J. Tirole, “The Management of Innovation,” Quarterly Journal of Economics, Vol. 109, No. 4, 1994, pp. 1185-1209. doi:10.2307/2118360

- T. Hellmann and V. Thiele, “Incentives and Innovation: A Multitasking Approach,” American Economic Journal: Microeconomics, Vol. 3, No. 1, 2011, pp. 78-128. doi:10.1257/mic.3.1.78

- W. Lazonick, “Innovative Enterprise and Historical Transformation,” Enterprise & Society, Vol. 3, No. 1, 2002, pp. 3-47. doi:10.1093/es/3.1.3

- O. E. Williamson, “Vertical Integration and Related Variations on a Transaction-Cost Economic Theme,” In: J. E. Stiglitz and G. F. Mathewson, eds., New Developments in the analysis of Market Structure, MIT Press, Cambridge, 1986.

- S. J. Grossman and O. D. Hart, “The Costs and Benefits of Ownership: A Theory of Lateral and Vertical Integration,” Journal of Political Economy, Vol. 94, No. 4, 1986, pp. 691-719. doi:10.2307/1833199

- R. R. Nelson and S. G. Winter, “The Schumpeterian Trade off Revisited,” The American Economic Review, Vol. 72, No. 1, 1982, pp. 114-132.

- K. Arrow, “Economic Welfare and the Allocation of Resources for Inventions,” In: R. Nelson, Ed., The Rate and Direction of Inventive Activity: Economic and Social Factors, Princeton University Press, New York, 1962, pp. 609-626.

- D. Teece, “Profiting from technological innovation: implications for integration, collaboration, licensing and public policy,” Research Policy, Vol. 15, No. 6, 1986, pp. 285-305. doi:10.1016/0048-7333(86)90027-2